- France

- /

- Entertainment

- /

- ENXTPA:BLV

3 Stocks That May Be Up To 49.3% Below Estimated Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate uncertainties surrounding trade policies and economic indicators, investors are closely monitoring the impact of tariffs and fluctuating job growth on major indices. Amid these conditions, identifying stocks that may be undervalued presents an opportunity for investors seeking potential value in a volatile market. Recognizing a good stock often involves assessing its intrinsic value relative to its current market price, especially when broader market sentiments might not fully reflect the company's fundamental strengths.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Gilead Sciences (NasdaqGS:GILD) | US$96.14 | US$191.74 | 49.9% |

| National World (LSE:NWOR) | £0.227 | £0.45 | 49.5% |

| On the Beach Group (LSE:OTB) | £2.495 | £4.94 | 49.5% |

| TCI (TPEX:8436) | NT$119.00 | NT$237.00 | 49.8% |

| Hanjaya Mandala Sampoerna (IDX:HMSP) | IDR575.00 | IDR1141.10 | 49.6% |

| APAC Realty (SGX:CLN) | SGD0.455 | SGD0.91 | 49.9% |

| Smurfit Westrock (NYSE:SW) | US$53.64 | US$107.04 | 49.9% |

| Array Technologies (NasdaqGM:ARRY) | US$6.87 | US$13.66 | 49.7% |

| SK D&D (KOSE:A210980) | ₩7110.00 | ₩14097.07 | 49.6% |

| Pantoro (ASX:PNR) | A$0.135 | A$0.27 | 49.5% |

Let's dive into some prime choices out of the screener.

Believe (ENXTPA:BLV)

Overview: Believe S.A. offers digital music services to independent labels and local artists across various regions including France, Germany, Europe, the Americas, Asia, Oceania, and the Pacific with a market cap of €1.47 billion.

Operations: The company's revenue is primarily derived from Premium Solutions, which generated €877.53 million, and Automated Solutions, contributing €61.50 million.

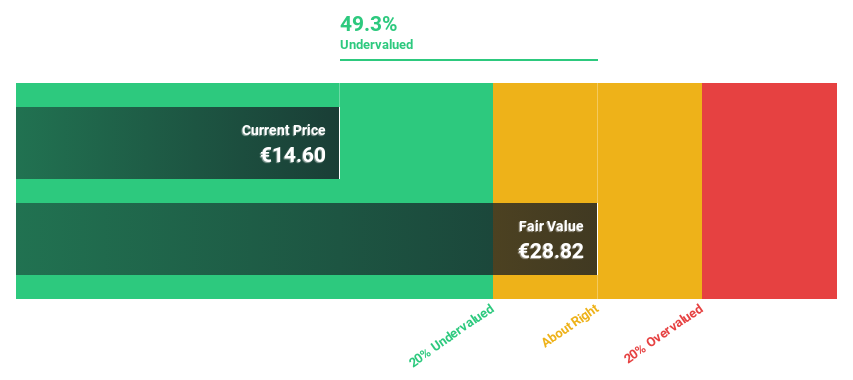

Estimated Discount To Fair Value: 49.3%

Believe is trading at €14.6, significantly below its estimated fair value of €28.82, highlighting its potential undervaluation based on cash flows. The company is forecast to achieve revenue growth of 13% annually, outpacing the French market's 5.8%. Earnings are expected to grow substantially at 56.95% per year, with profitability anticipated within three years. Despite a low forecasted return on equity of 10%, Believe presents a compelling case for investors focusing on cash flow valuation metrics.

- Our expertly prepared growth report on Believe implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Believe stock in this financial health report.

WemadeLtd (KOSDAQ:A112040)

Overview: Wemade Co., Ltd. develops and publishes games both in South Korea and internationally, with a market cap of ₩1.42 trillion.

Operations: The company's revenue is primarily generated from its gaming business, amounting to ₩663.58 billion.

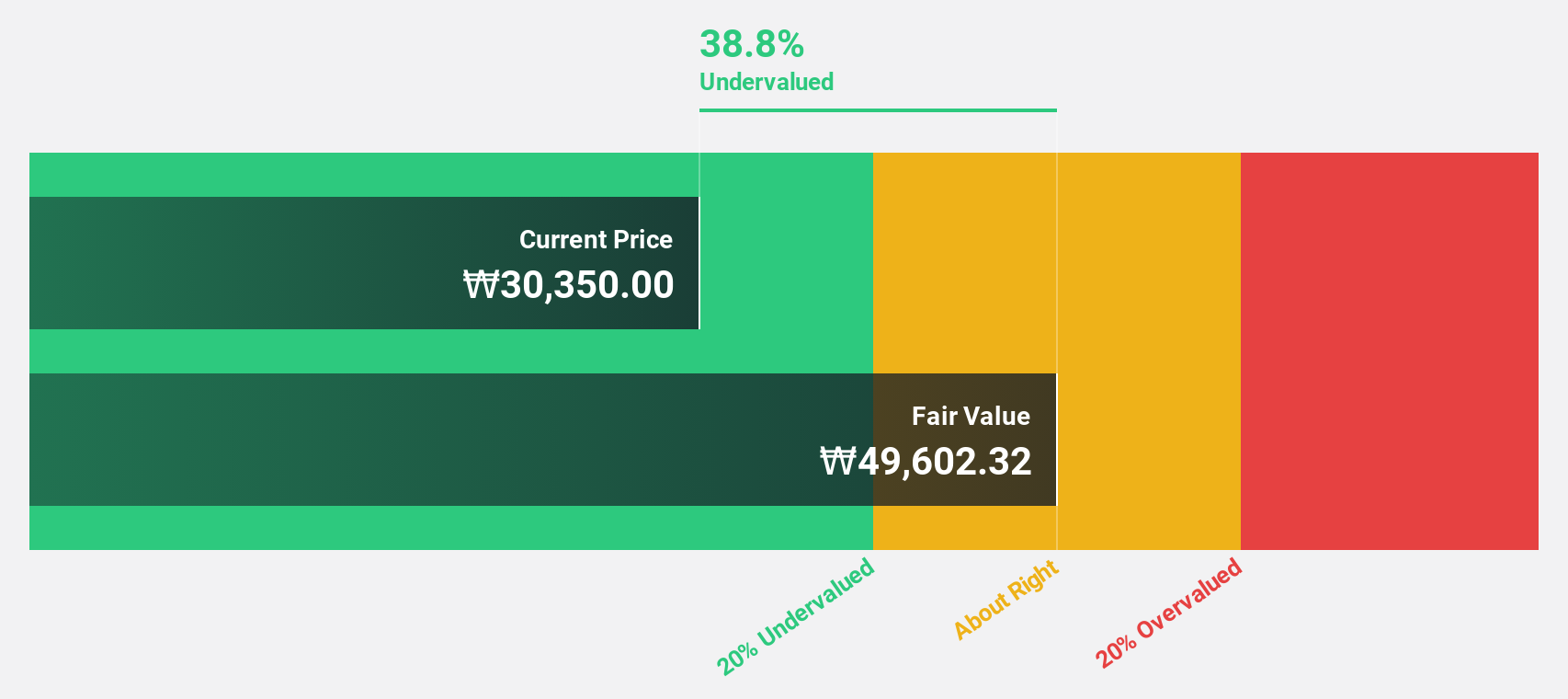

Estimated Discount To Fair Value: 18.5%

Wemade Ltd. is trading at ₩42,200, below its estimated fair value of ₩51,769.82, suggesting potential undervaluation based on cash flows. The company is expected to become profitable within the next three years with earnings projected to grow significantly at over 100% annually. While revenue growth is forecasted at 12.2% per year—faster than the Korean market's average—it remains below the 20% threshold for high growth expectations.

- Upon reviewing our latest growth report, WemadeLtd's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of WemadeLtd.

Nihon M&A Center Holdings (TSE:2127)

Overview: Nihon M&A Center Holdings Inc. offers mergers and acquisition-related services both in Japan and internationally, with a market cap of ¥192.59 billion.

Operations: Nihon M&A Center Holdings Inc. generates revenue through providing mergers and acquisition services domestically and globally.

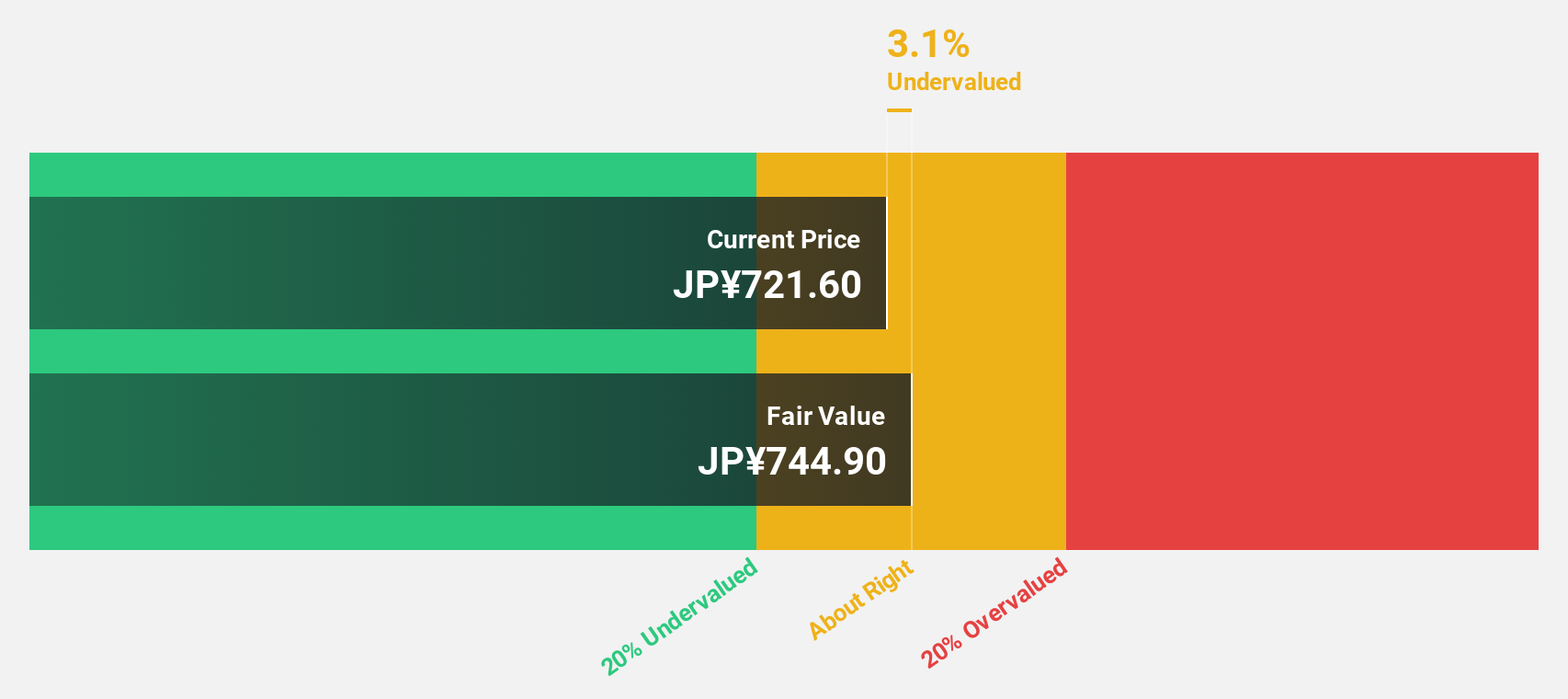

Estimated Discount To Fair Value: 24.8%

Nihon M&A Center Holdings, trading at ¥607.1, is undervalued relative to its estimated fair value of ¥806.92, reflecting a significant discount based on cash flows. The company's earnings and revenue are projected to grow faster than the Japanese market at 9.3% and 11.5% per year, respectively. Despite recent executive changes, Nihon's strategic expansion through AtoG Capital in ASEAN enhances its cross-border M&A potential, supporting Japanese firms' regional growth initiatives while maintaining a stable dividend yield of 3.79%.

- The analysis detailed in our Nihon M&A Center Holdings growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Nihon M&A Center Holdings' balance sheet health report.

Taking Advantage

- Click through to start exploring the rest of the 896 Undervalued Stocks Based On Cash Flows now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Believe might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BLV

Believe

Provides digital music services for independent labels and local artists in France, Germany, rest of Europe, the Americas, Asia, Oceania, and Pacific.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)