- United Kingdom

- /

- Tech Hardware

- /

- AIM:CNC

UK Penny Stocks: 3 Picks With Market Caps Below £300M

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting global economic uncertainties. Amid these broader market movements, investors often look for opportunities in less prominent areas like penny stocks, which can still offer growth potential despite their niche status. These stocks, typically representing smaller or newer companies, may present compelling opportunities when supported by strong financial health and long-term potential.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Ultimate Products (LSE:ULTP) | £0.64 | £54.07M | ✅ 4 ⚠️ 4 View Analysis > |

| Next 15 Group (AIM:NFG) | £2.615 | £260.08M | ✅ 4 ⚠️ 5 View Analysis > |

| Central Asia Metals (AIM:CAML) | £1.55 | £269.66M | ✅ 4 ⚠️ 2 View Analysis > |

| Warpaint London (AIM:W7L) | £3.55 | £286.79M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.41 | £386.35M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £3.75 | £361.49M | ✅ 3 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.60 | £992.4M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.93 | £148.32M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.91 | £2.15B | ✅ 5 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.34 | £36.79M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 393 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

AdvancedAdvT (AIM:ADVT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AdvancedAdvT Limited offers software solutions across Europe, the United Kingdom, North America, and other international markets, with a market capitalization of £199.80 million.

Operations: The company's revenue segment is derived entirely from Blank Checks, totaling £31.68 million.

Market Cap: £199.8M

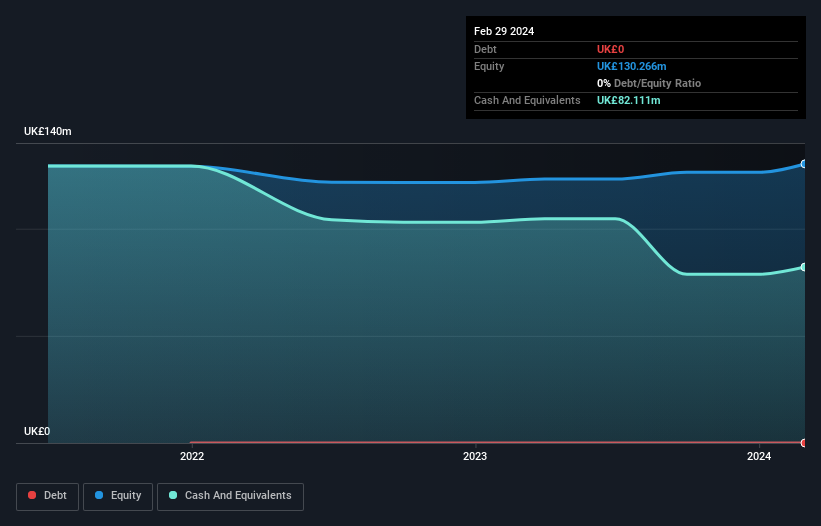

AdvancedAdvT Limited, with a market cap of £199.80 million, recently became profitable and is trading significantly below its estimated fair value. The company operates without debt, which simplifies financial stability concerns. Its short-term assets comfortably cover both short- and long-term liabilities, indicating strong liquidity. Despite the recent profitability milestone, earnings have been influenced by a substantial one-off gain of £2.5 million in the last year. While the board has seasoned members with an average tenure of four years, the management team is relatively new with 1.3 years average tenure. Recent executive changes include the resignation of Non-Executive Director Mark Brangstrup Watts in February 2025.

- Unlock comprehensive insights into our analysis of AdvancedAdvT stock in this financial health report.

- Learn about AdvancedAdvT's future growth trajectory here.

Concurrent Technologies (AIM:CNC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Concurrent Technologies Plc designs, develops, manufactures, and markets single board computers for system integrators and original equipment manufacturers globally, with a market cap of £135.97 million.

Operations: Concurrent Technologies has not reported any specific revenue segments.

Market Cap: £135.97M

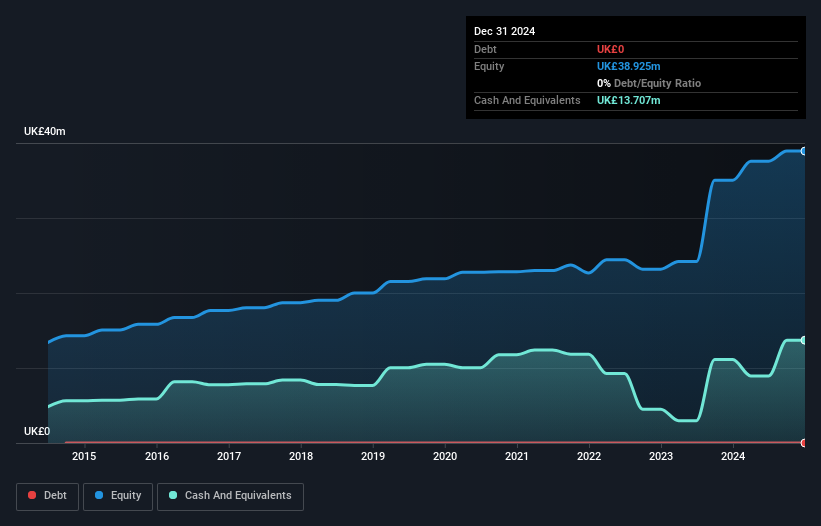

Concurrent Technologies Plc, with a market cap of £135.97 million, reported strong financial performance for 2024, with sales increasing to £40.32 million and net income rising to £4.7 million. The company is debt-free and maintains robust liquidity, with short-term assets significantly exceeding liabilities. Recent strategic moves include a planned headquarters expansion to support growth and the launch of Kratos, an advanced computing solution enhancing its product offerings in defense and industrial sectors. Despite lower-than-industry earnings growth last year, the company's profit margins remain healthy at 11.7%, supported by high-quality earnings and stable volatility levels.

- Get an in-depth perspective on Concurrent Technologies' performance by reading our balance sheet health report here.

- Gain insights into Concurrent Technologies' outlook and expected performance with our report on the company's earnings estimates.

Filtronic (AIM:FTC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Filtronic plc designs, develops, manufactures, and sells radio frequency technology globally with a market cap of £203.67 million.

Operations: The company generates revenue of £42.55 million from its Wireless Communications Equipment segment.

Market Cap: £203.67M

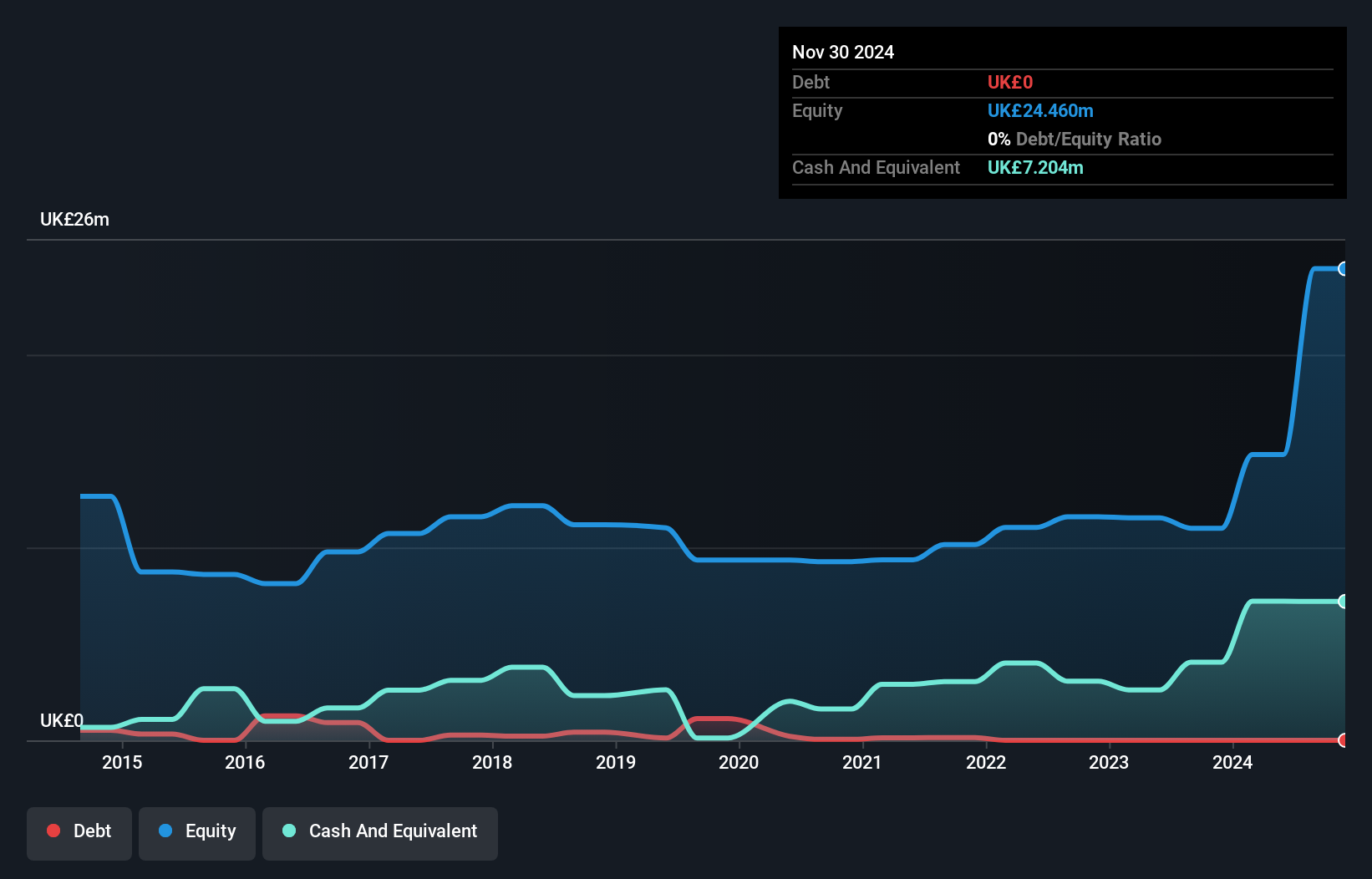

Filtronic plc, with a market cap of £203.67 million, has shown significant financial improvement, reporting sales of £25.6 million for the half year ending November 2024 and achieving profitability with a net income of £6.73 million. The company has no debt and maintains strong liquidity, with short-term assets exceeding liabilities by a substantial margin. Recent developments include an expanded strategic partnership with SpaceX to supply E-band SSPA modules for Starlink, alongside securing a $20.9 million contract from SpaceX. Despite high share price volatility and insider selling concerns, Filtronic's return on equity is outstanding at 42.5%.

- Click here to discover the nuances of Filtronic with our detailed analytical financial health report.

- Examine Filtronic's earnings growth report to understand how analysts expect it to perform.

Summing It All Up

- Reveal the 393 hidden gems among our UK Penny Stocks screener with a single click here.

- Looking For Alternative Opportunities? AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Concurrent Technologies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CNC

Concurrent Technologies

Designs, develops, manufactures, and markets single board computers for system integrators and original equipment manufacturers in the United Kingdom, the United States, Malaysia, Germany, rest of Europe, and internationally.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives