- United Kingdom

- /

- Software

- /

- AIM:DOTD

UK Penny Stocks To Watch In March 2025

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting global economic interdependencies. Despite these broader market fluctuations, investors often turn their attention to penny stocks for their potential growth and affordability. Though the term "penny stocks" might seem outdated, these smaller or newer companies can offer significant opportunities when backed by strong financials and a clear growth path.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Ultimate Products (LSE:ULTP) | £0.775 | £65.7M | ✅ 4 ⚠️ 3 View Analysis > |

| Next 15 Group (AIM:NFG) | £3.065 | £304.83M | ✅ 4 ⚠️ 5 View Analysis > |

| Helios Underwriting (AIM:HUW) | £2.09 | £149.11M | ✅ 4 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £3.80 | £306.99M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.69 | £419.72M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.39 | £423.18M | ✅ 4 ⚠️ 1 View Analysis > |

| RTC Group (AIM:RTC) | £1.05 | £14.29M | ✅ 2 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.01 | £160.96M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.792 | £2.1B | ✅ 5 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.335 | £36.25M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 447 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

dotdigital Group (AIM:DOTD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: dotdigital Group Plc provides intuitive software as a service (SaaS) and managed services to digital marketing professionals globally, with a market cap of £230.14 million.

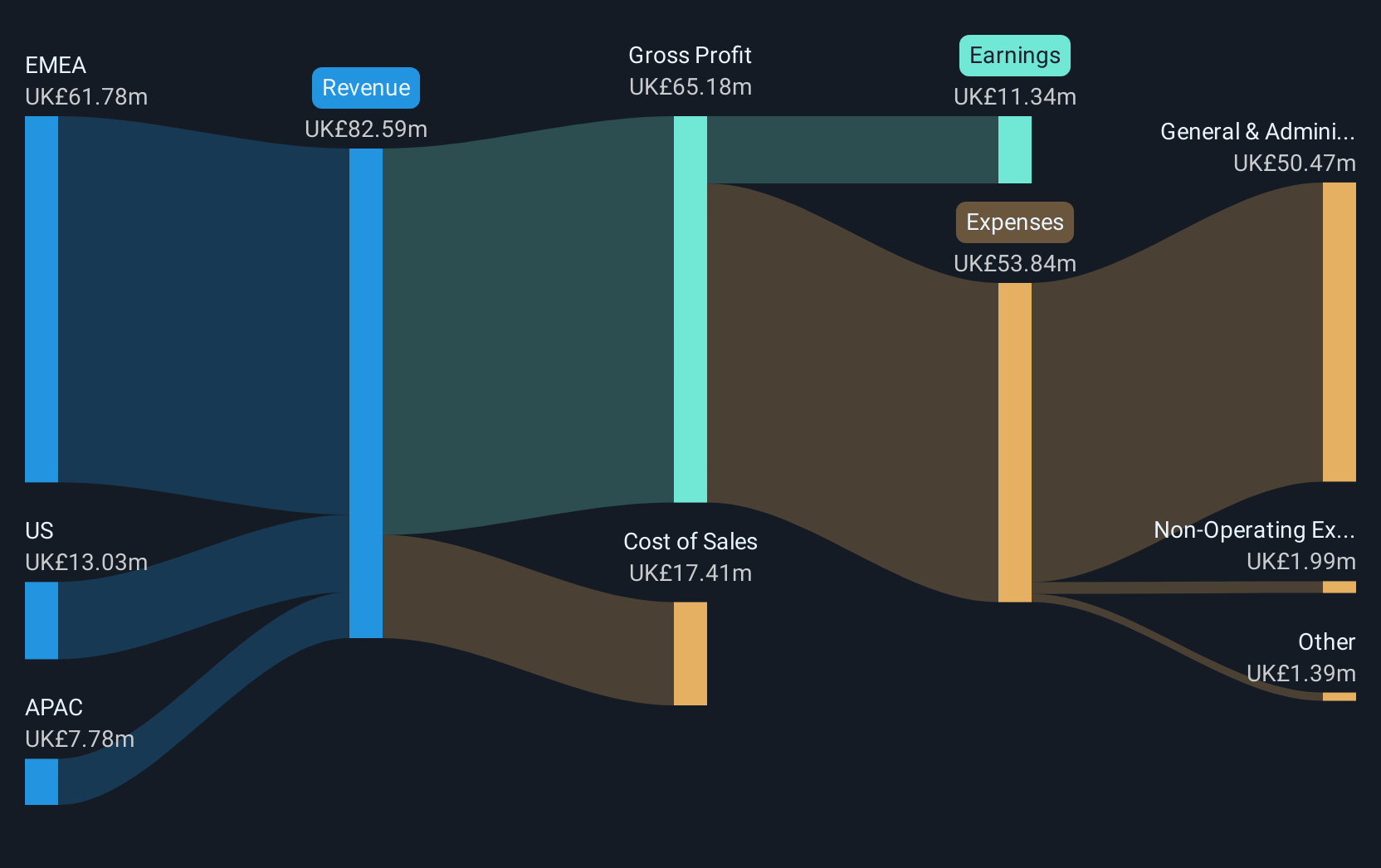

Operations: The company's revenue of £82.59 million is derived from its data-driven omni-channel marketing automation services.

Market Cap: £230.14M

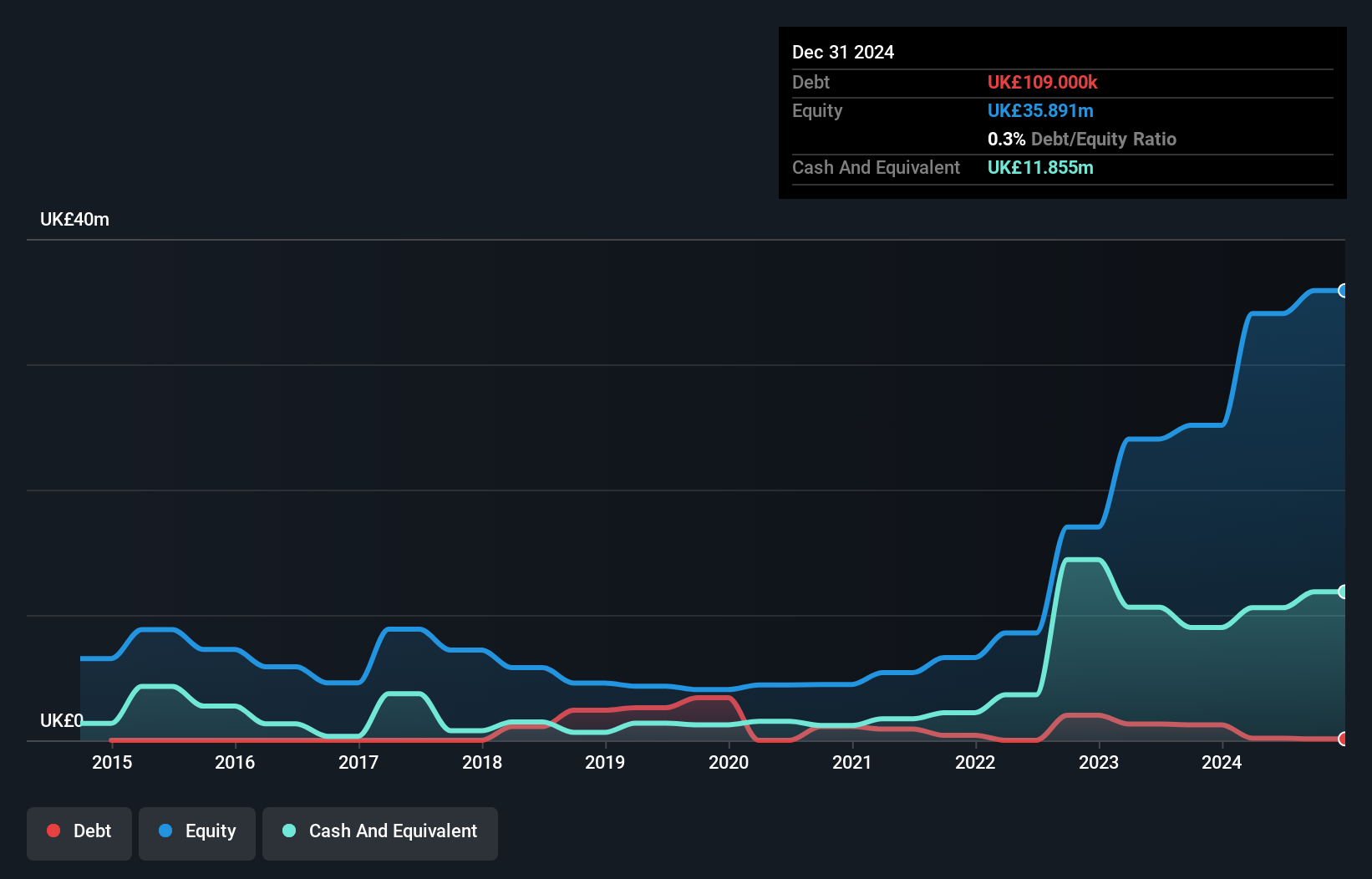

dotdigital Group Plc, with a market cap of £230.14 million, offers SaaS solutions for digital marketing, generating £82.59 million in revenue. The company is debt-free and maintains strong short-term asset coverage over liabilities (£64.7M vs £17.7M). Despite negative earnings growth last year and declining profits over five years, it trades below fair value estimates by 23.3%. Recent announcements include successful beta testing of its WhatsApp channel launching in April and plans for strategic acquisitions to enhance brand awareness and technology integration, despite recent executive changes with the CFO stepping down by mid-2025.

- Dive into the specifics of dotdigital Group here with our thorough balance sheet health report.

- Gain insights into dotdigital Group's outlook and expected performance with our report on the company's earnings estimates.

Eagle Eye Solutions Group (AIM:EYE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Eagle Eye Solutions Group plc offers marketing technology software as a service solutions across several regions including the United Kingdom, France, and the United States, with a market cap of £111.73 million.

Operations: No specific revenue segments have been reported for this company.

Market Cap: £111.73M

Eagle Eye Solutions Group, with a market cap of £111.73 million, has demonstrated profitability over the past year and maintains strong financial health, with short-term assets (£23.4M) exceeding both short-term (£13.0M) and long-term liabilities (£3.6M). Its debt is well-covered by operating cash flow, and it boasts a high return on equity (21.8%). Recent earnings guidance for FY25 anticipates revenue of £47.7 million, while its new five-year OEM agreement could significantly enhance recurring revenue streams by integrating Eagle Eye's platform into a major enterprise vendor's loyalty solution launching in 2025.

- Get an in-depth perspective on Eagle Eye Solutions Group's performance by reading our balance sheet health report here.

- Evaluate Eagle Eye Solutions Group's prospects by accessing our earnings growth report.

Zotefoams (LSE:ZTF)

Simply Wall St Financial Health Rating: ★★★★★★

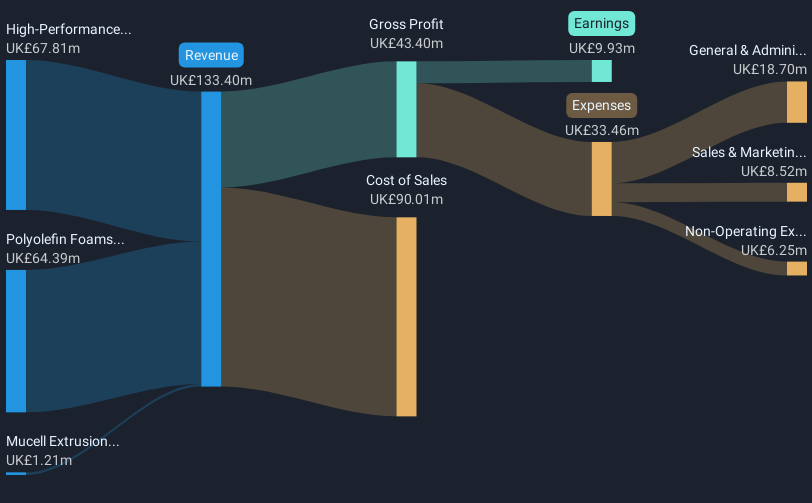

Overview: Zotefoams plc, along with its subsidiaries, manufactures, distributes, and sells polyolefin block foams across the United Kingdom, Europe, North America, and other international markets with a market cap of £145.16 million.

Operations: Zotefoams operates without specified revenue segments, focusing on the production and distribution of polyolefin block foams across the UK, Europe, North America, and other international markets.

Market Cap: £145.16M

Zotefoams plc, with a market cap of £145.16 million, reported 2024 sales of £147.79 million but faced a net loss of £2.76 million. Despite the current unprofitability and increased losses over five years, the company maintains satisfactory financial health with short-term assets exceeding liabilities and well-covered debt by operating cash flow. Zotefoams is expanding its international presence with new facilities in Vietnam and South Korea to bolster its strong position in athletic footwear, particularly through its partnership with Nike. This strategic investment aims to enhance customer relationships and sustainability while leveraging innovative manufacturing technologies for future growth.

- Click here and access our complete financial health analysis report to understand the dynamics of Zotefoams.

- Understand Zotefoams' earnings outlook by examining our growth report.

Taking Advantage

- Gain an insight into the universe of 447 UK Penny Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:DOTD

dotdigital Group

Engages in the provision of intuitive software as a service (SaaS) and managed services to digital marketing professionals worldwide.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives