- Switzerland

- /

- Software

- /

- SWX:TEMN

3 Stocks Estimated To Be Priced Below Intrinsic Value By Up To 44.5%

Reviewed by Simply Wall St

In the wake of a significant rally in U.S. stocks following the recent election, global markets have been buoyed by expectations of growth and tax reforms under a new administration. As major indices reach record highs, investors are increasingly interested in identifying stocks that may be undervalued despite the broader market's optimism. In such an environment, discerning investors often look for companies whose intrinsic value appears to exceed their current market price, offering potential opportunities amid prevailing economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| UMB Financial (NasdaqGS:UMBF) | US$122.86 | US$245.13 | 49.9% |

| Cambi (OB:CAMBI) | NOK15.10 | NOK30.14 | 49.9% |

| Ramssol Group Berhad (KLSE:RAMSSOL) | MYR0.695 | MYR1.39 | 49.8% |

| TBC Bank Group (LSE:TBCG) | £31.35 | £62.68 | 50% |

| Afya (NasdaqGS:AFYA) | US$16.16 | US$32.25 | 49.9% |

| Decisive Dividend (TSXV:DE) | CA$6.05 | CA$12.06 | 49.8% |

| XPEL (NasdaqCM:XPEL) | US$45.46 | US$90.91 | 50% |

| Grupo Traxión. de (BMV:TRAXION A) | MX$19.39 | MX$38.77 | 50% |

| S-Pool (TSE:2471) | ¥344.00 | ¥686.71 | 49.9% |

| BuySell TechnologiesLtd (TSE:7685) | ¥3890.00 | ¥7757.36 | 49.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

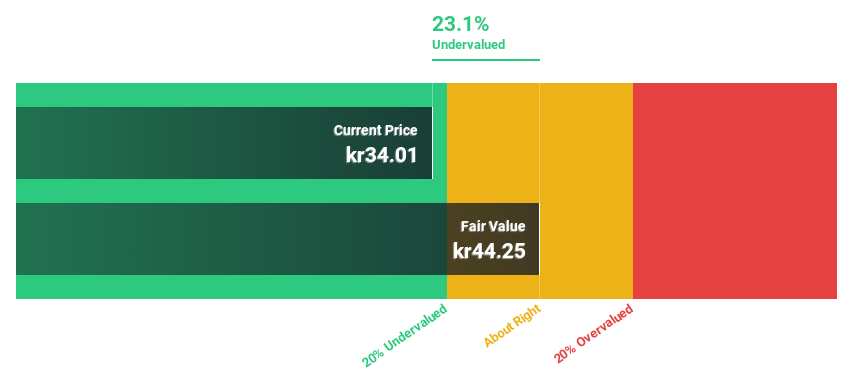

Vår Energi (OB:VAR)

Overview: Vår Energi AS is an independent upstream oil and gas company operating on the Norwegian continental shelf, with a market cap of NOK87.32 billion.

Operations: The company generates revenue primarily from its oil and gas exploration and production segment, amounting to $7.39 billion.

Estimated Discount To Fair Value: 21.6%

Vår Energi is trading at NOK34.98, below its estimated fair value of NOK44.59, making it potentially undervalued based on cash flows. Despite high debt levels, its earnings are forecast to grow faster than the Norwegian market at 16.2% annually. Recent quarterly revenue increased to USD 1.87 billion from USD 1.62 billion year-on-year, though net income slightly declined to USD 180 million due to narrower profit margins and a dividend decrease announcement impacting investor sentiment.

- Our comprehensive growth report raises the possibility that Vår Energi is poised for substantial financial growth.

- Take a closer look at Vår Energi's balance sheet health here in our report.

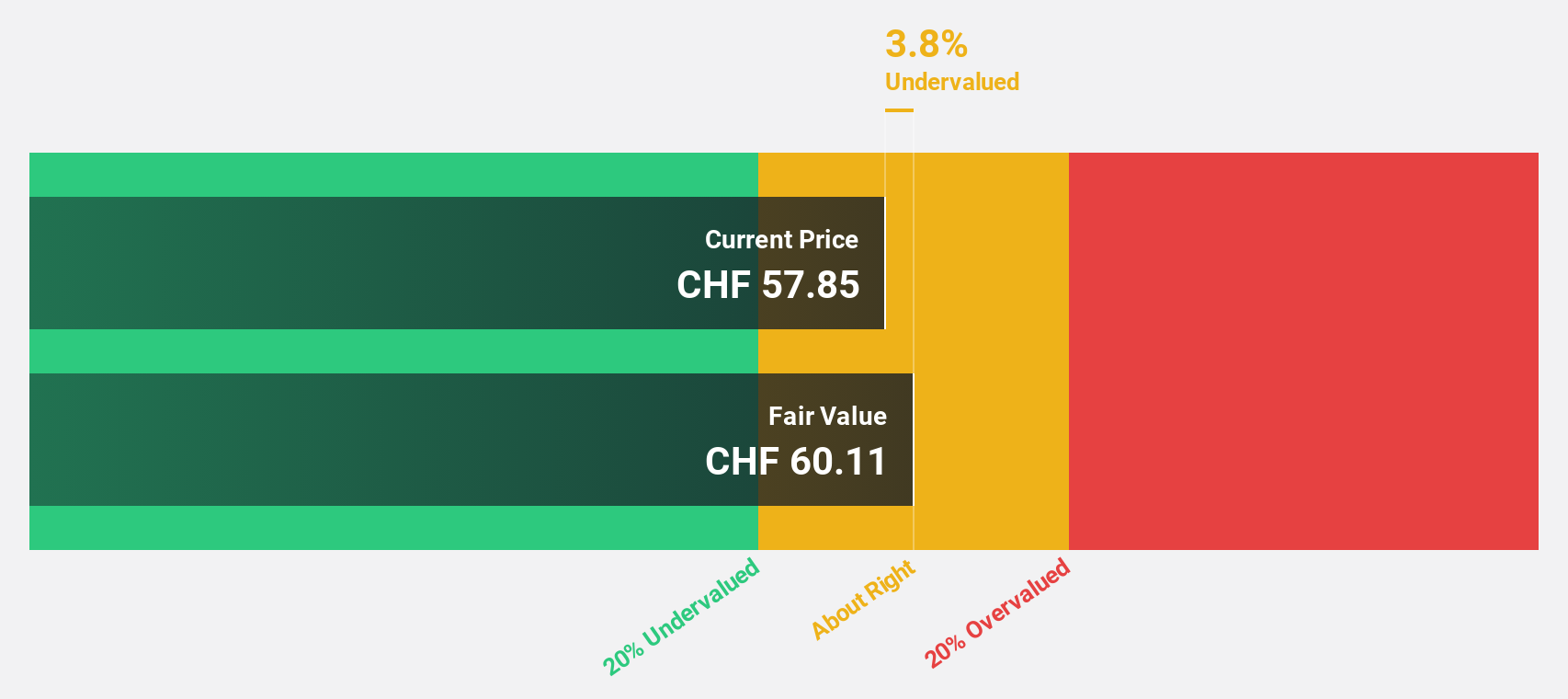

Temenos (SWX:TEMN)

Overview: Temenos AG develops, markets, and sells integrated banking software systems to banking and financial institutions globally, with a market cap of CHF4.37 billion.

Operations: The company's revenue segments include Software Licensing at $355.60 million, Software-as-a-Service at $150.30 million, Maintenance at $419.40 million, and Services at $133.90 million.

Estimated Discount To Fair Value: 44.5%

Temenos, trading at CHF59.9, is below its fair value estimate of CHF108, suggesting potential undervaluation based on cash flows. Despite high debt levels, earnings are expected to grow faster than the Swiss market at 11.7% annually. Recent Q3 results showed revenue increased to US$246.92 million from US$236.7 million year-on-year, with net income rising to US$30.85 million from US$21.88 million, reflecting improved profitability amidst strategic leadership changes and share buybacks.

- The analysis detailed in our Temenos growth report hints at robust future financial performance.

- Get an in-depth perspective on Temenos' balance sheet by reading our health report here.

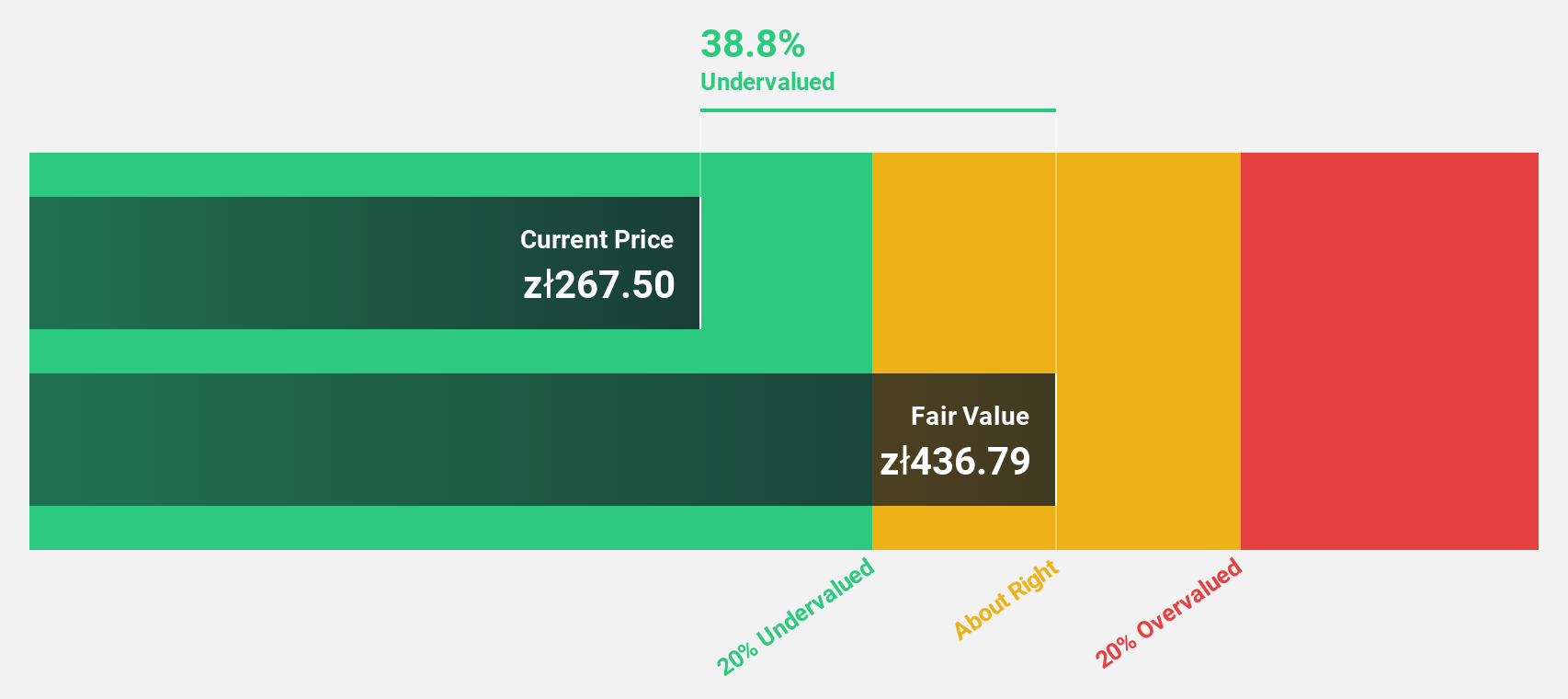

Mo-BRUK (WSE:MBR)

Overview: Mo-BRUK S.A. operates in the waste management sector, processing industrial, hazardous, and municipal waste across several European countries including Poland and Germany, with a market cap of PLN1.12 billion.

Operations: The company's revenue primarily comes from Waste Management, contributing PLN217.94 million, followed by Fuel Stations at PLN22.79 million.

Estimated Discount To Fair Value: 39.8%

Mo-BRUK, trading at PLN320, is significantly undervalued with a fair value estimate of PLN531.48 based on cash flow analysis. Despite recent earnings decline—net income fell to PLN 30.42 million from PLN 40.65 million—future prospects remain strong with earnings projected to grow 27.5% annually, outpacing the Polish market. However, the dividend yield of 4.12% isn't well supported by free cash flows, warranting cautious consideration for income-focused investors.

- The growth report we've compiled suggests that Mo-BRUK's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Mo-BRUK's balance sheet health report.

Make It Happen

- Take a closer look at our Undervalued Stocks Based On Cash Flows list of 900 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Temenos might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:TEMN

Temenos

Develops, markets, and sells integrated banking software systems to banking and other financial institutions worldwide.

Average dividend payer and fair value.