- United Kingdom

- /

- Specialty Stores

- /

- LSE:CURY

UK Penny Stocks: 3 Hidden Gems With Market Caps Below £2B

Reviewed by Simply Wall St

The UK market has faced challenges recently, with the FTSE 100 index closing lower due to weak trade data from China, highlighting ongoing global economic uncertainties. Despite these broader market fluctuations, penny stocks remain an intriguing investment option for those seeking growth opportunities at lower price points. Although the term "penny stock" might seem outdated, these smaller or newer companies can still offer significant potential when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.08 | £468.07M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.00 | £161.57M | ✅ 4 ⚠️ 2 View Analysis > |

| On the Beach Group (LSE:OTB) | £2.235 | £323.86M | ✅ 5 ⚠️ 1 View Analysis > |

| Ingenta (AIM:ING) | £0.80 | £12.08M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.35 | £29.82M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.615 | $357.52M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.452 | £178.79M | ✅ 3 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.45 | £70.02M | ✅ 3 ⚠️ 3 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.495 | £42.67M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.085 | £174.61M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 307 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

System1 Group (AIM:SYS1)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: System1 Group PLC, along with its subsidiaries, offers market research data and insight services across the United Kingdom, the United States, Latin America, Europe, and the Asia Pacific with a market cap of £29.82 million.

Operations: System1 Group PLC does not report distinct revenue segments.

Market Cap: £29.82M

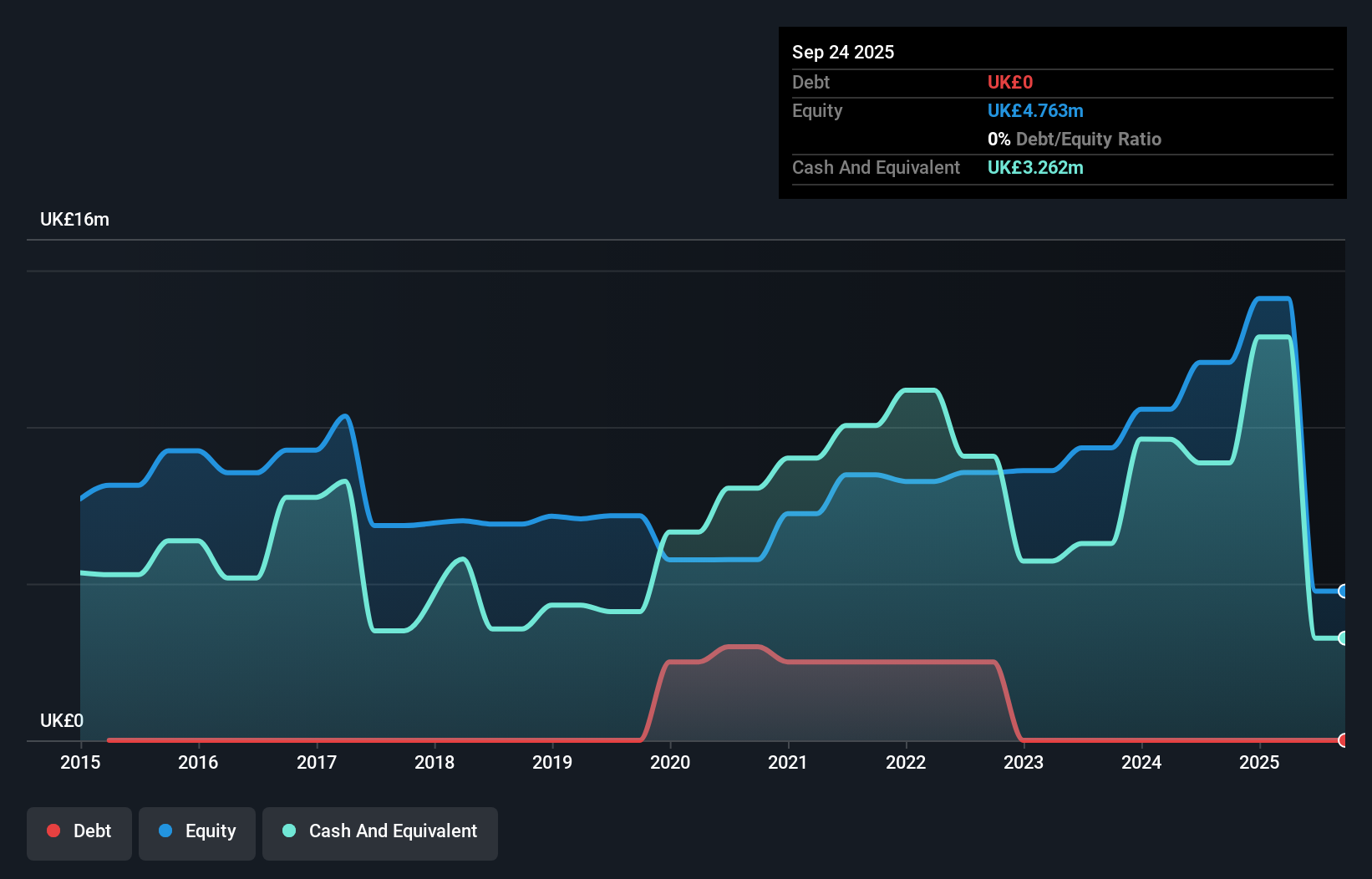

System1 Group PLC has demonstrated significant earnings growth, achieving a 58.1% increase over the past year, surpassing its five-year average of 40.1%. The company is debt-free and maintains strong financial health with short-term assets exceeding both short and long-term liabilities. Despite a volatile share price, System1's return on equity is outstanding at 103.8%, indicating efficient profit generation relative to shareholder equity. Recent developments include the launch of "Test Your Ad Competitive Edge," enhancing their market research capabilities. However, revenue for fiscal year 2026 is expected to remain stable at approximately £37 million, similar to fiscal year 2025 levels.

- Take a closer look at System1 Group's potential here in our financial health report.

- Gain insights into System1 Group's future direction by reviewing our growth report.

Currys (LSE:CURY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Currys plc is an omnichannel retailer offering technology products and services across the UK, Ireland, and several Nordic countries, with a market cap of £1.39 billion.

Operations: The company generates revenue from its operations in the UK & Ireland, contributing £5.35 billion, and the Nordics, adding £3.42 billion.

Market Cap: £1.39B

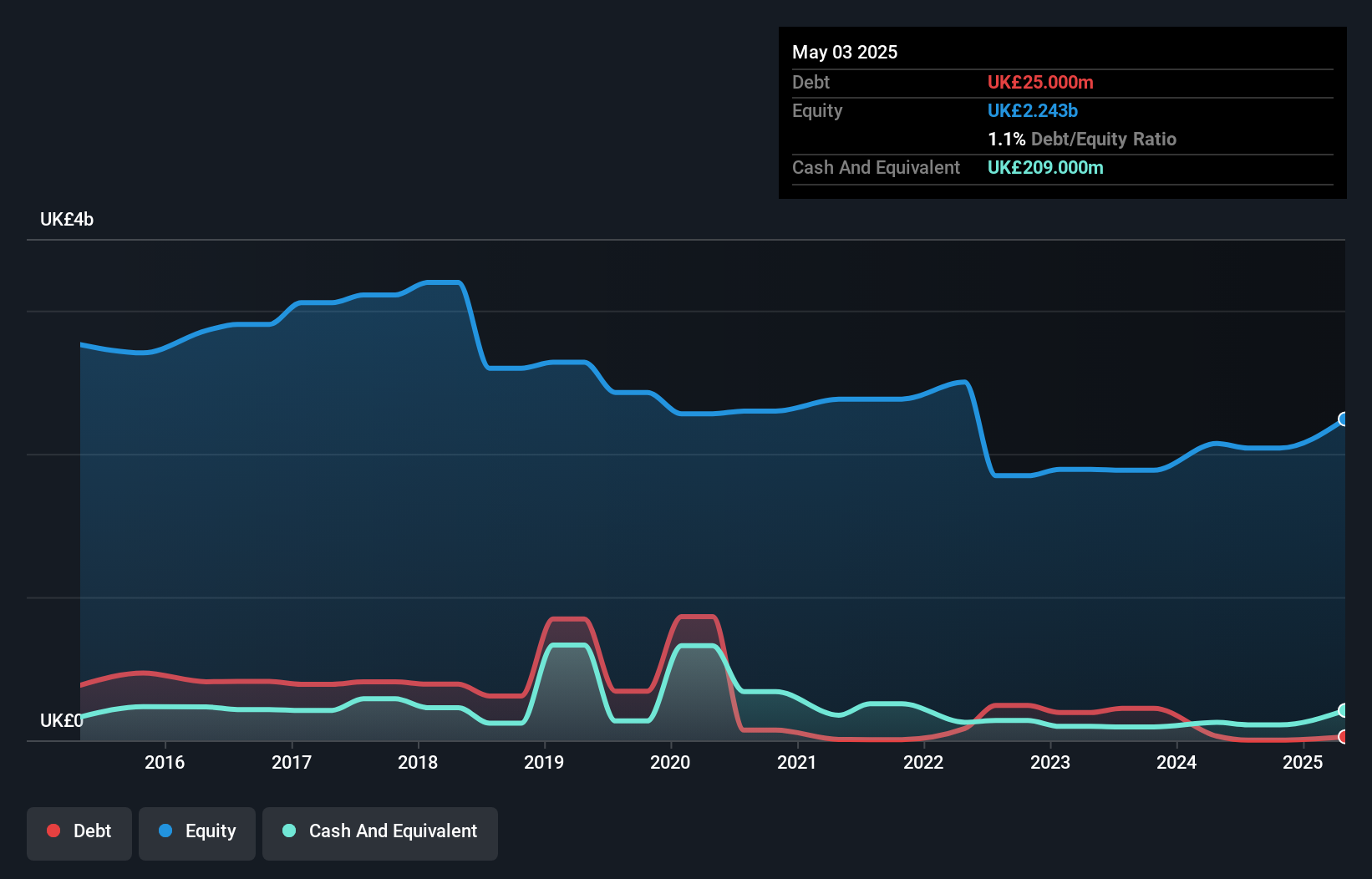

Currys plc has shown robust earnings growth, with a remarkable 286.2% increase over the past year, significantly outpacing its five-year average of 16.5%. The company is trading at a good value compared to peers and slightly below its estimated fair value, while analysts anticipate further stock price appreciation. Despite having more cash than total debt and reducing its debt-to-equity ratio from 37.5% to 1.1%, Currys faces challenges with short-term liabilities exceeding short-term assets by £300 million and interest payments not being well covered by EBIT. Recent board changes reflect an evolving ESG governance structure post-committee closure.

- Unlock comprehensive insights into our analysis of Currys stock in this financial health report.

- Explore Currys' analyst forecasts in our growth report.

Hansard Global (LSE:HSD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hansard Global plc is involved in distributing and servicing long-term investment products across regions including the Isle of Man, the Bahamas, the Republic of Ireland, Malaysia, Japan, and the United Arab Emirates with a market cap of £67.96 million.

Operations: The company's revenue of £80.6 million is generated from the distribution and servicing of long-term investment products across various regions.

Market Cap: £67.96M

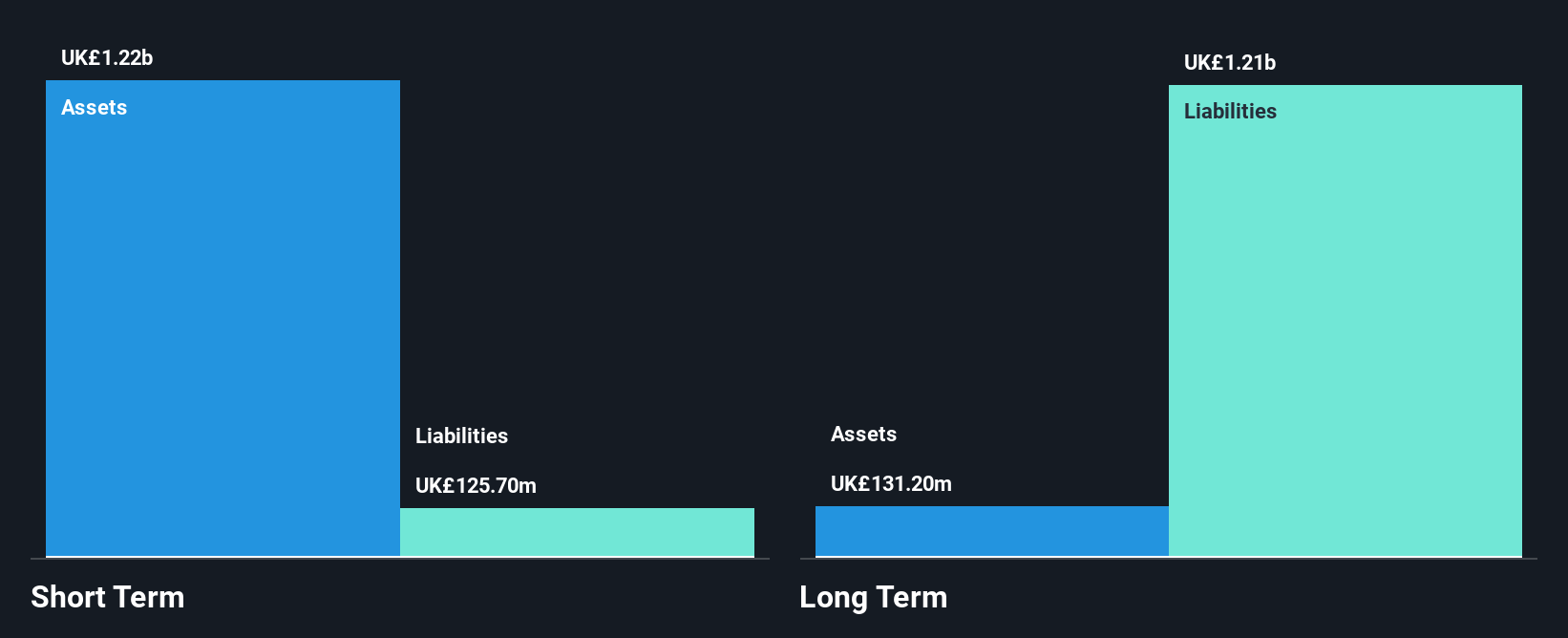

Hansard Global plc, with a market cap of £67.96 million, faces challenges as its earnings have declined by 6.5% annually over the past five years and experienced a significant one-off loss of £2.4 million recently. Despite being debt-free and having short-term assets (£1.2 billion) exceeding liabilities (£125.7 million), its return on equity is low at 10.9%, and profit margins have decreased to 2.2%. The company trades at a substantial discount to estimated fair value but struggles with negative earnings growth (-65.4%) this year compared to the insurance industry average decline (-26.2%).

- Get an in-depth perspective on Hansard Global's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Hansard Global's future.

Turning Ideas Into Actions

- Reveal the 307 hidden gems among our UK Penny Stocks screener with a single click here.

- Searching for a Fresh Perspective? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CURY

Currys

Operates as a omnichannel retailer of technology products and services in the United Kingdom, Ireland, Norway, Sweden, Finland, Denmark, Iceland, Greenland, and the Faroe Islands.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026