As global markets navigate a landscape marked by U.S.-China trade tensions, fluctuating oil prices, and evolving inflation dynamics, investors are increasingly seeking stability through dividend stocks. With major indices like the S&P 500 and Nasdaq Composite showing positive trends despite economic uncertainties, selecting dividend-paying stocks can offer a blend of income and potential growth in this complex market environment.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 3.65% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.01% | ★★★★★★ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.77% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.68% | ★★★★★★ |

| NCD (TSE:4783) | 4.40% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.06% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| Daicel (TSE:4202) | 4.46% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.65% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.58% | ★★★★★★ |

Click here to see the full list of 1361 stocks from our Top Global Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

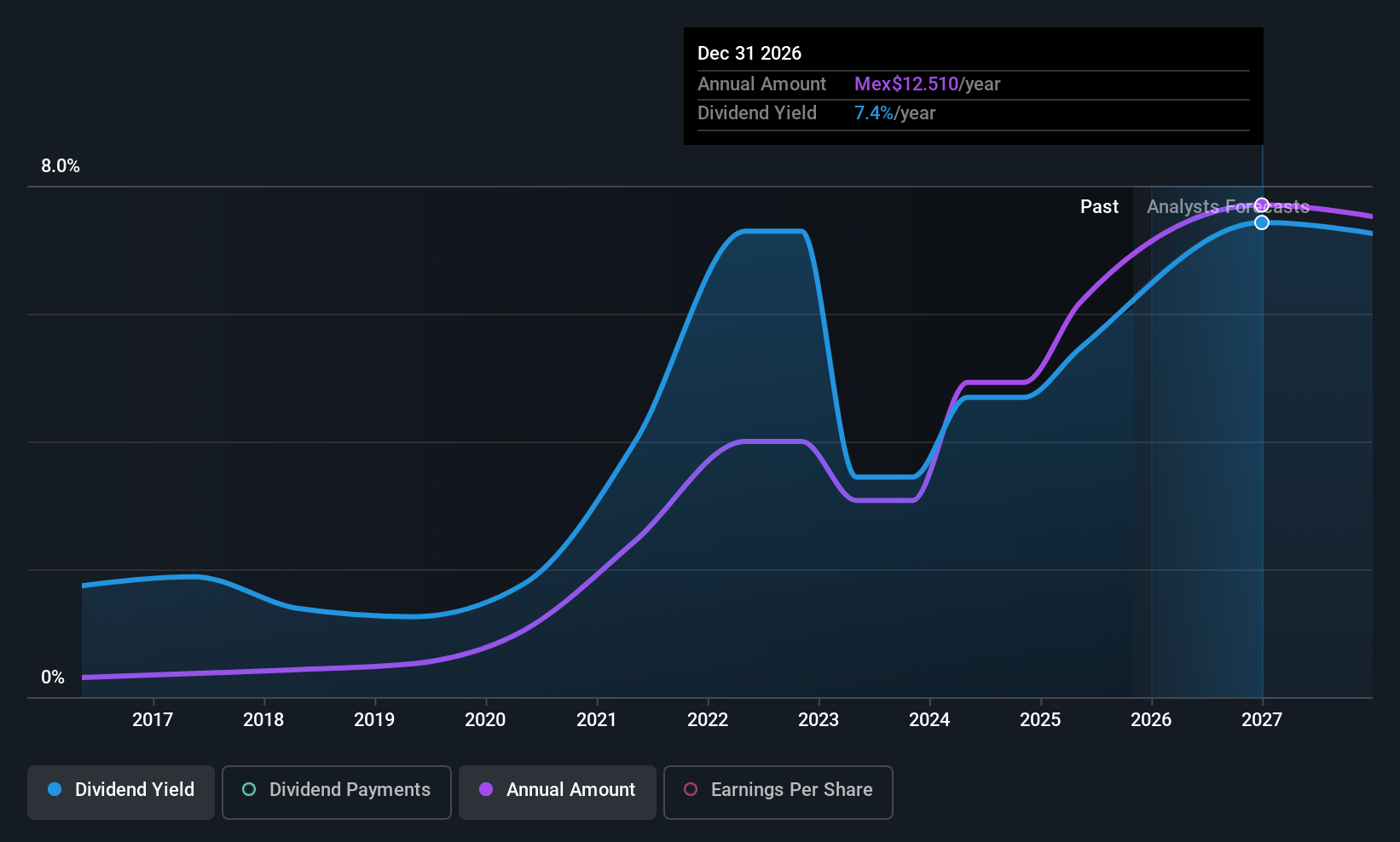

Quálitas Controladora. de (BMV:Q *)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Quálitas Controladora, S.A.B. de C.V. operates through its subsidiaries to offer insurance, coinsurance, and reinsurance services in personal accident, health, and automobile sectors across Mexico, El Salvador, Costa Rica, Peru, and the United States with a market cap of MX$67.16 billion.

Operations: Quálitas Controladora, S.A.B. de C.V. generates revenue through its subsidiaries by providing insurance, coinsurance, and reinsurance services in the personal accident, health, and automobile sectors across several countries.

Dividend Yield: 5.9%

Quálitas Controladora's dividend is covered by earnings and cash flows, with payout ratios of 59.7% and 50%, respectively, indicating sustainability. However, the dividend has been volatile over the past decade despite growth in payments. Its current yield of 5.87% is below the top tier in Mexico's market. Recent earnings show significant growth with net income rising to MX$1.73 billion for Q3 2025 from MX$1.15 billion a year prior, supporting its financial stability for dividends.

- Unlock comprehensive insights into our analysis of Quálitas Controladora. de stock in this dividend report.

- Our expertly prepared valuation report Quálitas Controladora. de implies its share price may be lower than expected.

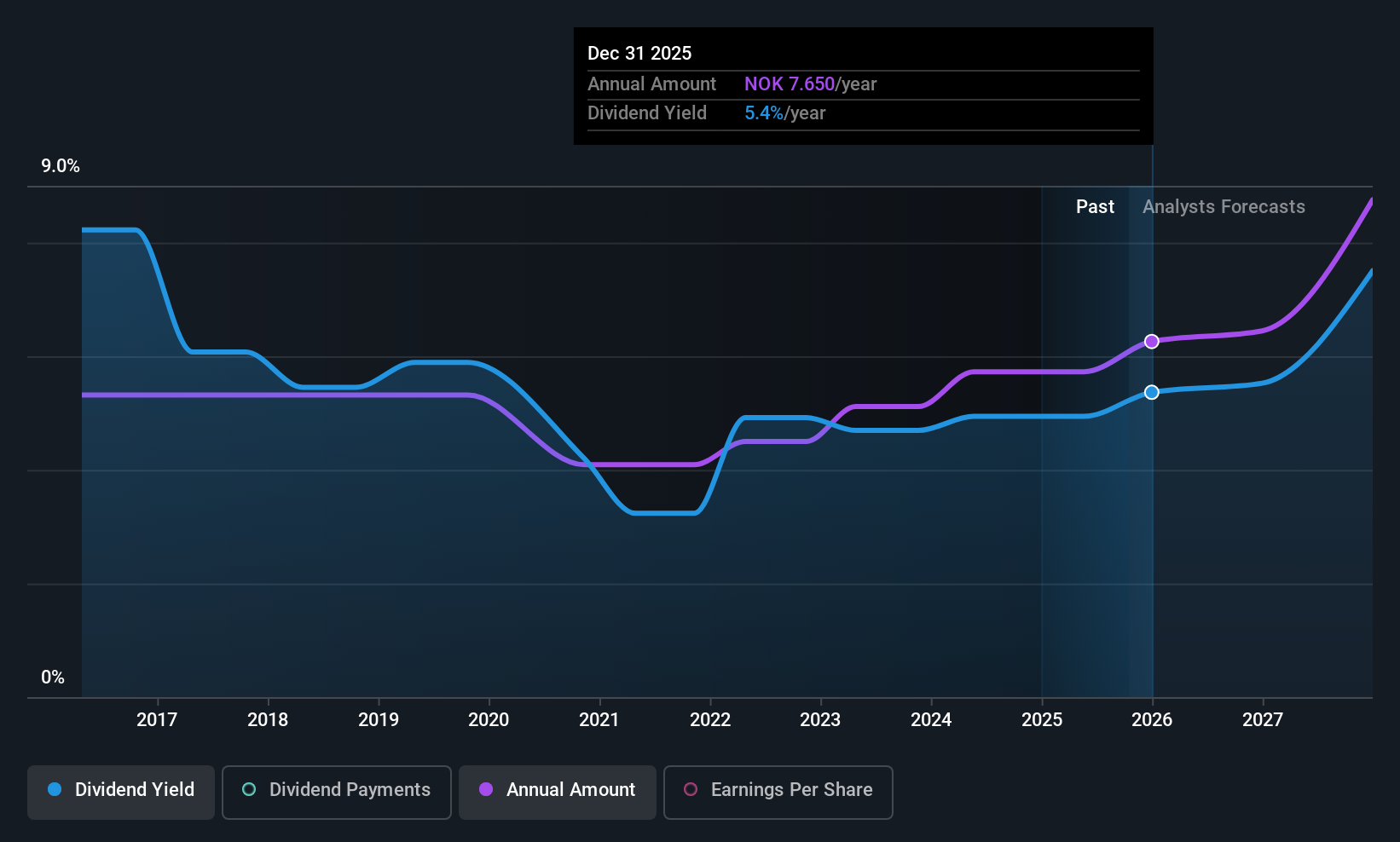

Atea (OB:ATEA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Atea ASA offers IT infrastructure and related solutions to businesses and public sector organizations in the Nordic countries and Baltic regions, with a market cap of NOK17.17 billion.

Operations: Atea ASA's revenue segments include NOK9.27 billion from Norway, NOK13.73 billion from Sweden, NOK8.56 billion from Denmark, NOK3.48 billion from Finland, and NOK1.90 billion from the Baltics, with additional contributions of NOK11.86 billion from Group Shared Services.

Dividend Yield: 4.5%

Atea's dividend reliability is notable with consistent growth over the past decade, yet its sustainability is questionable due to a high payout ratio of 98.2% and coverage issues by earnings. The current yield of 4.54% lags behind top-tier Norwegian dividends. Recent earnings reveal modest growth, with Q3 net income rising to NOK 226 million from NOK 192 million year-on-year, reflecting some financial stability despite concerns about dividend coverage and sustainability.

- Click here and access our complete dividend analysis report to understand the dynamics of Atea.

- Insights from our recent valuation report point to the potential undervaluation of Atea shares in the market.

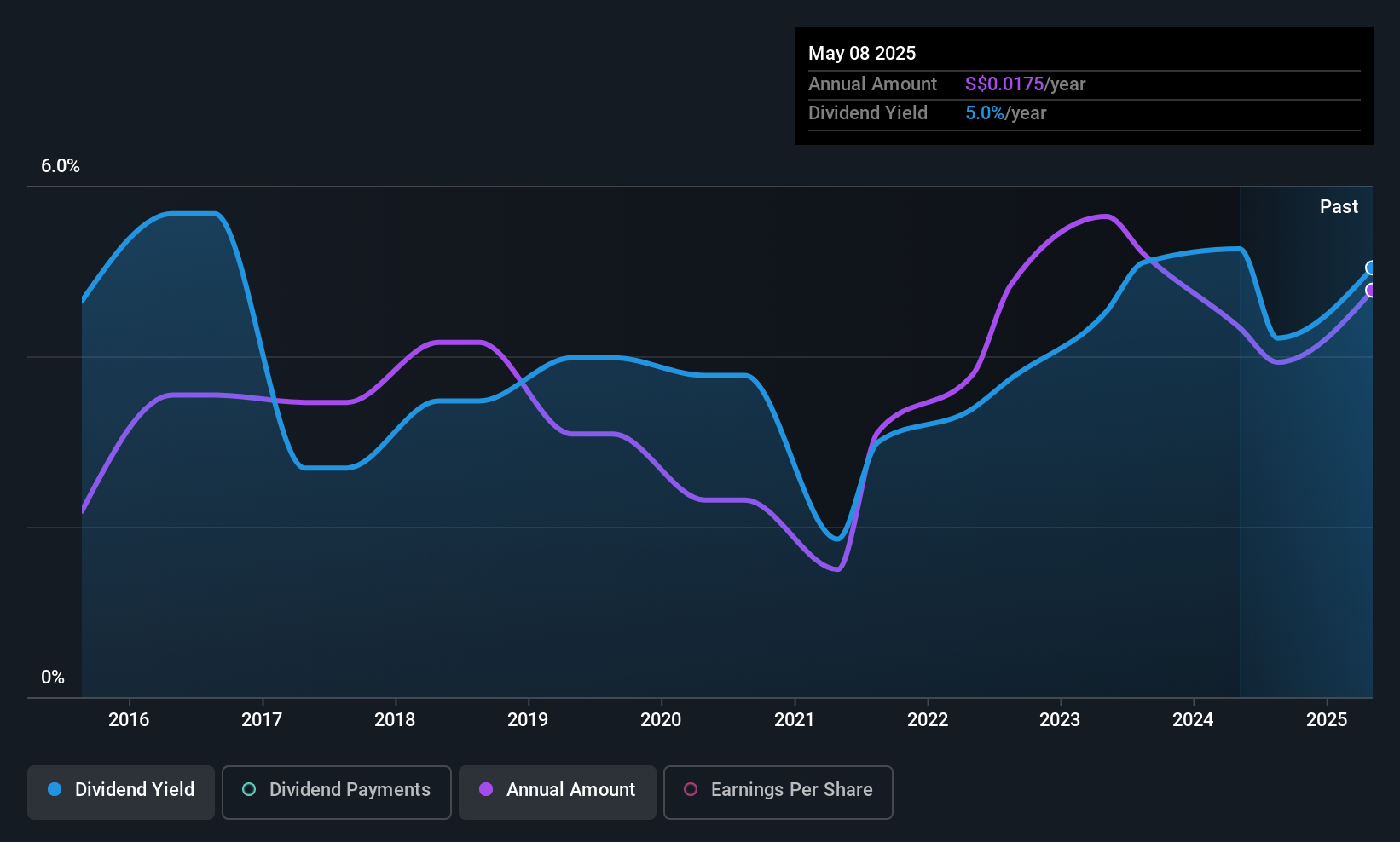

Nordic Group (SGX:MR7)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nordic Group Limited offers a range of services including system integration, maintenance, repair, overhaul, trading, precision engineering, scaffolding, insulation, petrochemical and environmental engineering, cleanroom solutions as well as air and water engineering and construction services with a market cap of SGD167.27 million.

Operations: Nordic Group Limited's revenue is primarily derived from Project Services, which account for SGD90.63 million, and Maintenance Services, contributing SGD81.99 million.

Dividend Yield: 4.1%

Nordic Group's dividends have been volatile over the past decade, with a current yield of 4.11%, below the top tier in Singapore. Despite this, dividends are well-covered by earnings and cash flow, with payout ratios of 39.9% and 27.4% respectively. Recent strategic expansion into India aims to bolster long-term growth but hasn't materially impacted financials yet. Earnings for H1 2025 were stable at SGD 8.28 million, slightly down from last year’s SGD 8.53 million.

- Delve into the full analysis dividend report here for a deeper understanding of Nordic Group.

- Our comprehensive valuation report raises the possibility that Nordic Group is priced lower than what may be justified by its financials.

Where To Now?

- Navigate through the entire inventory of 1361 Top Global Dividend Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:ATEA

Atea

Provides IT infrastructure and related solutions for businesses and public sector organizations in the Nordic countries and Baltic regions.

High growth potential, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)