As global markets navigate a choppy start to 2025, marked by inflation concerns and political uncertainties, investors are closely watching the performance of major indices like the Nasdaq Composite and Russell 2000, both of which have experienced notable declines. Amidst these fluctuations, dividend stocks offer a potential source of stability and income for investors seeking to weather economic volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.27% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.36% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.77% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.06% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.00% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.64% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.89% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.17% | ★★★★★★ |

Click here to see the full list of 2017 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

SpareBank 1 SMN (OB:MING)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SpareBank 1 SMN, along with its subsidiaries, offers a range of banking, accounting, and real estate products and services to both private individuals and companies in Norway and internationally, with a market cap of NOK25.07 billion.

Operations: SpareBank 1 SMN generates its revenue from several segments, including Retail Banking (NOK3.00 billion), Corporate Market (NOK1.89 billion), Sunnmøre and Fjordane (NOK858 million), Eiendoms Megler 1 Midt-Norge (NOK616 million), Sparebank 1 Finans Midt-Norge (NOK431 million), and Sparebank 1 Regnskapshuset SMN (NOK709 million).

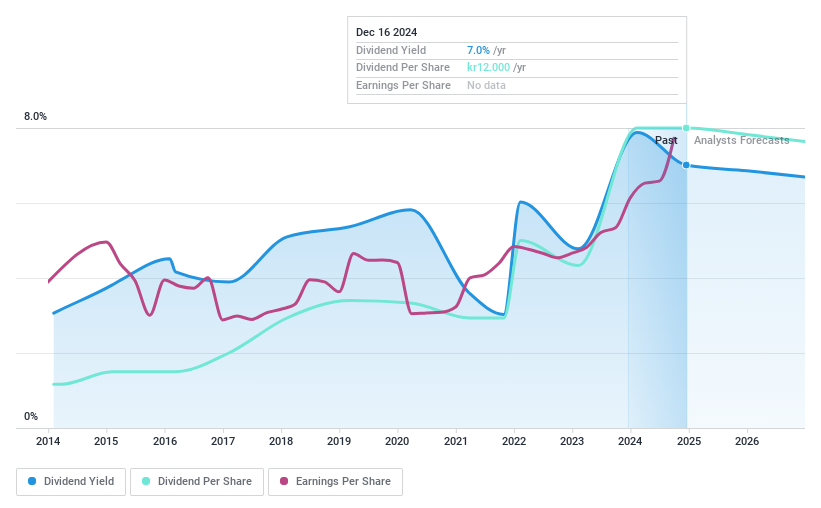

Dividend Yield: 6.9%

SpareBank 1 SMN's recent earnings report shows strong growth, with net income rising to NOK 1.42 billion in Q3 2024 from NOK 732 million a year ago. The bank offers a stable and reliable dividend yield of 6.9%, although lower than the top Norwegian payers. With a current payout ratio of 56.5% and forecasted coverage at 65.6% in three years, dividends are well-supported by earnings, reflecting sustainability and potential for continued growth over the past decade.

- Get an in-depth perspective on SpareBank 1 SMN's performance by reading our dividend report here.

- The analysis detailed in our SpareBank 1 SMN valuation report hints at an deflated share price compared to its estimated value.

Oversea-Chinese Banking (SGX:O39)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oversea-Chinese Banking Corporation Limited, along with its subsidiaries, offers financial services across Singapore, Malaysia, Indonesia, Greater China, the rest of the Asia Pacific region, and internationally with a market capitalization of SGD76.33 billion.

Operations: Oversea-Chinese Banking Corporation Limited generates revenue through various financial services provided across Singapore, Malaysia, Indonesia, Greater China, and other parts of the Asia Pacific region as well as internationally.

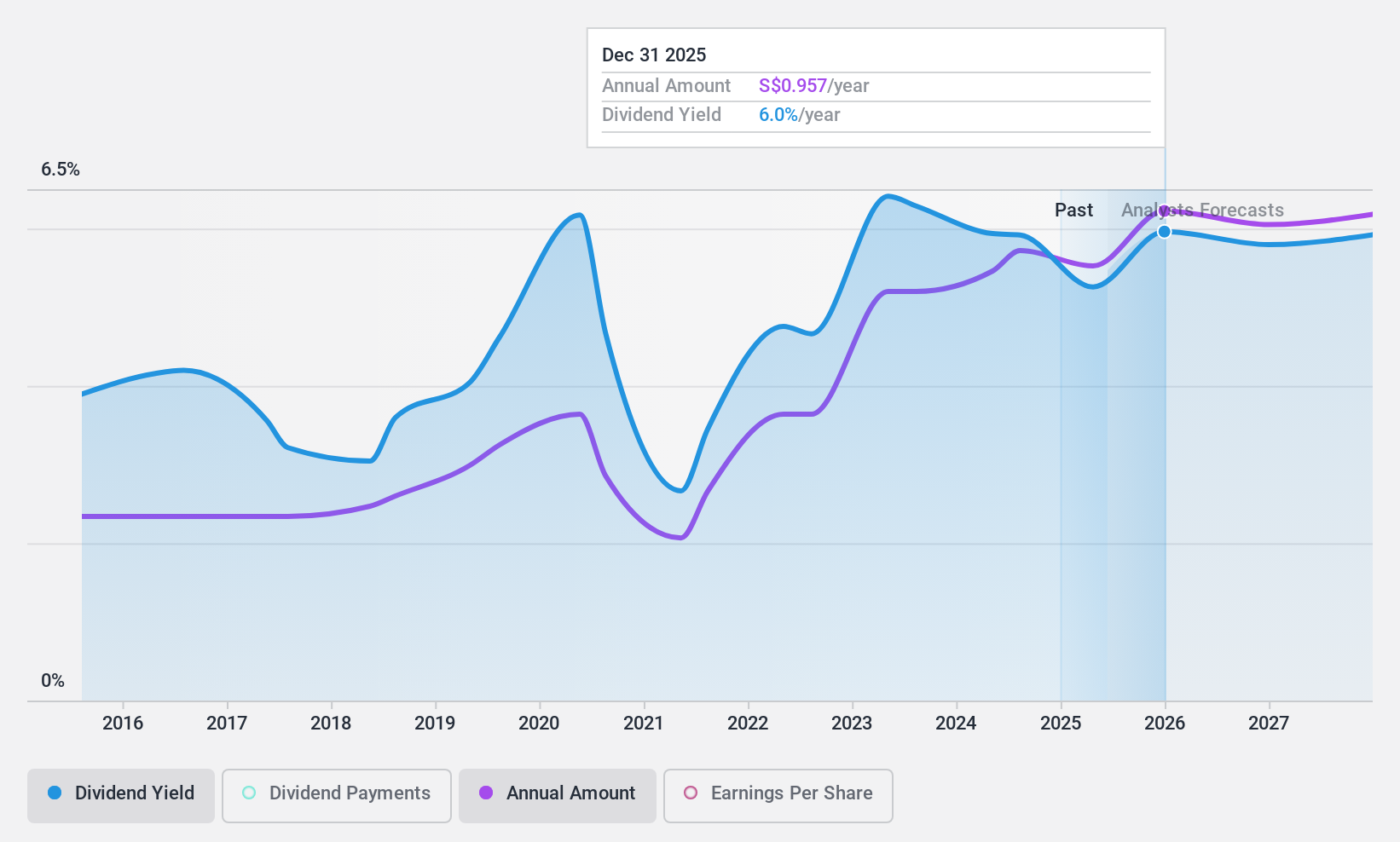

Dividend Yield: 5.2%

Oversea-Chinese Banking Corporation's dividend payments have been unstable, with volatility over the past decade. Despite this, dividends are currently covered by earnings with a payout ratio of 51.4%, and future coverage is forecasted at 56.4%. The dividend yield of 5.19% is below the top tier in Singapore's market. Recent strategic moves include a partnership with Ant International to enhance cross-border fund settlements, potentially bolstering financial operations and supporting long-term growth prospects.

- Click here to discover the nuances of Oversea-Chinese Banking with our detailed analytical dividend report.

- The analysis detailed in our Oversea-Chinese Banking valuation report hints at an inflated share price compared to its estimated value.

Benefit Systems (WSE:BFT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Benefit Systems S.A. offers non-pay employee benefits solutions in Poland and internationally, with a market cap of PLN8.79 billion.

Operations: Benefit Systems S.A. generates revenue primarily from its operations in Poland, amounting to PLN2.36 billion, and from foreign markets, contributing PLN874.71 million.

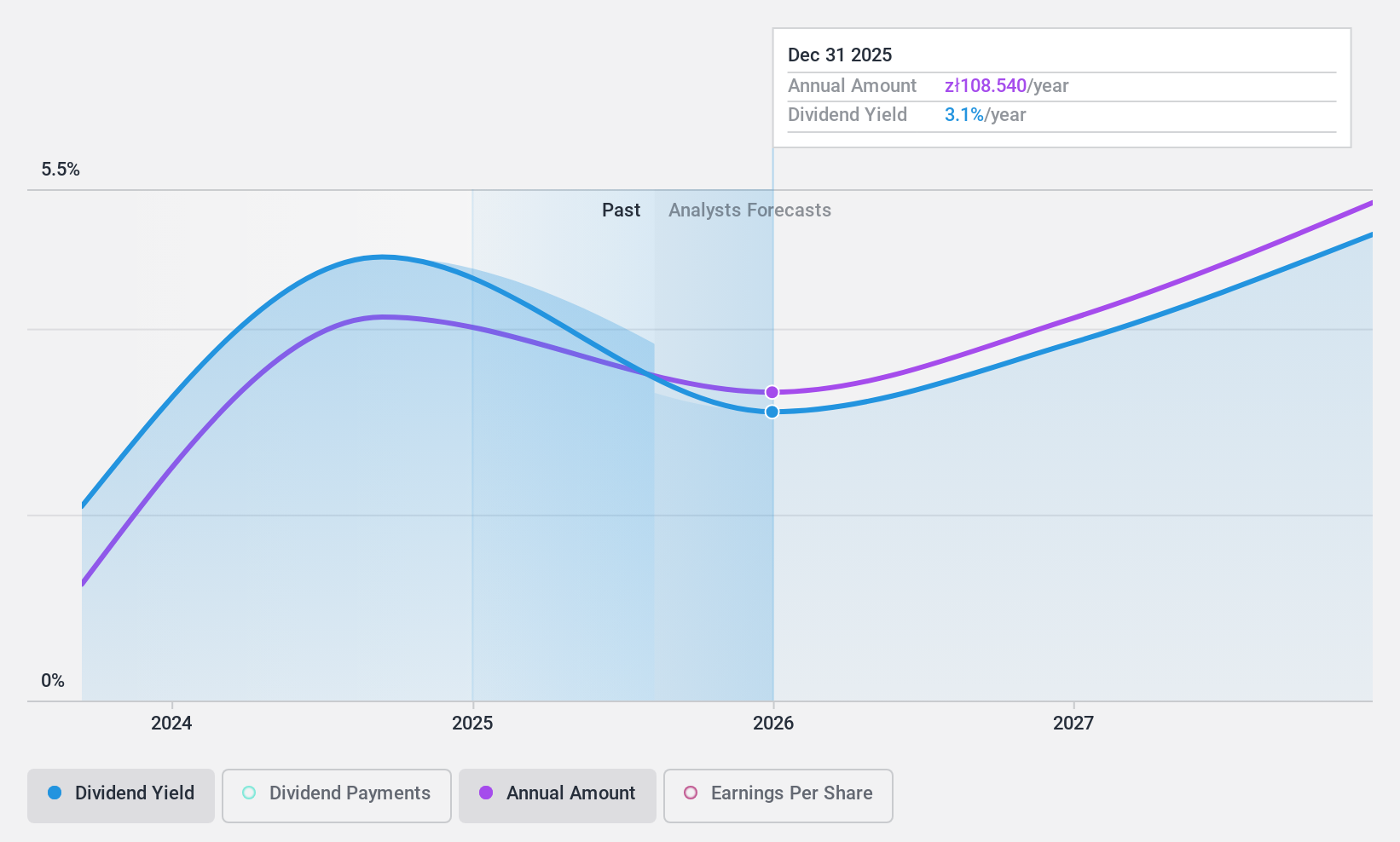

Dividend Yield: 4.5%

Benefit Systems' dividend payments have been inconsistent over the past decade, despite coverage by earnings with an 83.4% payout ratio and a cash payout ratio of 59.2%. The dividend yield of 4.55% is below Poland's top tier, though payments have increased over ten years. Recent earnings showed significant growth, with Q3 revenue at PLN 835.95 million and net income at PLN 134.02 million, suggesting potential for continued financial strength supporting dividends.

- Delve into the full analysis dividend report here for a deeper understanding of Benefit Systems.

- Our valuation report here indicates Benefit Systems may be undervalued.

Taking Advantage

- Click here to access our complete index of 2017 Top Dividend Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:O39

Oversea-Chinese Banking

Engages in the provision of financial services in Singapore, Malaysia, Indonesia, Greater China, rest of the Asia Pacific, and internationally.

Flawless balance sheet average dividend payer.