- United Kingdom

- /

- Pharma

- /

- AIM:FUM

3 UK Penny Stocks With Market Caps Under £200M To Watch

Reviewed by Simply Wall St

The United Kingdom's stock market has recently experienced fluctuations, with the FTSE 100 closing lower due to weak trade data from China impacting global economic sentiment. Despite these challenges, investors often look towards smaller or newer companies for potential growth opportunities. Penny stocks, though an outdated term, still represent a segment of the market where careful selection based on strong financials can uncover significant value and stability.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Croma Security Solutions Group (AIM:CSSG) | £0.84 | £11.57M | ✅ 3 ⚠️ 3 View Analysis > |

| Ultimate Products (LSE:ULTP) | £0.70 | £58.99M | ✅ 4 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £3.06 | £315.71M | ✅ 4 ⚠️ 1 View Analysis > |

| Helios Underwriting (AIM:HUW) | £2.25 | £163M | ✅ 4 ⚠️ 2 View Analysis > |

| Warpaint London (AIM:W7L) | £3.95 | £319.11M | ✅ 4 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.975 | £448.25M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.125 | £397.64M | ✅ 2 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.00 | £159.49M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £4.162 | £2.28B | ✅ 4 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.39 | £42.2M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 400 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Concurrent Technologies (AIM:CNC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Concurrent Technologies Plc designs, develops, manufactures, and markets single board computers for system integrators and original equipment manufacturers across various international markets including the United Kingdom and the United States, with a market cap of £160.64 million.

Operations: The company generates £40.32 million in revenue from the design, manufacture, and supply of high-end embedded computer products.

Market Cap: £160.64M

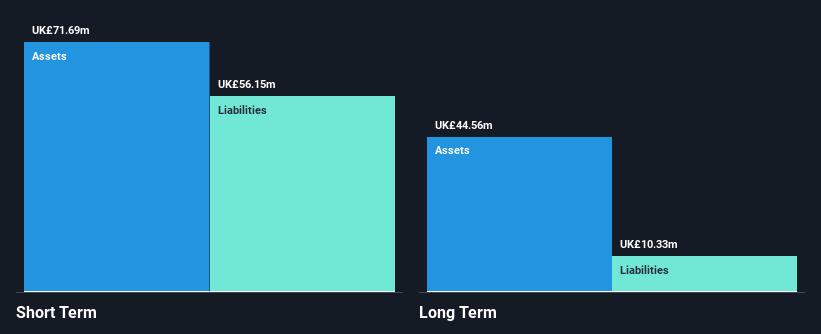

Concurrent Technologies Plc, with a market cap of £160.64 million, reported significant revenue growth to £40.32 million for 2024, up from £31.66 million the previous year, alongside a net income increase to £4.7 million. The company is expanding its manufacturing capacity with a new facility and has launched Kratos, an advanced computing solution in defense and industrial sectors. Despite stable weekly volatility and no debt over the past five years, insider selling has been noted recently. Earnings have grown consistently at 7% annually over five years but lag slightly behind industry averages in recent growth rates.

- Jump into the full analysis health report here for a deeper understanding of Concurrent Technologies.

- Explore Concurrent Technologies' analyst forecasts in our growth report.

Futura Medical (AIM:FUM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Futura Medical plc researches, develops, and sells pharmaceutical and healthcare products for sexual health with a market cap of £30.26 million.

Operations: The company generates revenue primarily from the development and commercialization of MED3000, amounting to £13.93 million.

Market Cap: £30.26M

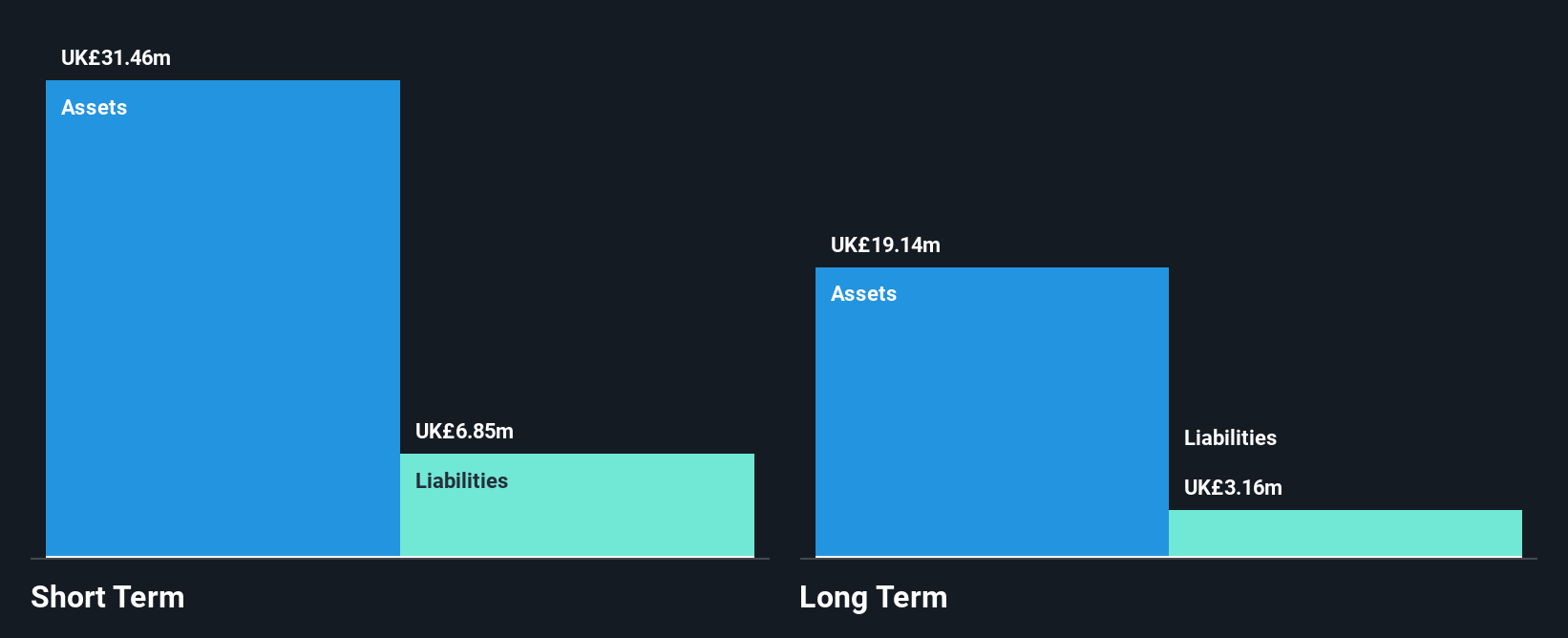

Futura Medical plc, with a market cap of £30.26 million, recently reported significant revenue growth to £13.93 million for 2024, marking its transition to profitability with a net income of £1.29 million compared to a previous net loss. The company's Price-To-Earnings ratio (23.4x) is below the industry average, suggesting potential value for investors. Futura Medical remains debt-free and has stable short-term assets exceeding liabilities, though it experiences higher volatility than most UK stocks. Recent board changes include the appointment of Harmesh Suniara as Non-executive Director, bringing extensive investment management experience focused on UK equities.

- Take a closer look at Futura Medical's potential here in our financial health report.

- Assess Futura Medical's future earnings estimates with our detailed growth reports.

Ultimate Products (LSE:ULTP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ultimate Products Plc, with a market cap of £58.99 million, supplies branded household products across the United Kingdom, Germany, the rest of Europe, and internationally.

Operations: The company generates revenue from its Wholesale - Miscellaneous segment, amounting to £150.80 million.

Market Cap: £58.99M

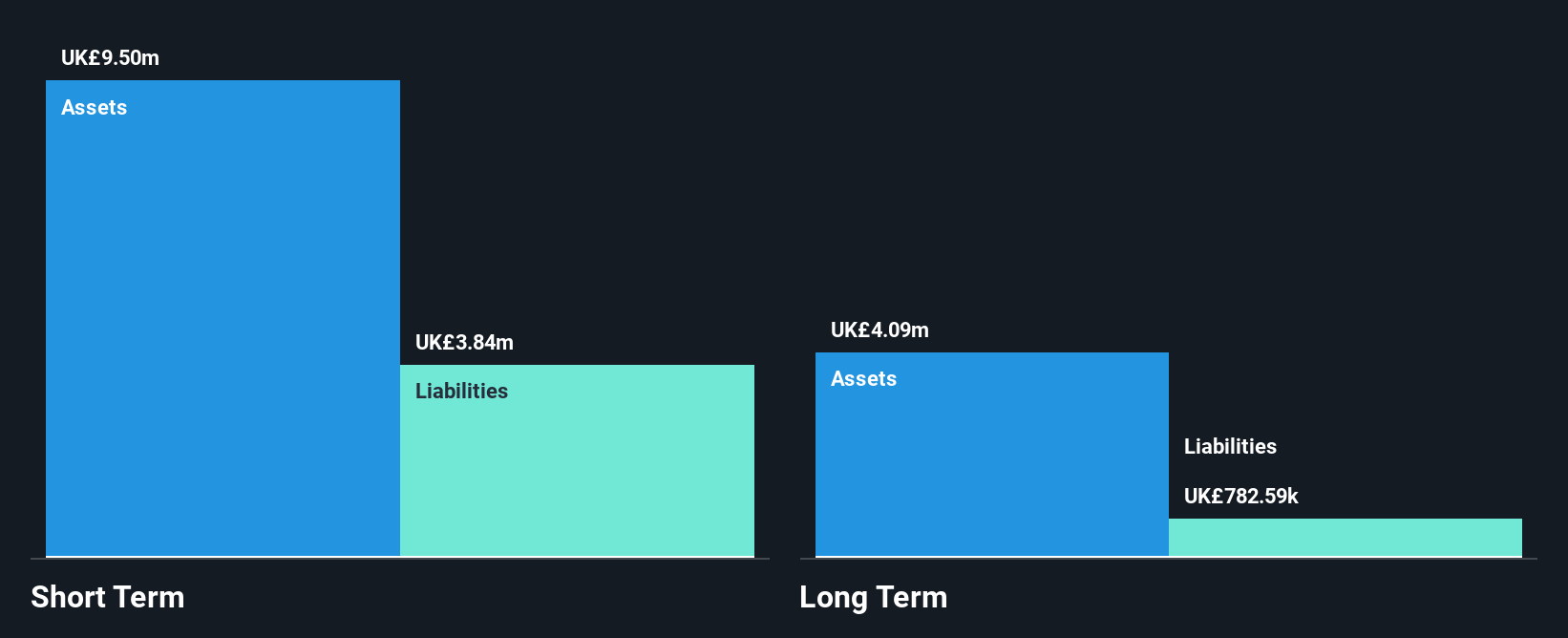

Ultimate Products Plc, with a market cap of £58.99 million, faces challenges as recent earnings show a decline in sales to £79.48 million and net income to £3.63 million for the half year ended January 2025. Despite lower profit margins and negative earnings growth over the past year, the company maintains satisfactory debt levels and has reduced its debt-to-equity ratio significantly over five years. The board is experienced, though recent changes include Alan Rigby's departure after eight years as Non-Executive Director. Trading well below fair value estimates, Ultimate Products offers potential upside but with inherent risks typical of penny stocks.

- Navigate through the intricacies of Ultimate Products with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Ultimate Products' future.

Make It Happen

- Click here to access our complete index of 400 UK Penny Stocks.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FUM

Futura Medical

Research, develops, and sells pharmaceutical and healthcare products for sexual health.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives