Overview of Cassiar Gold Corp (TSXV: GLDC)

Cassiar Gold Corp is a Canadian junior exploration company focused on its 100% owned, district-scale Cassiar Gold Property in northern British Columbia. The property spans 590 km² and includes two main areas: Cassiar North (home to the Taurus bulk-tonnage deposit and Newcoast prospect) and Cassiar South (historical high-grade vein systems with ~25 km of underground workings). The project benefits from existing infrastructure, including mine permits, road access, a fully owned and permitted mill, access to power, and a local team experienced in bringing projects into production. Historically, the district produced over 3 million ounces of gold from high-grade underground mines, with metallurgical recoveries of 80-90% in past operations.

As of September 2025, the company's market capitalization is approximately CAD $50-60 million (based on a share price of ~CAD $0.25-0.27 and ~200 million shares outstanding). The stock trades at a significant discount to its in-situ metal value, estimated at ~USD $10 billion under the assumed gold price of USD $5,000/oz. This undervaluation stems from its early-stage status but positions it for re-rating as catalysts unfold.

Current Resource and Project Highlights

- Resource Estimate (from the September 9, 2025 NI 43-101 Technical Report, effective June 8, 2025): 2.34 million ounces total, comprising:

- Indicated: 410,000 oz at 1.43 g/t Au.

- Inferred: 1.93 million oz at 0.95 g/t Au (primarily at Taurus).

- Mineralization starts from surface, enabling low-strip-ratio open-pit potential.

- Taurus Deposit: Core bulk-tonnage asset (~1 g/t Au) with expansion drilling ongoing (2,080 m completed in 2025 for lateral and depth extensions). High-grade veins (3 m wide, 10-20 g/t Au) offer early cash flow via selective mining.

- Newcoast Prospect: 2 km south of Taurus (an "optionality play" – buy Taurus, get Newcoast for free). Allocated 4,000 m of the 2025 program; mineralization extends at least twice as deep as Taurus (deepest hole: 720 m). Early intercepts show broad zones (e.g., 141.4 m at 0.89 g/t Au from 2024 drilling), with potential to triple total ounces.

- Ongoing 2025 Drill Program: Expanded to 7,000 m (5,211 m completed as of September 9, ahead of schedule). Focus: Lateral/depth expansion at Taurus and definition at Newcoast. Program concludes in fall 2025.

- Other Strengths: Potential for >5 million oz total; bulk-tonnage foundation for large-scale ops; historical production supports feasibility; re-permitting needed but infrastructure mitigates risks. Current resource insufficient for 10-year mine life, but expansion targets address this.

The project is de-risking rapidly: bigger scale, nearer to construction, and more economically viable under high gold prices.

Key Assumptions for 5-Year Forecast

- Gold Price: Starts at USD $5,000/oz in 2025 (user-specified base), held constant in nominal USD for simplicity, but adjusted for 8% annual real inflation in CAD valuation metrics (e.g., NPV, EV/Resource). This implies escalating nominal pressures on costs but boosts revenue potential.

- Resource Growth: Starts at 2.3 Moz; Newcoast triples ounces by 2027 (to ~7 Moz total inferred/indicated); further upgrades to >10 Moz by 2029 via infill and regional drilling.

- Development Timeline (based on notes): Bulk-tonnage production within 3 years (by 2028); high-grade selective mining earlier (2027).

- Capex/Opex: Assumed CAD $300-400M initial capex (escalating 8%/yr); AISC ~CAD $1,200/oz (escalating 8%/yr). Recovery: 85%.

- Valuation Framework:

- EV/Resource: Starts low (CAD $20/oz in-situ) due to inferred status; re-rates to CAD $100/oz by 2027 (PEA-driven), CAD $200/oz by 2029 (production).

- NPV (8% discount): Base case ~CAD $1.5B at $5,000/oz gold by 2028 (post-FS), adjusted for inflation.

- Share Structure: ~200M shares; dilution to 300M by 2029 via equity raises.

- Market: Positive reaction to catalysts; gold bull market amplifies multiples.

- Risks: Drill results disappoint; permitting delays; inflation erodes margins (mitigated by infrastructure).

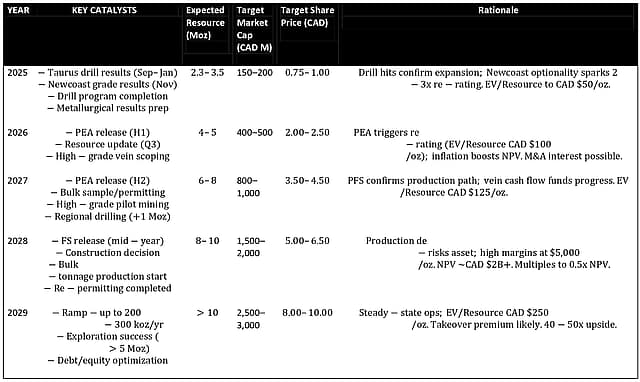

5-Year Forecast

The forecast projects stock price appreciation driven by resource upgrades, economic studies, and production milestones. Under $5,000/oz gold and 8% inflation, in-situ value escalates to ~CAD $25B+ by 2029 (inflation-adjusted). Market cap targets imply 10-20x upside from current ~CAD $55M.

Cumulative Upside: From current CAD $0.27, the 2029 target implies ~30-37x return, driven by 4x resource growth and economic validation. Inflation (8% real) amplifies CAD-denominated metrics by ~50% cumulatively, but high gold prices offset cost pressures. Monitor Q4 2025 drills for near-term triggers.

After 1911 Gold Corp doubled, I sold half (sacrificing 50% of my upside for 100% of my downside) and redeployed my cash into Cassiar Gold Corp (TSXV: GLDC). From what I can tell this company is drilling for ounces in order to attract a joint venture partner, who will fund the lion's share of drilling and CAPEX.

Management is experienced with skin in the game, no debt, but they do lack institutional investors at the moment (hence the low share price). However the coming 6 months is full of catalysts and in a bull market with investors gathering and moving down the value trail, this company is positioned at just the right stage of the Lassonde Curve (orphan stage) yet they hold permits, have a mill and infrastructure which will slash the CAPEX cost and attract a major JV partner (imho)

I personally expect this stock to double within the next 6 months, after drill results and a PEA are produced H1 2026.

Good luck to all you stock operators out there, and keep clear of lifestyle companies!

This forecast is speculative and based on assumptions; actual outcomes depend on execution and macro factors. For latest filings, see SEDAR+ or cassiargold.com.

How well do narratives help inform your perspective?

Disclaimer

The user Agricola has a position in TSXV:GLDC. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.