- Japan

- /

- Professional Services

- /

- TSE:6098

Shiseido Company And 2 Other Japanese Stocks That Could Be Trading Below Intrinsic Value

Reviewed by Simply Wall St

Japan’s stock markets have rebounded strongly, with the Nikkei 225 Index gaining 8.7% and the broader TOPIX Index up 7.9%, driven by better-than-expected U.S. economic data and a stronger-than-anticipated expansion in Japan's GDP for the second quarter. This positive momentum provides an opportune moment to explore stocks that may be trading below their intrinsic value, such as Shiseido Company and two other Japanese firms that could offer significant potential for investors looking to capitalize on undervalued assets in a recovering market environment.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Link and Motivation (TSE:2170) | ¥574.00 | ¥1069.52 | 46.3% |

| Syuppin (TSE:3179) | ¥1387.00 | ¥2666.89 | 48% |

| Hagiwara Electric Holdings (TSE:7467) | ¥3495.00 | ¥6710.60 | 47.9% |

| Micronics Japan (TSE:6871) | ¥5240.00 | ¥9759.90 | 46.3% |

| KATITAS (TSE:8919) | ¥1769.00 | ¥3174.81 | 44.3% |

| Shin Maint HoldingsLtd (TSE:6086) | ¥1525.00 | ¥2845.32 | 46.4% |

| Insource (TSE:6200) | ¥890.00 | ¥1612.49 | 44.8% |

| BayCurrent Consulting (TSE:6532) | ¥4433.00 | ¥8606.25 | 48.5% |

| Fudo Tetra (TSE:1813) | ¥2362.00 | ¥4420.01 | 46.6% |

| TORIDOLL Holdings (TSE:3397) | ¥3560.00 | ¥7057.04 | 49.6% |

Here's a peek at a few of the choices from the screener.

Shiseido Company (TSE:4911)

Overview: Shiseido Company, Limited is a global cosmetics producer and retailer with a market cap of ¥1.41 trillion.

Operations: Shiseido's revenue segments include Japan Business at ¥281.20 billion, China Business at ¥253.08 billion, Travel Retail Business at ¥122.20 billion, Americas Business at ¥120.34 billion, EMEA Business at ¥134.42 billion, and Asia-Pacific Business at ¥76.29 billion.

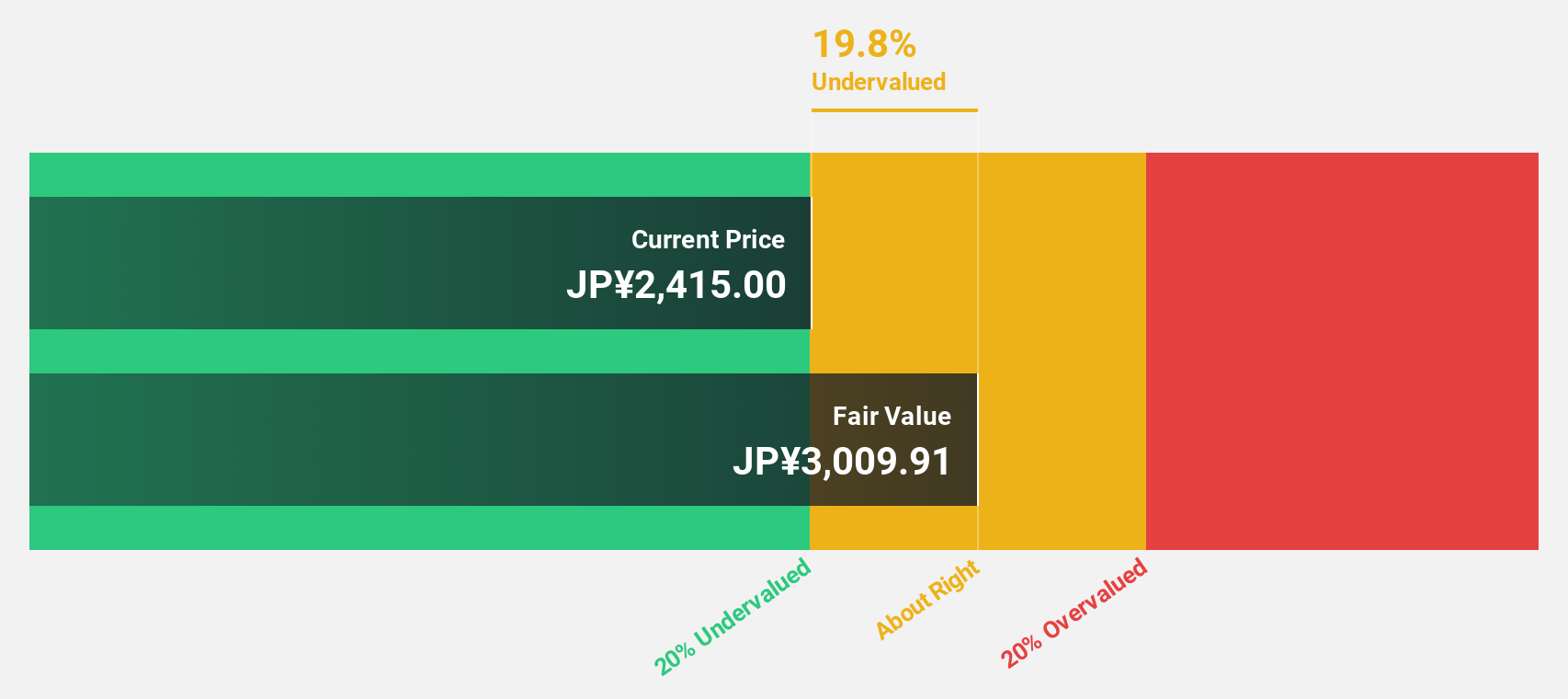

Estimated Discount To Fair Value: 20.9%

Shiseido Company is trading at ¥3520, 20.9% below its estimated fair value of ¥4450.65, suggesting potential undervaluation based on cash flows. Earnings are forecast to grow significantly at 35% per year, outpacing the JP market's 8.5%. However, profit margins have declined to 1% from last year's 2.8%, and Return on Equity is projected to be low at 11.4%. Recent buyback plans and stable dividends indicate a focus on shareholder value amidst executive changes.

- According our earnings growth report, there's an indication that Shiseido Company might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Shiseido Company.

Recruit Holdings (TSE:6098)

Overview: Recruit Holdings Co., Ltd. offers HR technology and business solutions that transform the world of work, with a market cap of ¥13.41 billion.

Operations: The company's revenue segments include Staffing (¥1.66 billion), HR Technology (¥1.04 billion), and Matching & Solutions (¥0.81 billion).

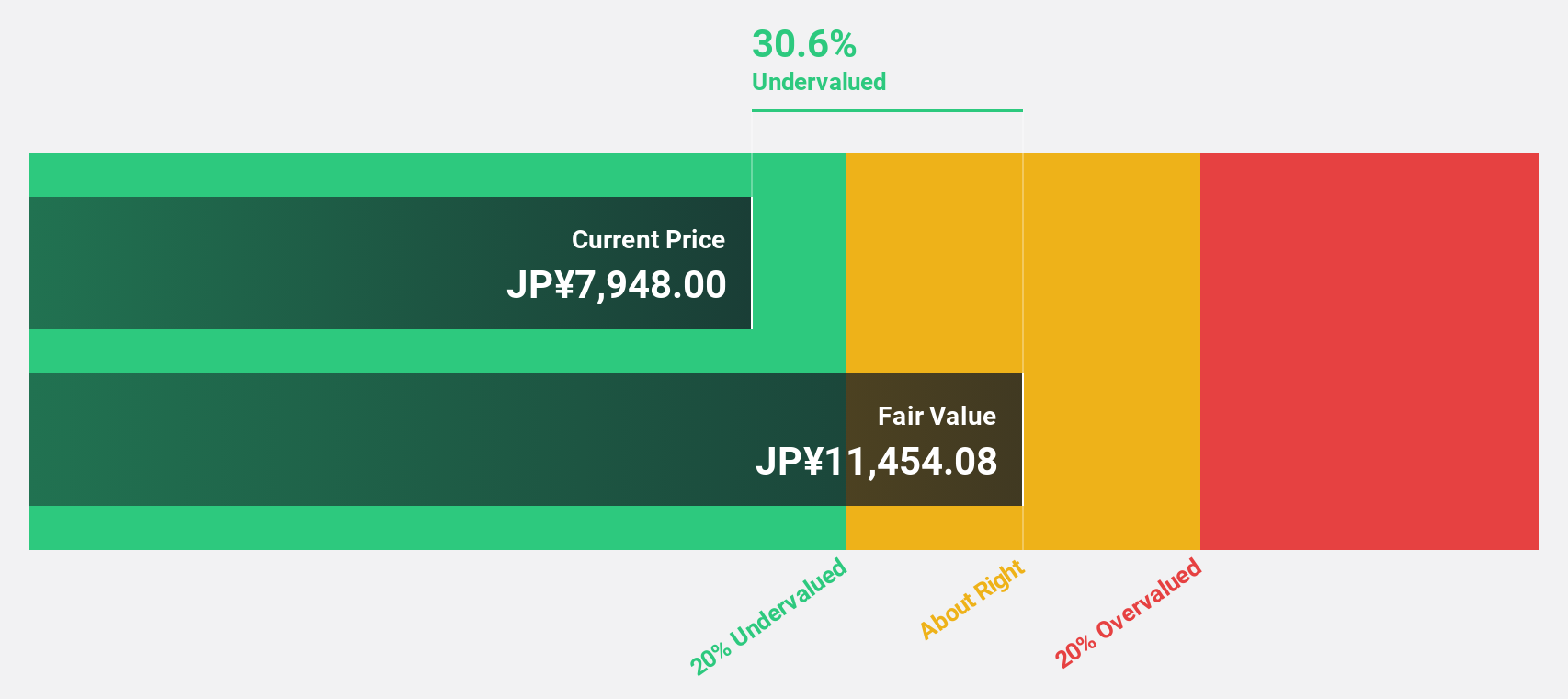

Estimated Discount To Fair Value: 10.5%

Recruit Holdings is trading at ¥8,810, approximately 10.5% below its estimated fair value of ¥9,846.54, indicating potential undervaluation based on cash flows. Recent guidance projects revenue between ¥3,300 billion and ¥3,500 billion for fiscal 2024 with operating income up to ¥500 billion. The company has also announced a significant share repurchase program worth ¥600 billion to enhance shareholder returns and strategic flexibility. Earnings are forecast to grow annually by 8.8%, outpacing the JP market's growth rate.

- The growth report we've compiled suggests that Recruit Holdings' future prospects could be on the up.

- Take a closer look at Recruit Holdings' balance sheet health here in our report.

Kokusai Electric (TSE:6525)

Overview: Kokusai Electric Corporation develops, manufactures, sells, repairs, and maintains semiconductor manufacturing equipment globally and has a market cap of ¥981.38 billion.

Operations: Revenue from the semiconductor manufacturing equipment business totals ¥213.35 billion.

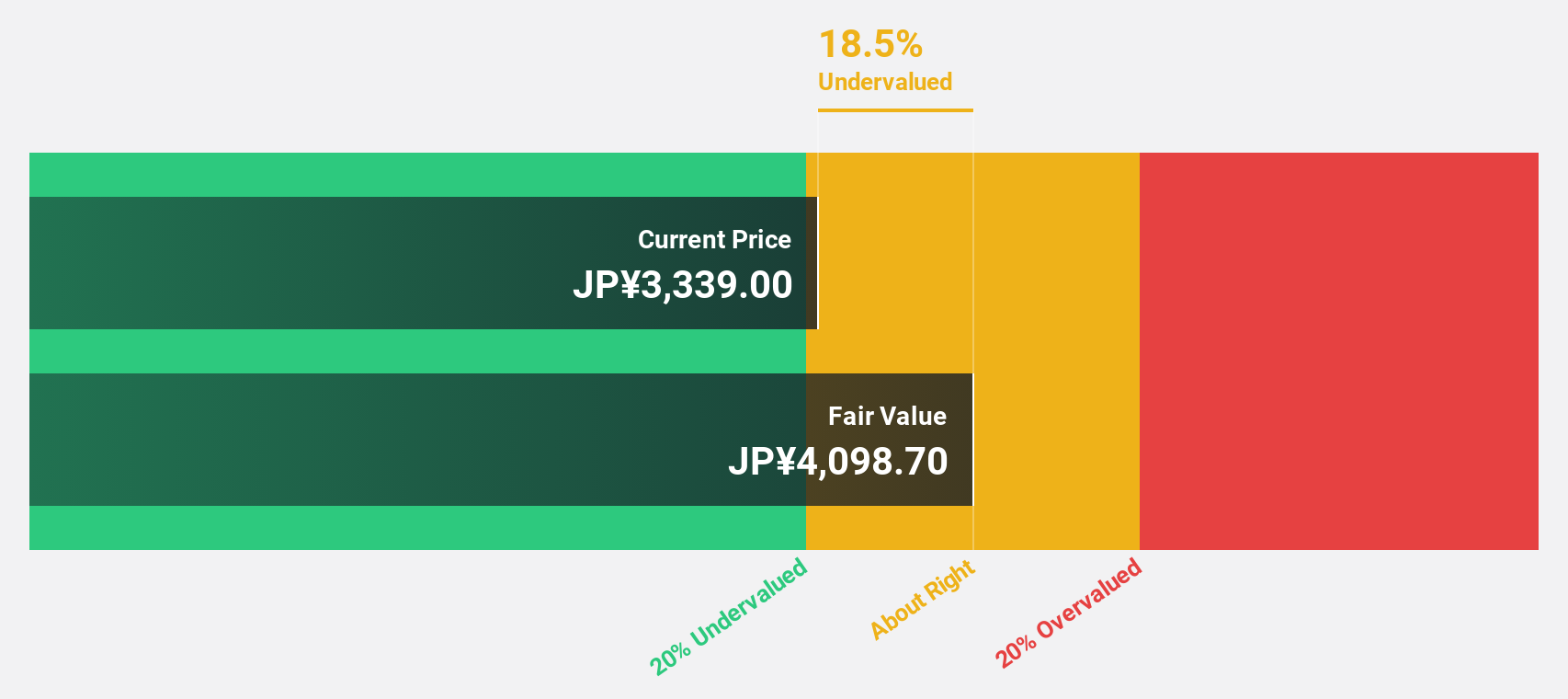

Estimated Discount To Fair Value: 20%

Kokusai Electric is trading at ¥4,175, approximately 20% below its estimated fair value of ¥5,215.93 based on discounted cash flows. For fiscal 2025, the company forecasts revenue of ¥217.50 billion and net income of ¥29 billion. Recent initiatives include a share repurchase program worth ¥18 billion and a dividend increase to ¥16 per share from zero last year. Earnings are projected to grow annually by 18.3%, surpassing the market's rate of 8.5%.

- Upon reviewing our latest growth report, Kokusai Electric's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Kokusai Electric's balance sheet by reading our health report here.

Seize The Opportunity

- Click here to access our complete index of 75 Undervalued Japanese Stocks Based On Cash Flows.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6098

Recruit Holdings

Provides HR technology and business solutions that transforms the world of work.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives