As the European market navigates a period of cautious optimism, with major indices such as Italy's FTSE MIB and Germany's DAX showing modest gains, investors are keenly assessing interest rate policies and trade dynamics. In this context, dividend stocks offer an appealing option for those seeking stability and income in their portfolios.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.33% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.32% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.69% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.61% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.93% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.34% | ★★★★★★ |

| d'Amico International Shipping (BIT:DIS) | 11.62% | ★★★★★☆ |

| Credito Emiliano (BIT:CE) | 5.46% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.71% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.66% | ★★★★★☆ |

Click here to see the full list of 221 stocks from our Top European Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

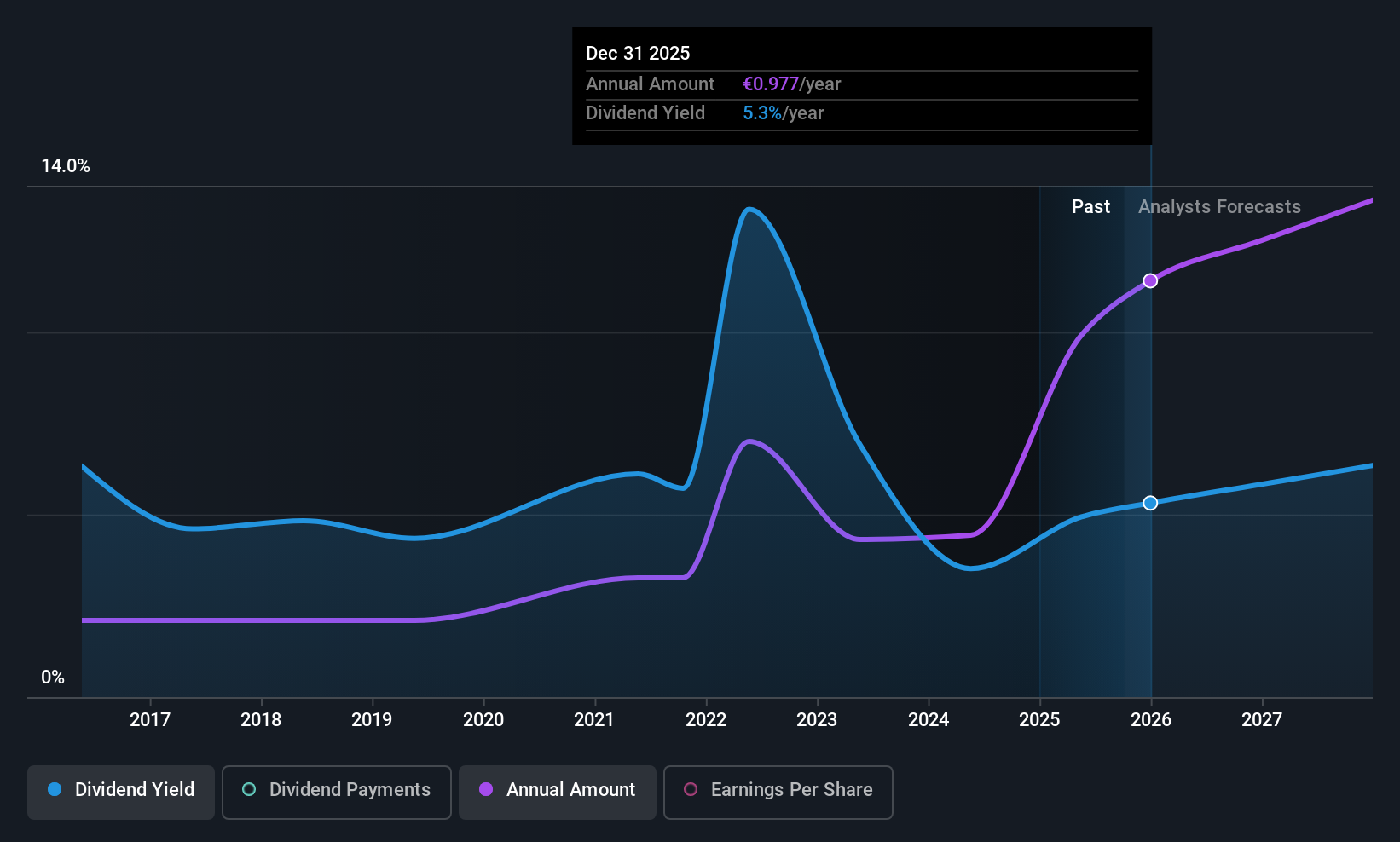

Unipol Assicurazioni (BIT:UNI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Unipol Assicurazioni S.p.A., along with its subsidiaries, offers insurance products and services mainly in Italy, with a market capitalization of €13.13 billion.

Operations: Unipol Assicurazioni S.p.A.'s revenue primarily comes from its Insurance segments, with €8.75 billion generated from the Non-Life Business and €875 million from the Life Business, alongside contributions of €394 million from Banking Associates.

Dividend Yield: 4.6%

Unipol Assicurazioni's dividend payments have been volatile over the past decade, though recent earnings growth and a payout ratio of 54.1% indicate sustainability. The company's cash payout ratio stands at 20.6%, suggesting dividends are well covered by cash flows. Despite trading below estimated fair value, its dividend yield of 4.64% is lower than Italy's top quartile payers. Recent earnings show improvement with net income reaching €600 million for H1 2025, up from €511 million last year.

- Unlock comprehensive insights into our analysis of Unipol Assicurazioni stock in this dividend report.

- The valuation report we've compiled suggests that Unipol Assicurazioni's current price could be quite moderate.

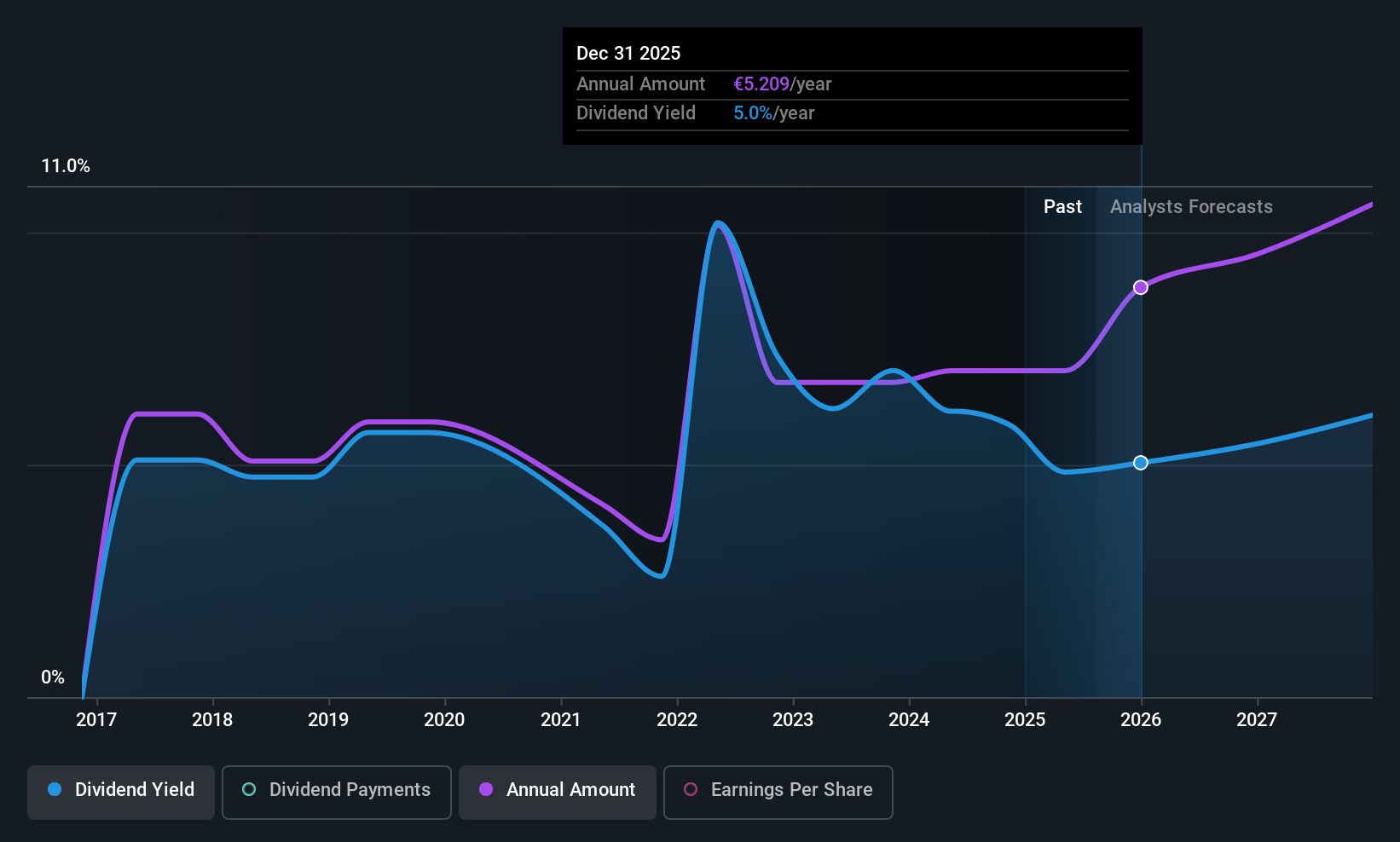

KBC Group (ENXTBR:KBC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KBC Group NV is a financial services company offering banking, insurance, and asset management services to retail, private banking, SMEs, and mid-cap clients in Belgium and several Central European countries with a market cap of €40.87 billion.

Operations: KBC Group's revenue segments include €6.77 billion from the Belgium Business, €2.39 billion from the Czech Republic Business, and contributions from International Markets with €1.13 billion in Hungary, €840 million in Bulgaria, and €493 million in Slovakia.

Dividend Yield: 4%

KBC Group's dividends have been unreliable and volatile over the past decade, but a low payout ratio of 47.6% suggests current sustainability. Although trading at a 27% discount to its estimated fair value, its dividend yield of 4.03% is below Belgium's top quartile payers. Recent earnings growth shows promise with net income reaching €1.56 billion for H1 2025, up from €1.43 billion last year, amid ongoing M&A discussions involving Ethias NV and ABN Amro.

- Navigate through the intricacies of KBC Group with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that KBC Group is priced lower than what may be justified by its financials.

Zurich Insurance Group (SWX:ZURN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Zurich Insurance Group AG offers insurance products and related services across Europe, the Middle East, Africa, North America, Latin America, and the Asia Pacific with a market cap of CHF81.13 billion.

Operations: Zurich Insurance Group AG's revenue is derived from segments including Farmers ($7.30 billion), Life - Asia Pacific ($2.46 billion), Life - Latin America ($2.83 billion), Property & Casualty - Asia Pacific ($4.25 billion), Life - Europe, Middle East & Africa ($8.00 billion), Property & Casualty - Latin America ($3.33 billion), Property & Casualty - North America ($22.53 billion), and Property & Casualty - Europe, Middle East & Africa ($20.44 billion).

Dividend Yield: 4.3%

Zurich Insurance Group offers a high and stable dividend yield of 4.34%, placing it among the top 25% in the Swiss market. Its dividends have consistently grown over the past decade, supported by a payout ratio of 75.4% covered by earnings and cash flows. Despite recent M&A withdrawal from nib Travel Pty Ltd., Zurich's financial health remains robust, with H1 2025 net income reaching US$3.07 billion, slightly up from last year.

- Click to explore a detailed breakdown of our findings in Zurich Insurance Group's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Zurich Insurance Group shares in the market.

Next Steps

- Discover the full array of 221 Top European Dividend Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:UNI

Unipol Assicurazioni

Provides insurance products and services primarily in Italy.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives