- Hong Kong

- /

- Entertainment

- /

- SEHK:2400

Exploring None's Top 3 High Growth Tech Stocks

Reviewed by Simply Wall St

As global markets navigate a period of heightened volatility, with U.S. equities experiencing declines amid inflation concerns and political uncertainties, small-cap stocks have notably underperformed their large-cap counterparts. In this environment, identifying high-growth tech stocks requires careful consideration of their resilience to economic headwinds and potential for innovation-driven expansion.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| CD Projekt | 23.18% | 27.00% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| AVITA Medical | 33.33% | 51.81% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| TG Therapeutics | 30.33% | 44.07% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 29.92% | 61.97% | ★★★★★★ |

Click here to see the full list of 1223 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

XD (SEHK:2400)

Simply Wall St Growth Rating: ★★★★★☆

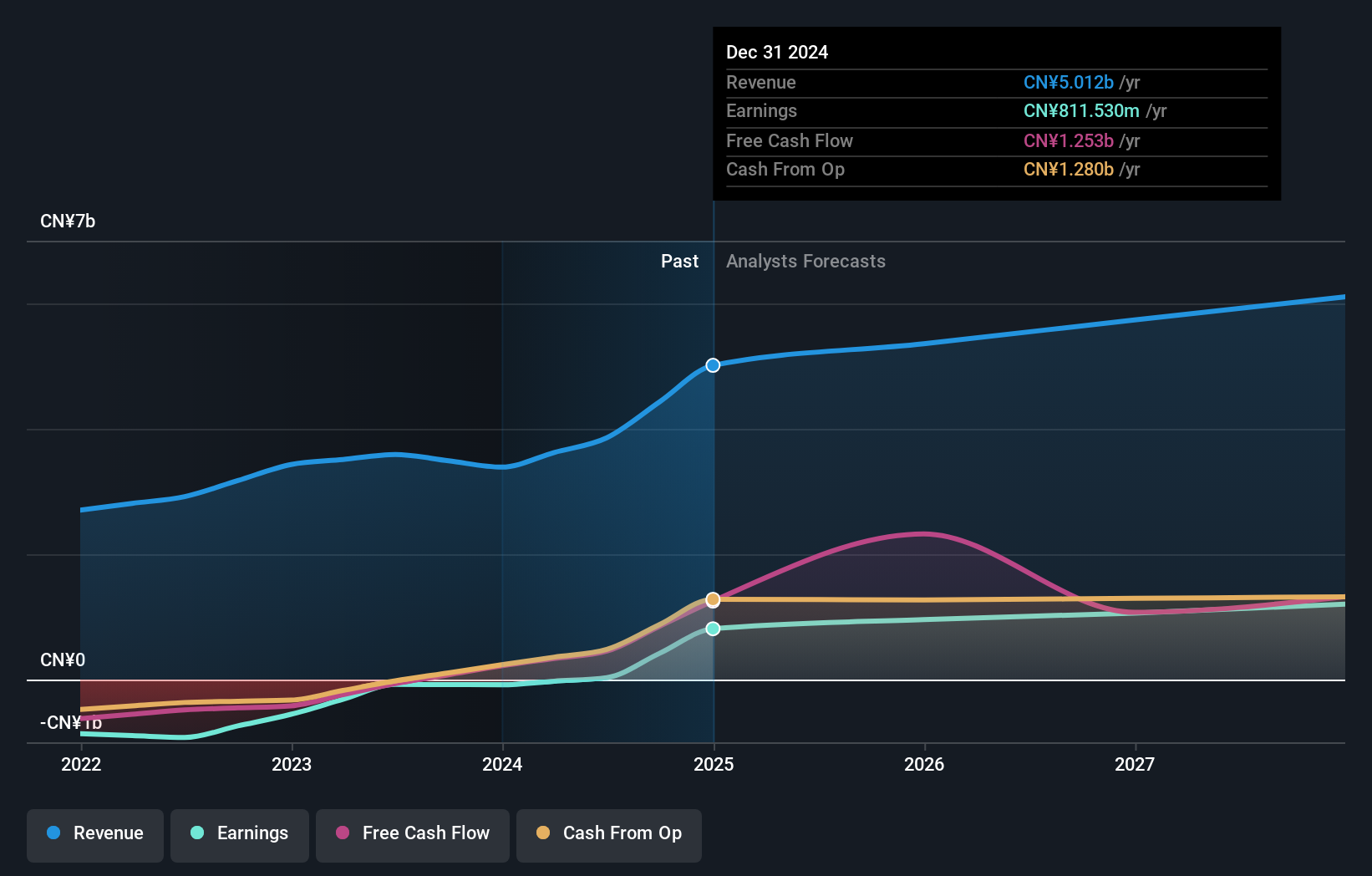

Overview: XD Inc. is an investment holding company that focuses on developing, publishing, operating, and distributing mobile and web games in Mainland China and internationally, with a market cap of approximately HK$11.41 billion.

Operations: XD Inc. generates revenue primarily from its Game segment, contributing CN¥2.43 billion, and the TapTap Platform segment, which brings in CN¥1.43 billion. The company's operations span both Mainland China and international markets within the mobile and web gaming industry.

XD has demonstrated robust growth dynamics, evidenced by its annual revenue and earnings growth rates of 15.0% and 52.7%, respectively, outpacing the Hong Kong market averages significantly. The company's commitment to innovation is underscored by its R&D spending, which has been strategically allocated to enhance technological advancements and maintain competitive edge in a rapidly evolving tech landscape. With a forecasted return on equity of 22.3% in three years, XD not only shows promise in profitability but also in shareholder value creation through strategic reinvestments and market positioning. This performance is particularly notable given that XD only recently became profitable, highlighting its potential trajectory in the high-growth tech sector amidst challenging industry comparisons.

- Get an in-depth perspective on XD's performance by reading our health report here.

Evaluate XD's historical performance by accessing our past performance report.

Ming Yuan Cloud Group Holdings (SEHK:909)

Simply Wall St Growth Rating: ★★★★☆☆

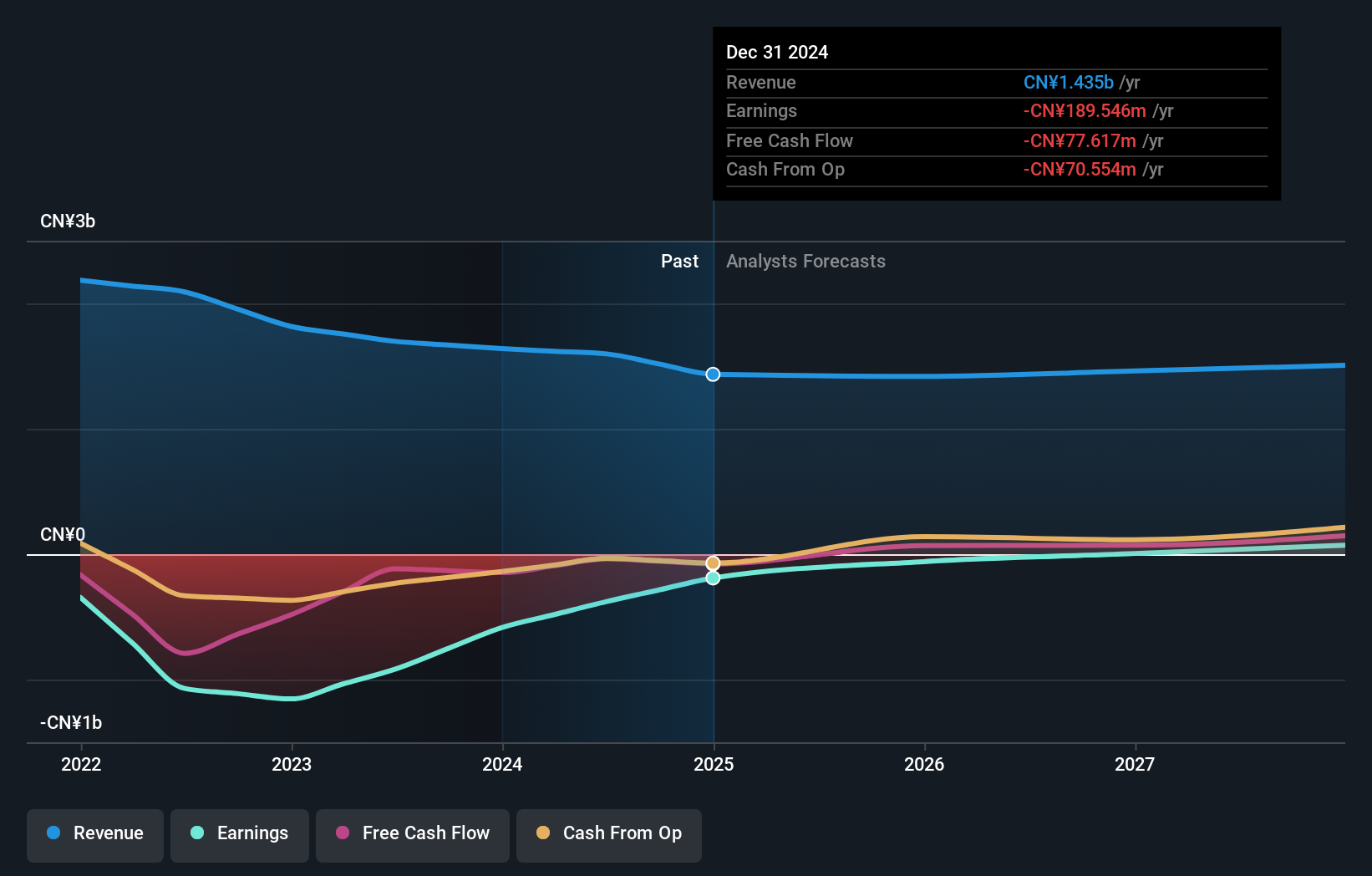

Overview: Ming Yuan Cloud Group Holdings Limited is an investment holding company that offers software solutions for property developers in China, with a market capitalization of HK$4.48 billion.

Operations: The company generates revenue primarily from Cloud Services and On-premise Software and Services, with Cloud Services contributing CN¥1.32 billion.

Ming Yuan Cloud Group Holdings is navigating the competitive tech landscape with a projected revenue growth of 12.2% annually, outstripping the Hong Kong market average of 7.6%. Despite current unprofitability, the company is anticipated to pivot into profitability within three years, boasting an expected earnings surge of 59.7% per annum. Recent strategic moves include appointing Ernst & Young as auditors during a December EGM, signaling robust governance and potential for future financial health enhancement. This shift not only reflects operational adjustments but also fortifies investor confidence amidst evolving market dynamics.

GNI Group (TSE:2160)

Simply Wall St Growth Rating: ★★★★★☆

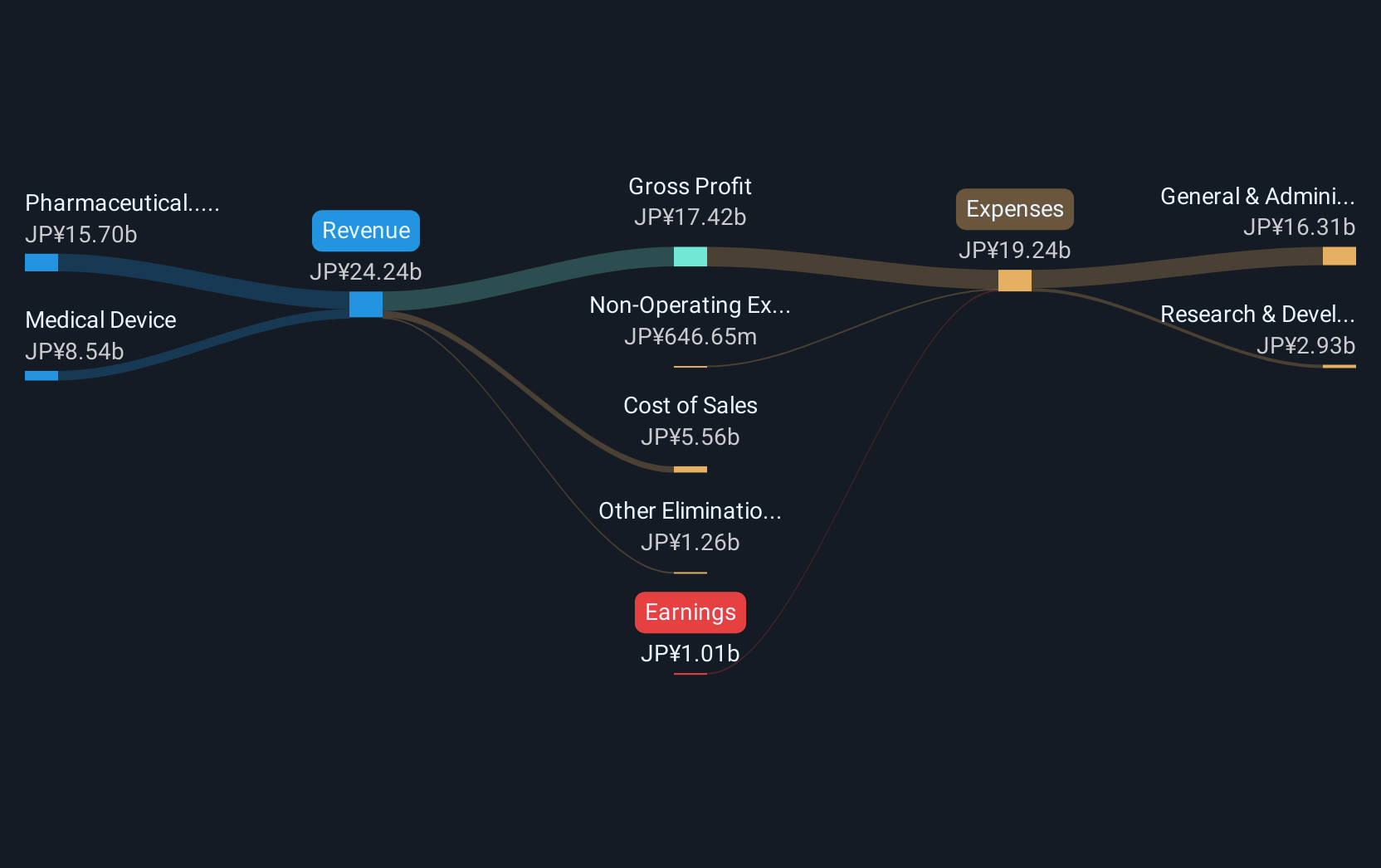

Overview: GNI Group Ltd. is involved in the research, development, manufacture, and sale of pharmaceutical drugs both in Japan and internationally with a market capitalization of ¥156.71 billion.

Operations: The company generates revenue primarily from its pharmaceutical segment, which accounts for approximately ¥18.31 billion, while its medical equipment segment contributes around ¥4.34 billion. The focus on pharmaceuticals plays a significant role in the company's financial structure and growth strategy.

GNI Group has demonstrated a robust trajectory in the tech sector, with its earnings soaring by 371.2% over the past year, significantly outpacing the industry average decline of 36.8%. This performance is underpinned by an aggressive R&D investment strategy, dedicating substantial resources to innovation—evident from its R&D expenses which are strategically aligned with revenue growth projections of 23.5% per annum. Furthermore, the company's forward-looking approach is expected to sustain an annual earnings increase of 22.5%, positioning it well above Japan's market growth rate of 8%. These financial dynamics are complemented by GNI’s focus on high-quality earnings and strategic market positioning, promising continued relevance and competitive edge in evolving tech landscapes.

- Take a closer look at GNI Group's potential here in our health report.

Assess GNI Group's past performance with our detailed historical performance reports.

Summing It All Up

- Click this link to deep-dive into the 1223 companies within our High Growth Tech and AI Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2400

XD

An investment holding company, develops, publishes, operates, and distributes mobile and web games in Mainland China and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives