As 2025 begins, global markets are navigating a complex landscape marked by inflation fears and political uncertainties, with U.S. equities experiencing declines amid stronger-than-expected labor market data and hawkish Federal Reserve signals. Despite these challenges, dividend stocks remain an attractive option for investors seeking steady income streams in turbulent times. In the current climate, selecting dividend stocks that demonstrate resilience and a strong track record of consistent payouts can be crucial for maintaining portfolio stability amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.13% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.40% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.70% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.10% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.50% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.58% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.15% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.03% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.00% | ★★★★★★ |

Click here to see the full list of 1990 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Fu Shou Yuan International Group (SEHK:1448)

Simply Wall St Dividend Rating: ★★★☆☆☆

Overview: Fu Shou Yuan International Group Limited, along with its subsidiaries, offers burial and funeral services in the People’s Republic of China and has a market cap of HK$8.40 billion.

Operations: Fu Shou Yuan International Group Limited generates revenue primarily from Burial Services (CN¥1.78 billion) and Funeral Services (CN¥357.97 million) in the People’s Republic of China.

Dividend Yield: 3.2%

Fu Shou Yuan International Group's dividend payments are well-covered by earnings and cash flows, with a payout ratio of 43.6% and a cash payout ratio of 36.7%. Despite this coverage, the dividend yield of 3.24% is low compared to top-tier payers in Hong Kong. Although dividends have grown over the past decade, they have been volatile and unreliable, experiencing annual drops exceeding 20%, which may concern some investors seeking stability in dividend income.

- Take a closer look at Fu Shou Yuan International Group's potential here in our dividend report.

- Our valuation report unveils the possibility Fu Shou Yuan International Group's shares may be trading at a premium.

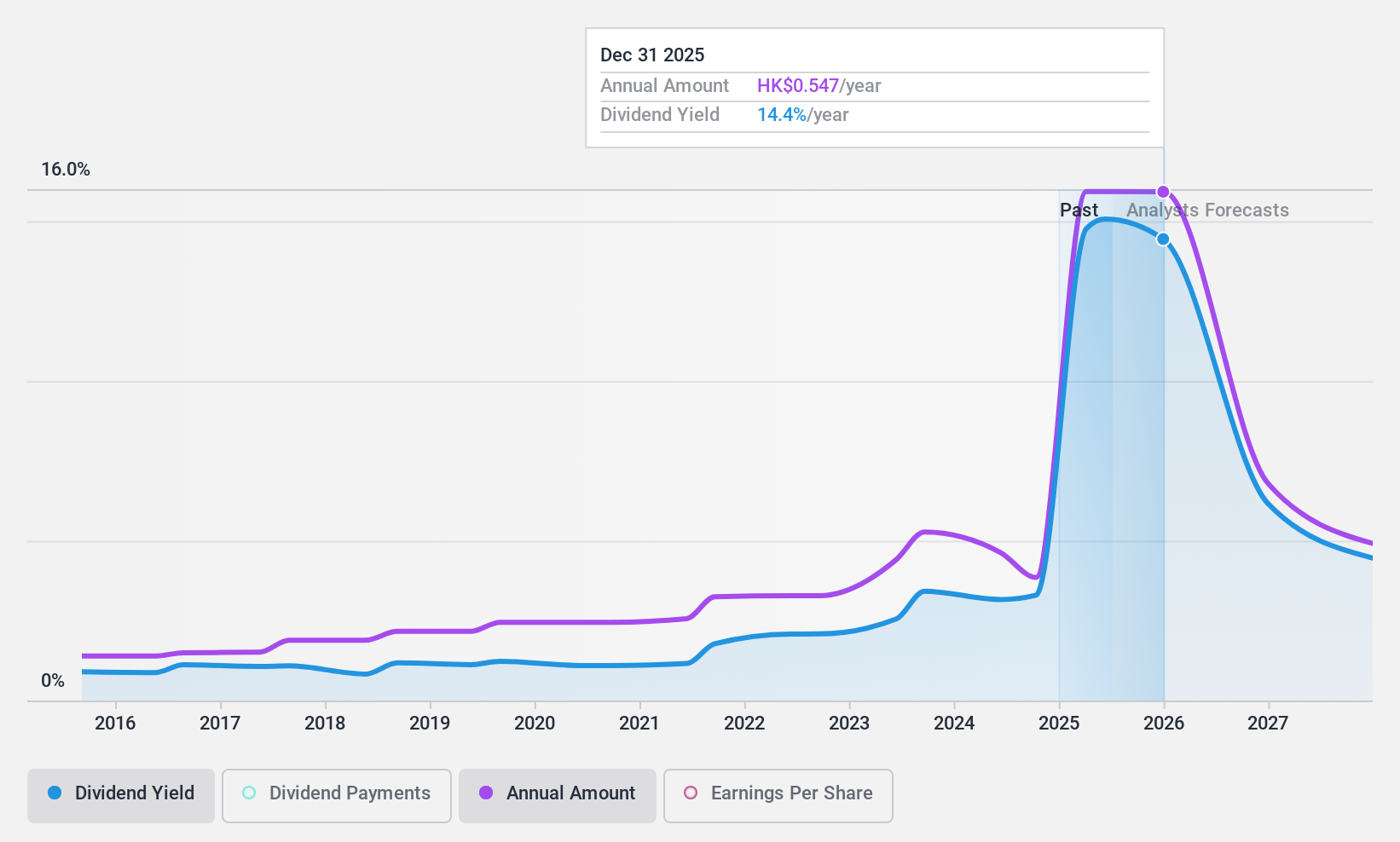

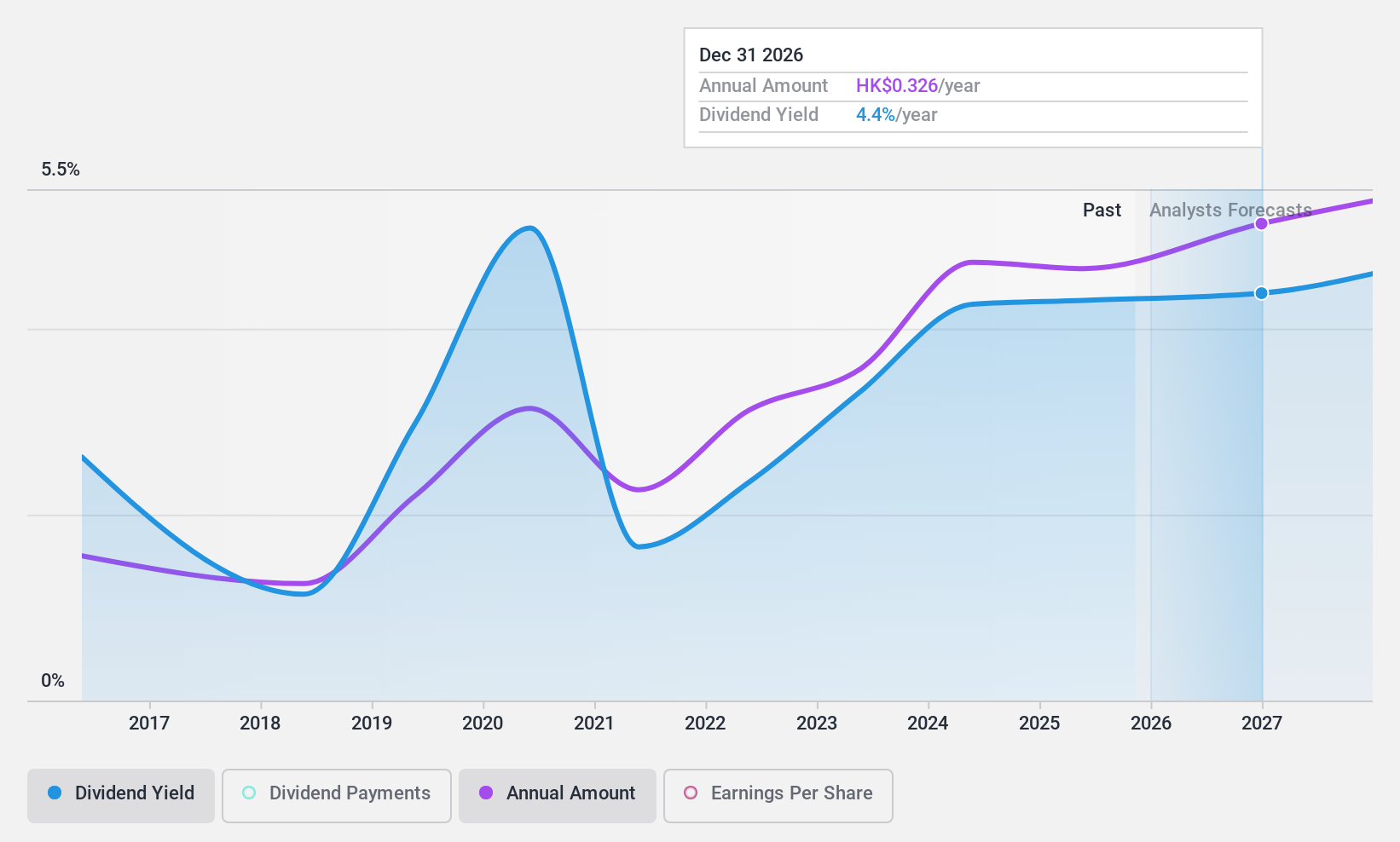

CIMC Enric Holdings (SEHK:3899)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CIMC Enric Holdings Limited offers transportation, storage, and processing equipment and services for the clean energy, chemicals, environmental, and liquid food sectors globally, with a market cap of HK$14.04 billion.

Operations: CIMC Enric Holdings Limited's revenue segments include CN¥16.49 billion from Clean Energy, CN¥4.59 billion from Liquid Food, and CN¥3.31 billion from Chemical and Environmental sectors.

Dividend Yield: 4.1%

CIMC Enric Holdings' dividends are covered by earnings and cash flows, with payout ratios of 52.8% and 62.6%, respectively. Despite this coverage, its dividend yield of 4.13% is lower than the top-tier payers in Hong Kong. While dividends have grown over the past decade, they have been volatile and unreliable, experiencing significant fluctuations that may concern investors seeking consistent income. Earnings are forecast to grow annually by 20.33%, potentially supporting future dividend sustainability.

- Get an in-depth perspective on CIMC Enric Holdings' performance by reading our dividend report here.

- The valuation report we've compiled suggests that CIMC Enric Holdings' current price could be inflated.

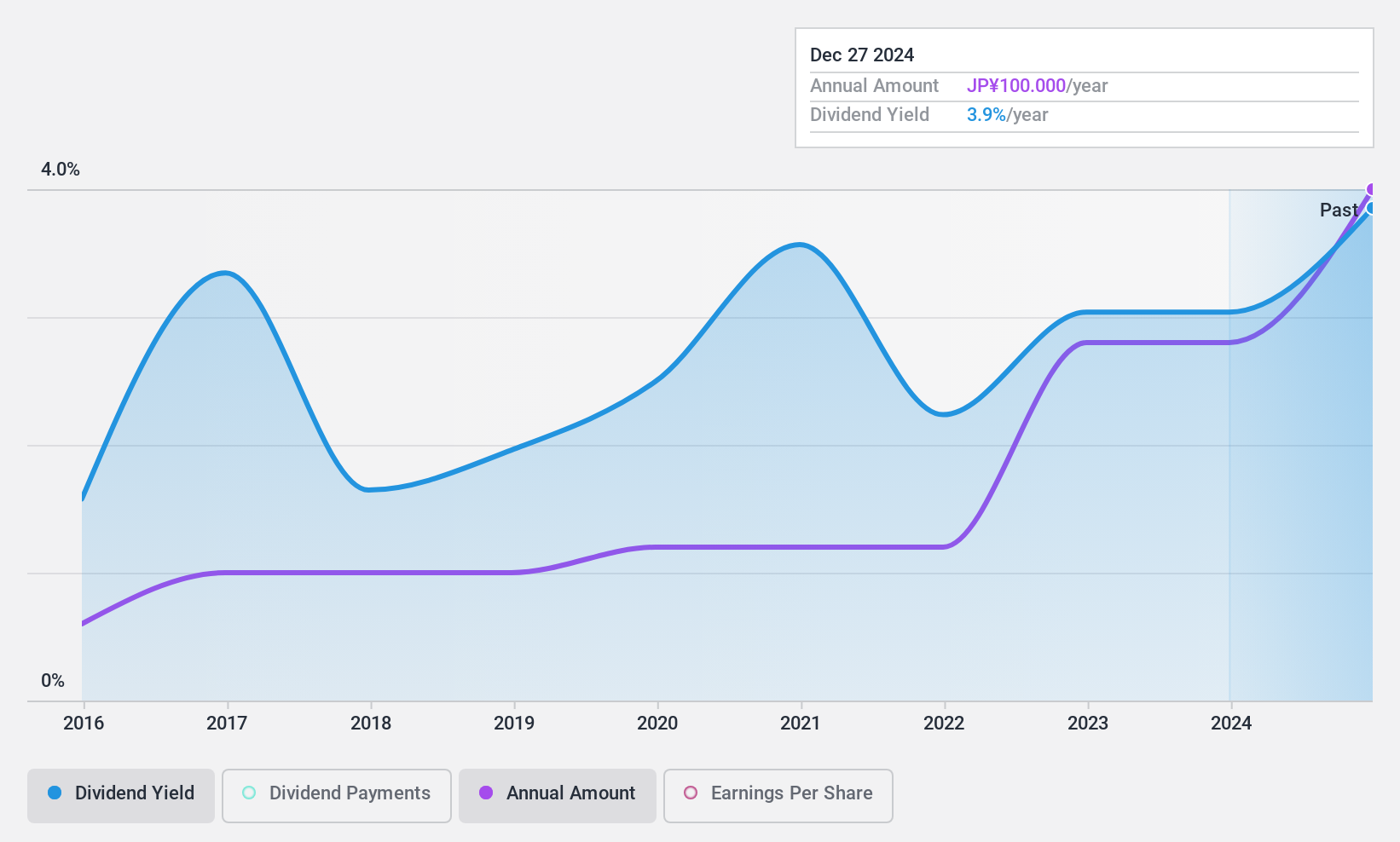

Look Holdings (TSE:8029)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Look Holdings Incorporated designs, produces, and markets women's apparel and related accessories both in Japan and internationally, with a market cap of ¥16.19 billion.

Operations: Look Holdings' revenue segments include Apparel in Japan (¥24.04 billion), Korea (¥28.88 billion), Europe (¥3.79 billion), and other overseas markets (¥383 million), along with a Logistics Business contributing ¥1.13 billion, and a Production and OEM Business generating ¥2.49 billion.

Dividend Yield: 4.5%

Look Holdings' dividends are well-covered by earnings and cash flows, with payout ratios of 30.2% and 79.6%, respectively. The dividend yield stands at 4.54%, placing it in the top quartile of Japanese dividend payers. Trading at 10.9% below its estimated fair value, the stock offers good value for investors seeking income stability; dividends have been stable and growing over the past decade without volatility concerns.

- Navigate through the intricacies of Look Holdings with our comprehensive dividend report here.

- The analysis detailed in our Look Holdings valuation report hints at an deflated share price compared to its estimated value.

Taking Advantage

- Click this link to deep-dive into the 1990 companies within our Top Dividend Stocks screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3899

CIMC Enric Holdings

Provides transportation, storage, and processing equipment and services for the clean energy, chemicals, environmental, and liquid food sectors worldwide.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives