- Poland

- /

- Metals and Mining

- /

- WSE:COG

This Analyst Just Wrote A Brand New Outlook For Cognor Holding S.A.'s (WSE:COG) Business

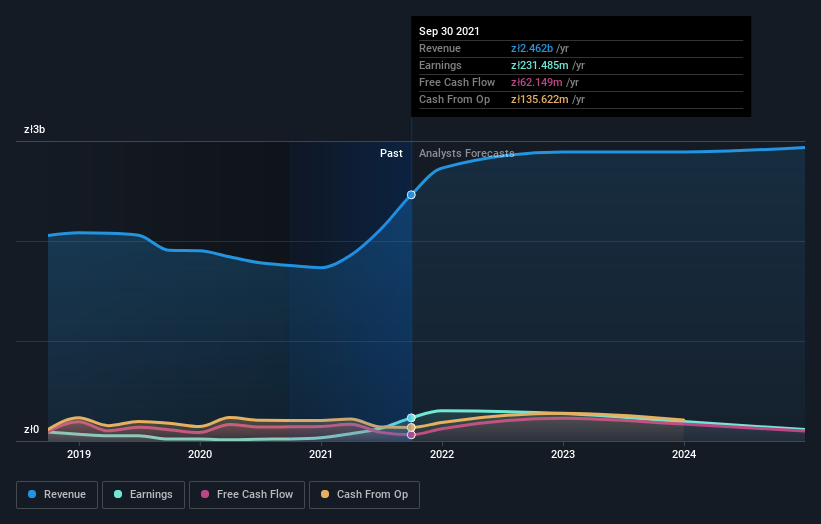

Cognor Holding S.A. (WSE:COG) shareholders will have a reason to smile today, with the covering analyst making substantial upgrades to next year's statutory forecasts. Consensus estimates suggest investors could expect greatly increased statutory revenues and earnings per share, with the analyst modelling a real improvement in business performance. The stock price has risen 9.5% to zł4.28 over the past week, suggesting investors are becoming more optimistic. Could this big upgrade push the stock even higher?

After this upgrade, Cognor Holding's sole analyst is now forecasting revenues of zł2.9b in 2022. This would be a meaningful 17% improvement in sales compared to the last 12 months. Per-share earnings are expected to swell 16% to zł1.57. Previously, the analyst had been modelling revenues of zł2.6b and earnings per share (EPS) of zł0.72 in 2022. There has definitely been an improvement in perception recently, with the analyst substantially increasing both their earnings and revenue estimates.

View our latest analysis for Cognor Holding

Although the analyst has upgraded their earnings estimates, there was no change to the consensus price target of zł5.11, suggesting that the forecast performance does not have a long term impact on the company's valuation. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic Cognor Holding analyst has a price target of zł6.12 per share, while the most pessimistic values it at zł4.10. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. It's clear from the latest estimates that Cognor Holding's rate of growth is expected to accelerate meaningfully, with the forecast 14% annualised revenue growth to the end of 2022 noticeably faster than its historical growth of 6.3% p.a. over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 1.2% annually. It seems obvious that, while the growth outlook is brighter than the recent past, the analyst also expect Cognor Holding to grow faster than the wider industry.

The Bottom Line

The biggest takeaway for us from these new estimates is that the analyst upgraded their earnings per share estimates, with improved earnings power expected for next year. They also upgraded their revenue estimates for next year, and sales are expected to grow faster than the wider market. The lack of change in the price target is puzzling, but with a serious upgrade to next year's earnings expectations, it might be time to take another look at Cognor Holding.

The covering analyst is clearly in love with Cognor Holding at the moment, but before diving in - you should be aware that we've identified some warning flags with the business, such as concerns around earnings quality. You can learn more, and discover the 2 other warning signs we've identified, for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:COG

Cognor Holding

Engages in the production and distribution of steel products in Poland, the Czech Republic, Germany, and internationally.

Good value with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion