- Netherlands

- /

- Hospitality

- /

- ENXTAM:BFIT

European Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As the European markets navigate a mixed landscape, with the pan-European STOXX Europe 600 Index seeing slight gains amid dovish signals from U.S. Federal Reserve officials and easing trade tensions, investors are keenly observing opportunities for undervalued stocks. In such an environment, identifying stocks that may be trading below their estimated value can provide potential entry points for those looking to capitalize on market inefficiencies and economic shifts.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sandoz Group (SWX:SDZ) | CHF48.42 | CHF95.00 | 49% |

| Mo-BRUK (WSE:MBR) | PLN291.50 | PLN582.24 | 49.9% |

| Micro Systemation (OM:MSAB B) | SEK62.00 | SEK122.78 | 49.5% |

| Lingotes Especiales (BME:LGT) | €5.60 | €11.14 | 49.7% |

| DSV (CPSE:DSV) | DKK1333.00 | DKK2654.85 | 49.8% |

| doValue (BIT:DOV) | €2.798 | €5.53 | 49.4% |

| DigiTouch (BIT:DGT) | €1.90 | €3.79 | 49.9% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.38 | €6.62 | 48.9% |

| Allegro.eu (WSE:ALE) | PLN33.545 | PLN66.46 | 49.5% |

| Aker BioMarine (OB:AKBM) | NOK85.50 | NOK169.44 | 49.5% |

Underneath we present a selection of stocks filtered out by our screen.

Ambu (CPSE:AMBU B)

Overview: Ambu A/S is a medical technology company that develops, produces, and sells medical devices to hospitals, clinics, and rescue services globally, with a market cap of DKK28.05 billion.

Operations: The company generates revenue of DKK5.96 billion from its Disposable Medical Products segment, catering to healthcare facilities and emergency services worldwide.

Estimated Discount To Fair Value: 27.2%

Ambu A/S is trading at DKK 105.3, significantly below its estimated fair value of DKK 144.67, presenting a potential undervaluation opportunity based on cash flows. The company forecasts earnings growth of 24.4% per year, surpassing the Danish market's average growth rate. Despite a modest revenue growth forecast of 11.1%, Ambu raised its financial guidance for EBIT margins to between 13% and 15%. However, low return on equity and large one-off items may impact results.

- The growth report we've compiled suggests that Ambu's future prospects could be on the up.

- Click here to discover the nuances of Ambu with our detailed financial health report.

Basic-Fit (ENXTAM:BFIT)

Overview: Basic-Fit N.V., with a market cap of €1.78 billion, operates fitness clubs through its subsidiaries.

Operations: The company's revenue segments include €541.70 million from Benelux and €766 million from France, Spain, and Germany.

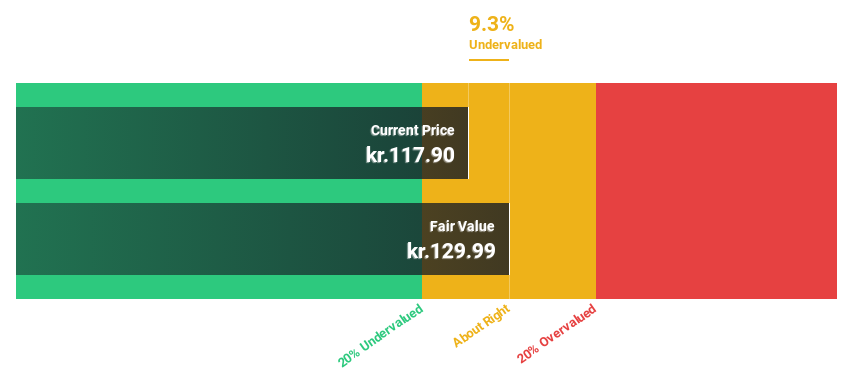

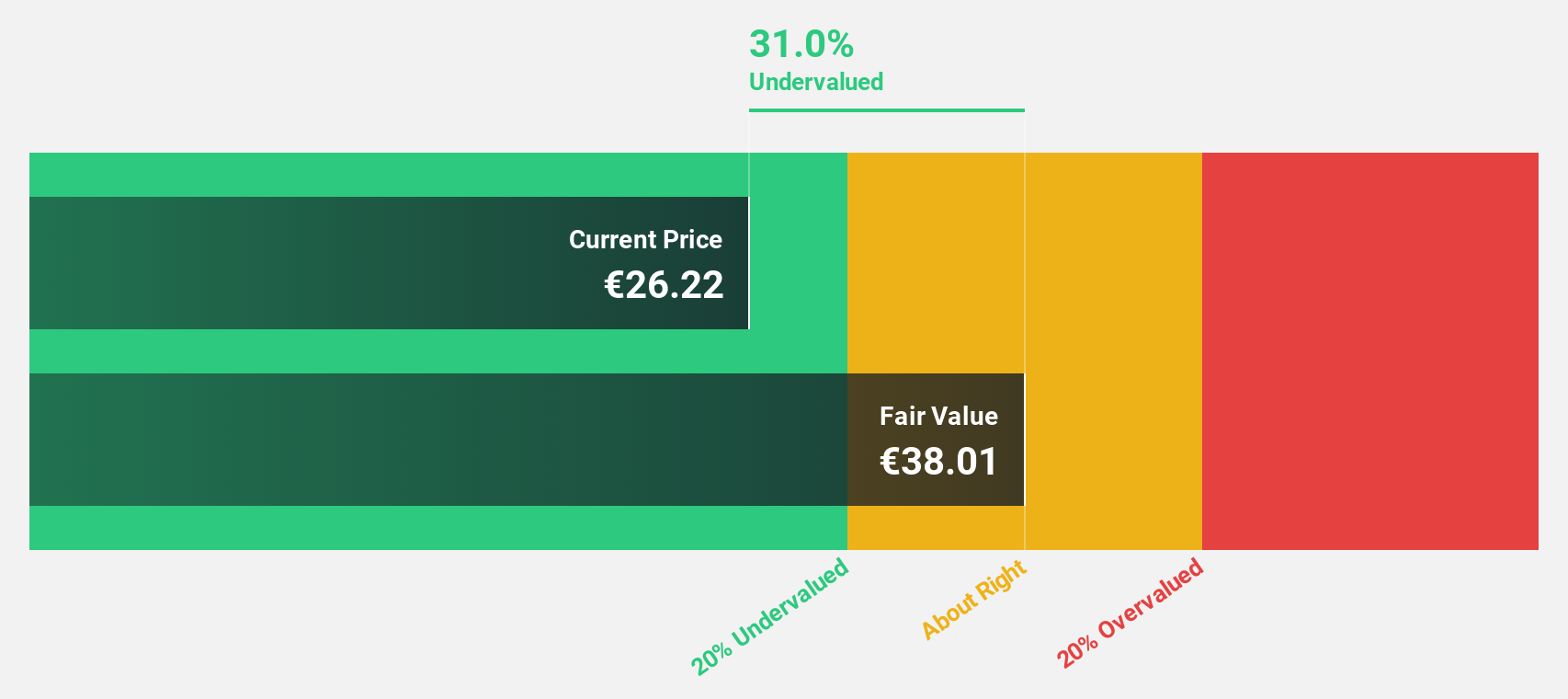

Estimated Discount To Fair Value: 28.3%

Basic-Fit N.V. is trading at €27.24, notably below its estimated fair value of €38.01, suggesting potential undervaluation based on cash flows. The company reaffirmed its revenue guidance for 2025 between €1.375 billion and €1.425 billion after reporting a significant 60% revenue increase in the first nine months compared to last year. Despite recent volatility, Basic-Fit is expected to become profitable within three years with above-average market growth forecasts for profit and revenue expansion at 46.72% annually.

- Upon reviewing our latest growth report, Basic-Fit's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Basic-Fit with our comprehensive financial health report here.

InPost (ENXTAM:INPST)

Overview: InPost S.A. operates as an out-of-home e-commerce enablement platform offering parcel locker services across Poland and other European countries, with a market cap of €5.21 billion.

Operations: The company generates revenue primarily from its parcel locker services in Poland and various European nations.

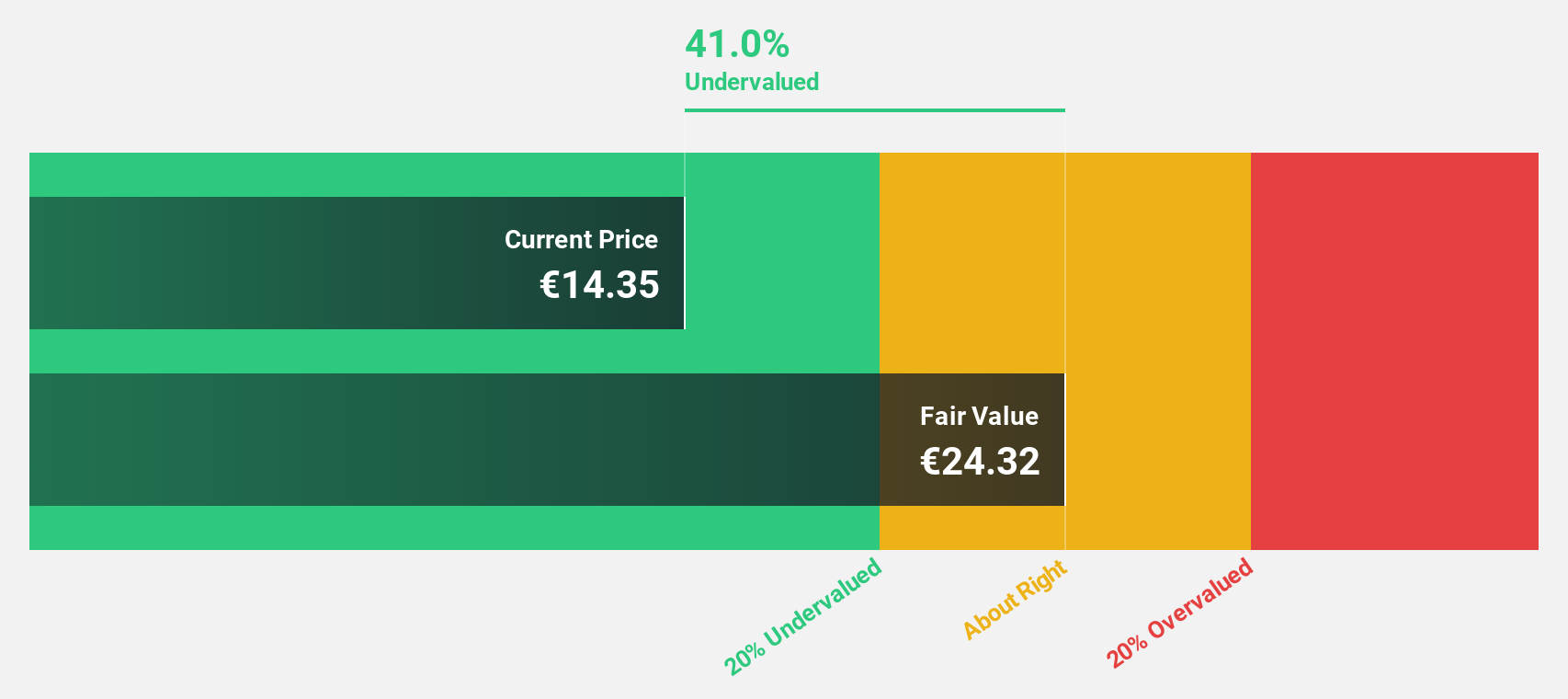

Estimated Discount To Fair Value: 45.7%

InPost is trading at €10.43, significantly below its estimated fair value of €19.2, reflecting potential undervaluation based on cash flows. Despite a high debt level, InPost's earnings are forecast to grow significantly at 24.6% annually over the next three years, outpacing the Dutch market's growth rate. Recent strategic moves include redeeming PLN 500 million and €490 million bonds while issuing €850 million in new notes to optimize financial structure amidst volatile share price conditions.

- In light of our recent growth report, it seems possible that InPost's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of InPost.

Taking Advantage

- Discover the full array of 215 Undervalued European Stocks Based On Cash Flows right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Basic-Fit might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:BFIT

High growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)