- United Kingdom

- /

- Chemicals

- /

- LSE:ZTF

Essentra And 2 More UK Penny Stocks To Watch In The Market

Reviewed by Simply Wall St

Amidst the backdrop of a faltering FTSE 100, influenced by weak trade data from China and its ripple effects on global markets, investors may find themselves exploring alternative investment avenues. Penny stocks, often representing smaller or newer companies, continue to attract attention for their potential value despite being considered a somewhat outdated term. By focusing on those with strong financial health and growth potential, these stocks can offer compelling opportunities in today's market landscape.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.68 | £523.96M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.18 | £176.12M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.74 | £11.17M | ✅ 2 ⚠️ 2 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.08 | £14.86M | ✅ 4 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £2.44 | £30.96M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.565 | $328.45M | ✅ 4 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.52 | £258.33M | ✅ 4 ⚠️ 1 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.475 | £71.24M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.105 | £176.36M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.785 | £10.81M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 296 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Essentra (LSE:ESNT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Essentra plc manufactures and distributes plastic injection moulded, vinyl dip moulded, and metal products across Europe, the Middle East, Africa, the Americas, and the Asia Pacific with a market cap of £320.76 million.

Operations: The company's revenue is derived from its operations in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Market Cap: £320.76M

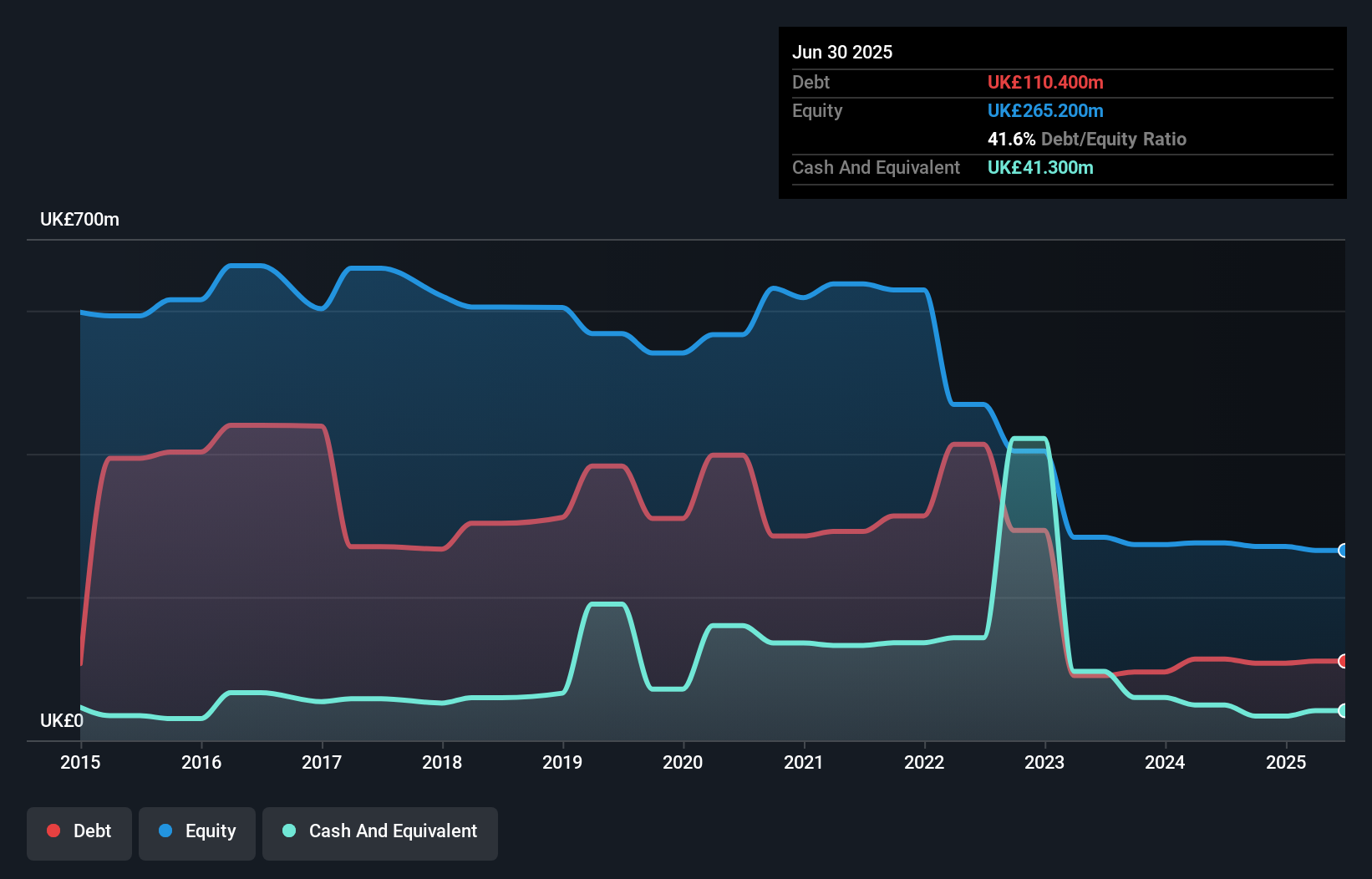

Essentra plc's recent financial performance highlights both opportunities and challenges for investors considering penny stocks. The company trades significantly below its estimated fair value, offering potential upside. Despite a low return on equity of 3.5%, Essentra has improved its net profit margins to 3.2% from last year's 0.2%. Debt management shows progress with a reduced debt-to-equity ratio and satisfactory net debt levels, although interest coverage remains weak at 1.3x EBIT. Recent board changes bring seasoned leadership, while the company's share buyback program indicates confidence in its valuation despite declining sales and earnings per share compared to the previous year.

- Click here and access our complete financial health analysis report to understand the dynamics of Essentra.

- Gain insights into Essentra's outlook and expected performance with our report on the company's earnings estimates.

Genel Energy (LSE:GENL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Genel Energy plc is an independent oil and gas exploration and production company with a market cap of approximately £188.05 million.

Operations: The company's revenue is primarily derived from its production segment, totaling $72.9 million.

Market Cap: £188.05M

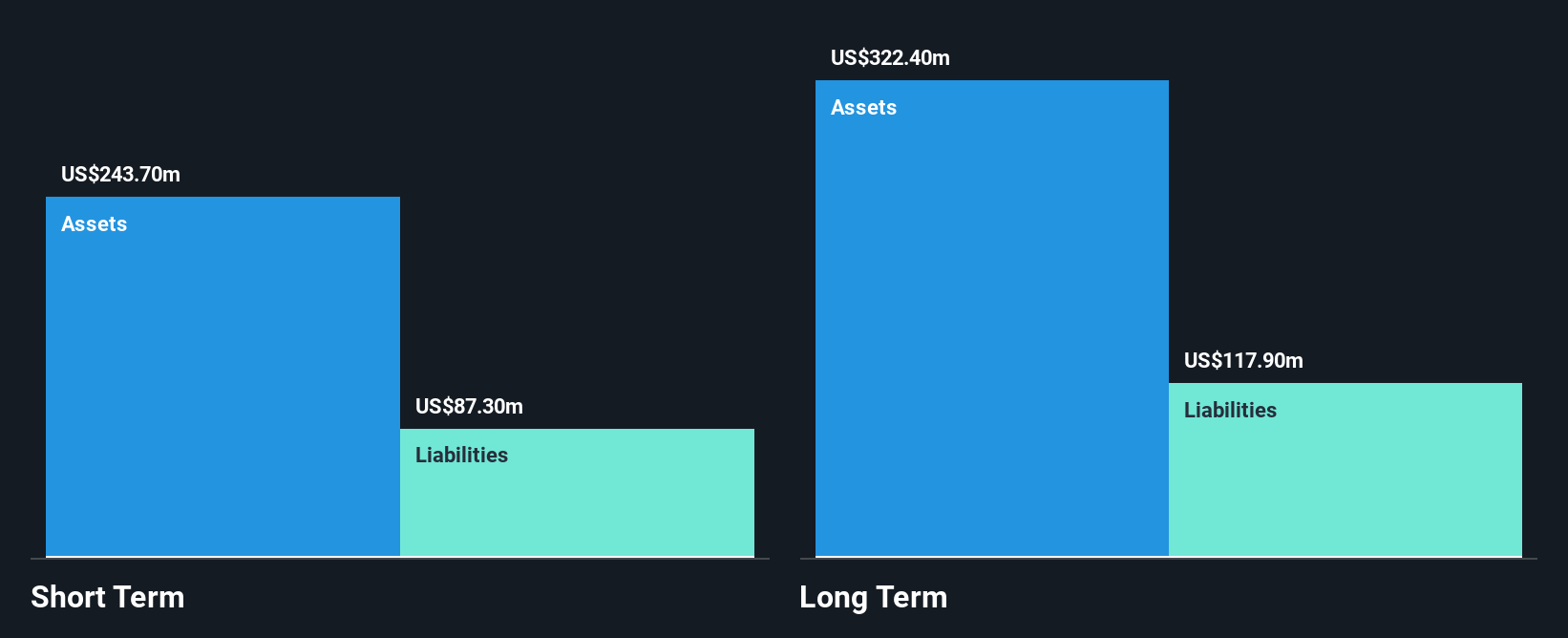

Genel Energy's position as a penny stock presents both potential and risks for investors. The company has a market cap of £188.05 million and recently reported half-year sales of US$35.8 million, with net income turning positive at US$0.6 million from a previous loss. Despite being unprofitable, Genel has reduced its debt-to-equity ratio over five years and maintains more cash than total debt, ensuring a cash runway exceeding three years even if free cash flow declines. Recent agreements to resume oil exports via the Iraq-Turkiye Pipeline could bolster revenue prospects but share price volatility remains high.

- Get an in-depth perspective on Genel Energy's performance by reading our balance sheet health report here.

- Gain insights into Genel Energy's future direction by reviewing our growth report.

Zotefoams (LSE:ZTF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zotefoams plc, with a market cap of £213.91 million, manufactures, distributes, and sells polyolefin foams in the United Kingdom, Europe, North America, and internationally.

Operations: The company's revenue is primarily derived from its Mucell Extrusion LLC (MEL) segment, which generated £0.82 million.

Market Cap: £213.91M

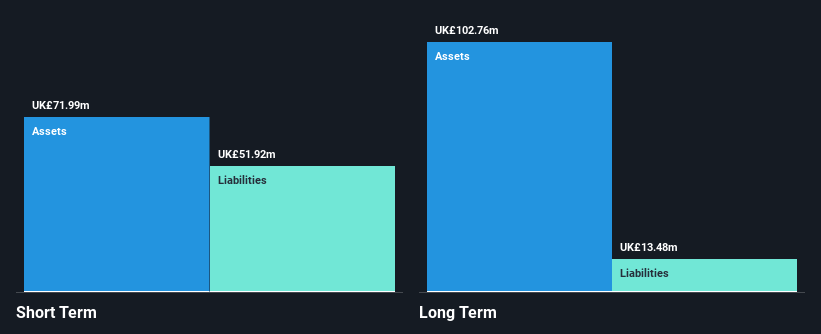

Zotefoams plc, with a market cap of £213.91 million, presents a mixed picture for investors interested in penny stocks. The company reported half-year sales of £77.43 million and net income of £9.75 million, though its profit margins have decreased significantly from the previous year. Recent strategic initiatives include a joint venture in Vietnam and the establishment of innovation hubs in the UK and South Korea to bolster growth in footwear markets. Despite stable debt coverage by operating cash flow and experienced board leadership, Zotefoams faces challenges with high share price volatility and low return on equity at 0.6%.

- Dive into the specifics of Zotefoams here with our thorough balance sheet health report.

- Examine Zotefoams' earnings growth report to understand how analysts expect it to perform.

Key Takeaways

- Dive into all 296 of the UK Penny Stocks we have identified here.

- Seeking Other Investments? Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Zotefoams might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ZTF

Zotefoams

Manufactures, distributes, and sells polyolefin foams in the United Kingdom, rest of Europe, North America, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)