The Hong Kong stock market has been experiencing notable fluctuations, mirroring global concerns over economic slowdowns and mixed corporate earnings. Amid this backdrop, dividend stocks have garnered attention for their potential to provide steady income even in volatile times. When evaluating dividend stocks, it's crucial to consider factors such as a company's financial health, consistent payout history, and the ability to sustain dividends through various market conditions.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| Luk Fook Holdings (International) (SEHK:590) | 9.71% | ★★★★★☆ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.52% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 7.71% | ★★★★★☆ |

| Lenovo Group (SEHK:992) | 4.22% | ★★★★★☆ |

| Chow Tai Fook Jewellery Group (SEHK:1929) | 8.89% | ★★★★★☆ |

| China Construction Bank (SEHK:939) | 7.98% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 5.85% | ★★★★★☆ |

| PC Partner Group (SEHK:1263) | 9.78% | ★★★★★☆ |

| Zhongsheng Group Holdings (SEHK:881) | 9.06% | ★★★★★☆ |

| Zhejiang Expressway (SEHK:576) | 7.38% | ★★★★★☆ |

Click here to see the full list of 73 stocks from our Top SEHK Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Eagle Nice (International) Holdings (SEHK:2368)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eagle Nice (International) Holdings Limited is an investment holding company that manufactures and trades sportswear and garments globally, with a market cap of HK$2.50 billion.

Operations: Eagle Nice (International) Holdings Limited generates revenue from various regions, including HK$2.33 billion from Mainland China, HK$728.81 million from the USA, HK$488.07 million from Europe, and HK$88.98 million from Japan.

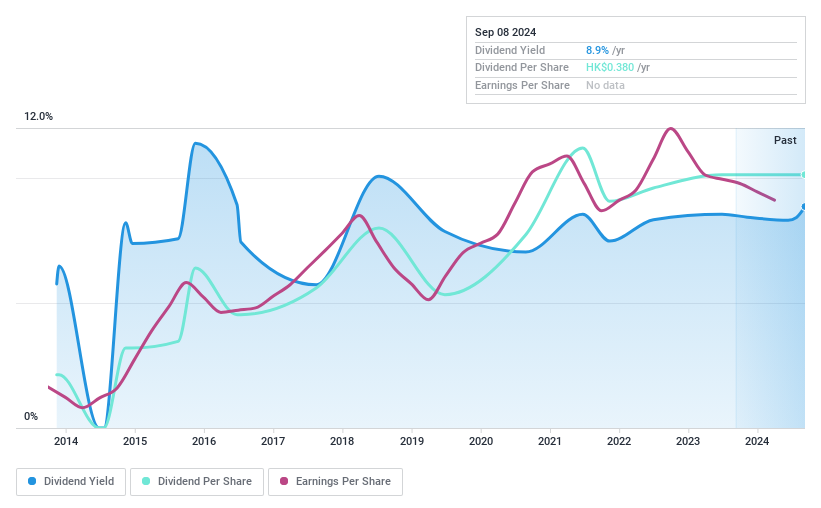

Dividend Yield: 8.7%

Eagle Nice (International) Holdings' dividend yield of 8.72% is attractive, placing it in the top 25% of Hong Kong dividend payers. However, its dividends are not well covered by free cash flow with a high cash payout ratio of 223.7%, raising sustainability concerns despite stable earnings coverage at a 77% payout ratio. Recent executive changes, including the promotion of Mr. Chung Chi Kit to CEO, may impact future strategic direction and dividend stability.

- Delve into the full analysis dividend report here for a deeper understanding of Eagle Nice (International) Holdings.

- Our valuation report unveils the possibility Eagle Nice (International) Holdings' shares may be trading at a premium.

Chongqing Rural Commercial Bank (SEHK:3618)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chongqing Rural Commercial Bank Co., Ltd., along with its subsidiaries, provides banking services in the People's Republic of China and has a market cap of HK$58.47 billion.

Operations: Chongqing Rural Commercial Bank Co., Ltd. generates revenue primarily from Personal Banking (CN¥8.51 billion), Corporate Banking (CN¥6.98 billion), and Financial Market Operations (CN¥5.58 billion).

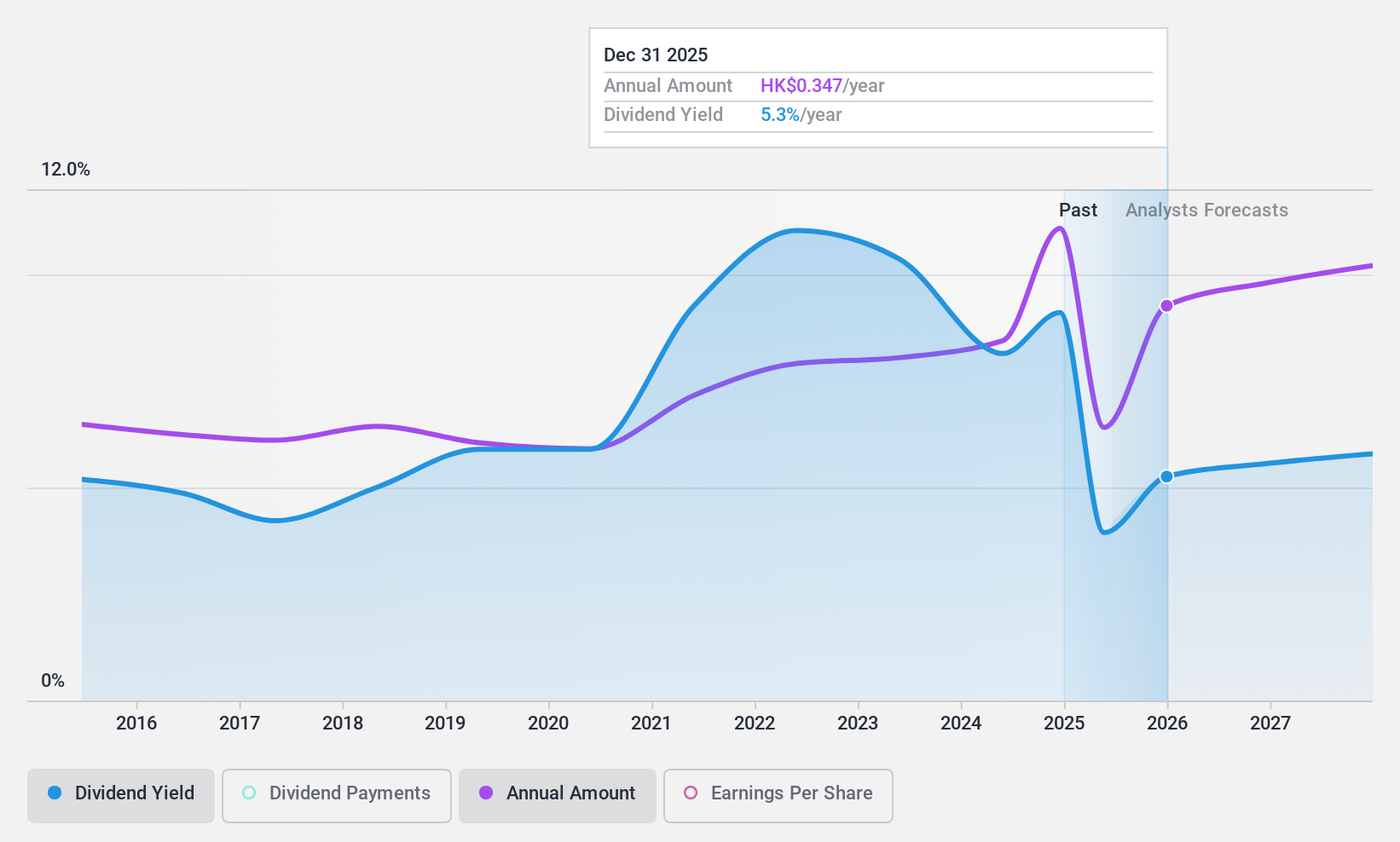

Dividend Yield: 8.5%

Chongqing Rural Commercial Bank offers a stable dividend yield of 8.52%, supported by a low payout ratio of 29.7%. Despite a slight decline in net interest income to CNY 11.08 billion, net income increased to CNY 7.36 billion for H1 2024, ensuring dividends remain well-covered by earnings both currently and in the forecasted period (28.6% payout ratio). The bank's consistent dividend growth over the past decade underscores its reliability for income-focused investors.

- Get an in-depth perspective on Chongqing Rural Commercial Bank's performance by reading our dividend report here.

- The analysis detailed in our Chongqing Rural Commercial Bank valuation report hints at an deflated share price compared to its estimated value.

Pico Far East Holdings (SEHK:752)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Pico Far East Holdings Limited (SEHK:752) is an investment holding company involved in exhibition, event, and brand activation; visual branding; museum and themed environment projects; and meeting architecture, with a market cap of HK$2.21 billion.

Operations: Pico Far East Holdings Limited generates revenue from various segments including Visual Branding Activation (HK$454.95 million), Meeting Architecture Activation (HK$162.78 million), Museum and Themed Entertainment (HK$444.37 million), and Exhibition, Event and Brand Activation (HK$5.01 billion).

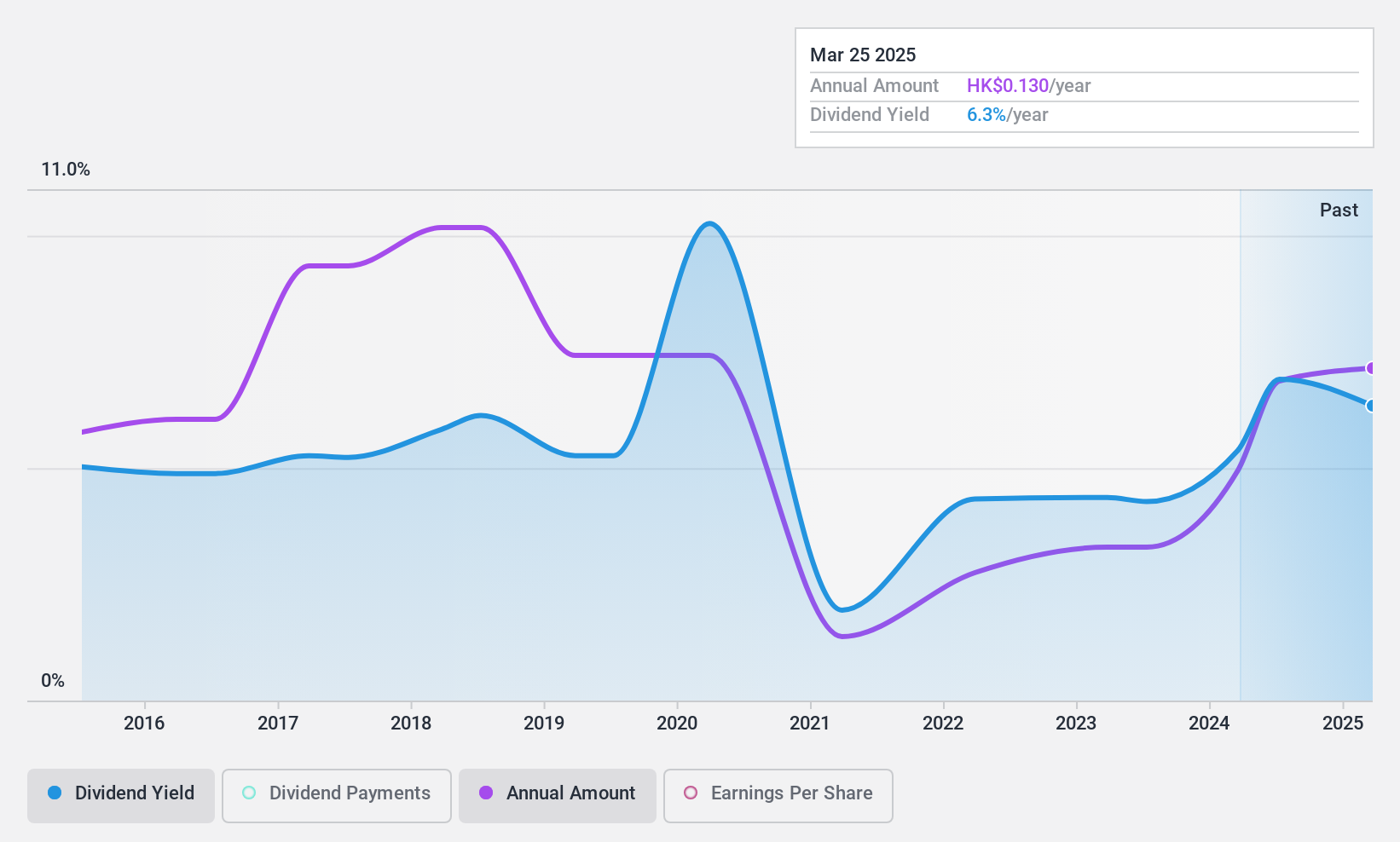

Dividend Yield: 7.0%

Pico Far East Holdings' recent interim dividend of HKD 0.055 per share, coupled with strong earnings growth—sales increased to HKD 2.94 billion and net income to HKD 191.7 million for Q2 2024—highlights its potential as a dividend stock. Despite a volatile dividend history, the current payout ratios (earnings: 48.6%, cash flow: 36.2%) suggest sustainability in the near term. However, its yield (7.02%) is lower compared to top-tier Hong Kong dividend payers (8.57%).

- Dive into the specifics of Pico Far East Holdings here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Pico Far East Holdings is trading behind its estimated value.

Seize The Opportunity

- Reveal the 73 hidden gems among our Top SEHK Dividend Stocks screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3618

Chongqing Rural Commercial Bank

Engages in the provision of banking services in the People’s Republic of China.

Flawless balance sheet established dividend payer.