- United Kingdom

- /

- Diversified Financial

- /

- LSE:WPS

Discover Coats Group And 2 More UK Stocks Estimated Below Fair Value

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, as evidenced by the FTSE 100 and FTSE 250 indices closing lower amid weak trade data from China, impacting companies with significant ties to the Chinese economy. In such volatile conditions, identifying undervalued stocks can be a strategic approach for investors seeking opportunities that may offer potential value relative to their current market prices.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Fevertree Drinks (AIM:FEVR) | £6.74 | £13.12 | 48.6% |

| Brickability Group (AIM:BRCK) | £0.64 | £1.27 | 49.5% |

| Bellway (LSE:BWY) | £24.92 | £48.46 | 48.6% |

| GlobalData (AIM:DATA) | £1.89 | £3.74 | 49.4% |

| Zotefoams (LSE:ZTF) | £3.15 | £5.83 | 45.9% |

| Tracsis (AIM:TRCS) | £5.00 | £9.78 | 48.9% |

| Duke Capital (AIM:DUKE) | £0.306 | £0.58 | 47.4% |

| Vp (LSE:VP.) | £5.625 | £10.14 | 44.5% |

| Victrex (LSE:VCT) | £10.76 | £19.87 | 45.8% |

| Quartix Technologies (AIM:QTX) | £1.56 | £3.07 | 49.2% |

We're going to check out a few of the best picks from our screener tool.

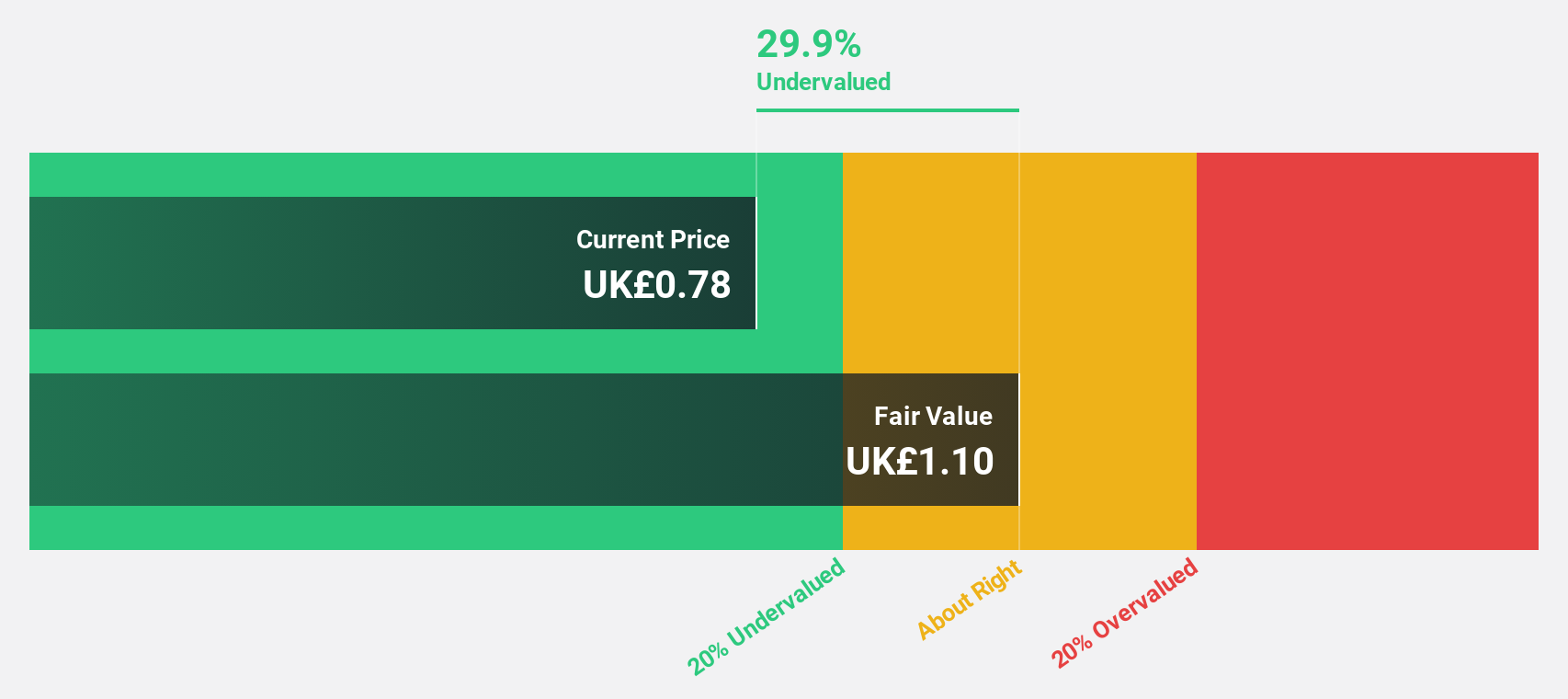

Coats Group (LSE:COA)

Overview: Coats Group plc, with a market cap of £1.50 billion, manufactures and supplies industrial sewing threads globally through its subsidiaries.

Operations: Coats Group generates revenue from its segments, including Apparel ($731 million), Footwear ($381.90 million), and Performance Materials ($327 million).

Estimated Discount To Fair Value: 30.2%

Coats Group is trading at £0.94, below its estimated fair value of £1.35, making it potentially undervalued based on cash flows. The company's recent revenue growth of 11% highlights strong performance in Footwear and Apparel segments despite weaknesses in Performance Materials. Analysts agree on a potential stock price rise of 29.1%. However, Coats carries a high level of debt and has an unstable dividend track record, which investors should consider carefully.

- The growth report we've compiled suggests that Coats Group's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Coats Group.

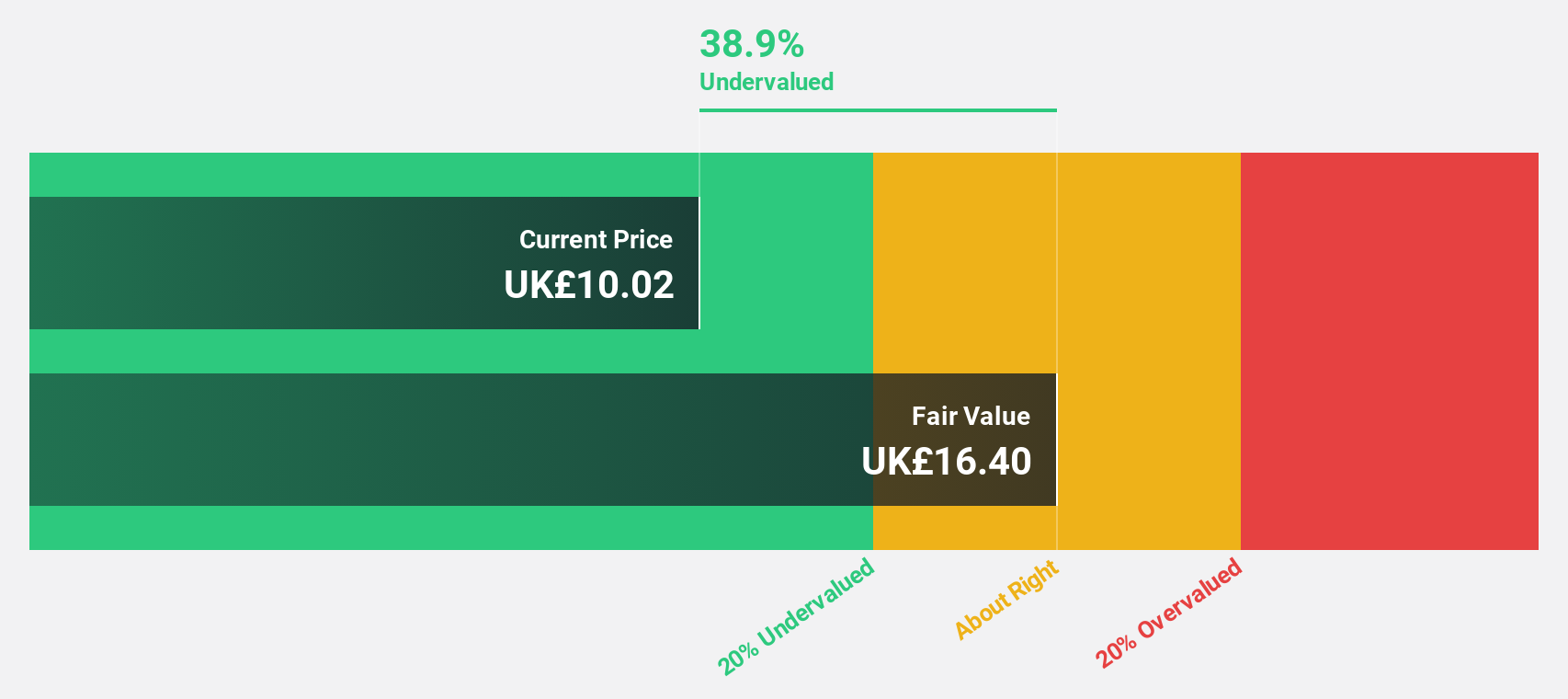

Savills (LSE:SVS)

Overview: Savills plc, along with its subsidiaries, provides real estate services across the United Kingdom, Continental Europe, the Asia Pacific, Africa, North America, and the Middle East with a market cap of £1.40 billion.

Operations: The company's revenue segments include Consultancy (£464.80 million), Transaction Advisory (£803.60 million), Investment Management (£100.50 million), and Property and Facilities Management (£920.90 million).

Estimated Discount To Fair Value: 25.4%

Savills is trading at £10.36, below its estimated fair value of £13.90, suggesting potential undervaluation based on cash flows. Despite a lower profit margin this year (1.9% vs 3.8% last year), earnings are forecast to grow significantly at 33.3% annually, outpacing the UK market's growth rate of 14.8%. Recent strategic moves include marketing a prime Dublin office asset and expanding its Middle East commercial agency service line under new leadership, potentially boosting future revenue streams.

- Our earnings growth report unveils the potential for significant increases in Savills' future results.

- Delve into the full analysis health report here for a deeper understanding of Savills.

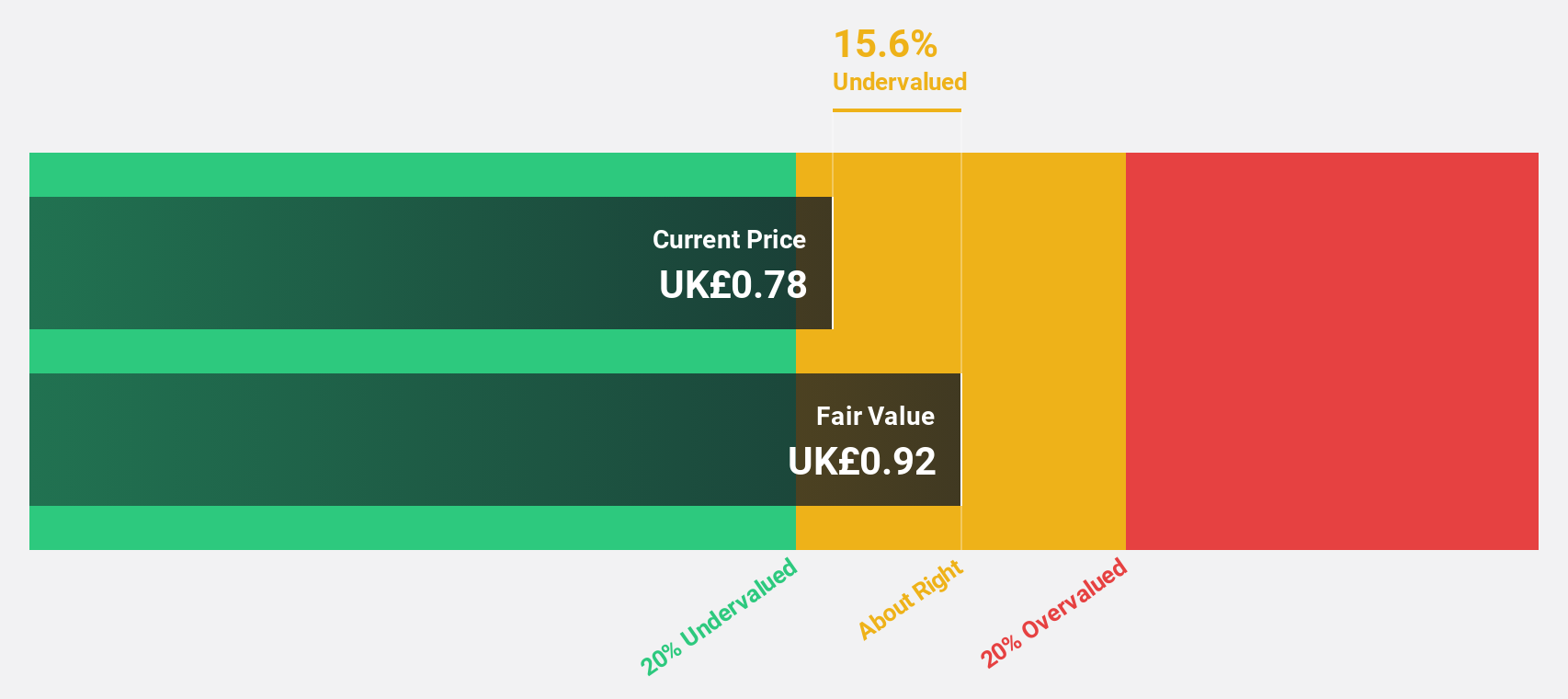

W.A.G payment solutions (LSE:WPS)

Overview: W.A.G payment solutions plc operates an integrated payments and mobility platform targeting the commercial road transportation industry primarily in Europe, with a market cap of £551.58 million.

Operations: The company's revenue segments consist of Payment Solutions generating €2.10 billion and Mobility Solutions contributing €124.13 million.

Estimated Discount To Fair Value: 10.2%

W.A.G Payment Solutions is trading at £0.80, slightly below its fair value of £0.89, indicating potential undervaluation based on cash flows. Analysts expect the company to become profitable in three years, with earnings projected to grow significantly at 61.35% annually and revenue growth outpacing the UK market at 9.5% per year. However, interest payments are not well covered by earnings, which may pose a financial risk despite good relative value compared to peers and industry standards.

- Upon reviewing our latest growth report, W.A.G payment solutions' projected financial performance appears quite optimistic.

- Navigate through the intricacies of W.A.G payment solutions with our comprehensive financial health report here.

Turning Ideas Into Actions

- Delve into our full catalog of 55 Undervalued UK Stocks Based On Cash Flows here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if W.A.G payment solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:WPS

W.A.G payment solutions

Operates integrated payments and mobility platform that focuses on the commercial road transportation industry primary in Europe.

Good value with moderate growth potential.

Market Insights

Community Narratives