- United Kingdom

- /

- Airlines

- /

- LSE:EZJ

3 UK Penny Stocks With Market Caps Up To £4B

Reviewed by Simply Wall St

The United Kingdom's financial markets have recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, impacting investor sentiment. Amid these broader market fluctuations, investors often turn their attention to smaller or newer companies that may offer unique growth opportunities. While the term "penny stocks" might seem outdated, it still captures the essence of investing in smaller-cap companies that can provide both affordability and potential for significant returns when backed by strong financial health.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Ultimate Products (LSE:ULTP) | £0.64 | £54.1M | ✅ 4 ⚠️ 4 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.65 | £273.74M | ✅ 4 ⚠️ 1 View Analysis > |

| Next 15 Group (AIM:NFG) | £2.46 | £244.66M | ✅ 4 ⚠️ 5 View Analysis > |

| Central Asia Metals (AIM:CAML) | £1.50 | £260.96M | ✅ 4 ⚠️ 2 View Analysis > |

| Warpaint London (AIM:W7L) | £3.60 | £290.83M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.23 | £365.96M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £3.605 | £347.51M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £149.92M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.774 | £2.08B | ✅ 5 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.34 | £36.79M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 391 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Baltic Classifieds Group (LSE:BCG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Baltic Classifieds Group PLC operates online classifieds portals for automotive, real estate, jobs and services, and general merchandise in Estonia, Latvia, and Lithuania with a market cap of £1.49 billion.

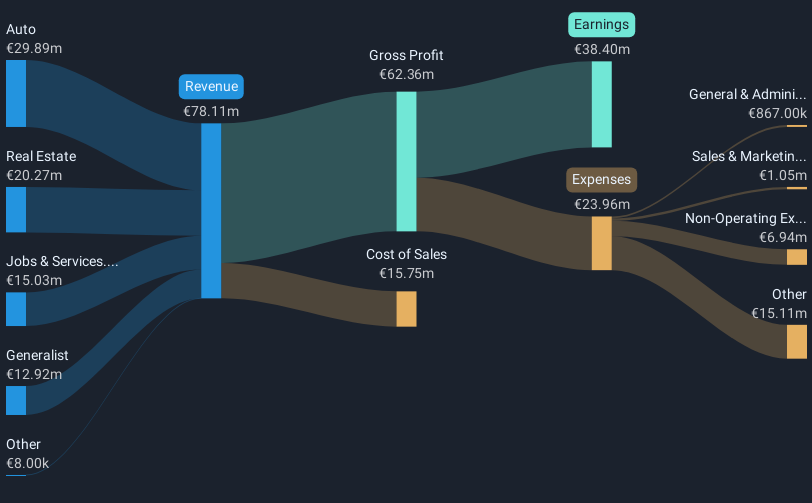

Operations: The company's revenue is derived from four main segments: Auto (€29.89 million), Real Estate (€20.27 million), Jobs & Services (€15.03 million), and Generalist (€12.92 million).

Market Cap: £1.49B

Baltic Classifieds Group, with a market cap of £1.49 billion, is a notable entity in the online classifieds sector across the Baltic region. Despite its classification as a penny stock, it boasts strong financial metrics: short-term assets (€26.6M) exceed short-term liabilities (€13M), and interest payments are well covered by EBIT (15.5x coverage). The company has demonstrated robust earnings growth of 42.1% over the past year, outpacing industry averages, although this rate is below its 5-year average of 72.3%. Recent board changes include Tom Hall's appointment to key committees to enhance governance practices.

- Click to explore a detailed breakdown of our findings in Baltic Classifieds Group's financial health report.

- Learn about Baltic Classifieds Group's future growth trajectory here.

easyJet (LSE:EZJ)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: easyJet plc is a low-cost airline carrier operating in Europe with a market cap of £3.40 billion.

Operations: The company generates revenue through its Airline segment, which accounts for £8.17 billion, and its Holidays segment, contributing £1.52 billion.

Market Cap: £3.4B

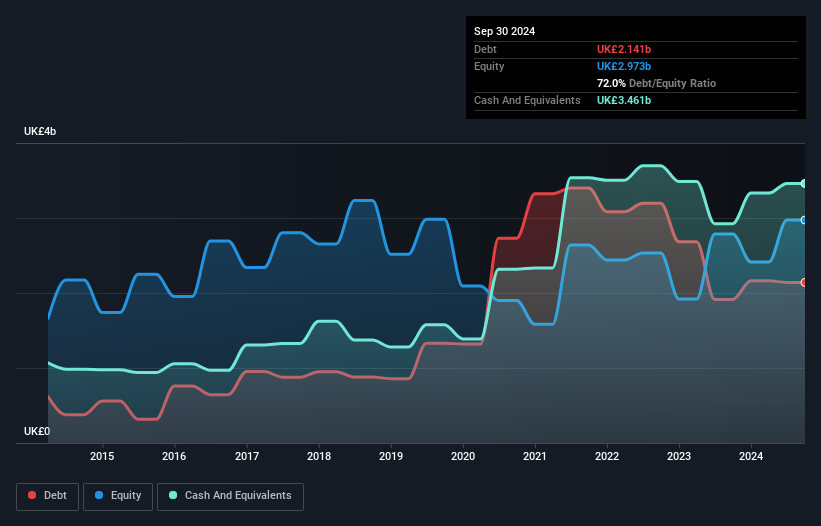

easyJet plc, with a market cap of £3.40 billion, presents a mixed picture for investors interested in penny stocks. The company shows strong financial health with short-term assets covering both short and long-term liabilities and more cash than total debt. Its earnings growth of 39.5% over the past year surpasses industry averages, indicating robust performance despite low return on equity at 15.2%. The stock trades at a favorable price-to-earnings ratio compared to the UK market average, though its dividend history is unstable. Recent corporate guidance anticipates moderate capacity growth and reduced costs for fiscal 2025.

- Jump into the full analysis health report here for a deeper understanding of easyJet.

- Explore easyJet's analyst forecasts in our growth report.

On the Beach Group (LSE:OTB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: On the Beach Group plc is an online retailer specializing in short-haul beach holidays in the United Kingdom, with a market cap of £372.41 million.

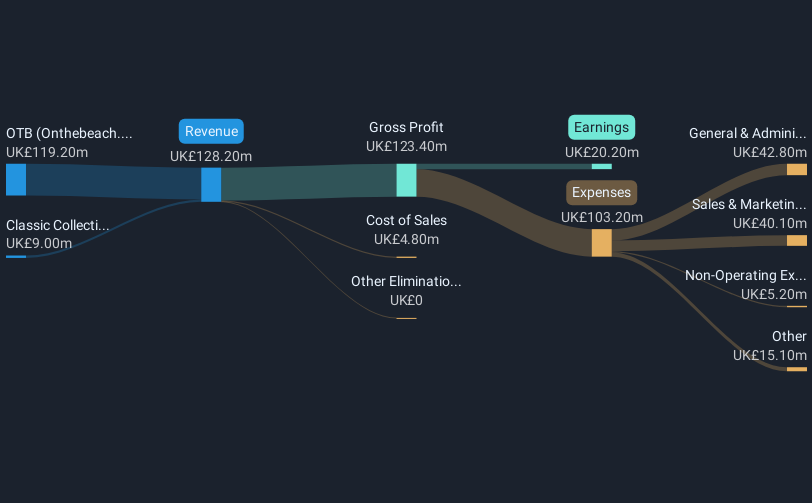

Operations: The company generates revenue through its Classic Collection segment, which contributed £9 million, and its OTB segment (Onthebeach.Co.Uk and Sunshine.Co.Uk), which brought in £119.2 million.

Market Cap: £372.41M

On the Beach Group, with a market cap of £372.41 million, offers an intriguing opportunity within penny stocks due to its robust financial position and growth trajectory. The company is debt-free, with short-term assets of £423.7 million comfortably covering both short and long-term liabilities. Earnings grew significantly by 69.7% last year, outpacing the industry average and highlighting strong performance despite a low return on equity at 11.1%. Recent board changes include appointing Ms. Victoria Ann Self as a Non-Executive Director in February 2025, potentially strengthening governance as the stock trades below estimated fair value by 50.2%.

- Get an in-depth perspective on On the Beach Group's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into On the Beach Group's future.

Summing It All Up

- Get an in-depth perspective on all 391 UK Penny Stocks by using our screener here.

- Contemplating Other Strategies? Trump's oil boom is here — pipelines are primed to profit. Discover the 20 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:EZJ

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives