- United Kingdom

- /

- Metals and Mining

- /

- LSE:RIO

M.P. Evans Group And 2 Other UK Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting global economic interdependencies. In such uncertain times, dividend stocks like M.P. Evans Group can offer a measure of stability and income potential, making them appealing options for investors seeking to enhance their portfolios amidst fluctuating market conditions.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Pets at Home Group (LSE:PETS) | 6.10% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.52% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.34% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.30% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 8.03% | ★★★★★☆ |

| Man Group (LSE:EMG) | 6.03% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.83% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.68% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 4.06% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 6.72% | ★★★★★☆ |

Click here to see the full list of 63 stocks from our Top UK Dividend Stocks screener.

We'll examine a selection from our screener results.

M.P. Evans Group (AIM:MPE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: M.P. Evans Group PLC, with a market cap of £519.22 million, operates through its subsidiaries in the ownership and development of oil palm plantations in Indonesia and Malaysia.

Operations: M.P. Evans Group PLC generates revenue primarily from its plantation operations in Indonesia, amounting to $336.59 million.

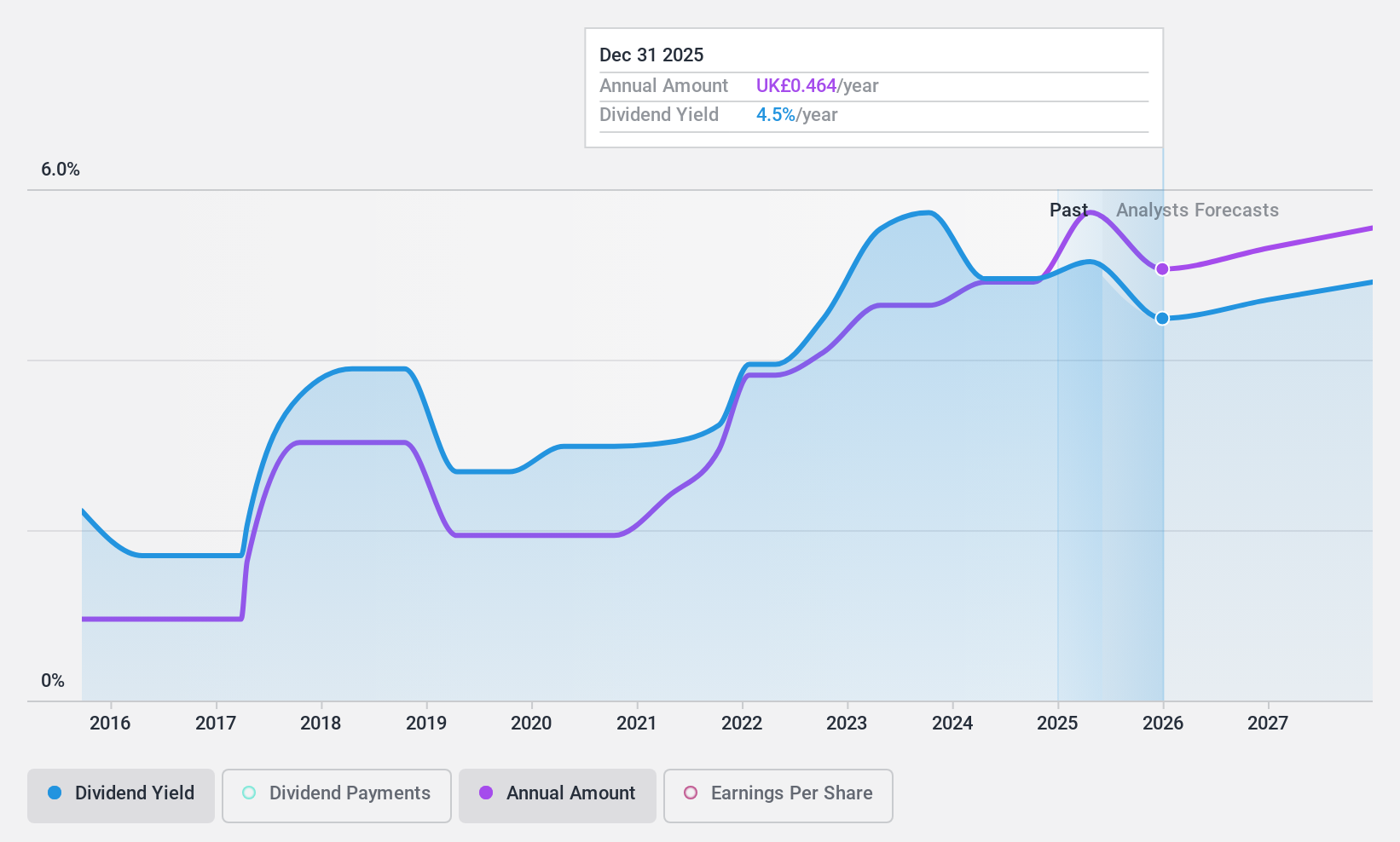

Dividend Yield: 4.5%

M.P. Evans Group's dividend payments are well covered by earnings with a payout ratio of 48.9% and cash flows at 32.8%. Despite being below fair value estimates, the stock has an unstable dividend track record over the past decade, though payments have grown during this period. The recent operating results show stable production levels in crude palm oil and palm kernel oil, which could support future dividend sustainability despite its relatively low yield compared to top UK payers.

- Click to explore a detailed breakdown of our findings in M.P. Evans Group's dividend report.

- The valuation report we've compiled suggests that M.P. Evans Group's current price could be quite moderate.

Ninety One Group (LSE:N91)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ninety One Group is an independent global asset manager with a market cap of £1.37 billion.

Operations: The company generates revenue from its Investment Management Business, amounting to £584.50 million.

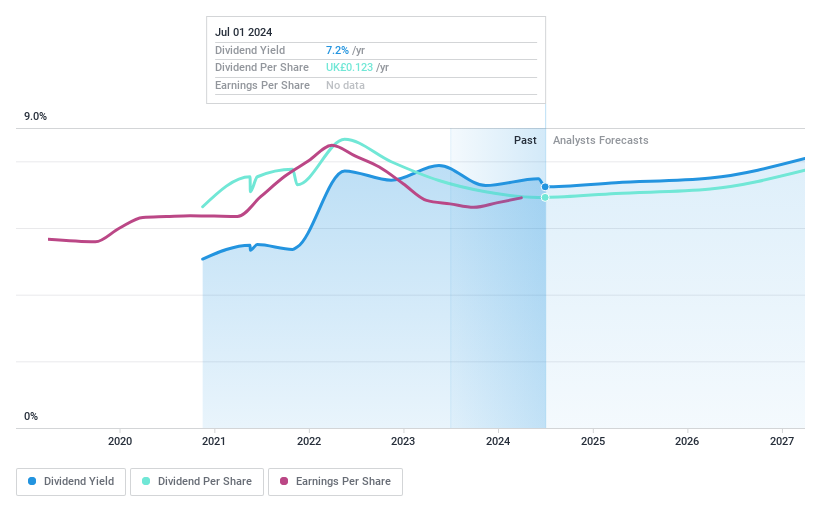

Dividend Yield: 7.8%

Ninety One Group offers an attractive dividend yield, ranking in the top 25% of UK payers, with a sustainable payout ratio backed by earnings and cash flows. However, its dividend history is brief and inconsistent over the past four years. Recent earnings show a slight decline in revenue and net income compared to last year. The appointment of Alper Kilic as head of alternative credit may enhance their emerging markets strategy amidst these financial challenges.

- Get an in-depth perspective on Ninety One Group's performance by reading our dividend report here.

- Our expertly prepared valuation report Ninety One Group implies its share price may be lower than expected.

Rio Tinto Group (LSE:RIO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rio Tinto Group is involved in exploring, mining, and processing mineral resources globally, with a market cap of £86.42 billion.

Operations: Rio Tinto Group's revenue segments include Copper at $7.60 billion, Iron Ore at $31.86 billion, Minerals at $5.78 billion, and Aluminium at $12.51 billion.

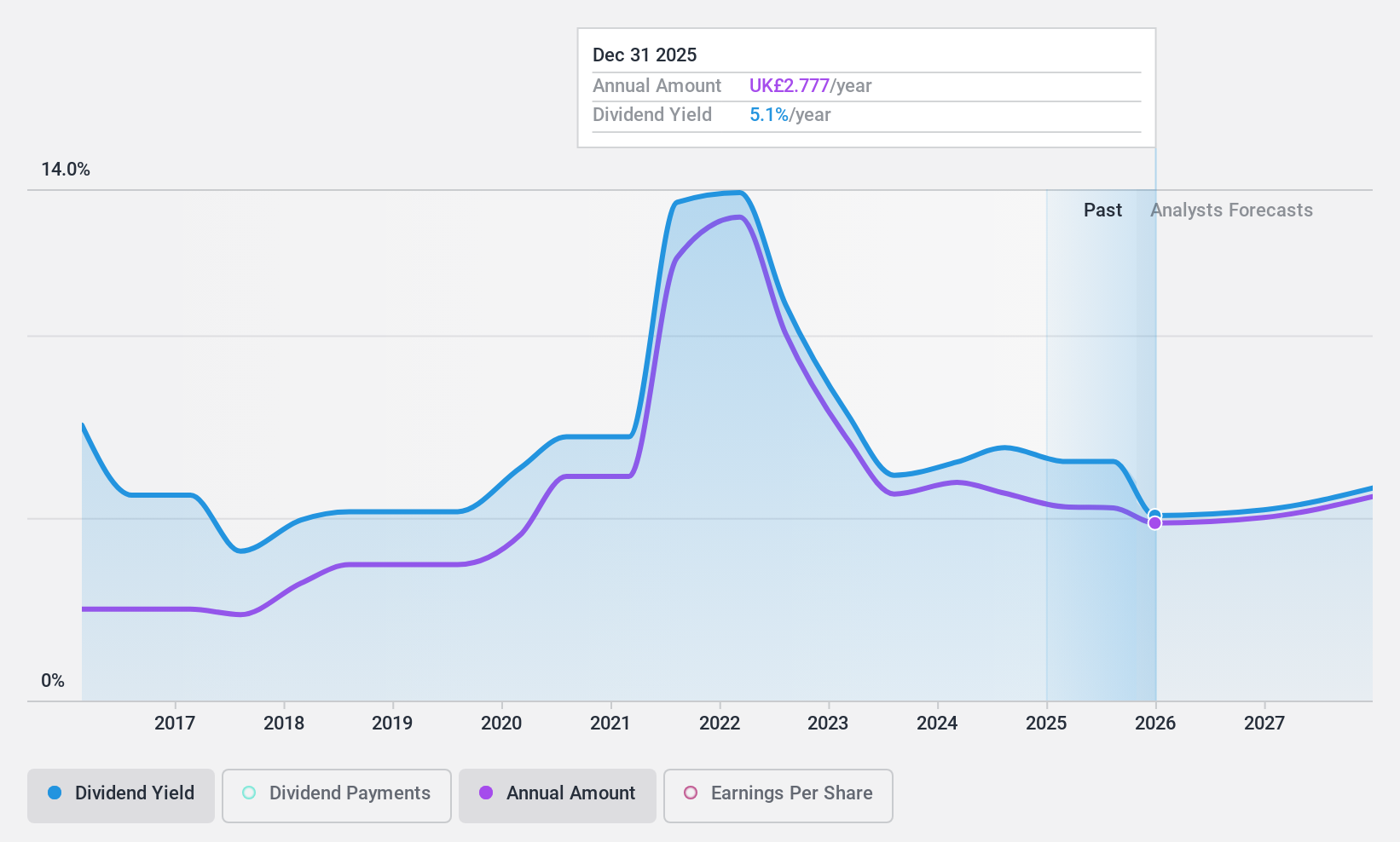

Dividend Yield: 6.9%

Rio Tinto Group's dividend yield is among the top 25% in the UK, but its payments have been volatile over the past decade. While dividends are covered by earnings with a payout ratio of 65.6%, they are not well-supported by free cash flows, reflected in a high cash payout ratio of 98.9%. Recent discussions about potential mergers and strategic expansions into lithium and copper projects may influence future financial stability and dividend sustainability.

- Delve into the full analysis dividend report here for a deeper understanding of Rio Tinto Group.

- Our valuation report unveils the possibility Rio Tinto Group's shares may be trading at a premium.

Next Steps

- Reveal the 63 hidden gems among our Top UK Dividend Stocks screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:RIO

Rio Tinto Group

Engages in exploring, mining, and processing mineral resources worldwide.

Solid track record with excellent balance sheet and pays a dividend.