- United Kingdom

- /

- Media

- /

- LSE:INF

Exploring High Growth Tech Stocks in the UK for November 2024

Reviewed by Simply Wall St

The United Kingdom's market has recently experienced a downturn, with the FTSE 100 closing lower due to weak trade data from China, highlighting concerns over global economic recovery and its impact on commodity-dependent sectors. In this challenging environment, identifying high-growth tech stocks in the UK requires focusing on companies that demonstrate resilience and innovation, as they are better positioned to navigate economic uncertainties and capitalize on emerging opportunities.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Facilities by ADF | 48.47% | 189.97% | ★★★★★☆ |

| Redcentric | 5.32% | 67.90% | ★★★★★☆ |

| Windar Photonics | 79.38% | 195.81% | ★★★★★☆ |

| Beeks Financial Cloud Group | 22.12% | 36.94% | ★★★★★☆ |

| Seeing Machines | 21.44% | 97.64% | ★★★★★☆ |

| Oxford Biomedica | 21.05% | 93.23% | ★★★★★☆ |

| YouGov | 8.52% | 55.02% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 47 stocks from our UK High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

GB Group (AIM:GBG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GB Group plc, with a market cap of £944.43 million, offers identity data intelligence products and services across the United Kingdom, the United States, Australia, and globally.

Operations: GB Group plc generates revenue through three main segments: Identity (£159.78 million), Location (£83.94 million), and Fraud (£38.14 million).

GB Group, transitioning from a challenging past to promising growth, has recently pivoted into profitability with its latest earnings report showcasing a significant recovery. For the half-year ended September 30, 2024, the company's sales increased to £136.9 million from £132.36 million year-over-year, and it swung to a net income of £1.58 million from a previous net loss of £55.15 million. This turnaround is underscored by an expected annual earnings growth rate of 36.6%, outpacing the UK market forecast of 14.6%. Despite slower revenue growth projections at 6.9% annually—above the UK average but below high-growth benchmarks—GB Group's recent performance and strategic focus on enhancing its software solutions could position it well for sustained future growth in an increasingly digital landscape.

- Click here and access our complete health analysis report to understand the dynamics of GB Group.

Review our historical performance report to gain insights into GB Group's's past performance.

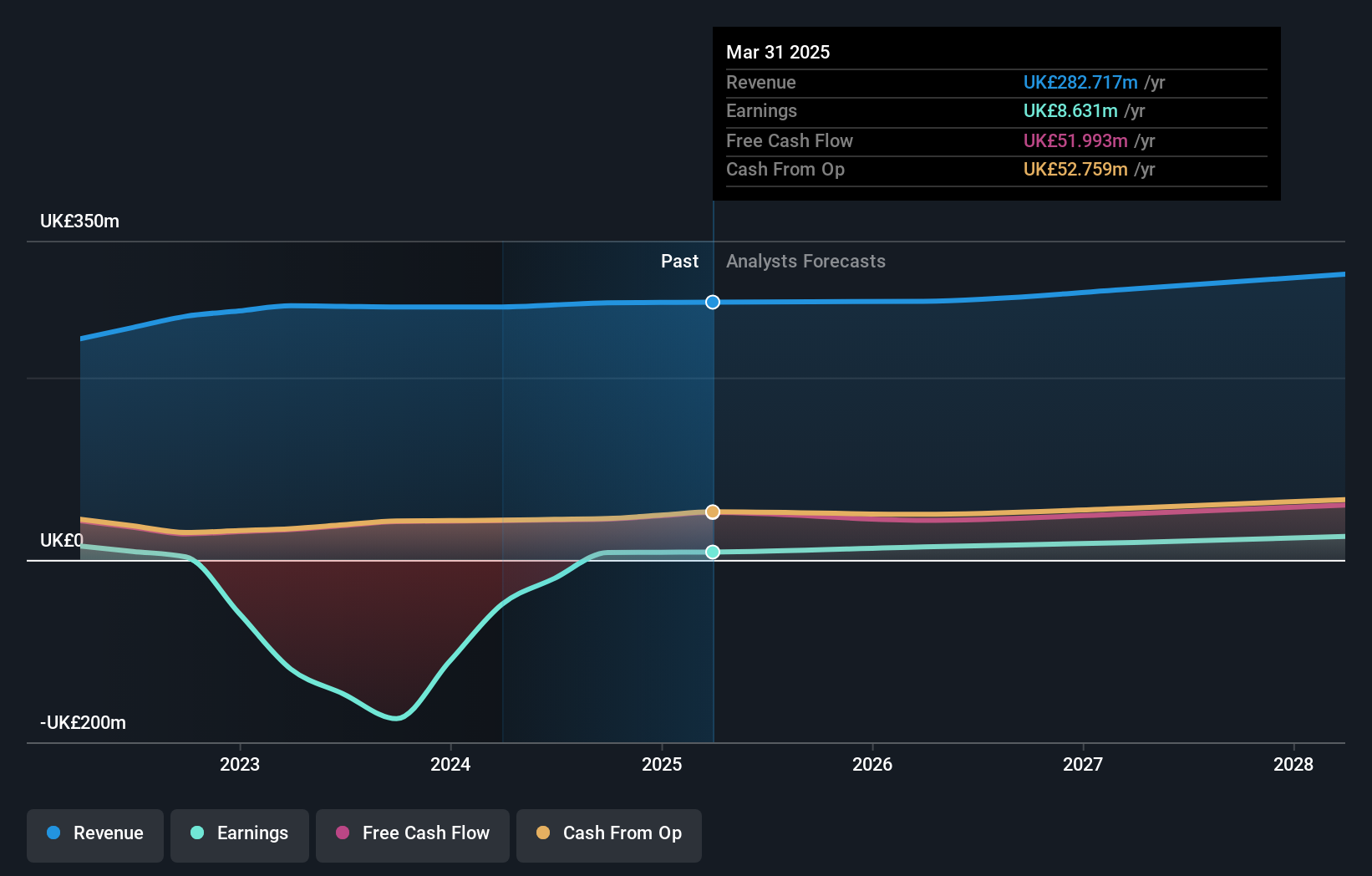

Informa (LSE:INF)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Informa plc is an international company specializing in events, digital services, and academic research across the United Kingdom, Continental Europe, the United States, China, and other global markets with a market capitalization of £11.50 billion.

Operations: Informa generates revenue through its four primary segments: Informa Tech (£426.70 million), Informa Connect (£630.20 million), Informa Markets (£1.67 billion), and Taylor & Francis (£636.70 million).

Informa has demonstrated resilience with a forecasted revenue growth of 7.7% per year, outpacing the UK market's average of 3.5%, despite a challenging backdrop marked by a significant one-off loss of £213.5 million affecting its financial results up to June 30, 2024. The company's strategic initiatives, including recent fixed-income offerings totaling over €1.74 billion and active participation in global conferences, underscore its commitment to strengthening its market position and expanding its international footprint. Moreover, earnings are expected to surge by an impressive 22.4% annually, highlighting Informa's potential for robust financial performance amidst evolving industry dynamics.

- Get an in-depth perspective on Informa's performance by reading our health report here.

Explore historical data to track Informa's performance over time in our Past section.

Oxford Biomedica (LSE:OXB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Oxford Biomedica plc is a contract development and manufacturing organization specializing in delivering therapies globally, with a market capitalization of £447.25 million.

Operations: Oxford Biomedica generates revenue primarily from its Platform segment, amounting to £97.24 million. The company operates as a contract development and manufacturing organization, focusing on global therapeutic delivery.

Oxford Biomedica, amid a challenging biotech landscape, stands out with its aggressive growth trajectory, forecasting a revenue increase of 21% per year. This rate significantly surpasses the UK's average market growth of 3.5%. The company is also poised for substantial earnings expansion, with an expected surge of 93.2% annually. These figures underscore Oxford Biomedica’s commitment to innovation and market expansion, particularly highlighted by their recent strategic executive appointments and robust R&D investments which align with their forward-looking financial guidance projecting revenues between £126 million and £134 million by the end of 2024.

- Take a closer look at Oxford Biomedica's potential here in our health report.

Assess Oxford Biomedica's past performance with our detailed historical performance reports.

Next Steps

- Gain an insight into the universe of 47 UK High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:INF

Informa

Operates as an international events, digital services, and academic research company in the United Kingdom, Continental Europe, the United States, China, and internationally.

Reasonable growth potential with adequate balance sheet.