- Italy

- /

- Diversified Financial

- /

- BIT:NEXI

Assessing Nexi (BIT:NEXI) Valuation After Its Removal from Key S&P Indices

Reviewed by Simply Wall St

Nexi (BIT:NEXI) is in the spotlight after being removed from several major S&P indices, a move that can prompt forced selling by index funds and sharpen the market focus on its long term prospects.

See our latest analysis for Nexi.

That backdrop helps explain why, even with a 3.33% 7 day share price return and a small bounce after the index news, Nexi’s year to date share price return and one year total shareholder return remain firmly negative, suggesting momentum is still under pressure rather than rebuilding.

If Nexi’s recent volatility has you rethinking your exposure to financial infrastructure, it could be a good moment to explore fast growing stocks with high insider ownership for other ideas with stronger market momentum.

With the shares trading well below analyst targets but still reflecting years of weak returns, the key question now is whether Nexi is quietly undervalued or if the market is already pricing in any future growth.

Most Popular Narrative: 28.1% Undervalued

With Nexi last closing at €4.07 versus a narrative fair value of €5.66, the current market price sits well below modeled long term potential.

Synergy driven margin improvements, reduced integration costs, and innovative digital service offerings are driving higher profitability and new growth opportunities. Ongoing integration of recent mergers and realization of associated cost synergies including the reduction of transformation and integration expenses are expanding EBITDA margins and generating stronger free cash flow, positioning Nexi for enhanced future earnings.

Curious how falling revenues can still support a higher value? The narrative leans heavily on margin repair, rising earnings power, and a richer future multiple. Want to see exactly how those moving parts combine to justify a higher price tag, and what would need to go right operationally for that scenario to play out?

Result: Fair Value of €5.66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stubborn revenue headwinds from lost bank contracts and slower than hoped ISV adoption could easily derail the margin expansion story that investors are betting on.

Find out about the key risks to this Nexi narrative.

Another Angle on Valuation

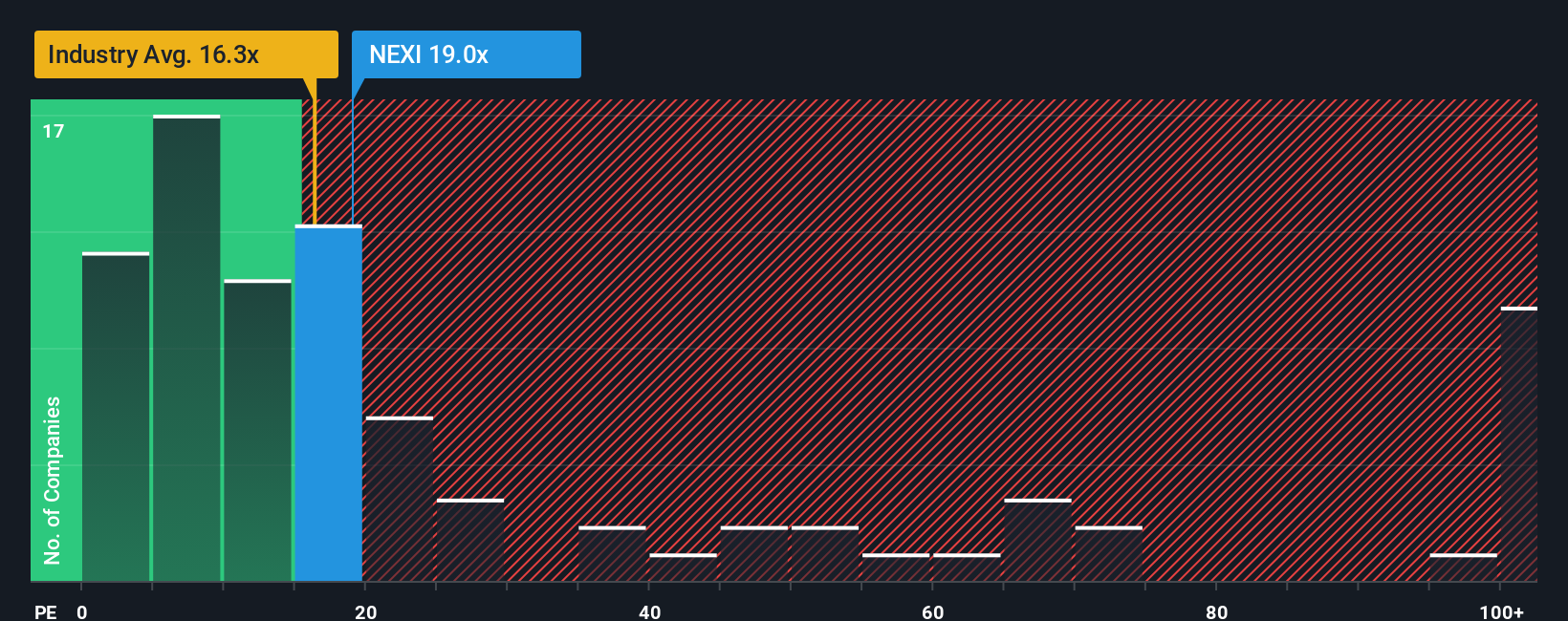

While the narrative fair value points to upside, the simple earnings multiple sends a cooler message. Nexi trades on about 15.9 times earnings, richer than the European diversified financials at 13.7 times and its peer average of 12.6 times, but still below its 17.8 times fair ratio. This leaves investors to question whether this is early value or lingering risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nexi Narrative

If you are not fully convinced by this view or would rather dig into the numbers yourself, you can build a fresh narrative in just a few minutes: Do it your way.

A great starting point for your Nexi research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, you can continue your research by exploring fresh, data backed stock ideas while others stay stuck watching from the sidelines.

- Explore potential mispricings by targeting companies trading below their estimated worth through these 905 undervalued stocks based on cash flows, where cash flow characteristics align with specific entry points.

- Research the AI transformation by filtering for innovators working to reshape industries with intelligent automation and data driven products using these 25 AI penny stocks.

- Assess your portfolio’s income stream by focusing on companies with established dividend histories, specific yield characteristics, and identifiable fundamentals via these 12 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nexi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:NEXI

Nexi

Provides electronic money and payment services to banks, small and medium-sized enterprises, large international corporations, institutions, and public administrations in Italy, Nordics and Baltics, Germany, Austria, Switzerland, Poland, Southeast Europe, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026