Top 3 Japanese Exchange Stocks Estimated Below Value In July 2024

Reviewed by Simply Wall St

Amid a backdrop of global economic fluctuations, Japan's stock markets have recently shown robust performance, with major indices like the Nikkei 225 and TOPIX reaching all-time highs. This surge is particularly interesting for investors looking for value, as certain stocks may still be undervalued relative to their intrinsic worth in this thriving market environment.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Plus Alpha ConsultingLtd (TSE:4071) | ¥1848.00 | ¥3693.33 | 50% |

| Link and Motivation (TSE:2170) | ¥475.00 | ¥925.64 | 48.7% |

| Hibino (TSE:2469) | ¥2623.00 | ¥5188.98 | 49.5% |

| Fujibo Holdings (TSE:3104) | ¥4780.00 | ¥9437.07 | 49.3% |

| Hamee (TSE:3134) | ¥1123.00 | ¥2152.15 | 47.8% |

| S-Pool (TSE:2471) | ¥324.00 | ¥622.58 | 48% |

| Macromill (TSE:3978) | ¥858.00 | ¥1671.10 | 48.7% |

| Yokowo (TSE:6800) | ¥2023.00 | ¥3906.35 | 48.2% |

| DKS (TSE:4461) | ¥3820.00 | ¥7269.35 | 47.5% |

| Money Forward (TSE:3994) | ¥5315.00 | ¥10377.77 | 48.8% |

Here's a peek at a few of the choices from the screener

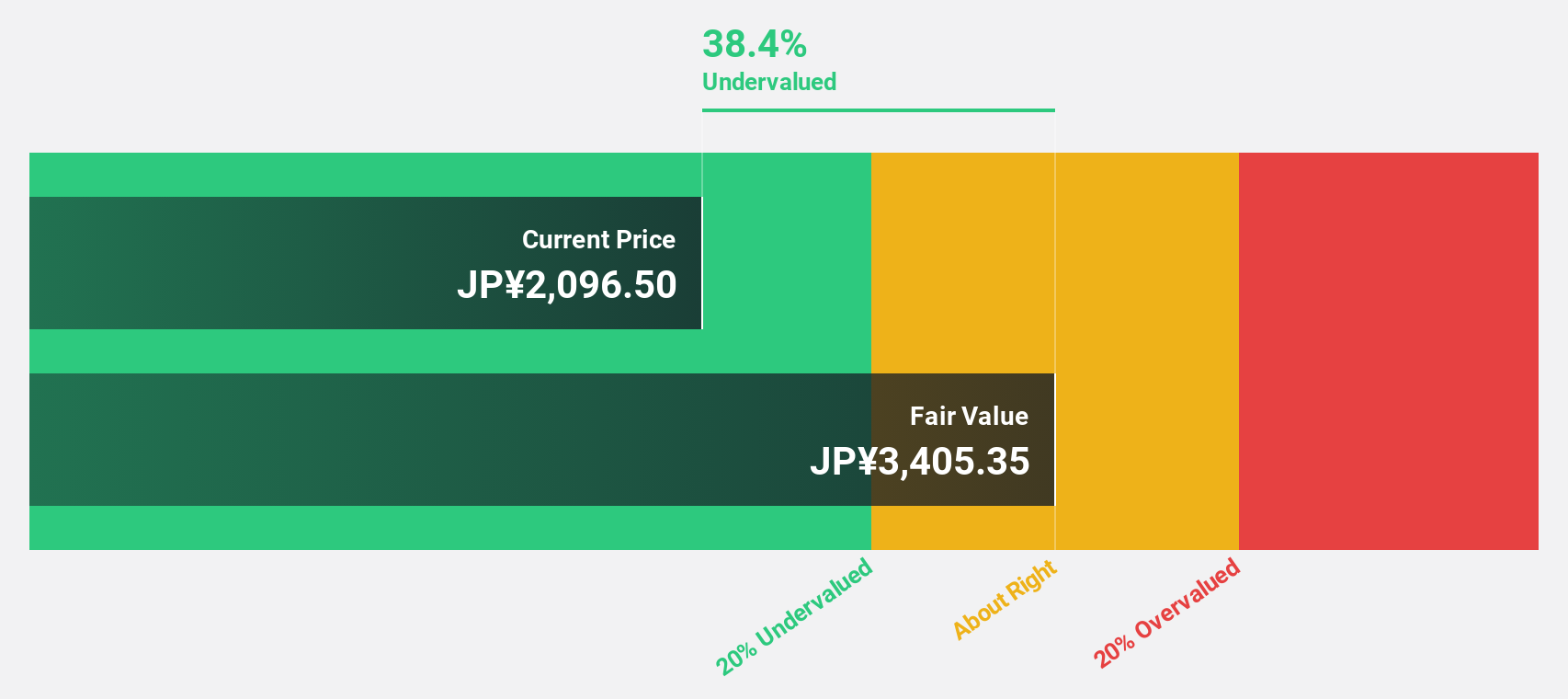

Rorze (TSE:6323)

Overview: Rorze Corporation specializes in creating automation systems for semiconductor and flat panel display manufacturing, operating globally with a market capitalization of approximately ¥570.41 billion.

Operations: The company generates revenue primarily through its Life Science Business, which brought in ¥1.22 billion, and its Semiconductor/FPD Related Equipment Business, with revenues of ¥92.04 billion.

Estimated Discount To Fair Value: 33.2%

Rorze, a Japanese company, appears undervalued based on its cash flows. It's trading at ¥32,400, significantly below the estimated fair value of ¥48,512.25. The firm's revenue and earnings are expected to grow annually by 13.9%, outpacing the Japanese market averages of 4.3% and 8.9% respectively. However, its share price has shown high volatility recently. Additionally, Rorze has been active in shareholder returns with recent share buybacks totaling ¥438.31 million and consistent dividend payments.

- Upon reviewing our latest growth report, Rorze's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Rorze.

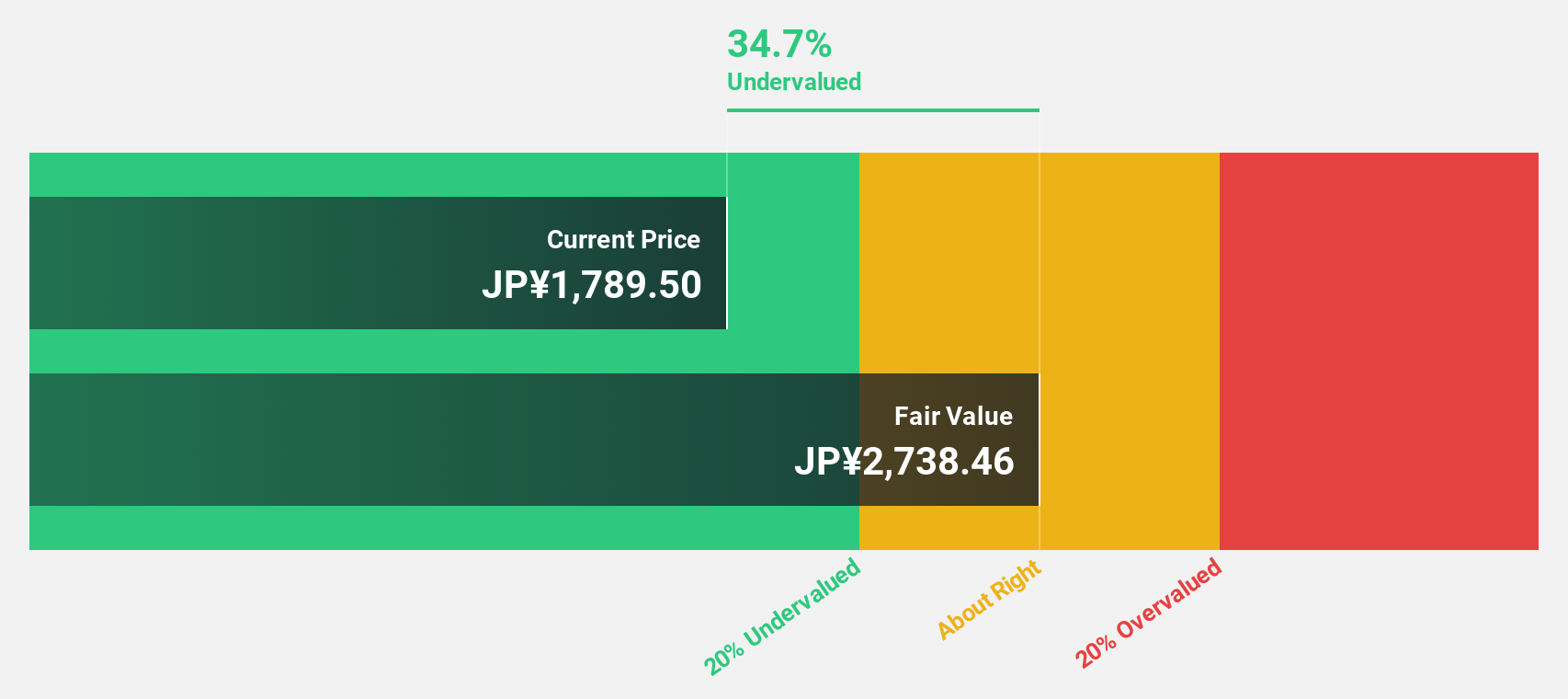

Micronics Japan (TSE:6871)

Overview: Micronics Japan Co., Ltd. specializes in developing, manufacturing, and selling testing and measurement equipment for semiconductors and LCD systems globally, with a market capitalization of approximately ¥268.13 billion.

Operations: The firm's revenue is primarily derived from the sale of semiconductor and LCD testing and measurement equipment on a global scale.

Estimated Discount To Fair Value: 40.5%

Micronics Japan is currently perceived as undervalued in the market, with a trading price of ¥6950, which is substantially below the calculated fair value of ¥11687.42. The company's earnings are projected to increase by 39.78% annually, significantly outstripping the Japanese market forecast of 8.9%. Despite this promising growth trajectory and a high expected return on equity at 26.8%, the firm's profit margins have declined from last year's 16.7% to 10.6%, reflecting some operational challenges amidst its rapid expansion.

- The growth report we've compiled suggests that Micronics Japan's future prospects could be on the up.

- Get an in-depth perspective on Micronics Japan's balance sheet by reading our health report here.

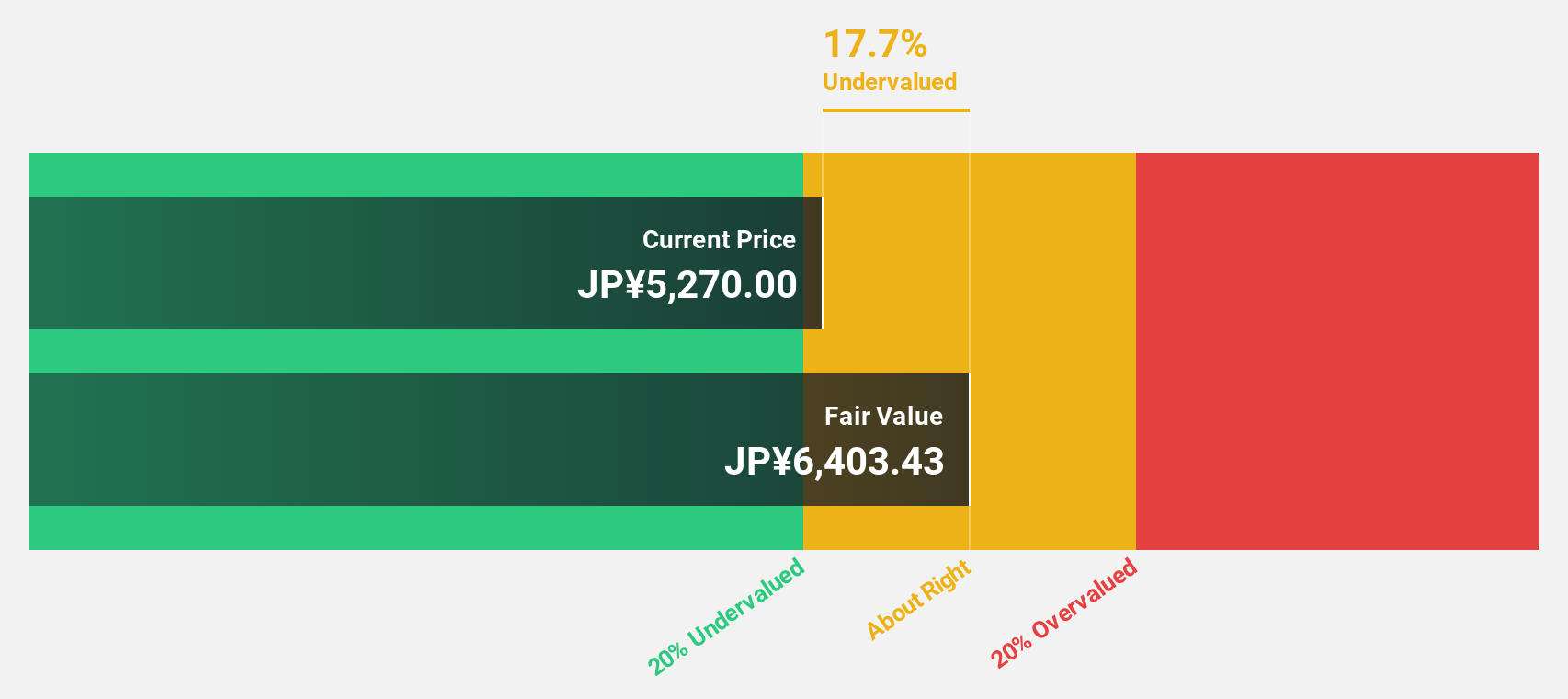

Aozora Bank (TSE:8304)

Overview: Aozora Bank, Ltd. offers a range of banking products and services both in Japan and internationally, with a market capitalization of approximately ¥352.31 billion.

Operations: Aozora Bank's revenue is generated through various segments, with the Structured Finance Group contributing ¥41.57 billion, followed by the International Business Group at ¥19.53 billion, Institutional Banking Group at ¥16.29 billion, and Customer Relations Group generating ¥7.83 billion.

Estimated Discount To Fair Value: 10.1%

Aozora Bank's recent strategic alliance with Daiwa Securities and a series of private placements underscore its proactive approach in enhancing corporate value through diversified business models. Trading at ¥2547, which is 10.1% below the estimated fair value of ¥2834.4, the bank shows potential as an undervalued asset based on cash flows. However, challenges such as a high bad loans ratio at 3.2% and a low allowance for bad loans at 67% suggest areas of financial risk that need careful management. The bank's revenue growth forecast at 9.3% annually is robust compared to the broader Japanese market's 4.3%, positioning it for potential profitability improvements within three years.

- In light of our recent growth report, it seems possible that Aozora Bank's financial performance will exceed current levels.

- Dive into the specifics of Aozora Bank here with our thorough financial health report.

Make It Happen

- Gain an insight into the universe of 92 Undervalued Japanese Stocks Based On Cash Flows by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8304

Aozora Bank

Provides various banking products and services in Japan and internationally.

Reasonable growth potential with adequate balance sheet.