3 Indian Stocks That May Be Priced Below Their Estimated Value

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has experienced a 3.2% drop, yet it remains up by an impressive 40% over the past year, with earnings projected to grow by 17% annually in the coming years. In this context, identifying stocks that may be priced below their estimated value can offer opportunities for investors seeking growth potential amid current market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Titagarh Rail Systems (NSEI:TITAGARH) | ₹1095.65 | ₹2153.46 | 49.1% |

| IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹445.35 | ₹762.32 | 41.6% |

| RITES (NSEI:RITES) | ₹325.10 | ₹517.88 | 37.2% |

| Vedanta (NSEI:VEDL) | ₹496.25 | ₹904.12 | 45.1% |

| Patel Engineering (BSE:531120) | ₹55.48 | ₹91.96 | 39.7% |

| Artemis Medicare Services (NSEI:ARTEMISMED) | ₹262.55 | ₹445.15 | 41% |

| Orchid Pharma (NSEI:ORCHPHARMA) | ₹1373.10 | ₹2142.32 | 35.9% |

| Tarsons Products (NSEI:TARSONS) | ₹434.40 | ₹709.57 | 38.8% |

| Manorama Industries (BSE:541974) | ₹879.25 | ₹1665.51 | 47.2% |

| Strides Pharma Science (NSEI:STAR) | ₹1505.25 | ₹2704.30 | 44.3% |

Let's review some notable picks from our screened stocks.

Orchid Pharma (NSEI:ORCHPHARMA)

Overview: Orchid Pharma Limited is a pharmaceutical company involved in the development, manufacture, and marketing of active pharmaceutical ingredients, bulk actives, finished dosage formulations, and nutraceuticals in India with a market cap of ₹69.64 billion.

Operations: The company generates its revenue primarily from the Pharmaceuticals segment, amounting to ₹8.81 billion.

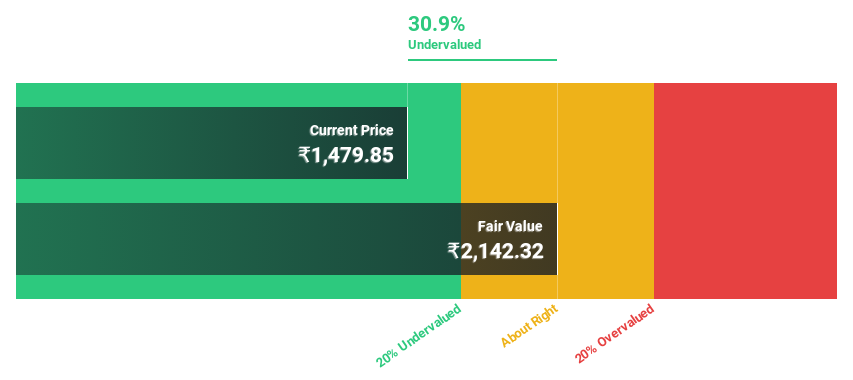

Estimated Discount To Fair Value: 35.9%

Orchid Pharma is trading at ₹1,373.10, significantly below its estimated fair value of ₹2,142.32, highlighting potential undervaluation based on cash flows. With forecasted earnings growth of 43.7% annually outpacing the Indian market's 17.3%, and revenue expected to grow by 31.8% per year, Orchid demonstrates strong growth prospects despite a recent tax-related regulatory order from Tamil Nadu authorities concerning past financial activities.

- Our earnings growth report unveils the potential for significant increases in Orchid Pharma's future results.

- Unlock comprehensive insights into our analysis of Orchid Pharma stock in this financial health report.

Pearl Global Industries (NSEI:PGIL)

Overview: Pearl Global Industries Limited, along with its subsidiaries, manufactures and exports readymade garments both in India and internationally, with a market cap of ₹43.99 billion.

Operations: The company's revenue segments include the manufacturing and exporting of readymade garments for both domestic and international markets.

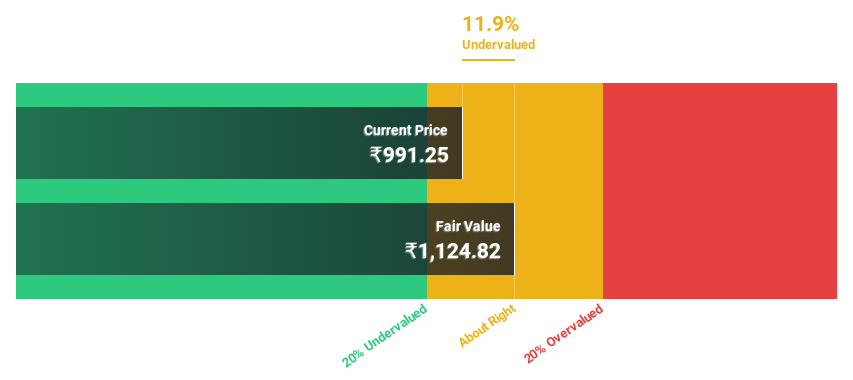

Estimated Discount To Fair Value: 14.5%

Pearl Global Industries is trading at ₹959.3, below its fair value estimate of ₹1,121.47, indicating potential undervaluation based on cash flows. Despite recent volatility and past shareholder dilution, the company's earnings are projected to grow 28.6% annually over the next three years—outpacing the Indian market's growth rate—and revenue is expected to increase faster than the market average. Recent inclusion in the S&P Global BMI Index may enhance visibility among investors.

- The growth report we've compiled suggests that Pearl Global Industries' future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Pearl Global Industries' balance sheet health report.

Strides Pharma Science (NSEI:STAR)

Overview: Strides Pharma Science Limited develops, manufactures, and sells pharmaceutical products across various global markets including Africa, Australia, North America, Europe, Asia, and India with a market cap of ₹138.42 billion.

Operations: The company's revenue is primarily generated from its Pharmaceutical Business, excluding the Bio-Pharmaceutical segment, amounting to ₹42.09 billion.

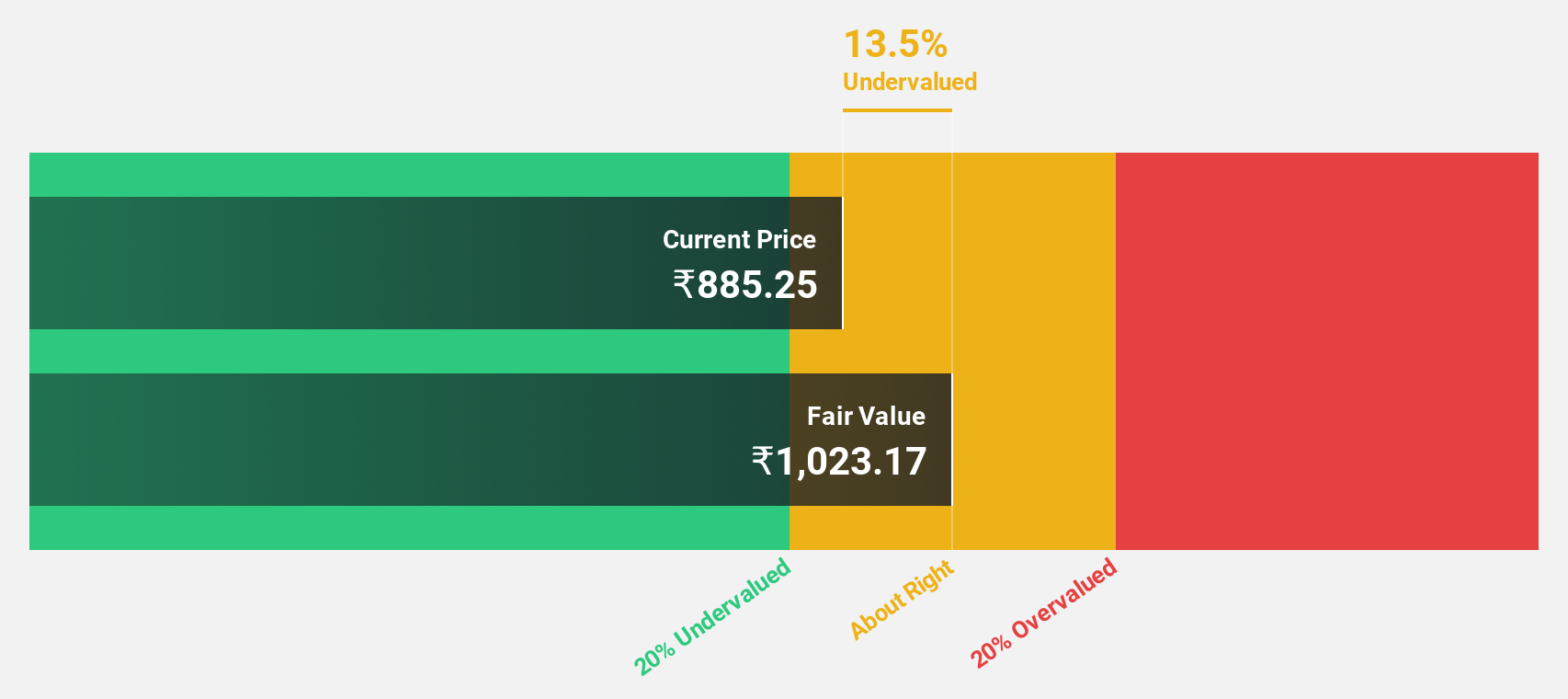

Estimated Discount To Fair Value: 44.3%

Strides Pharma Science is trading at ₹1,505.25, significantly below its estimated fair value of ₹2,704.30, suggesting undervaluation based on cash flows. Recent debt reductions have strengthened its financial position by reducing outstanding non-convertible debentures to ₹242 million from an initial ₹1,250 million. Earnings are forecasted to grow 65.18% annually over the next three years, with revenue growth expected to outpace the Indian market average despite a recent executive resignation in R&D leadership.

- Our comprehensive growth report raises the possibility that Strides Pharma Science is poised for substantial financial growth.

- Click here to discover the nuances of Strides Pharma Science with our detailed financial health report.

Key Takeaways

- Embark on your investment journey to our 29 Undervalued Indian Stocks Based On Cash Flows selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Orchid Pharma, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ORCHPHARMA

Orchid Pharma

A pharmaceutical company, engages in the development, manufacture, and marketing of active pharmaceutical ingredients, bulk actives, finished dosage formulations, and nutraceuticals in India.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives