- Switzerland

- /

- Capital Markets

- /

- SWX:SQN

Three Stocks Possibly Priced Below Their Estimated Worth In December 2024

Reviewed by Simply Wall St

In a climate of cautious economic sentiment and fluctuating market indices, global investors are navigating the complexities of rate cuts and political uncertainties. Amid these challenges, identifying stocks that may be undervalued can offer potential opportunities, as such equities might be priced below their intrinsic value due to broader market pressures rather than company-specific issues.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiamen Bank (SHSE:601187) | CN¥5.69 | CN¥11.34 | 49.8% |

| Lindab International (OM:LIAB) | SEK226.40 | SEK450.98 | 49.8% |

| Absolent Air Care Group (OM:ABSO) | SEK255.00 | SEK509.76 | 50% |

| T'Way Air (KOSE:A091810) | ₩2505.00 | ₩4994.20 | 49.8% |

| NCSOFT (KOSE:A036570) | ₩205500.00 | ₩409580.73 | 49.8% |

| Pluk Phak Praw Rak Mae (SET:OKJ) | THB15.50 | THB30.86 | 49.8% |

| STIF Société anonyme (ENXTPA:ALSTI) | €24.60 | €49.13 | 49.9% |

| Surgical Science Sweden (OM:SUS) | SEK159.10 | SEK317.10 | 49.8% |

| Nanjing King-Friend Biochemical PharmaceuticalLtd (SHSE:603707) | CN¥13.24 | CN¥26.38 | 49.8% |

| RENK Group (DB:R3NK) | €18.342 | €36.47 | 49.7% |

Let's review some notable picks from our screened stocks.

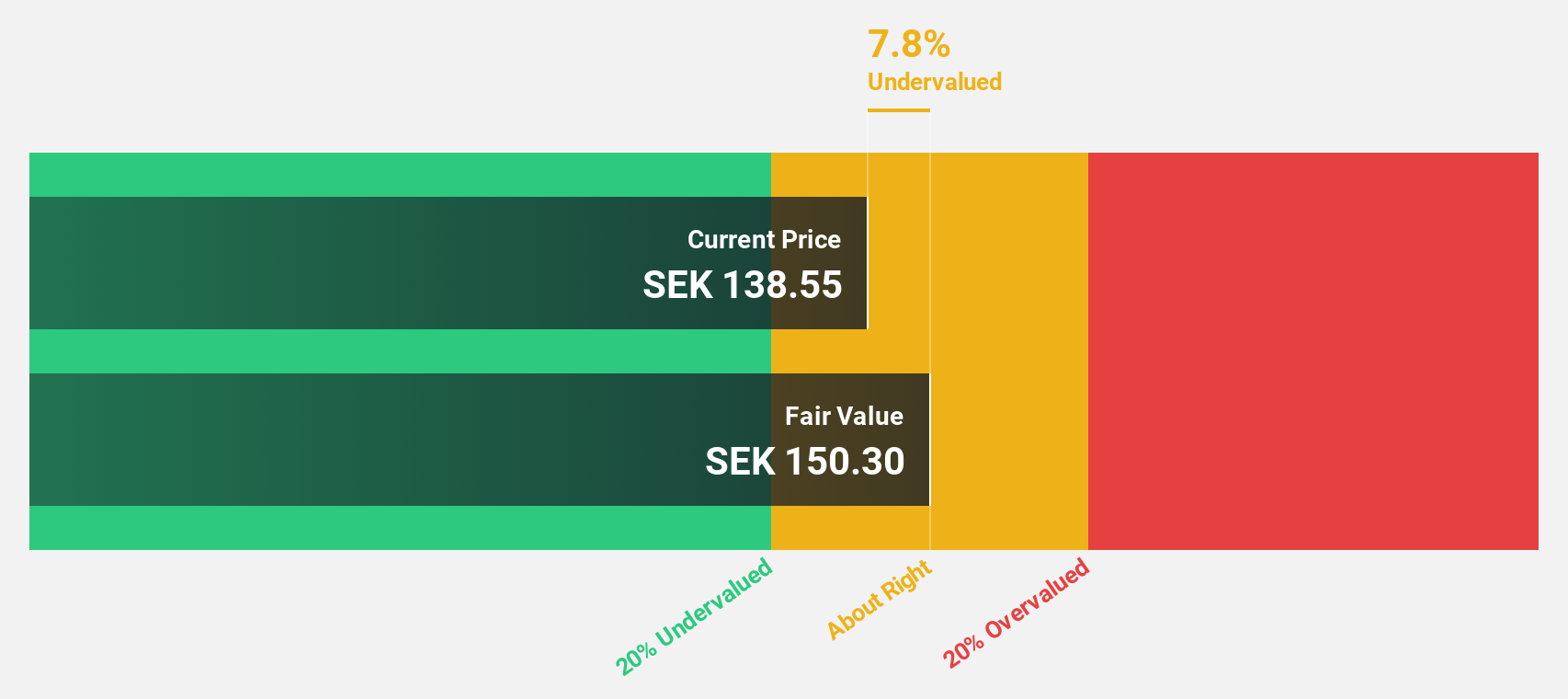

Yubico (OM:YUBICO)

Overview: Yubico AB offers authentication solutions for computers, networks, and online services, with a market cap of SEK21.18 billion.

Operations: The company's revenue from Security Software & Services amounts to SEK2.28 billion.

Estimated Discount To Fair Value: 12.8%

Yubico is trading at SEK246, slightly below its estimated fair value of SEK282.15, suggesting potential undervaluation based on cash flows. The company reported strong earnings growth, with net income reaching SEK81.2 million in Q3 2024 compared to a loss a year ago. Forecasts indicate annual earnings growth of 28.8%, outpacing the Swedish market's 14.7%. Despite recent insider selling and index fluctuations, Yubico's revenue is expected to grow significantly at 21.2% annually.

- Our comprehensive growth report raises the possibility that Yubico is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Yubico.

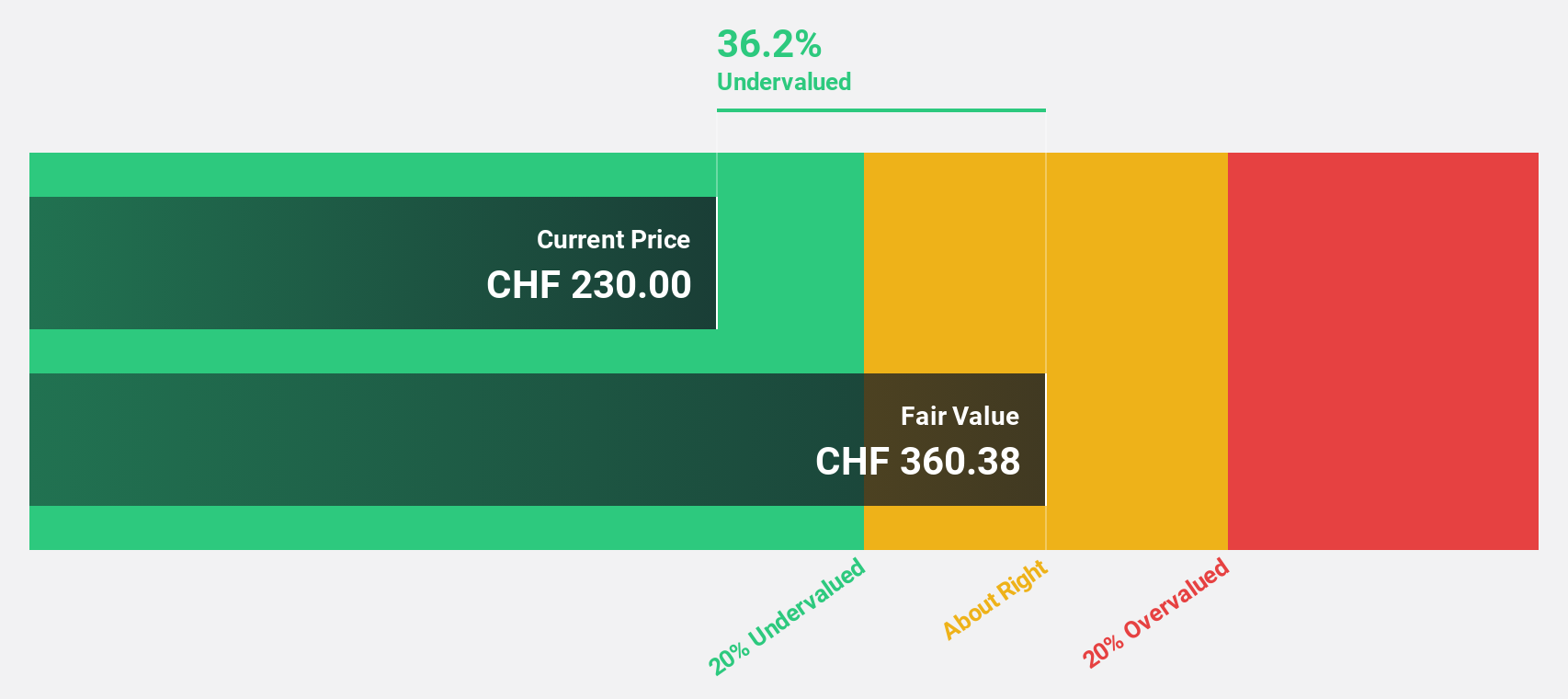

Comet Holding (SWX:COTN)

Overview: Comet Holding AG, with a market cap of CHF1.95 billion, offers X-ray and radio frequency power technology solutions across Europe, North America, Asia, and other international markets.

Operations: The company's revenue segments include X-Ray Systems (CHF115.34 million), Industrial X-Ray Modules (CHF95.90 million), and Plasma Control Technologies (CHF180.62 million).

Estimated Discount To Fair Value: 35.9%

Comet Holding, trading at CHF251, is valued 35.9% below its estimated fair value of CHF391.52, highlighting potential undervaluation based on cash flows. Analysts agree on a 45.9% stock price increase, with revenue and earnings growth forecasts significantly outpacing the Swiss market at 20.2% and 48.5% annually, respectively. However, profit margins have decreased from last year (10.8%) to 4.6%, and share price volatility has been high recently despite positive growth projections.

- Our expertly prepared growth report on Comet Holding implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Comet Holding's balance sheet by reading our health report here.

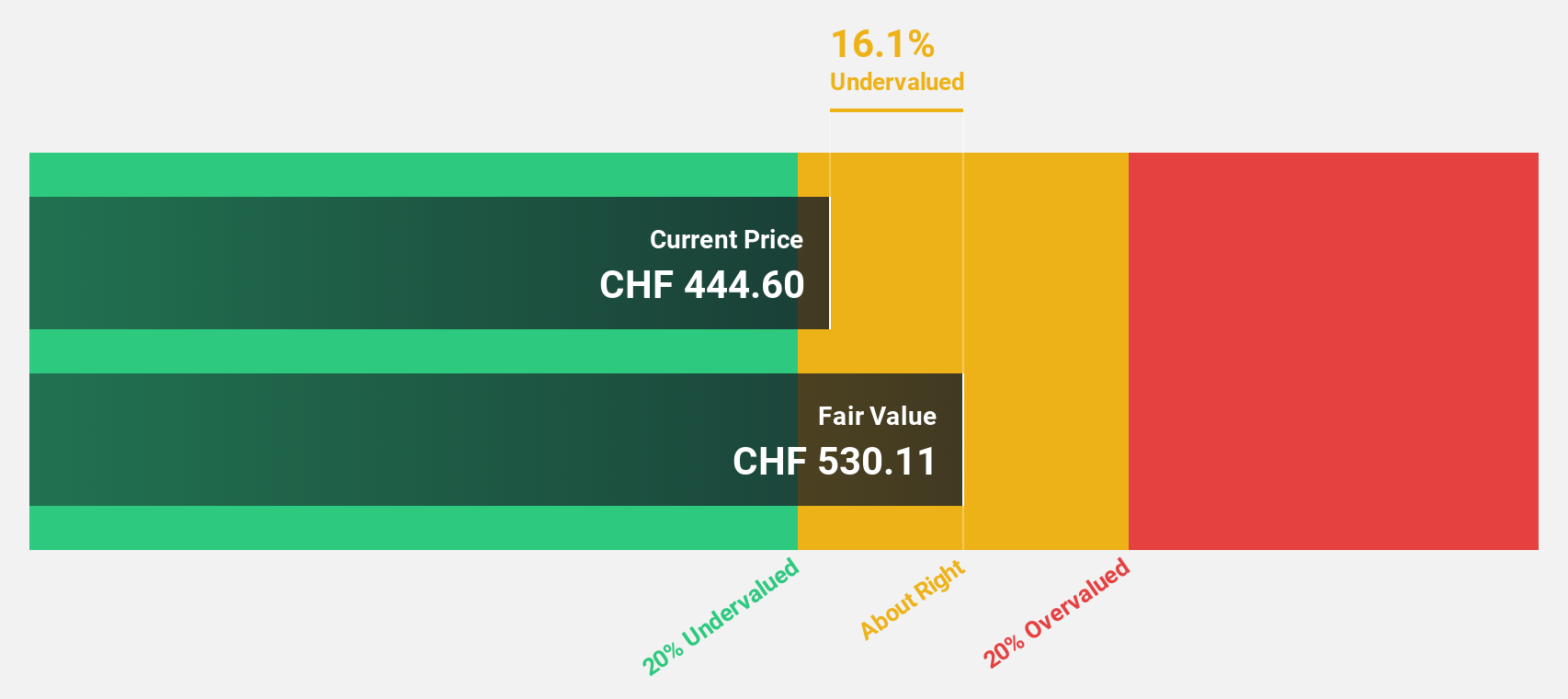

Swissquote Group Holding (SWX:SQN)

Overview: Swissquote Group Holding Ltd offers a range of online financial services to retail, affluent, and professional investors globally, with a market cap of CHF5.06 billion.

Operations: The company's revenue is primarily derived from two segments: Leveraged Forex, contributing CHF93.28 million, and Securities Trading, generating CHF488.98 million.

Estimated Discount To Fair Value: 40.1%

Swissquote Group Holding is trading at CHF340.8, significantly below its estimated fair value of CHF568.59, suggesting undervaluation based on cash flows. The company's earnings are forecast to grow at 11.8% annually, slightly outpacing the Swiss market's growth rate of 11.6%. Despite a robust past year with earnings growth of 36.9%, future revenue growth is expected to be moderate at 10.2%, yet still above the broader market's pace of 4.2%.

- Our earnings growth report unveils the potential for significant increases in Swissquote Group Holding's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Swissquote Group Holding.

Make It Happen

- Embark on your investment journey to our 868 Undervalued Stocks Based On Cash Flows selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SQN

Swissquote Group Holding

Provides online financial services to retail investors, affluent investors, and professional and institutional customers in Switzerland and internationally.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives