- Hong Kong

- /

- Paper and Forestry Products

- /

- SEHK:2689

Nine Dragons Paper (SEHK:2689) Profit Margins Double, Reinforcing Bullish Earnings Narratives

Reviewed by Simply Wall St

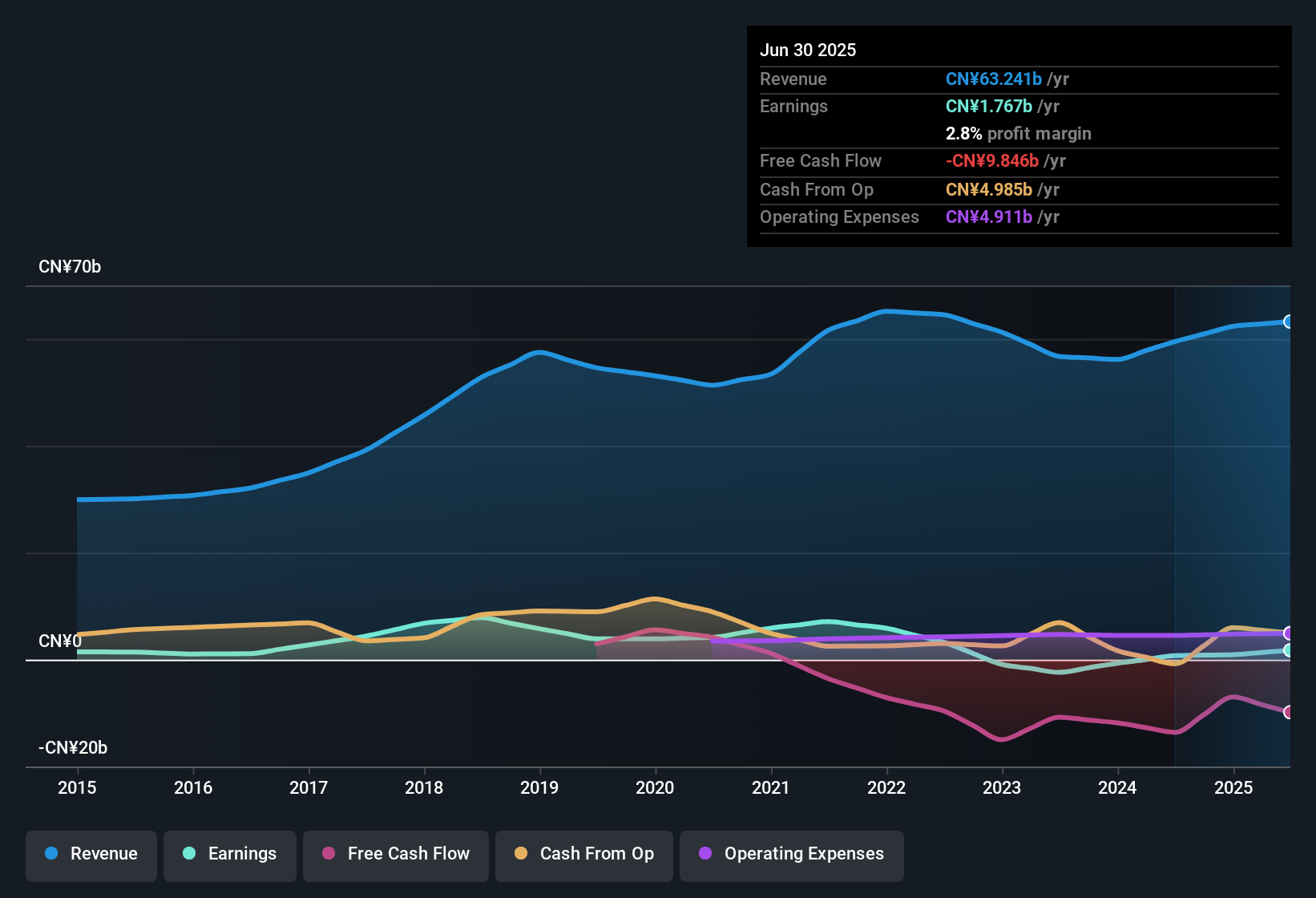

Nine Dragons Paper (Holdings) (SEHK:2689) reported a net profit margin of 2.8%, up from 1.3% the previous year, with earnings growth of 135.4% over the last twelve months. While revenue is forecast to grow by 5.3% per year and earnings are expected to increase by 20.3% annually, these figures show the company’s earnings momentum now outpacing the Hong Kong market average. For investors, the key story is accelerating profit improvement alongside robust earnings quality. However, questions linger given the premium share price and the company’s financial position.

See our full analysis for Nine Dragons Paper (Holdings).Next, we put the latest numbers into context by comparing them to the narratives investors follow most closely. This helps to see where the recent earnings results might confirm or contradict those views.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins More Than Double

- Net profit margin rose from 1.3% to 2.8% year-on-year, marking a significant turnaround for the business after years of pressure on profitability.

- Surging margins heavily support the case that management’s focus on operational efficiency and cost controls is now delivering tangible improvement, as the bullish argument expects:

- The dramatic shift, following a five-year streak of average annual earnings declines of 46.1%, demonstrates that the company has meaningfully reversed its declining profitability trend.

- Forecasted earnings growth of 20.3% per year going forward points to continued earnings recovery, contrasting with previous market skepticism about the company’s ability to grow profits consistently.

Revenue Growth Trails Sector Pace

- Revenue is projected to rise by 5.3% per year, falling short of the broader Hong Kong market’s expected annual growth rate of 8.6%.

- What’s striking is that, despite recent momentum in net income, the pace of top-line growth remains conservative relative to the sector:

- This challenges any bullish assumption that all engines are firing equally. The story is more about improved profitability from existing revenues rather than market expansion.

- Investors following the prevailing market view should recognize that slower growth in sales could limit the headroom for earnings beats if margin gains flatten out.

Premium Valuation Adds Caution

- The current share price of HK$5.57 sits significantly above the company’s DCF fair value estimate of HK$2.06 and reflects a price-to-earnings multiple that is higher than the peer average.

- Valuation tension is further heightened as robust earnings recovery justifies some optimism, but not enough to ignore balance sheet risks and the steep premium to the company’s own fair value:

- Bulls may cite the fact that forecast earnings growth outpaces the Hong Kong market’s 12.3% as a reason for the valuation gap. Critics, however, point directly to the large spread between current price and DCF fair value as a flag for cautious investors.

- The company’s financial position is not considered strong, so despite positive momentum, the share price demands a higher level of confidence in continued margin improvement than past years might warrant.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Nine Dragons Paper (Holdings)'s growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite impressive margin recovery, Nine Dragons Paper faces concerns about a premium valuation and a financial position that may not fully support continued optimism.

If you want exposure to companies with more robust financial health and less valuation risk, check out our solid balance sheet and fundamentals stocks screener (1984 results) to find stronger alternatives built for resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Nine Dragons Paper (Holdings) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2689

Nine Dragons Paper (Holdings)

Manufactures and sells packaging paper, printing and writing paper, and specialty paper products and pulp in the People’s Republic of China.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)