Amidst ongoing concerns about U.S. trade tariffs and economic growth, European markets have experienced a mix of declines and modest gains, with the pan-European STOXX Europe 600 Index ending slightly lower. As investors navigate these uncertainties, dividend stocks in Europe can offer a stable income stream, making them an attractive option for those seeking resilience in volatile market conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.50% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.22% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.61% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.76% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.07% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.36% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.26% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.44% | ★★★★★★ |

| VERBUND (WBAG:VER) | 5.90% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.62% | ★★★★★★ |

Click here to see the full list of 229 stocks from our Top European Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Mapfre (BME:MAP)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Mapfre, S.A. operates in the investment, insurance, property, financial, and services sectors in Spain with a market cap of €8.76 billion.

Operations: Mapfre, S.A. generates revenue through several segments: EMEA (€1.70 billion), Brazil (€5.30 billion), Iberia (€8.75 billion), Reinsurance (€7.11 billion), Global Risks (€2.31 billion), North America (€3.08 billion), and Mapfre Asistencia-Mawdy (€216.90 million).

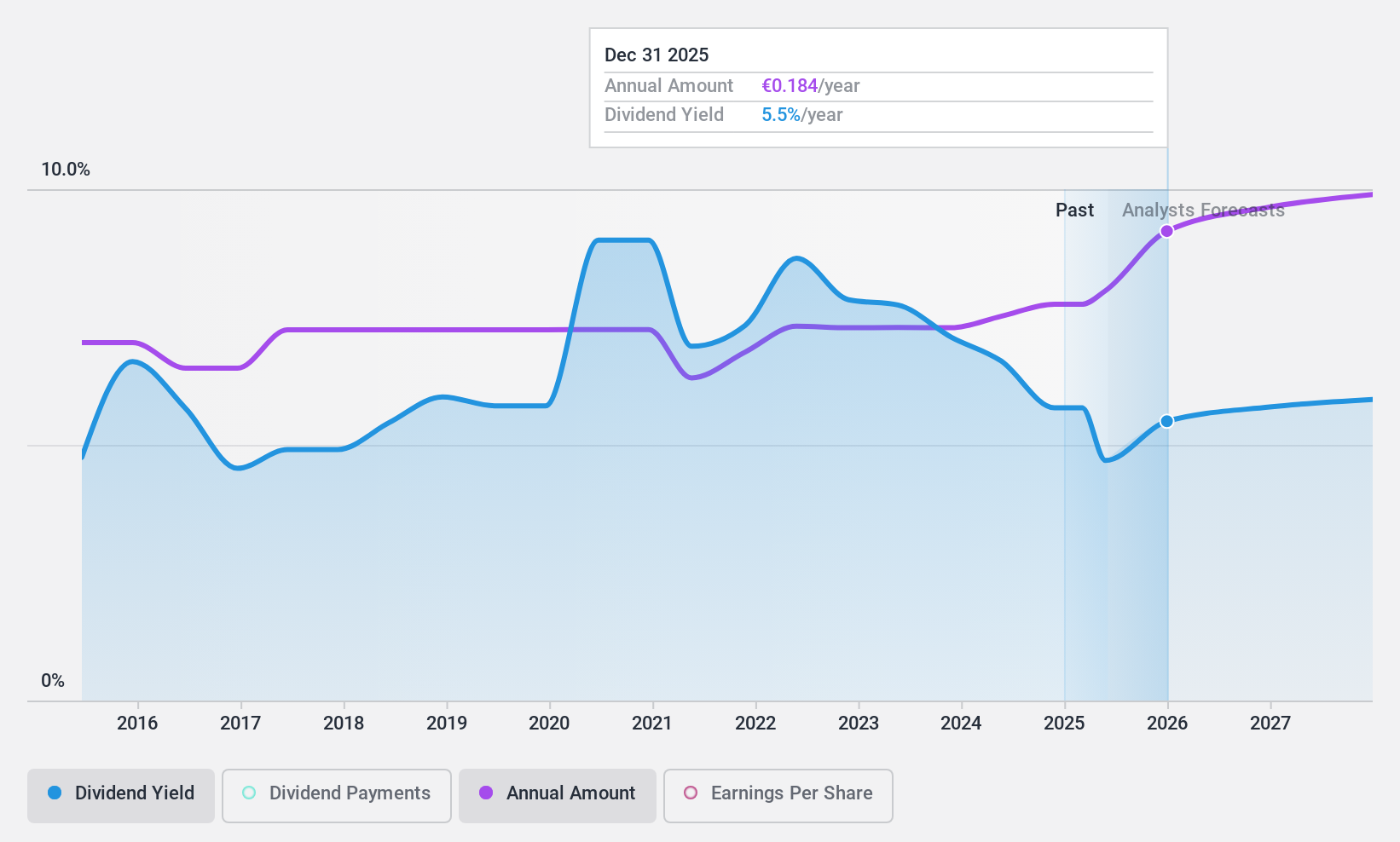

Dividend Yield: 5.6%

Mapfre offers a compelling dividend profile with stable and growing payouts over the past decade. Its current dividend yield of 5.61% ranks in the top 25% of Spanish market payers, supported by a sustainable payout ratio of 50.8%. The company's dividends are well-covered by both earnings and cash flows, with a cash payout ratio at 40.6%. Recent announcements include a proposed final dividend, contributing to total dividends of €0.16 for 2024, aligning with its target range.

- Click here and access our complete dividend analysis report to understand the dynamics of Mapfre.

- In light of our recent valuation report, it seems possible that Mapfre is trading behind its estimated value.

Powszechny Zaklad Ubezpieczen (WSE:PZU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Powszechny Zaklad Ubezpieczen SA offers life and non-life insurance products and services across Poland, the Baltic States, and Ukraine, with a market cap of PLN48.86 billion.

Operations: Powszechny Zaklad Ubezpieczen SA generates revenue through its life and non-life insurance operations in Poland, the Baltic States, and Ukraine.

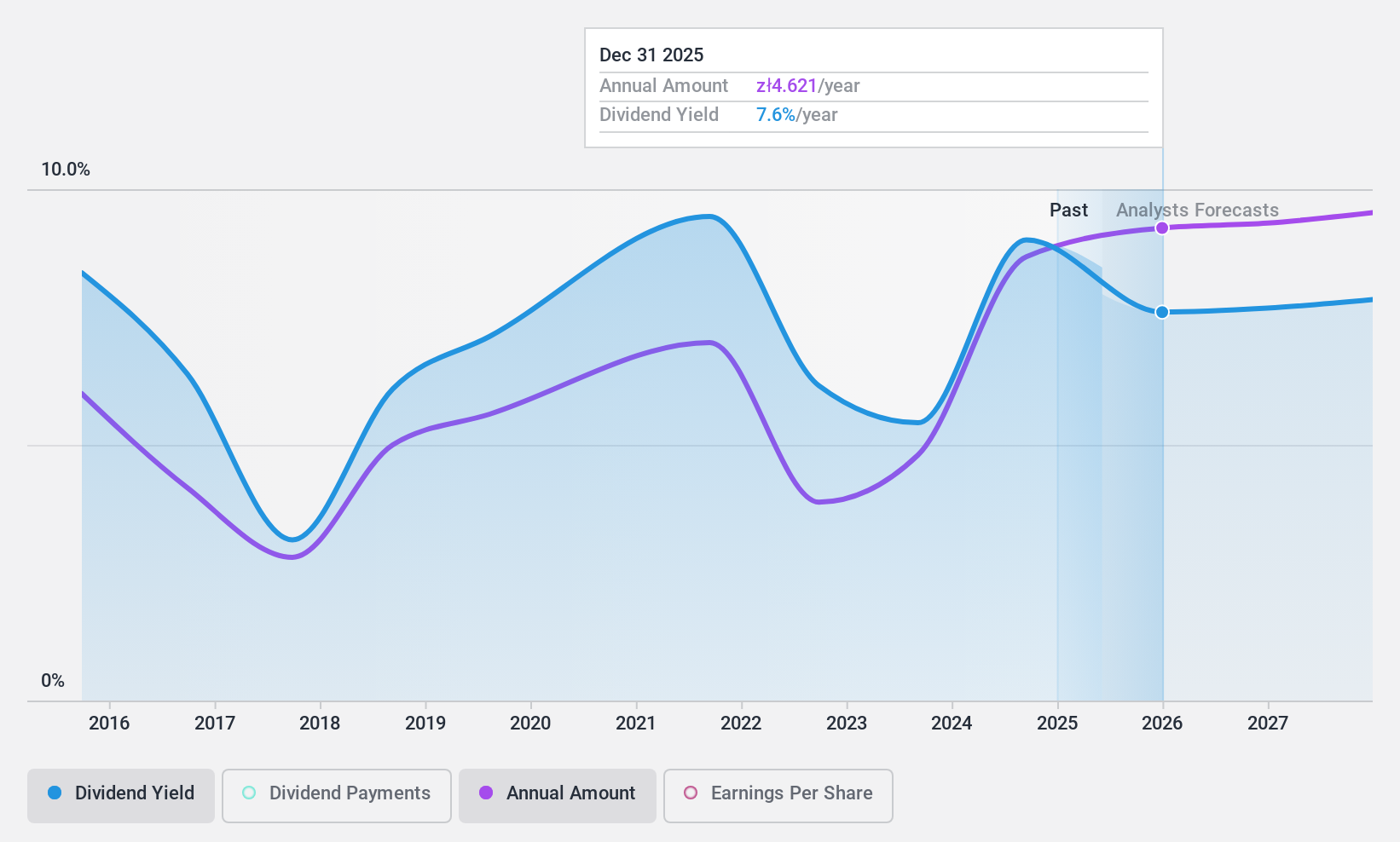

Dividend Yield: 7.7%

Powszechny Zaklad Ubezpieczen's dividend payments are well-covered by both earnings and cash flows, with payout ratios of 71.2% and 44.1%, respectively, yet its dividend history is marked by volatility over the past decade. Trading at a significant discount to estimated fair value, PZU's current yield of 7.67% is slightly below the top tier in Poland. Recent executive changes may impact strategic direction but have not directly affected dividend policy as of now.

- Dive into the specifics of Powszechny Zaklad Ubezpieczen here with our thorough dividend report.

- The analysis detailed in our Powszechny Zaklad Ubezpieczen valuation report hints at an deflated share price compared to its estimated value.

MPC Münchmeyer Petersen Capital (XTRA:MPCK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MPC Münchmeyer Petersen Capital AG is a publicly owned investment manager with a market cap of €174.13 million.

Operations: MPC Münchmeyer Petersen Capital AG generates revenue primarily through Management Services (€34.81 million) and Transaction Services (€6.19 million).

Dividend Yield: 5.5%

MPC Münchmeyer Petersen Capital's dividend yield of 5.47% ranks in the top quarter of German payers, supported by a sustainable payout ratio of 56.3% and a cash payout ratio of 28.7%. While dividends have been stable and growing, they have only been paid for three years. The stock trades at a significant discount to fair value with analysts expecting price appreciation. Recent guidance forecasts revenue between €43 million and €47 million for 2025, affirming an annual dividend of €0.27 per share payable in June.

- Take a closer look at MPC Münchmeyer Petersen Capital's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of MPC Münchmeyer Petersen Capital shares in the market.

Key Takeaways

- Gain an insight into the universe of 229 Top European Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Mapfre, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:MAP

Mapfre

Engages in the investment, insurance, property, financial, and services businesses in Spain.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives