- United Kingdom

- /

- Hospitality

- /

- LSE:OTB

UK Stocks That Might Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices closing lower amid concerns over weak trade data from China, highlighting the global interconnectedness of markets. In such an environment, identifying stocks that might be trading below their estimated value can offer potential opportunities for investors seeking to navigate these turbulent times.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vistry Group (LSE:VTY) | £6.01 | £11.85 | 49.3% |

| Van Elle Holdings (AIM:VANL) | £0.395 | £0.73 | 45.8% |

| Topps Tiles (LSE:TPT) | £0.37 | £0.73 | 49.4% |

| TBC Bank Group (LSE:TBCG) | £48.65 | £95.93 | 49.3% |

| Marlowe (AIM:MRL) | £4.44 | £8.37 | 47% |

| LSL Property Services (LSE:LSL) | £3.04 | £5.90 | 48.5% |

| Franchise Brands (AIM:FRAN) | £1.4475 | £2.70 | 46.3% |

| Burberry Group (LSE:BRBY) | £13.175 | £23.94 | 45% |

| AstraZeneca (LSE:AZN) | £102.94 | £194.44 | 47.1% |

| Aptitude Software Group (LSE:APTD) | £2.87 | £5.40 | 46.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

On the Beach Group (LSE:OTB)

Overview: On the Beach Group plc is an online retailer specializing in short-haul beach holidays under the On the Beach brand in the United Kingdom, with a market cap of £449.08 million.

Operations: The company generates revenue primarily from its online platforms, Onthebeach.co.uk and Sunshine.co.uk, totaling £122.30 million.

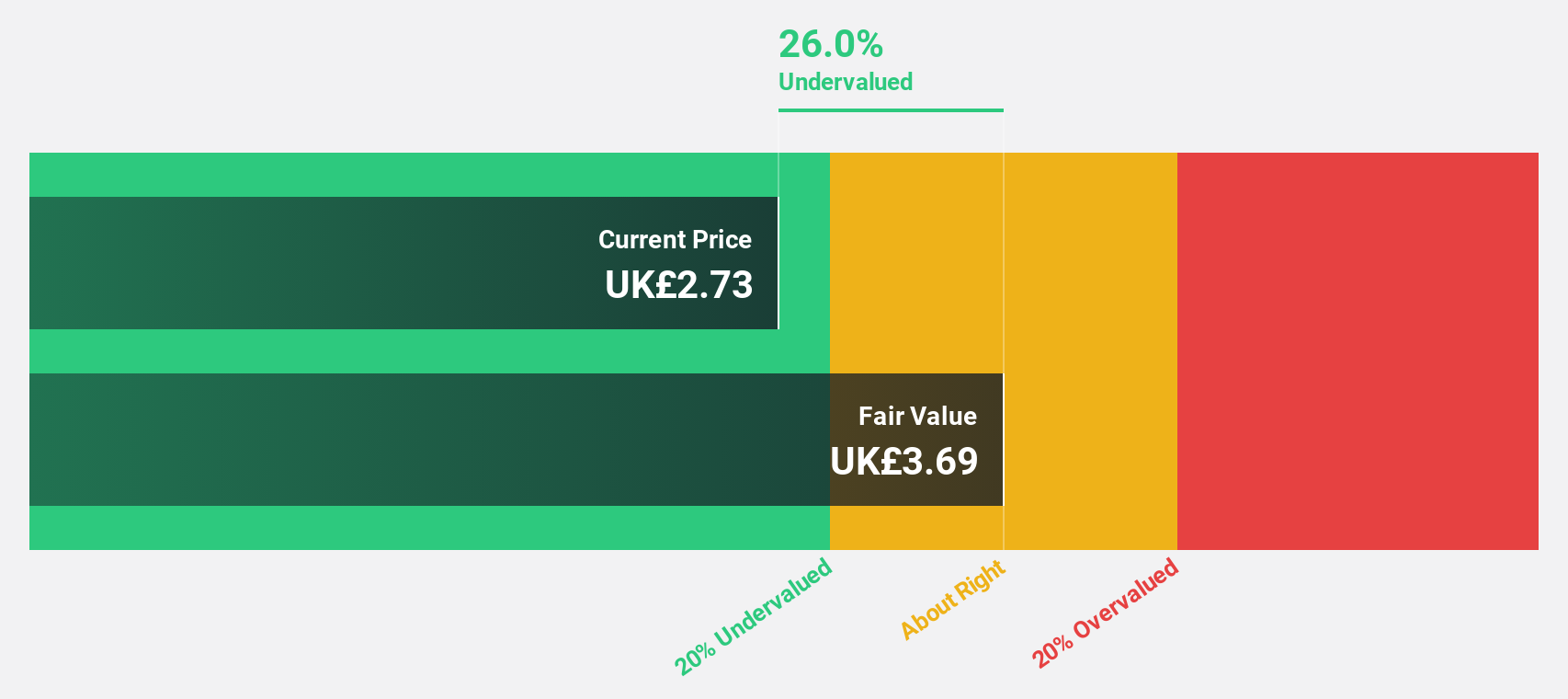

Estimated Discount To Fair Value: 32.1%

On the Beach Group is trading at £2.87, significantly below its estimated fair value of £4.23, indicating it may be undervalued based on cash flows. The company has demonstrated robust earnings growth, with a 65.8% annual increase over five years and forecasts suggesting continued strong profit growth of 24.3% annually, outpacing the UK market's 14.5%. Recent buybacks totaling £25 million for 6.53% of shares could further enhance shareholder value.

- Insights from our recent growth report point to a promising forecast for On the Beach Group's business outlook.

- Navigate through the intricacies of On the Beach Group with our comprehensive financial health report here.

PayPoint (LSE:PAY)

Overview: PayPoint plc operates in the United Kingdom, offering payments and banking, shopping, and e-commerce services and products, with a market cap of approximately £534.75 million.

Operations: The company's revenue is primarily generated from its Pay Point segment, contributing £163.58 million, and the Love2shop segment, which adds £147.14 million.

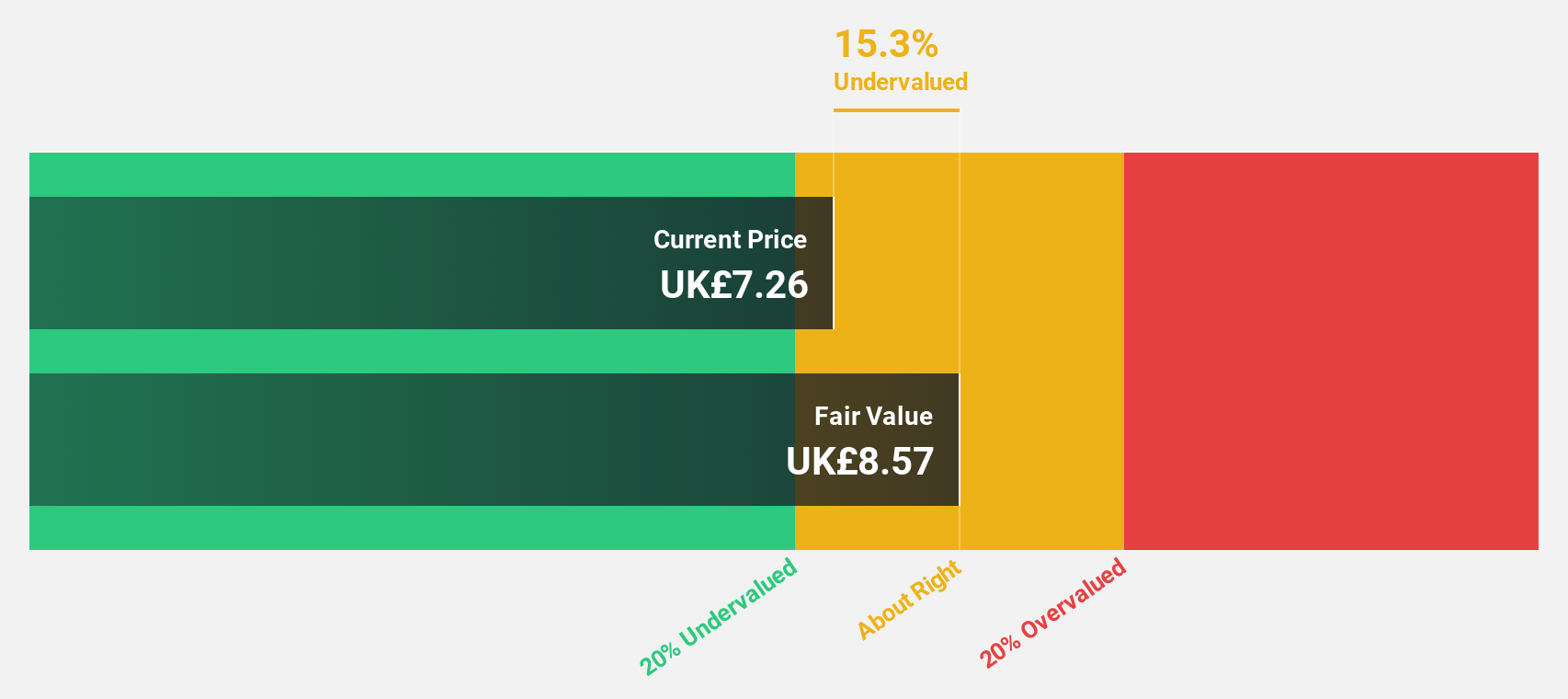

Estimated Discount To Fair Value: 10.8%

PayPoint is trading at £7.65, slightly below its estimated fair value of £8.58, which could suggest undervaluation based on cash flows. Despite a forecasted 43.5% annual earnings growth, revenue is expected to decline by 12.1% annually over the next three years. The company recently authorized a £30 million share buyback program to reduce share capital, potentially enhancing shareholder value despite challenges such as lower profit margins and high debt levels.

- In light of our recent growth report, it seems possible that PayPoint's financial performance will exceed current levels.

- Get an in-depth perspective on PayPoint's balance sheet by reading our health report here.

Zegona Communications (LSE:ZEG)

Overview: Zegona Communications plc invests in telecommunications, media, and technology businesses across Europe, with a market cap of £5.59 billion.

Operations: The company's revenue is primarily derived from its Internet Telephone segment, which generated €2.41 billion.

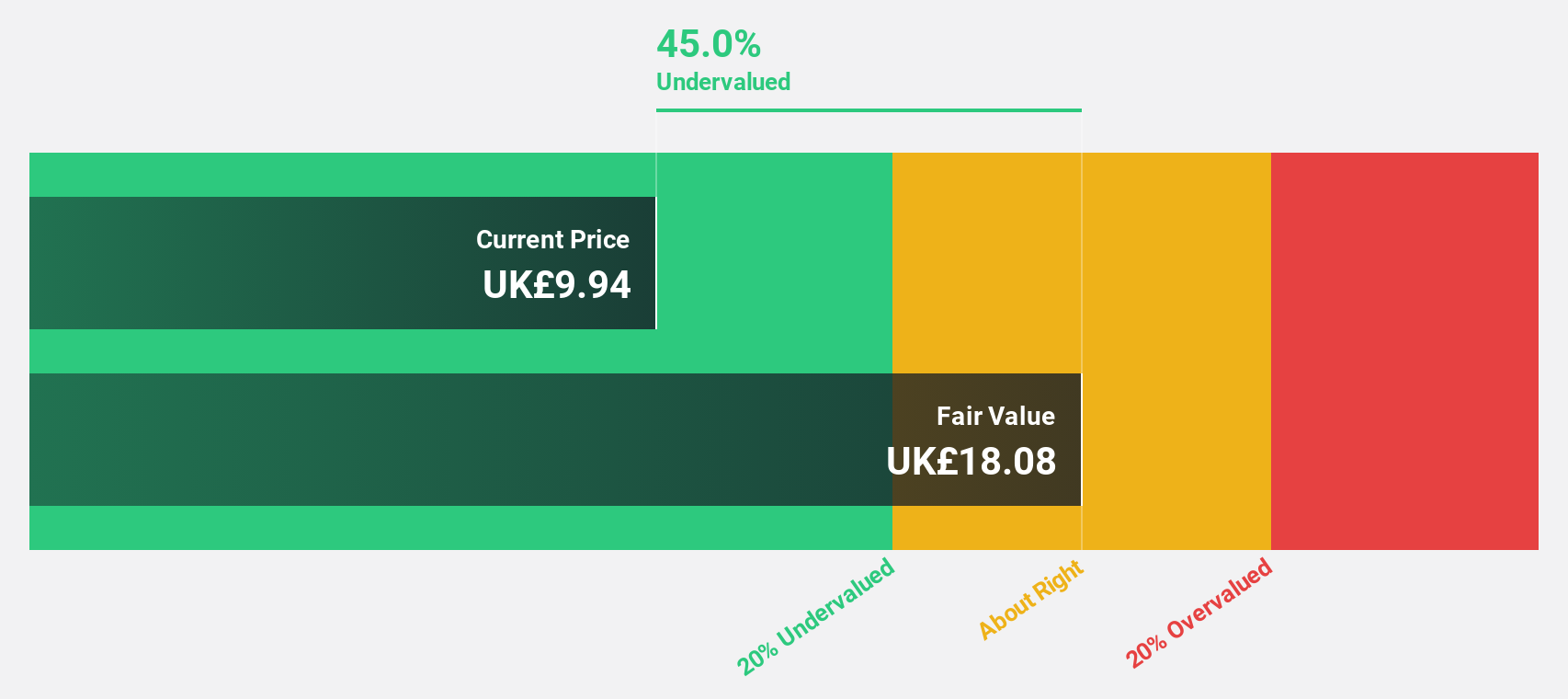

Estimated Discount To Fair Value: 14.4%

Zegona Communications is trading at £7.36, below its estimated fair value of £8.59, indicating potential undervaluation based on cash flows. Despite reporting a net loss of €438.81 million for the fifteen months ended March 31, 2025, earnings are forecast to grow significantly at 93.27% annually and the company is expected to become profitable within three years. Additionally, ongoing M&A discussions could impact future valuations and strategic direction positively or negatively depending on outcomes.

- Our expertly prepared growth report on Zegona Communications implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Zegona Communications.

Where To Now?

- Dive into all 56 of the Undervalued UK Stocks Based On Cash Flows we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:OTB

On the Beach Group

Operates as an online retailer of short haul beach holidays under the On the Beach brand name in the United Kingdom.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives