As global markets navigate a mixed economic landscape marked by fluctuating consumer confidence and varied regional growth, investors are increasingly looking towards stable income-generating options like dividend stocks. In the current environment, characterized by moderate gains in major indices and ongoing economic uncertainties, selecting dividend stocks with yields of at least 3% can provide a reliable source of income while potentially offering some cushion against market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.12% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.41% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.71% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.45% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.79% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.37% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.13% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.15% | ★★★★★★ |

Click here to see the full list of 1963 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

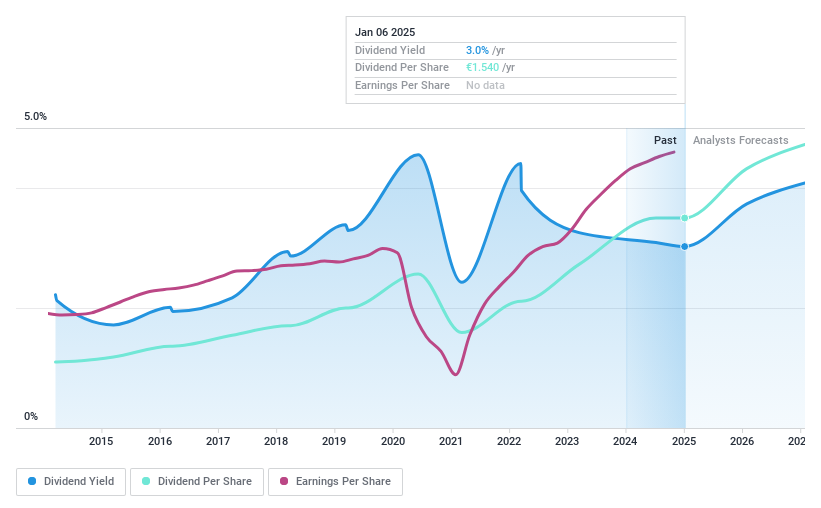

Industria de Diseño Textil (BME:ITX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Industria de Diseño Textil, S.A. operates in the retail and online distribution of clothing, footwear, accessories, and household products with a market cap of €156.73 billion.

Operations: Industria de Diseño Textil, S.A. generates revenue through its diverse segments, including clothing, footwear, accessories, and household products.

Dividend Yield: 3.1%

Industria de Diseño Textil's dividend payments have been volatile over the past decade, with a payout ratio of 57.5% indicating coverage by earnings and a cash payout ratio of 75.6% showing coverage by cash flows. Despite an unreliable track record, dividends have grown over the last ten years. The recent announcement of a special dividend of €0.50 per share highlights potential for additional shareholder returns, though its regular dividend yield remains low compared to top-tier Spanish market payers.

- Dive into the specifics of Industria de Diseño Textil here with our thorough dividend report.

- The analysis detailed in our Industria de Diseño Textil valuation report hints at an inflated share price compared to its estimated value.

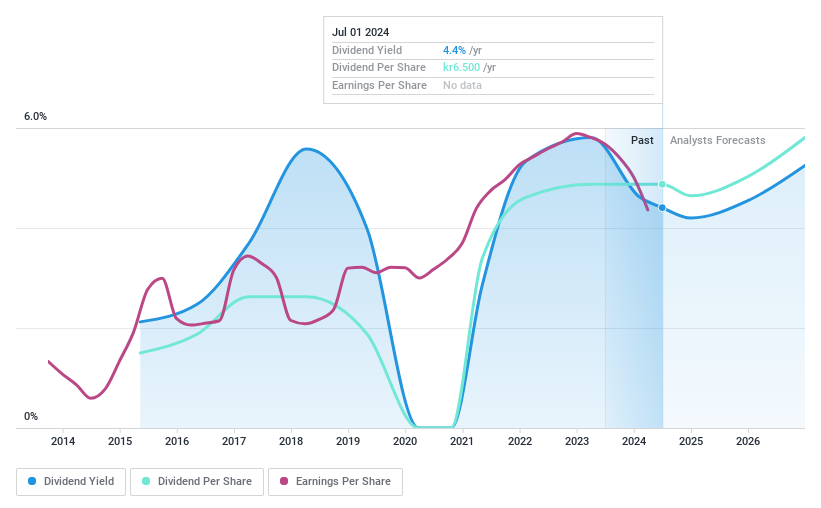

Inwido (OM:INWI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Inwido AB (publ) operates through its subsidiaries in the development, manufacture, and sale of windows and doors, with a market cap of SEK10.83 billion.

Operations: Inwido AB (publ) generates revenue from several segments, including E-Commerce (SEK1.10 billion), Scandinavia (SEK4.08 billion), Eastern Europe (SEK1.71 billion), and Western Europe (SEK1.83 billion).

Dividend Yield: 3.5%

Inwido's dividend yield of 3.48% is considered low relative to top Swedish market payers. Although its dividends have increased over the past decade, they have been volatile, with a payout ratio of 69.7% and a cash payout ratio of 66%, indicating coverage by earnings and cash flows. Recent earnings showed slight declines in net income, but dividends remain covered. The stock trades at a significant discount to estimated fair value, offering potential value for investors despite its unstable dividend history.

- Click here and access our complete dividend analysis report to understand the dynamics of Inwido.

- Our valuation report here indicates Inwido may be undervalued.

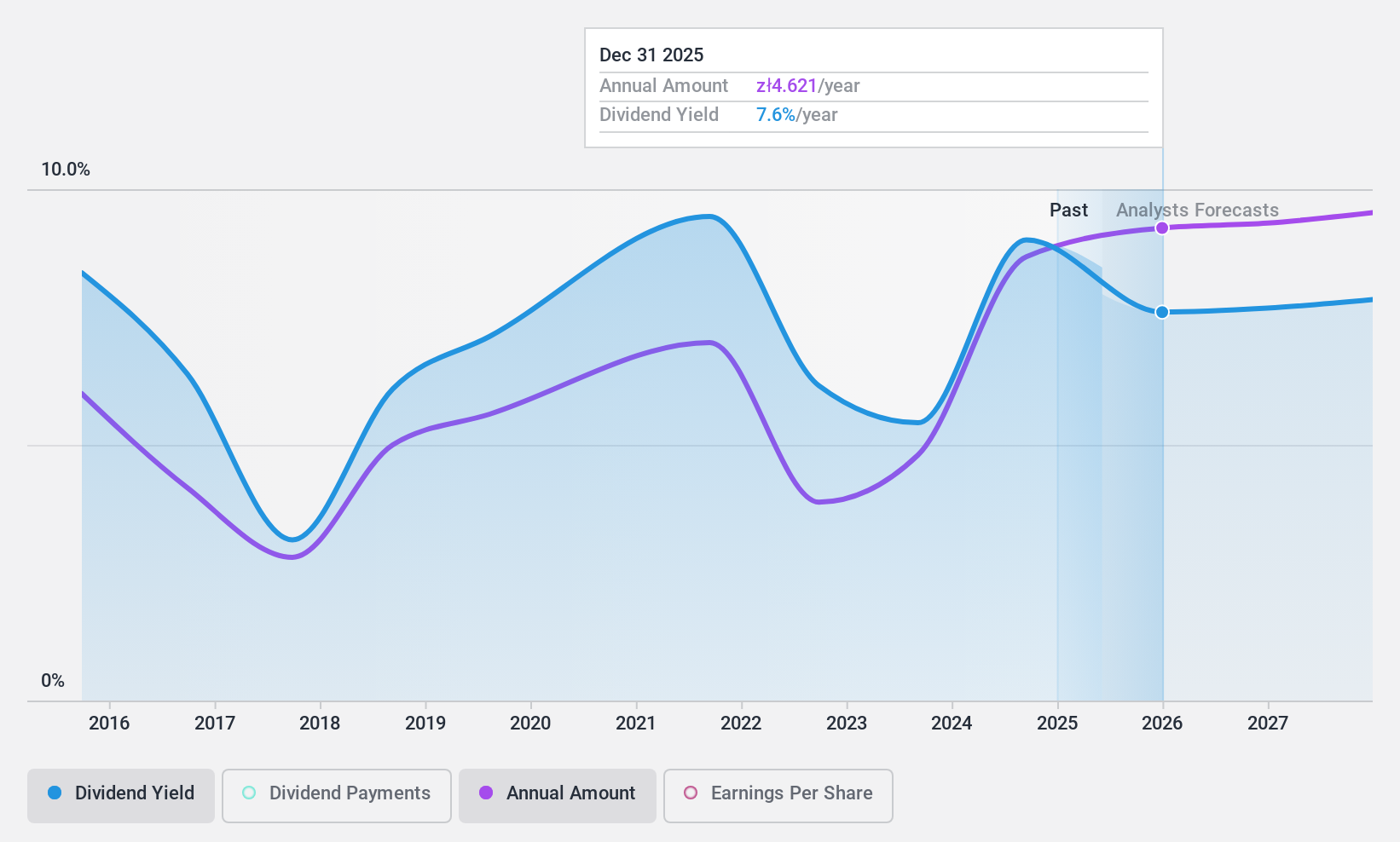

Powszechny Zaklad Ubezpieczen (WSE:PZU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Powszechny Zaklad Ubezpieczen SA offers life and non-life insurance products and services in Poland, the Baltic States, and Ukraine, with a market cap of PLN401.02 billion.

Operations: Powszechny Zaklad Ubezpieczen SA generates revenue through its provision of life and non-life insurance products and services across Poland, the Baltic States, and Ukraine.

Dividend Yield: 9.3%

Powszechny Zaklad Ubezpieczen's dividend yield is among the top 25% in the Polish market, but its dividends have been volatile and unreliable over the past decade. Despite this, dividends are well covered by earnings with a payout ratio of 71.2% and a cash payout ratio of 44.1%. Recent earnings showed a decline, with Q3 net income at PLN 1.22 billion compared to PLN 1.48 billion last year, yet dividend payments remain sustainable for now.

- Click to explore a detailed breakdown of our findings in Powszechny Zaklad Ubezpieczen's dividend report.

- Our comprehensive valuation report raises the possibility that Powszechny Zaklad Ubezpieczen is priced lower than what may be justified by its financials.

Where To Now?

- Gain an insight into the universe of 1963 Top Dividend Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:PZU

Powszechny Zaklad Ubezpieczen

Provides life and non-life insurance products and services in Poland, the Baltic States, and Ukraine.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives