As European markets navigate the complexities of U.S. trade policy and economic uncertainties, the STOXX Europe 600 Index recently experienced a slight decline, breaking a streak of ten consecutive weeks of gains. Despite these challenges, increased spending initiatives in defense and infrastructure by Germany and the European Union offer some positive outlooks for investors seeking stable returns through dividend stocks. In such an environment, selecting dividend stocks that demonstrate strong fundamentals and resilience can be a prudent strategy for investors looking to balance growth with income potential.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 4.28% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.17% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.86% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.81% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.64% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.14% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.44% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.27% | ★★★★★★ |

| VERBUND (WBAG:VER) | 5.96% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.56% | ★★★★★★ |

Click here to see the full list of 228 stocks from our Top European Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

SpareBank 1 Helgeland (OB:HELG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SpareBank 1 Helgeland offers a range of financial products and services to retail customers, small and medium enterprises, municipal authorities, and institutions in Norway, with a market cap of NOK4.43 billion.

Operations: SpareBank 1 Helgeland generates revenue through its Retail segment, contributing NOK446 million, and its Corporate Market segment, adding NOK291 million.

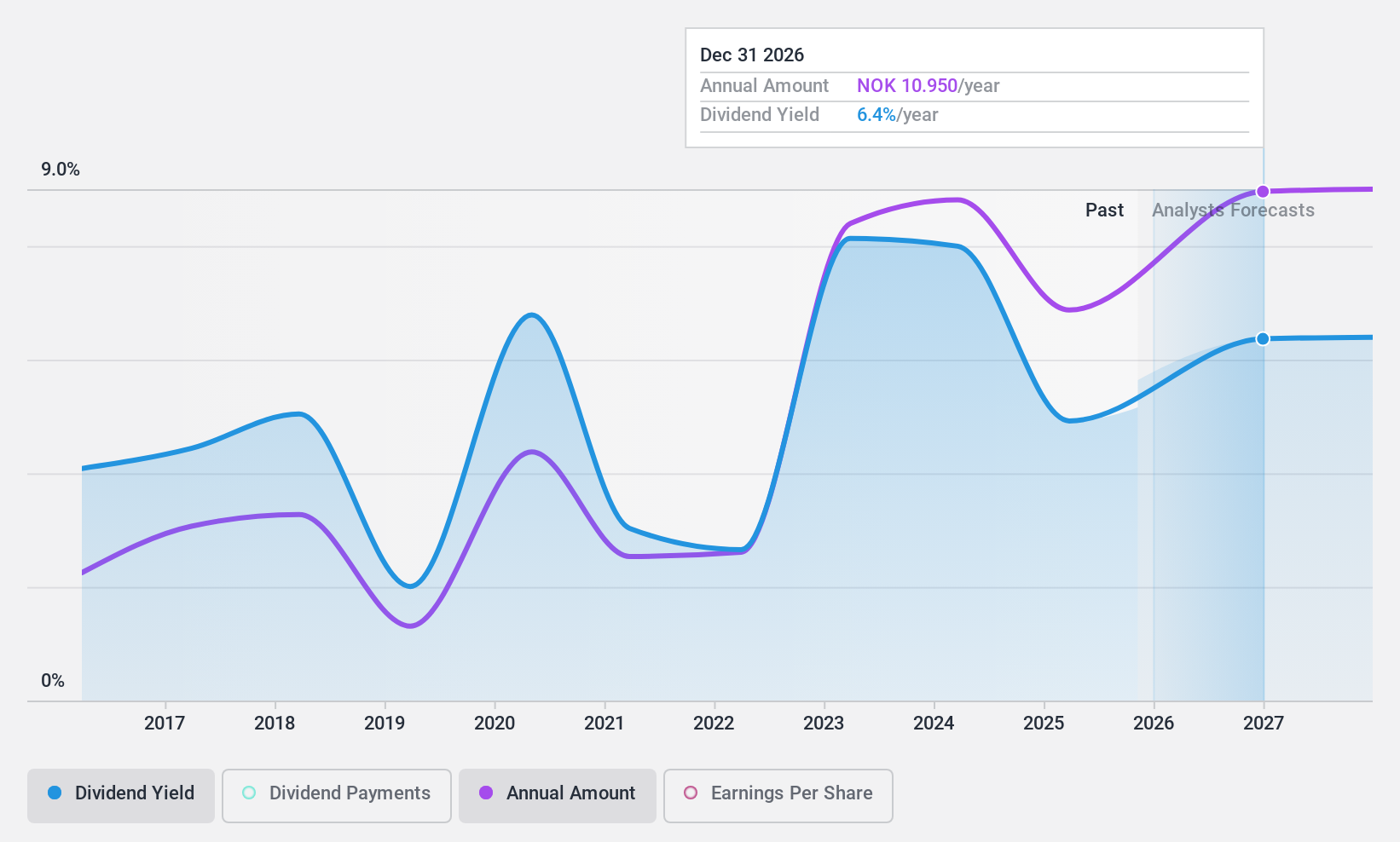

Dividend Yield: 5.1%

SpareBank 1 Helgeland's dividend payments, with a payout ratio of 51.9%, are currently covered by earnings and forecasted to remain sustainable in three years at 66.9%. Despite a history of volatility and unreliability in dividends over the past decade, the bank has shown consistent earnings growth, reporting NOK 571 million net income for 2024, up from NOK 490 million. The dividend yield is relatively low compared to top-tier Norwegian payers.

- Click here and access our complete dividend analysis report to understand the dynamics of SpareBank 1 Helgeland.

- Our comprehensive valuation report raises the possibility that SpareBank 1 Helgeland is priced higher than what may be justified by its financials.

Benefit Systems (WSE:BFT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Benefit Systems S.A. offers non-pay employee benefits solutions in Poland and internationally, with a market cap of PLN8.79 billion.

Operations: Benefit Systems S.A. generates revenue primarily from its operations in Poland, including the cafeteria segment, amounting to PLN2.36 billion, and from foreign markets contributing PLN874.71 million.

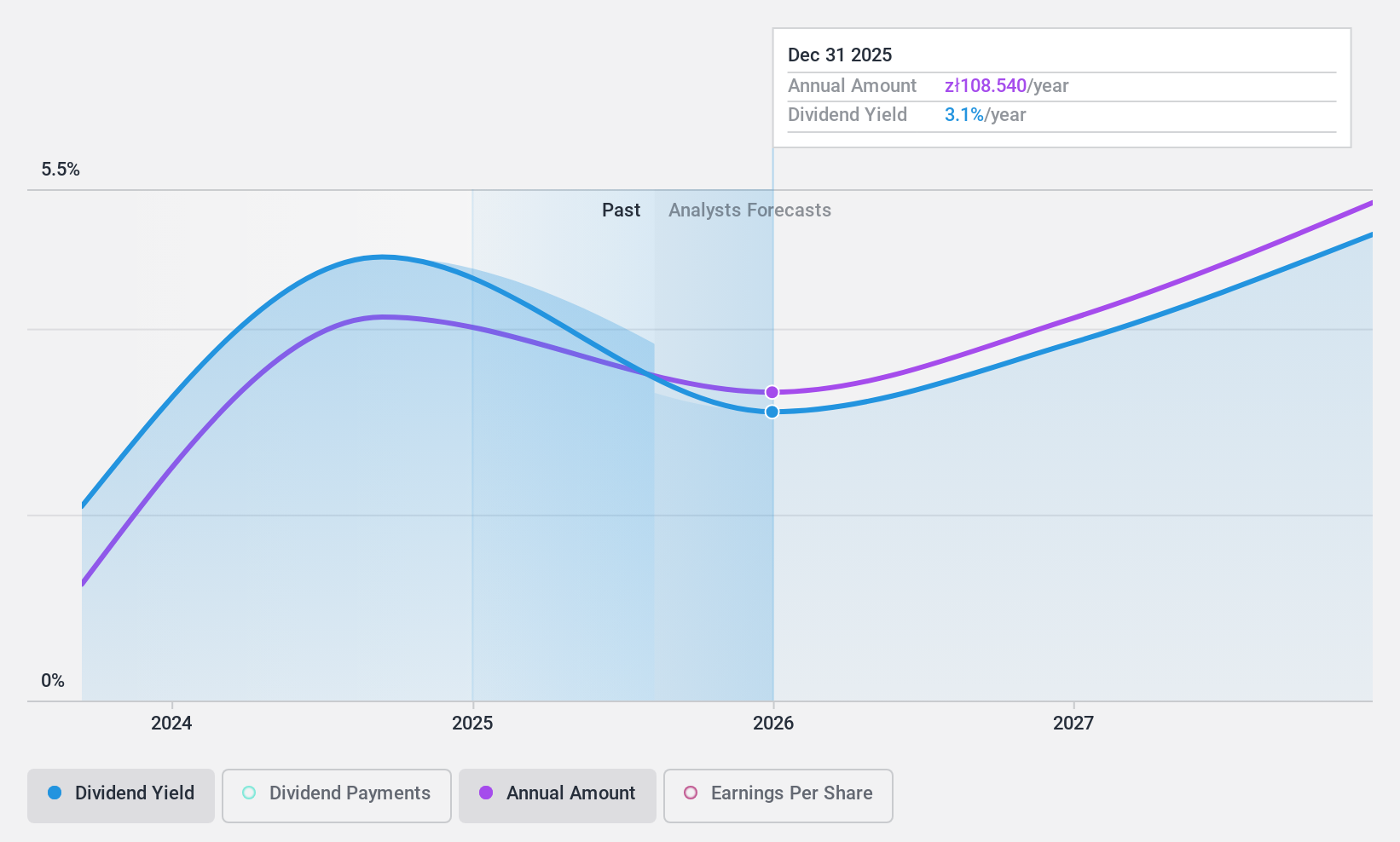

Dividend Yield: 4.5%

Benefit Systems' dividends have grown over the past decade, yet they remain unreliable due to volatility. Despite a payout ratio of 83.4% and cash flow coverage at 59.2%, indicating sustainability, the dividend yield of 4.55% is lower than top Polish payers. Earnings growth has been robust, with a recent annual increase of 32.2%. The stock trades at a significant discount to its estimated fair value and offers good relative value compared to peers.

- Unlock comprehensive insights into our analysis of Benefit Systems stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Benefit Systems shares in the market.

Dom Development (WSE:DOM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dom Development S.A. operates in Poland, focusing on the development and sale of residential and commercial real estate properties along with related support activities, with a market cap of PLN5.25 billion.

Operations: Dom Development S.A. generates its revenue primarily from the development and sale of residential and commercial real estate properties, amounting to PLN2.80 billion.

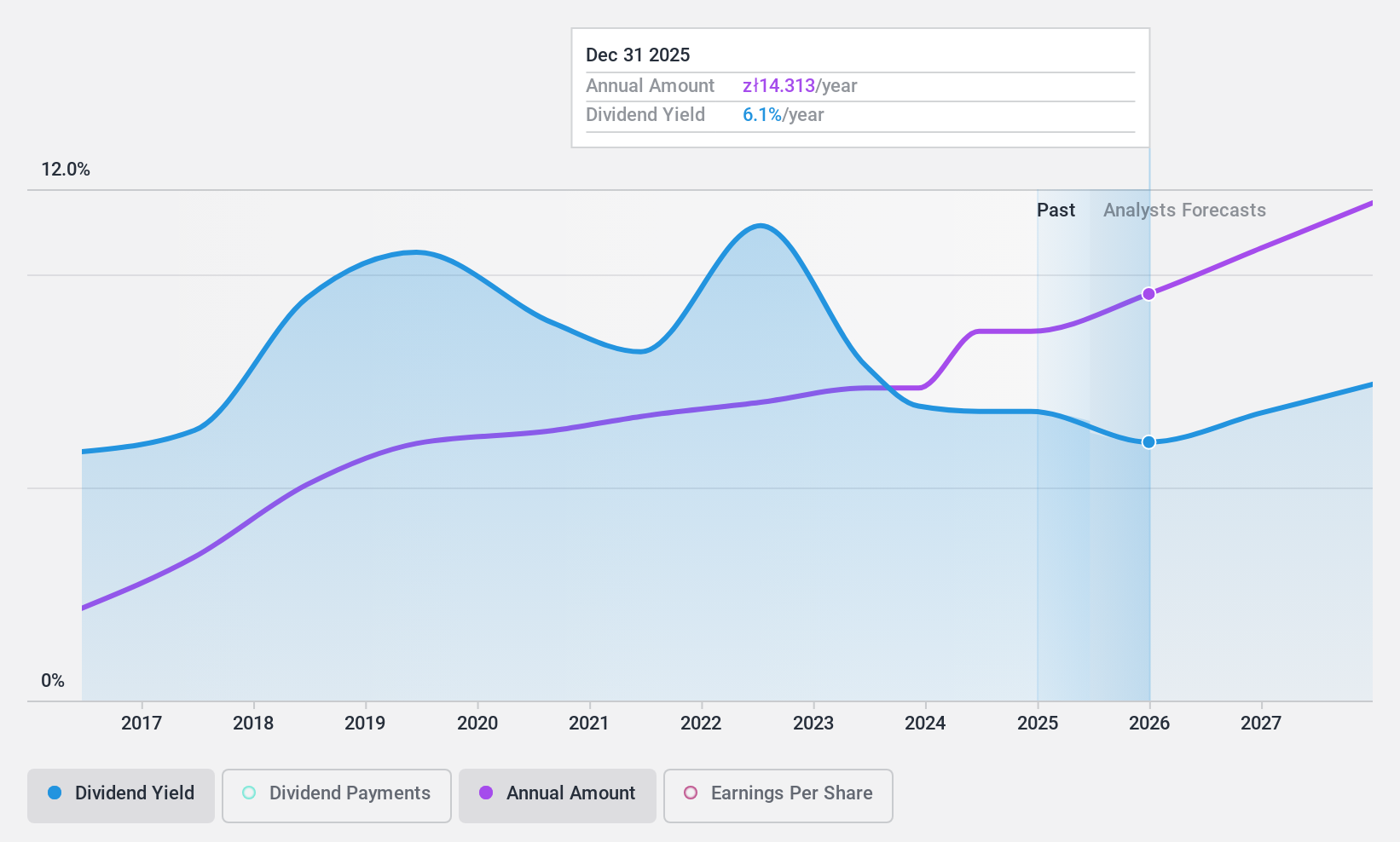

Dividend Yield: 6.4%

Dom Development's dividends have been stable and growing over the past decade, supported by a low payout ratio of 33.8% and cash flow coverage at 74.2%, ensuring sustainability. The current yield of 6.39%, while reliable, is below top-tier Polish dividend payers. Earnings have grown consistently at 11.8% annually over five years, with future growth forecasted at 8.7%. Trading below its estimated fair value, it presents potential value for investors seeking dividend stability and growth prospects in Europe.

- Take a closer look at Dom Development's potential here in our dividend report.

- Our valuation report here indicates Dom Development may be undervalued.

Seize The Opportunity

- Unlock our comprehensive list of 228 Top European Dividend Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade SpareBank 1 Helgeland, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:HELG

SpareBank 1 Helgeland

Provides various financial products and services to retail customers, small and medium enterprises, municipal authorities, and institutions in Norway.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives