- United Kingdom

- /

- Metals and Mining

- /

- LSE:MILA

Goldplat And 2 Other Top Penny Stocks On The UK Exchange

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines influenced by weak trade data from China. Despite these broader market pressures, investors continue to seek opportunities in various segments, including penny stocks. While the term 'penny stocks' might seem outdated, it still signifies a realm of potential for smaller or newer companies that demonstrate strong financial health and growth prospects.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.948 | £149.54M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.05 | £772.37M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.62 | £69.04M | ★★★★☆☆ |

| Luceco (LSE:LUCE) | £1.284 | £198.03M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.355 | £172.56M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.935 | £391.36M | ★★★★☆☆ |

| Foresight Group Holdings (LSE:FSG) | £4.11 | £470.86M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.21 | £103.38M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.47 | £315.6M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.437 | $254.04M | ★★★★★★ |

Click here to see the full list of 469 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Goldplat (AIM:GDP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Goldplat PLC, with a market cap of £12.16 million, operates as a mining services company in South Africa and Ghana through its subsidiaries.

Operations: The company generates revenue from its West African Recovery Operations (£53.56 million), South African Recovery Operations (£19.34 million), and South American Recovery Operations (£1.72 million).

Market Cap: £12.16M

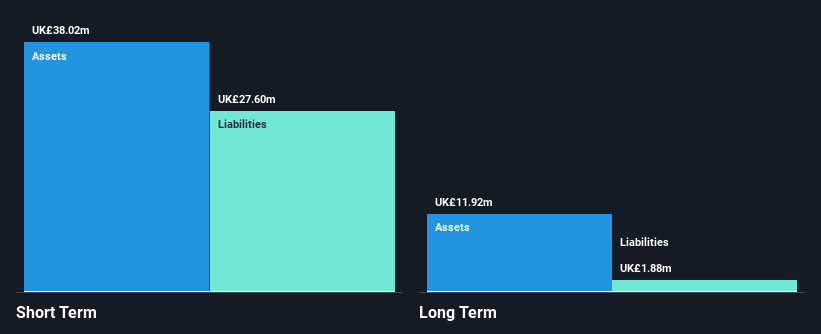

Goldplat PLC, with a market cap of £12.16 million, demonstrates strong financial health in the penny stock sector. Its Return on Equity is high at 21.1%, and earnings have grown significantly by 50.4% over the past year, outpacing industry averages. The company has reduced its debt to equity ratio from 5.6% to 2.5% over five years and maintains more cash than total debt, ensuring robust liquidity with short-term assets exceeding liabilities (£38M vs £27.6M). Despite a slight decline in net profit margins from last year (6.7% to 5.8%), Goldplat trades at a substantial discount below estimated fair value.

- Navigate through the intricacies of Goldplat with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Goldplat's future.

Scholium Group (AIM:SCHO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Scholium Group Plc, with a market cap of £4.22 million, operates in the United Kingdom through trading, retailing, and selling rare books and fine arts.

Operations: The company's revenue primarily comes from its Collectibles segment, generating £10.40 million.

Market Cap: £4.22M

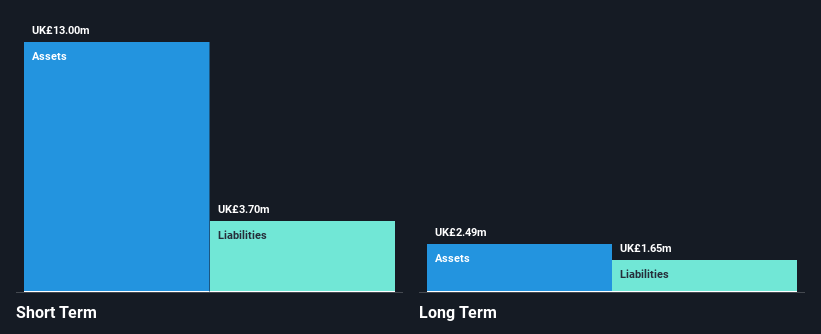

Scholium Group Plc, with a market cap of £4.22 million, has shown strong earnings growth, increasing by 430% over the past year and maintaining profitability for seven consecutive half-year periods. Despite its low Return on Equity at 4.2%, the company benefits from satisfactory debt levels and well-covered interest payments. However, Scholium's share price remains volatile and undervalued relative to its net asset value, prompting plans to delist from AIM to cut costs and enhance profitability by an estimated 25%. The recent transition to a new property in Bond Street has positively impacted sales in books and art.

- Dive into the specifics of Scholium Group here with our thorough balance sheet health report.

- Assess Scholium Group's previous results with our detailed historical performance reports.

Mila Resources (LSE:MILA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mila Resources Plc focuses on the exploration and development of mineral resource properties, with a market cap of £1.90 million.

Operations: Mila Resources Plc does not report any revenue segments.

Market Cap: £1.9M

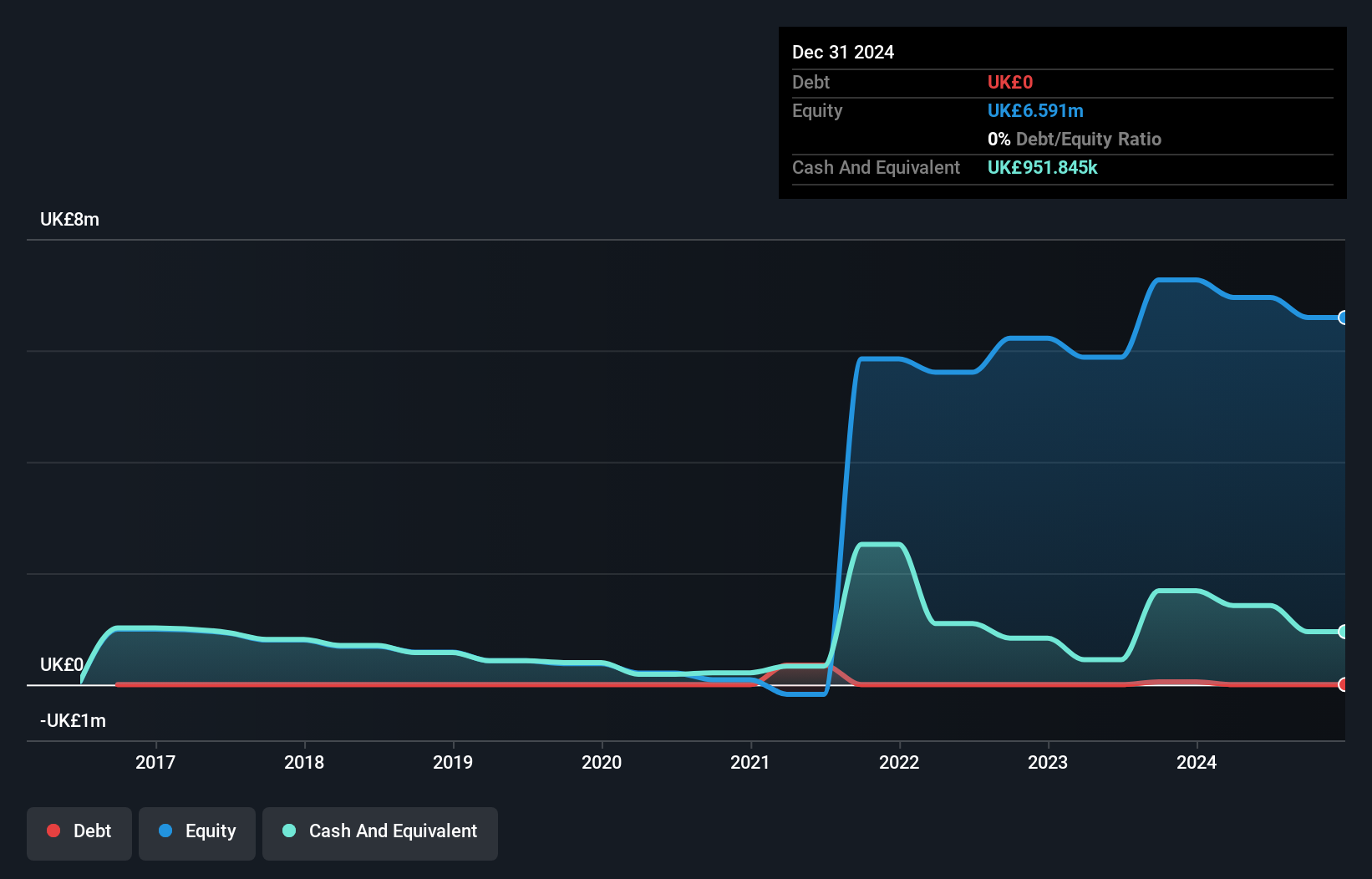

Mila Resources Plc, with a market cap of £1.90 million, is pre-revenue and unprofitable, facing challenges in earnings growth compared to the industry. Despite this, it has not diluted shareholders recently and maintains a sufficient cash runway for over a year. Recent strategic developments include board changes and promising exploration results from its Monal and Yarrol licenses in Australia, indicating potential mineralization of gold and copper. However, volatility remains high with auditor concerns about its ability to continue as a going concern due to ongoing losses increasing over the past five years by 21.1% annually.

- Unlock comprehensive insights into our analysis of Mila Resources stock in this financial health report.

- Examine Mila Resources' past performance report to understand how it has performed in prior years.

Summing It All Up

- Jump into our full catalog of 469 UK Penny Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:MILA

Mila Resources

Engages in exploration and development of mineral resource properties.

Flawless balance sheet slight.

Market Insights

Community Narratives