As global markets navigate a choppy start to the year, with U.S. equities experiencing declines amid inflation concerns and political uncertainties, investors are keenly assessing opportunities that offer stability and income. In such volatile environments, dividend stocks can be appealing due to their potential for providing consistent returns through regular payouts, making them a valuable consideration for those looking to mitigate risk while maintaining exposure to the equity markets.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.13% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.40% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.70% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.10% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.50% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.58% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.15% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.03% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.00% | ★★★★★★ |

Click here to see the full list of 1990 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Jiangxi Hongcheng EnvironmentLtd (SHSE:600461)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiangxi Hongcheng Environment Co., Ltd., along with its subsidiaries, is engaged in the production and supply of tap water in China, with a market capitalization of CN¥11.88 billion.

Operations: Jiangxi Hongcheng Environment Co., Ltd. generates its revenue through the production and distribution of tap water in China.

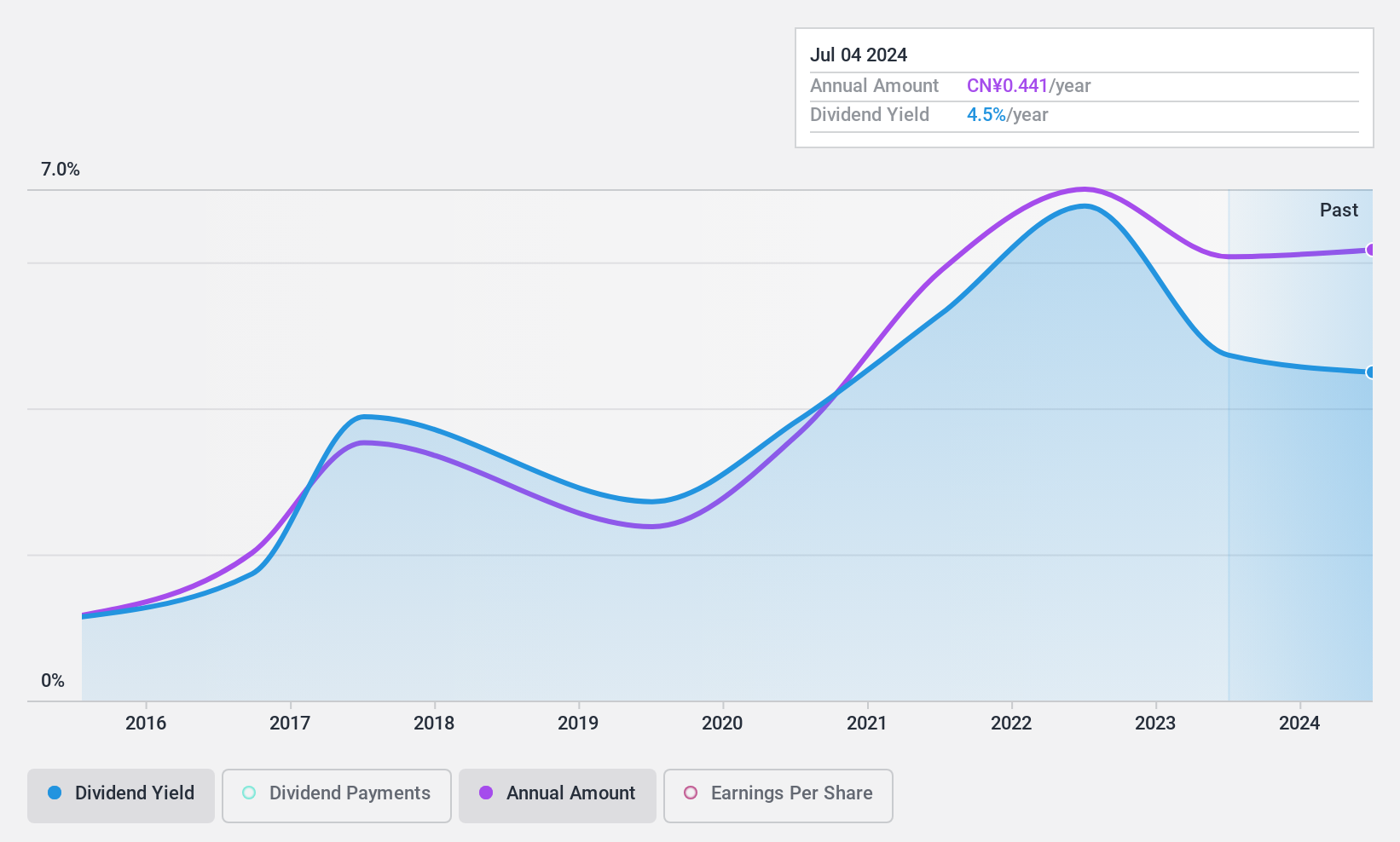

Dividend Yield: 4.6%

Jiangxi Hongcheng Environment Ltd. offers a dividend yield of 4.57%, placing it in the top 25% of dividend payers in China, but its dividends are not well covered by free cash flows, with a high cash payout ratio of 179.5%. Despite trading at good value relative to peers and industry, the company's dividends have been volatile and unreliable over the past decade. Additionally, shareholders experienced dilution last year amidst high debt levels.

- Get an in-depth perspective on Jiangxi Hongcheng EnvironmentLtd's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Jiangxi Hongcheng EnvironmentLtd's current price could be quite moderate.

Furuno Electric (TSE:6814)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Furuno Electric Co., Ltd. manufactures and sells marine and industrial electronics equipment, wireless LAN systems, and handy terminals across Japan, the Americas, Europe, Asia, and internationally with a market cap of ¥78.40 billion.

Operations: Furuno Electric's revenue segments include marine and industrial electronics equipment, wireless LAN systems, and handy terminals.

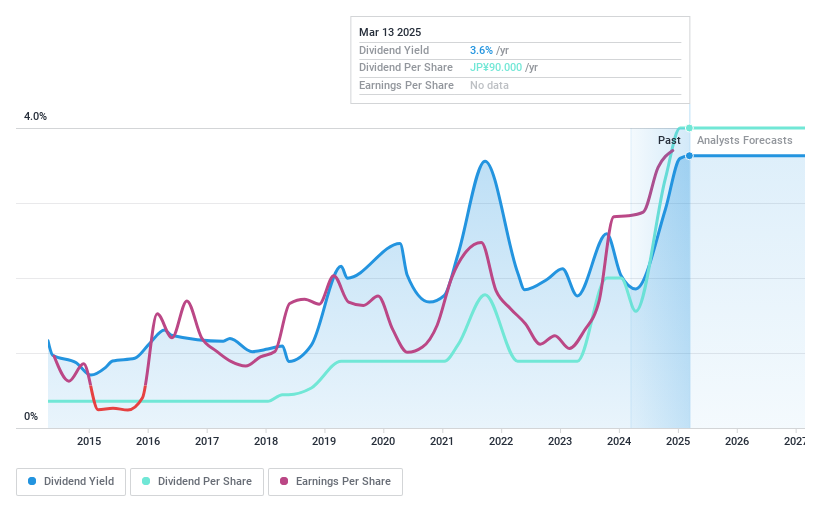

Dividend Yield: 2.7%

Furuno Electric's dividend payments are covered by earnings (37.4% payout ratio) and cash flows (73.5% cash payout ratio), though the yield of 2.65% is below Japan's top dividend payers. The company's dividends have been volatile over the past decade, with significant annual drops, impacting reliability. Despite this, Furuno trades at a substantial discount to its estimated fair value and has seen robust earnings growth recently, although future earnings are expected to decline annually by 13.5%.

- Take a closer look at Furuno Electric's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Furuno Electric is trading behind its estimated value.

Sompo Holdings (TSE:8630)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sompo Holdings, Inc. is a company that offers property and casualty insurance services both in Japan and internationally, with a market cap of ¥3.91 trillion.

Operations: Sompo Holdings, Inc. generates revenue primarily from its Domestic Non-Life Insurance Business (¥2.27 billion), Overseas Insurance Business (¥1.60 billion), Domestic Life Insurance Business (¥311.87 million), and Nursing Care and Seniors Business (¥180.21 million).

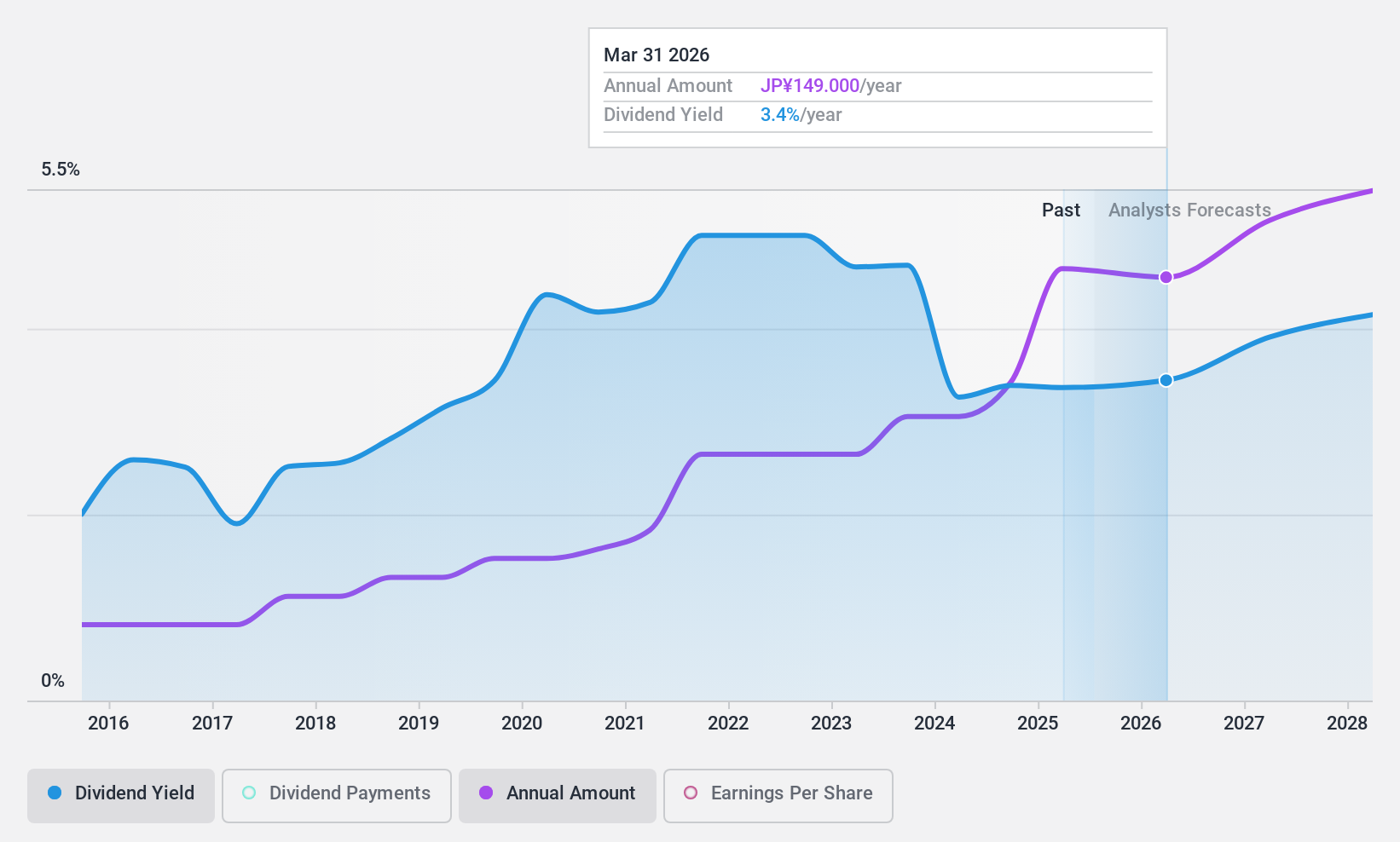

Dividend Yield: 3.7%

Sompo Holdings' dividend payments are well-supported by earnings (55.1% payout ratio) and cash flows (40.8% cash payout ratio), ensuring stability over the past decade. Despite a lower yield of 3.66% compared to Japan's top dividend payers, recent strategic share buybacks totaling ¥32.76 billion aim to enhance shareholder value alongside an increased year-end dividend forecast from ¥56 to ¥76 per share, reflecting strong financial performance and capital efficiency improvements.

- Dive into the specifics of Sompo Holdings here with our thorough dividend report.

- The analysis detailed in our Sompo Holdings valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Investigate our full lineup of 1990 Top Dividend Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8630

Sompo Holdings

Provides property and casualty (P&C) insurance services in Japan and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives