- United Kingdom

- /

- Media

- /

- LSE:INF

3 UK Stocks Estimated To Be Trading Below Intrinsic Value By At Least 28.4%

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced turbulence, with the FTSE 100 index closing lower due to weak trade data from China. Amid these challenging conditions, investors may find opportunities in stocks that are trading below their intrinsic value, offering potential for future gains despite current market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Gaming Realms (AIM:GMR) | £0.40 | £0.76 | 47.4% |

| Victorian Plumbing Group (AIM:VIC) | £1.005 | £1.87 | 46.3% |

| Topps Tiles (LSE:TPT) | £0.481 | £0.92 | 47.6% |

| Informa (LSE:INF) | £8.458 | £16.88 | 49.9% |

| Fevertree Drinks (AIM:FEVR) | £7.625 | £14.65 | 47.9% |

| Redcentric (AIM:RCN) | £1.285 | £2.45 | 47.5% |

| Velocity Composites (AIM:VEL) | £0.43 | £0.83 | 47.9% |

| Tortilla Mexican Grill (AIM:MEX) | £0.51 | £1.01 | 49.4% |

| Foxtons Group (LSE:FOXT) | £0.632 | £1.20 | 47.5% |

| SysGroup (AIM:SYS) | £0.345 | £0.64 | 46.3% |

Below we spotlight a couple of our favorites from our exclusive screener.

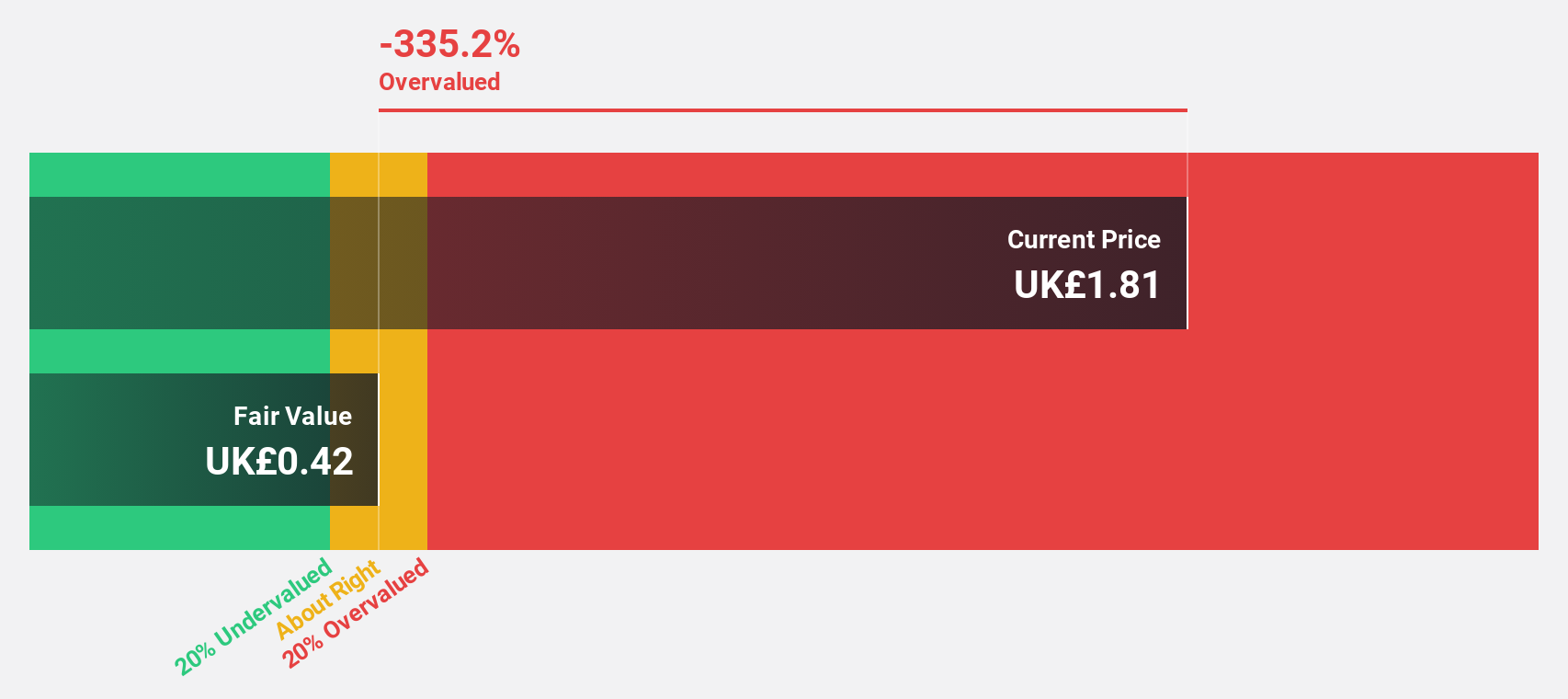

Gulf Keystone Petroleum (LSE:GKP)

Overview: Gulf Keystone Petroleum Limited is involved in the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq, with a market cap of £253.32 million.

Operations: The company's revenue from the exploration and production of oil and gas in the Kurdistan Region of Iraq is $115.15 million.

Estimated Discount To Fair Value: 44.4%

Gulf Keystone Petroleum is trading 44.4% below its estimated fair value of £2.1 per share, with a current price of £1.17, indicating significant undervaluation based on discounted cash flows. The company’s revenue is forecast to grow at 42.8% annually, outpacing the UK market's 3.7%. Recent earnings show a turnaround with net income of US$0.442 million for H1 2024 compared to a loss last year, and ongoing share buybacks totaling US$10 million further enhance shareholder value.

- The analysis detailed in our Gulf Keystone Petroleum growth report hints at robust future financial performance.

- Navigate through the intricacies of Gulf Keystone Petroleum with our comprehensive financial health report here.

Informa (LSE:INF)

Overview: Informa plc is an international company specializing in events, digital services, and academic research with operations in the United Kingdom, Continental Europe, the United States, China, and other global markets; it has a market cap of £11.17 billion.

Operations: Informa's revenue segments include Informa Tech (£426.70 million), Informa Connect (£630.20 million), Informa Markets (£1.67 billion), and Taylor & Francis (£636.70 million).

Estimated Discount To Fair Value: 49.9%

Informa is trading 49.9% below its fair value estimate of £16.88, with a current price of £8.46, suggesting significant undervaluation based on discounted cash flows. Earnings are projected to grow at 21.5% annually over the next three years, outpacing the UK market's 14.3%. Despite a history of unstable dividends and large one-off items affecting earnings quality, recent share buybacks totaling £1.30 billion enhance shareholder value and signal confidence in future performance.

- Our expertly prepared growth report on Informa implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Informa's balance sheet health report.

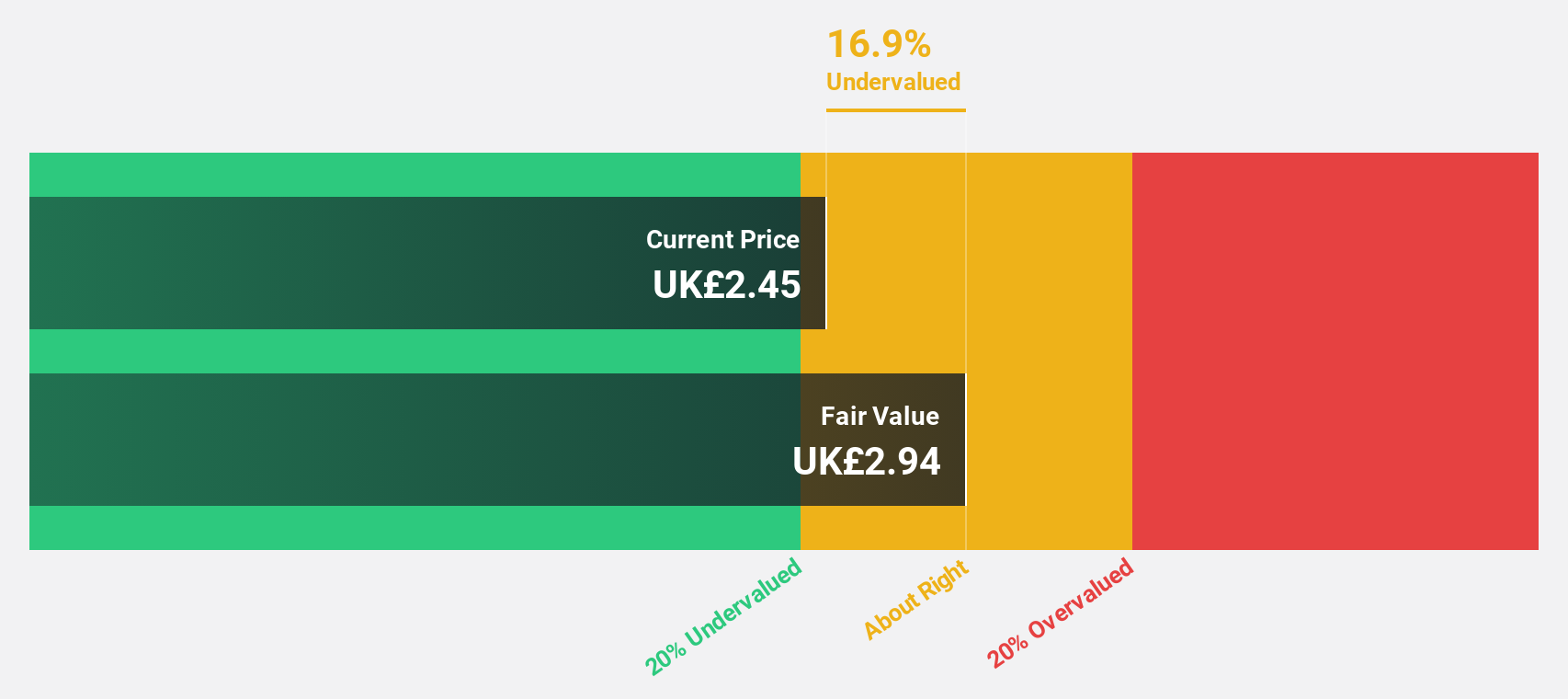

PageGroup (LSE:PAGE)

Overview: PageGroup plc, with a market cap of £1.17 billion, offers recruitment consultancy and ancillary services across the UK, Europe, the Middle East, Africa, the Asia Pacific, and the Americas.

Operations: The company generates £1.87 billion in revenue from recruitment services across various regions including the UK, Europe, the Middle East, Africa, the Asia Pacific, and the Americas.

Estimated Discount To Fair Value: 28.4%

PageGroup (£3.72) is trading 28.4% below its estimated fair value of £5.2, indicating significant undervaluation based on discounted cash flows. Despite a recent decline in sales and net income for H1 2024, earnings are forecast to grow significantly at 35.38% per year, outpacing the UK market's growth rate of 14.3%. However, profit margins have decreased from last year and the dividend yield of 4.46% is not well covered by earnings.

- Our comprehensive growth report raises the possibility that PageGroup is poised for substantial financial growth.

- Get an in-depth perspective on PageGroup's balance sheet by reading our health report here.

Where To Now?

- Access the full spectrum of 53 Undervalued UK Stocks Based On Cash Flows by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:INF

Informa

Operates as an international events, digital services, and academic research company in the United Kingdom, Continental Europe, North America, China, and internationally.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026