- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:1024

Top Growth Companies With Strong Insider Confidence January 2025

Reviewed by Simply Wall St

As global markets navigate a choppy start to 2025, marked by inflation concerns and political uncertainties, investors are closely watching how these factors impact growth stocks. Despite recent declines in U.S. equities and a mixed performance across international indices, companies with high insider ownership can signal strong confidence from those who know the business best, making them appealing candidates for potential growth opportunities in this volatile environment.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Propel Holdings (TSX:PRL) | 36.8% | 38.9% |

| Laopu Gold (SEHK:6181) | 36.4% | 35.8% |

| Pharma Mar (BME:PHM) | 11.9% | 56.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.2% | 66.2% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Here we highlight a subset of our preferred stocks from the screener.

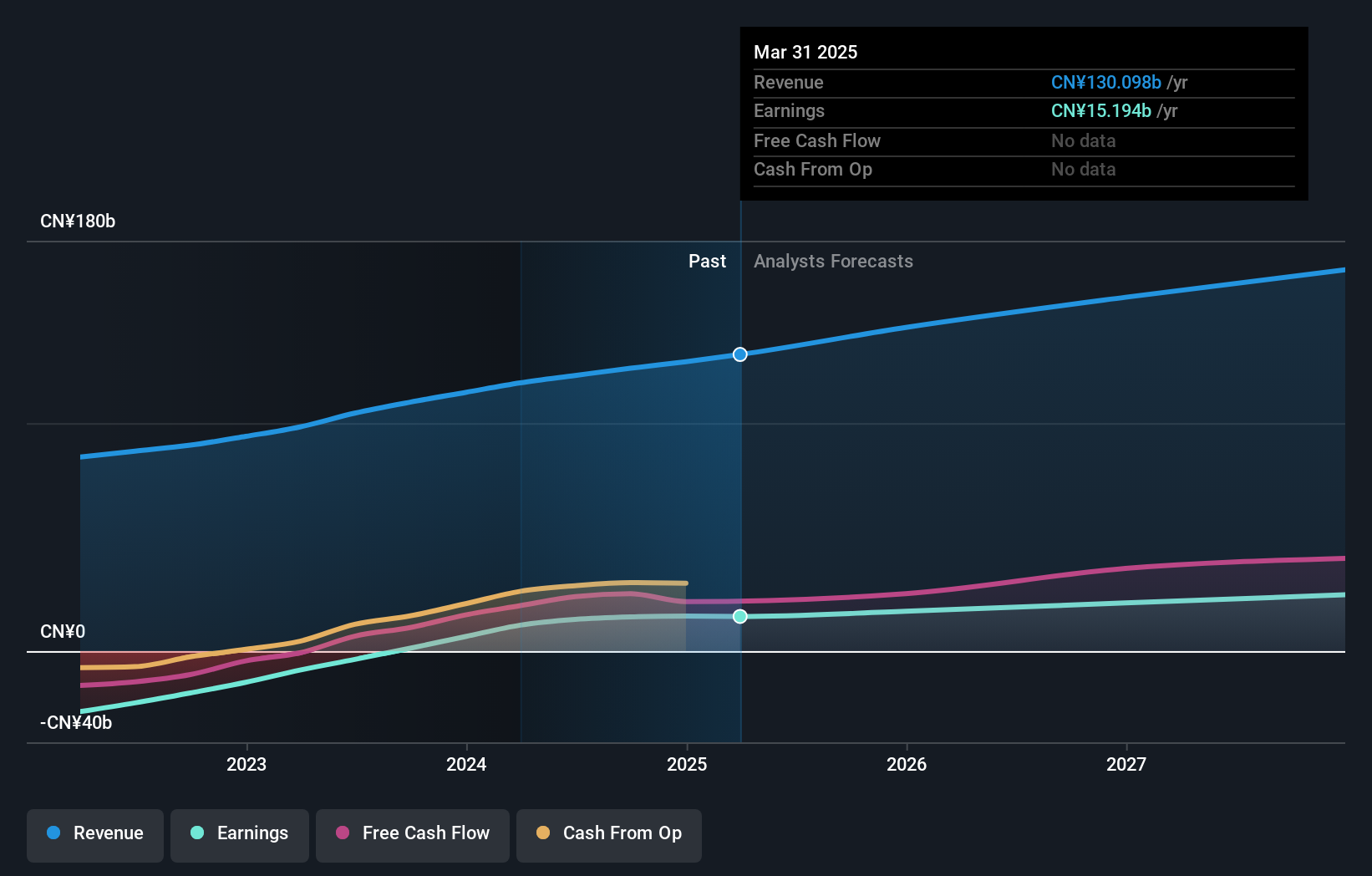

Kuaishou Technology (SEHK:1024)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kuaishou Technology is an investment holding company that offers live streaming, online marketing, and other services in the People's Republic of China, with a market cap of approximately HK$173.97 billion.

Operations: The company's revenue segments include CN¥119.83 billion from domestic operations and CN¥4.25 billion from overseas activities.

Insider Ownership: 19.6%

Earnings Growth Forecast: 16.7% p.a.

Kuaishou Technology, recently added to the Hang Seng Index, demonstrates robust growth potential with earnings surging over the past year and forecasted to grow 16.7% annually, outpacing the Hong Kong market. The company trades at a significant discount to its fair value and has completed a substantial share buyback program worth HK$2.44 billion. Despite moderate revenue growth expectations, Kuaishou's strong insider ownership aligns management interests with shareholders.

- Navigate through the intricacies of Kuaishou Technology with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Kuaishou Technology's shares may be trading at a discount.

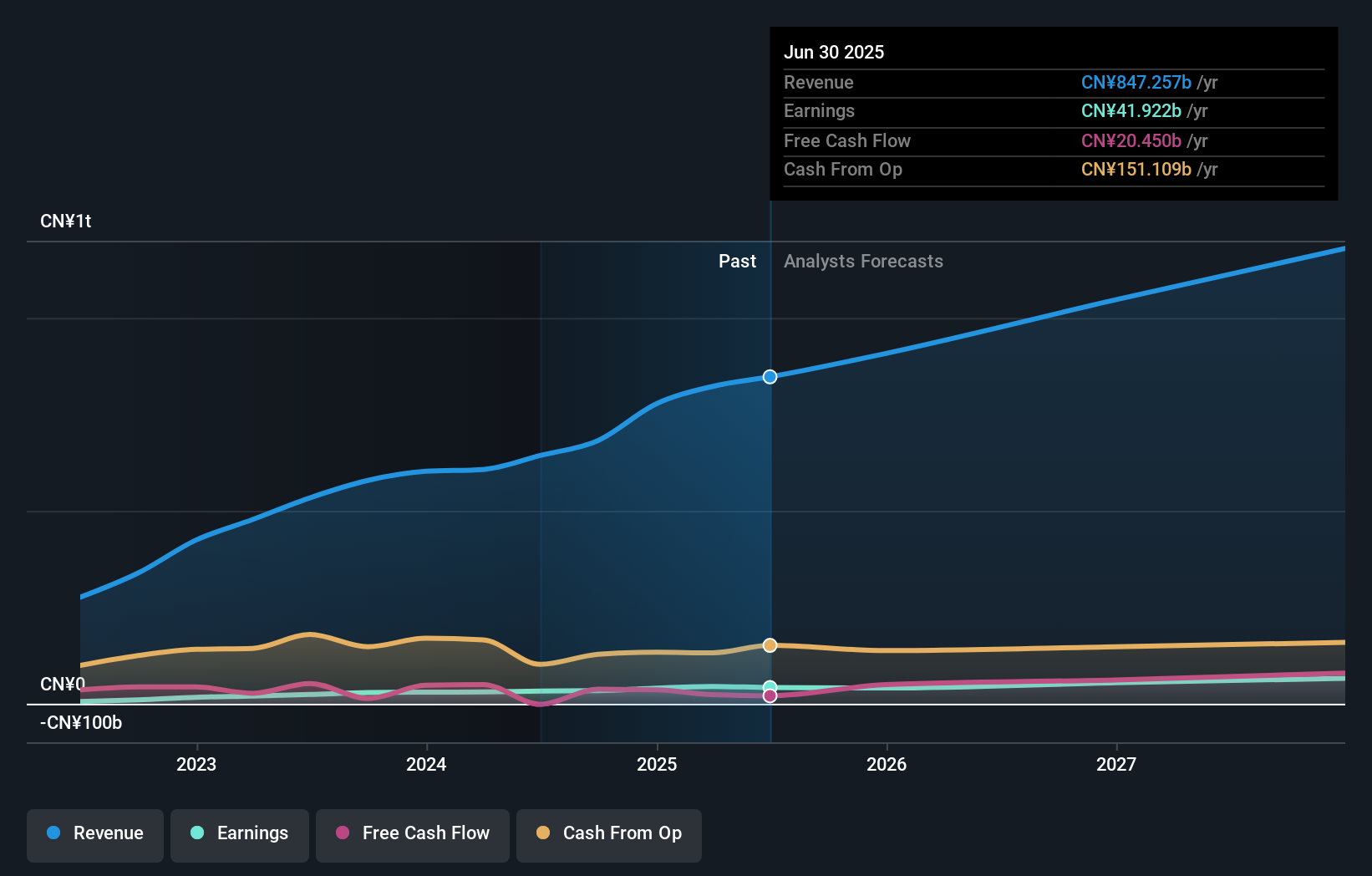

BYD (SEHK:1211)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BYD Company Limited, along with its subsidiaries, operates in the automobiles and batteries sectors across the People’s Republic of China, Hong Kong, Macau, Taiwan, and internationally with a market cap of approximately HK$812.55 billion.

Operations: BYD's revenue primarily stems from its operations in the automobiles and batteries sectors across various regions, including China, Hong Kong, Macau, Taiwan, and international markets.

Insider Ownership: 30.1%

Earnings Growth Forecast: 16.9% p.a.

BYD Company Limited shows substantial growth with recent sales and production volumes significantly exceeding last year's figures, reflecting strong market demand. The company's strategic UK expansion enhances its global presence in the electric vehicle sector. Earnings are projected to grow at 16.9% annually, outpacing the Hong Kong market, while trading slightly below fair value estimates. Despite no recent insider trading activity, high insider ownership aligns management interests with shareholders, supporting long-term growth prospects.

- Dive into the specifics of BYD here with our thorough growth forecast report.

- Our valuation report here indicates BYD may be overvalued.

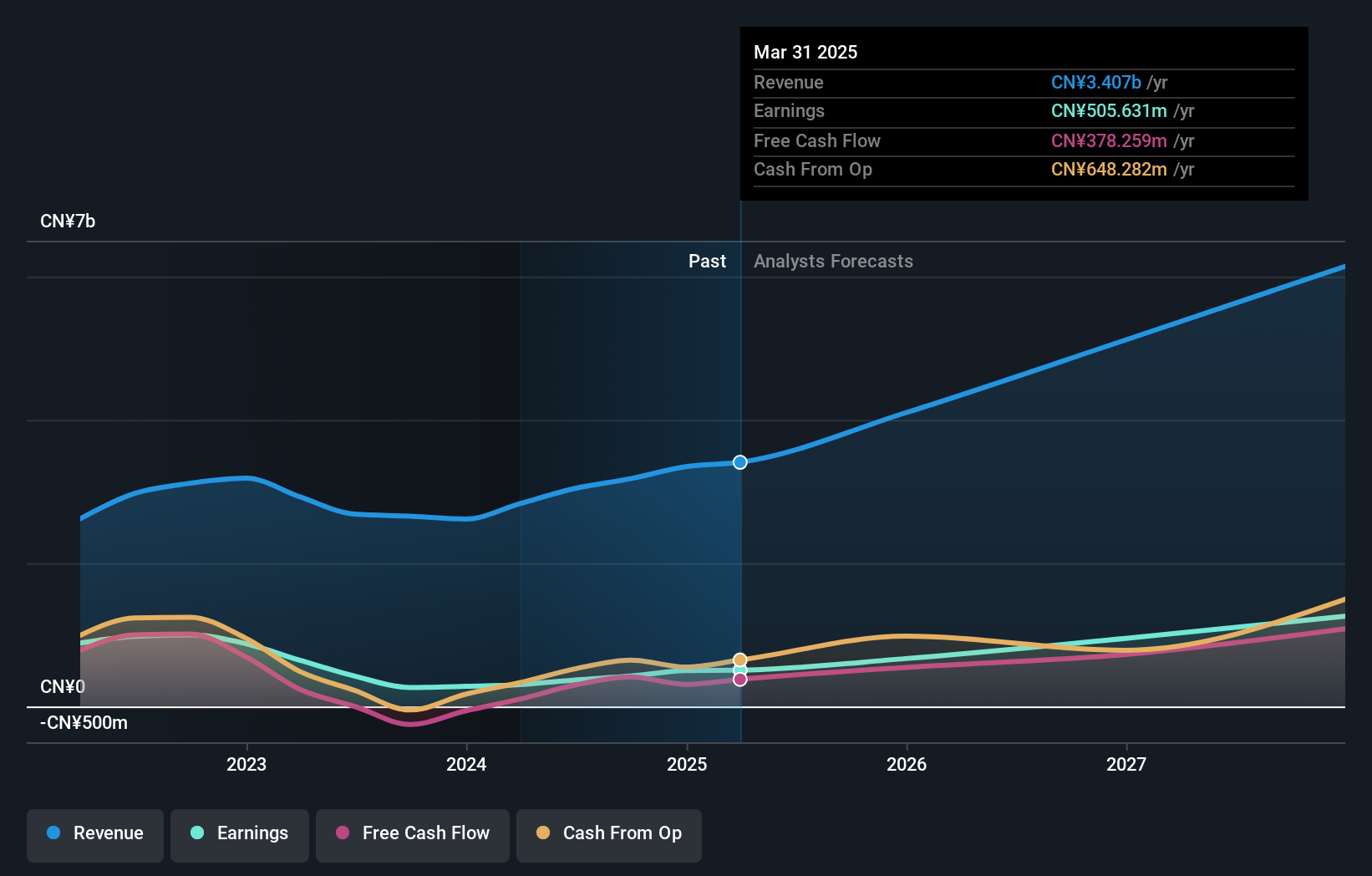

SG Micro (SZSE:300661)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SG Micro Corp designs, markets, and sells analog ICs primarily in China with a market cap of CN¥35.96 billion.

Operations: The company's revenue from the Integrated Circuit Industry segment is CN¥3.18 billion.

Insider Ownership: 32.9%

Earnings Growth Forecast: 41.4% p.a.

SG Micro demonstrates robust growth with its earnings forecast to increase by 41.4% annually, surpassing the Chinese market's average. Revenue is also projected to grow at 22% per year, outpacing the market rate. Recent earnings reports show significant improvement, with net income doubling from CNY 142.04 million to CNY 284.9 million over nine months. Although insider trading activity is unavailable, high insider ownership typically aligns management interests with shareholders for sustained growth.

- Click here and access our complete growth analysis report to understand the dynamics of SG Micro.

- In light of our recent valuation report, it seems possible that SG Micro is trading beyond its estimated value.

Next Steps

- Click this link to deep-dive into the 1444 companies within our Fast Growing Companies With High Insider Ownership screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Kuaishou Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1024

Kuaishou Technology

An investment holding company, provides live streaming, online marketing, and other services in the People’s Republic of China.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives