- United Kingdom

- /

- Healthtech

- /

- AIM:FDBK

3 UK Penny Stocks With Market Caps Under £30M To Watch

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently experienced declines, influenced by weak trade data from China, which highlights the interconnected nature of global markets. Despite such fluctuations in major indices, opportunities still exist for investors willing to explore smaller segments of the market. Penny stocks, often representing newer or smaller companies, can offer growth potential at lower price points when backed by strong financials and fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.948 | £149.54M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.05 | £772.37M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.62 | £69.04M | ★★★★☆☆ |

| Luceco (LSE:LUCE) | £1.284 | £198.03M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.355 | £172.56M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.935 | £391.36M | ★★★★☆☆ |

| Foresight Group Holdings (LSE:FSG) | £4.11 | £470.86M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.21 | £103.38M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.47 | £315.6M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.437 | $254.04M | ★★★★★★ |

Click here to see the full list of 469 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Feedback (AIM:FDBK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Feedback plc is a medical imaging technology company that provides software and systems for medical imaging professionals, with a market cap of £2.43 million.

Operations: The company generates revenue from its Medical Imaging segment, amounting to £1.18 million.

Market Cap: £2.43M

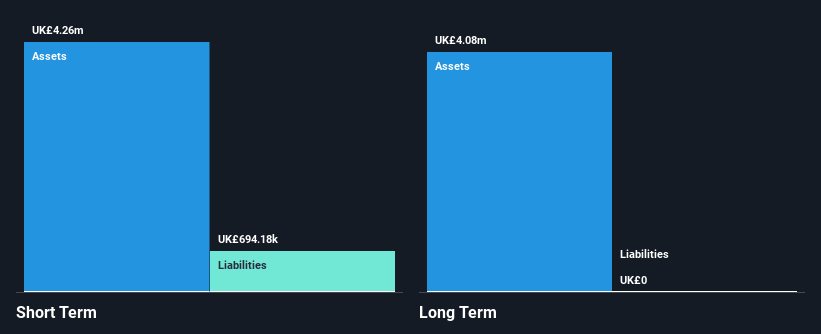

Feedback plc, with a market cap of £2.43 million, is navigating the penny stock landscape amidst financial challenges. The company remains debt-free and has short-term assets of £4.3 million exceeding liabilities of £694.2K, providing some liquidity cushion despite ongoing losses and negative return on equity (-43.15%). Revenue from its Medical Imaging segment reached £1.18 million for the year ended May 2024, but net losses increased to £3.3 million from the previous year’s £2.92 million loss. Recent capital raises through follow-on equity offerings suggest efforts to bolster its cash runway amid volatile share prices and management changes.

- Jump into the full analysis health report here for a deeper understanding of Feedback.

- Examine Feedback's earnings growth report to understand how analysts expect it to perform.

Lexington Gold (AIM:LEX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Lexington Gold Ltd focuses on exploring and developing gold projects in the United States and South Africa, with a market cap of £13.99 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: £13.99M

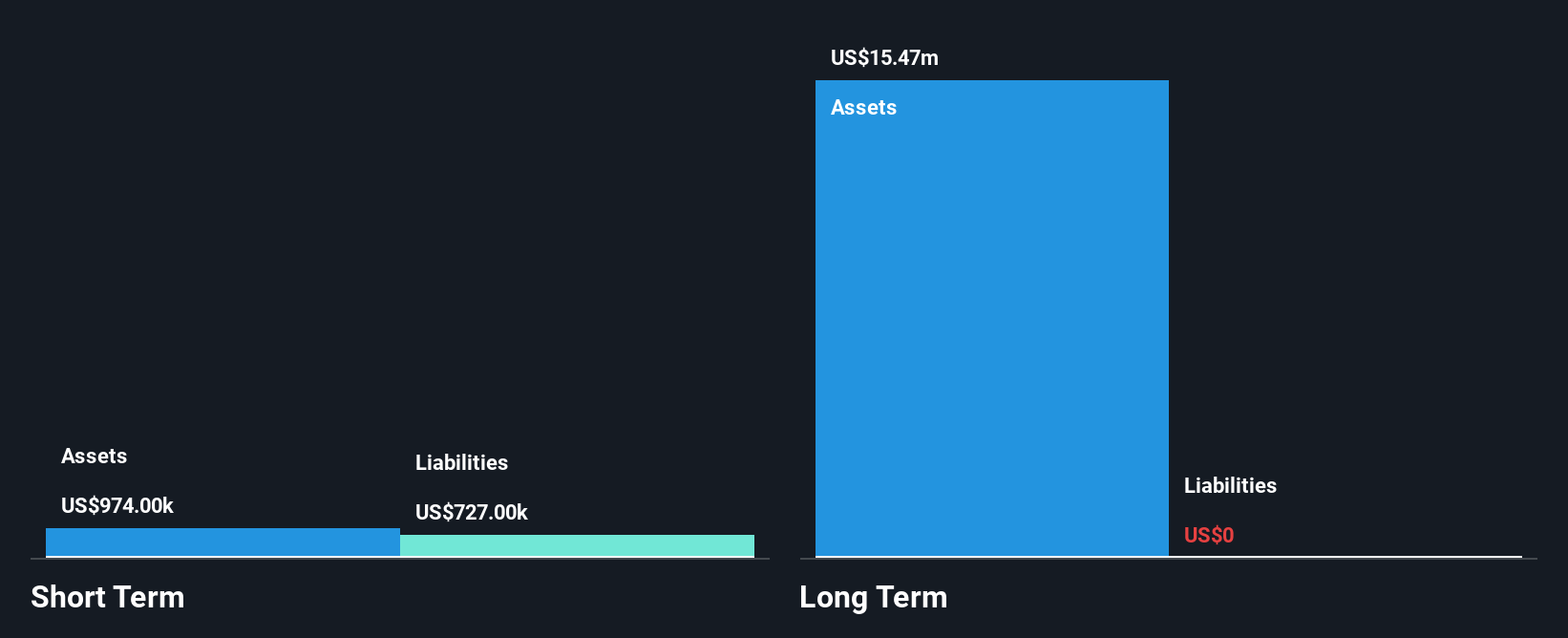

Lexington Gold Ltd, with a market cap of £13.99 million, is pre-revenue and focuses on gold exploration in the US and South Africa. The company has recently entered into an agreement with Letsema Holdings and Gold One Africa to explore collaboration opportunities aimed at enhancing project viability in South Africa. Lexington's financial position is stable, with short-term assets of $1.6M surpassing liabilities of $875K, and it remains debt-free. The seasoned management team has overseen the company's transition to profitability over the past year, although its return on equity remains low at 0.4%.

- Get an in-depth perspective on Lexington Gold's performance by reading our balance sheet health report here.

- Understand Lexington Gold's track record by examining our performance history report.

XLMedia (AIM:XLM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: XLMedia PLC is a digital media company that produces content to link audiences with advertisers in North America and Europe, with a market cap of £23.46 million.

Operations: The company's revenue segment includes Publishing, which generated $43.76 million.

Market Cap: £23.46M

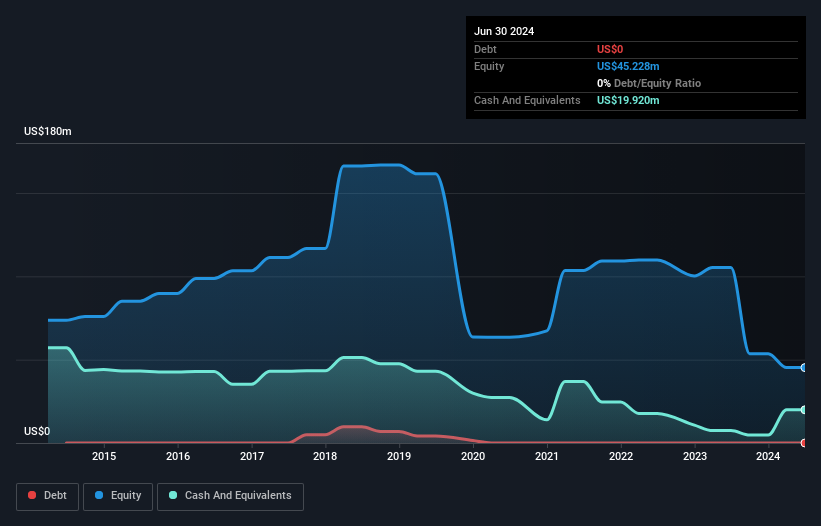

XLMedia PLC, with a market cap of £23.46 million, is currently unprofitable and has experienced increased losses over the past five years. Despite being debt-free and having short-term assets of $40.5M that exceed both its short-term ($18.9M) and long-term liabilities ($1.4M), its share price remains highly volatile compared to most UK stocks. Recent developments include planned suspension from AIM in May 2025 following asset disposals in North America, leading to board changes and preparations for liquidation by June 2025, which may impact shareholder value amidst ongoing strategic shifts within the company’s structure.

- Dive into the specifics of XLMedia here with our thorough balance sheet health report.

- Gain insights into XLMedia's historical outcomes by reviewing our past performance report.

Seize The Opportunity

- Explore the 469 names from our UK Penny Stocks screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FDBK

Feedback

A medical imaging technology company, engages in the provision of software and systems to those working in the field of medical imaging.

Flawless balance sheet slight.

Market Insights

Community Narratives