- Switzerland

- /

- Capital Markets

- /

- SWX:LEON

Insider-Favored Growth Stocks For December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape of cautious Federal Reserve commentary and political uncertainties, U.S. stocks have experienced notable fluctuations, with recent rate cuts and economic data influencing investor sentiment. Amidst these shifting conditions, insider ownership in growth companies can serve as a compelling indicator of confidence in a company's long-term potential, particularly when facing broader market volatility.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.4% | 66.3% |

| HANA Micron (KOSDAQ:A067310) | 18.5% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Underneath we present a selection of stocks filtered out by our screen.

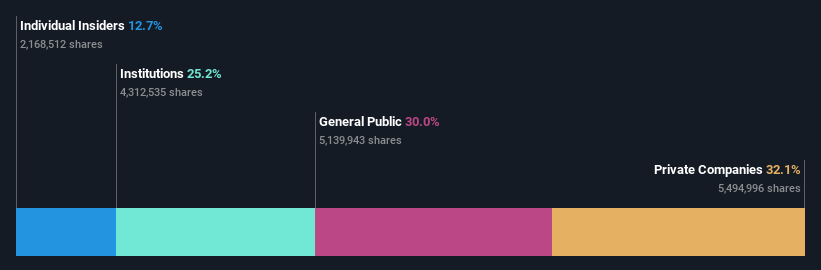

Alsea. de (BMV:ALSEA *)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alsea, S.A.B. de C.V. operates restaurants across Latin America and Europe with a market cap of MX$36.50 billion.

Operations: Alsea generates its revenue from operating restaurants in Latin America and Europe.

Insider Ownership: 38.6%

Earnings Growth Forecast: 24.7% p.a.

Alsea, S.A.B. de C.V. showcases robust growth potential with earnings forecasted to expand at 24.7% annually, outpacing the Mexican market's 12.6%. Despite a recent dip in net income for Q3 2024 to MXN 0.454 million from MXN 530.5 million last year, revenue rose to MXN 20,741.95 million from MXN 19,469.97 million year-over-year, indicating strong sales momentum. The stock trades at a slight discount to its fair value and is expected to achieve high returns on equity in three years but faces challenges with interest coverage and dividend stability.

- Take a closer look at Alsea. de's potential here in our earnings growth report.

- Our expertly prepared valuation report Alsea. de implies its share price may be lower than expected.

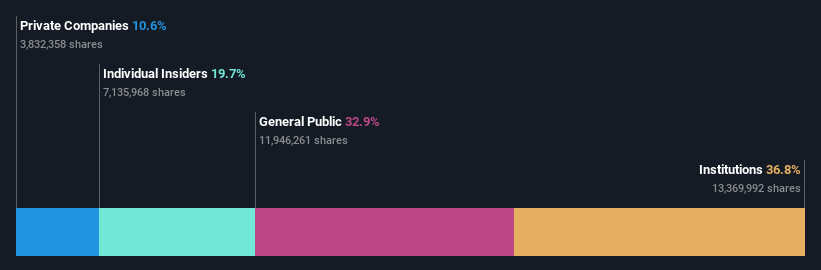

Vaisala Oyj (HLSE:VAIAS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vaisala Oyj operates in the weather and environmental, and industrial measurement sectors, serving weather-related and industrial markets, with a market cap of €1.71 billion.

Operations: The company's revenue is derived from two primary segments: Industrial Measurements, contributing €219.40 million, and Weather and Environment, accounting for €325 million.

Insider Ownership: 19.7%

Earnings Growth Forecast: 16.2% p.a.

Vaisala Oyj, with a strong insider ownership structure, is positioned for growth through strategic leadership changes and product innovation. The recent appointment of Lorenzo Gulli as EVP of Strategy and M&A underscores its focus on leveraging mergers and acquisitions for expansion. Despite moderate revenue growth forecasts at 6.7% annually, earnings are expected to grow faster than the Finnish market at 16.2%. Recent Q3 results show steady sales increase to €136.6 million, supporting its growth trajectory.

- Navigate through the intricacies of Vaisala Oyj with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Vaisala Oyj's share price might be on the expensive side.

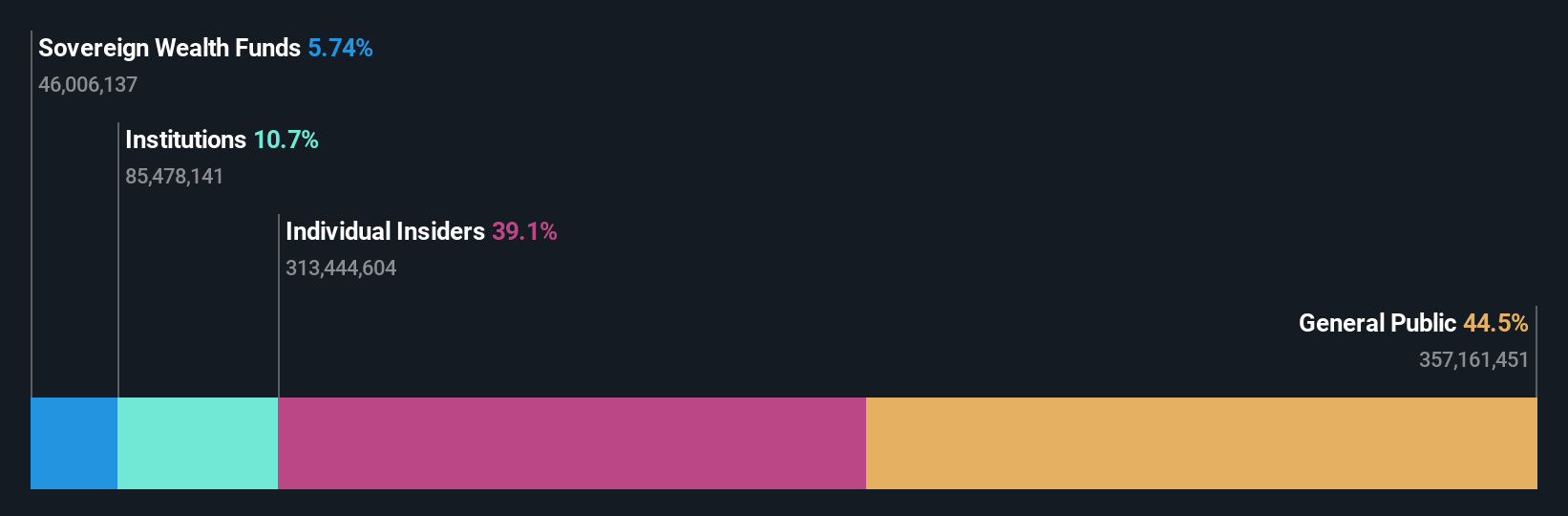

Leonteq (SWX:LEON)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Leonteq AG is a Swiss company offering structured investment products and long-term savings and retirement solutions across Switzerland, Europe, and Asia including the Middle East, with a market cap of CHF353.20 million.

Operations: The company's revenue primarily comes from its brokerage segment, which generated CHF244.51 million.

Insider Ownership: 17.7%

Earnings Growth Forecast: 40.9% p.a.

Leonteq AG, despite its highly volatile share price recently, shows promising growth potential with earnings forecasted to grow significantly at 40.89% annually over the next three years, outpacing the Swiss market. However, profit margins have decreased from last year and debt coverage by operating cash flow is inadequate. While trading substantially below its estimated fair value, insider ownership remains a key factor in its strategic direction and growth prospects.

- Get an in-depth perspective on Leonteq's performance by reading our analyst estimates report here.

- The analysis detailed in our Leonteq valuation report hints at an inflated share price compared to its estimated value.

Where To Now?

- Discover the full array of 1515 Fast Growing Companies With High Insider Ownership right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:LEON

Leonteq

Provides structured investment products and long-term savings and retirement solutions in Switzerland, Europe, and Asia including the Middle East.

Moderate with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives