- United Kingdom

- /

- Capital Markets

- /

- AIM:WHI

November 2024's Top Penny Stocks On UK Exchange

Reviewed by Simply Wall St

The UK market has been experiencing some turbulence, with the FTSE 100 index recently closing lower due to weak trade data from China, highlighting global economic challenges. In such a climate, identifying stocks with potential for growth becomes crucial. Penny stocks, often associated with smaller or newer companies, can offer unique opportunities for investors seeking affordable entry points and growth potential when backed by strong financial health.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.23 | £840.18M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.8789 | £385.78M | ★★★★☆☆ |

| Supreme (AIM:SUP) | £1.61 | £187.74M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.445 | £356.66M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.825 | £62.48M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.25 | £106.71M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.31 | £202.04M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.46 | £185.93M | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | £3.335 | £426.76M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.4245 | $246.77M | ★★★★★★ |

Click here to see the full list of 465 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

SDX Energy (AIM:SDX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: SDX Energy plc is involved in the exploration, development, and production of oil and gas in Egypt and Morocco, with a market cap of £3.99 million.

Operations: The company generates revenue of $9.26 million from its upstream oil and gas exploration and production activities.

Market Cap: £3.99M

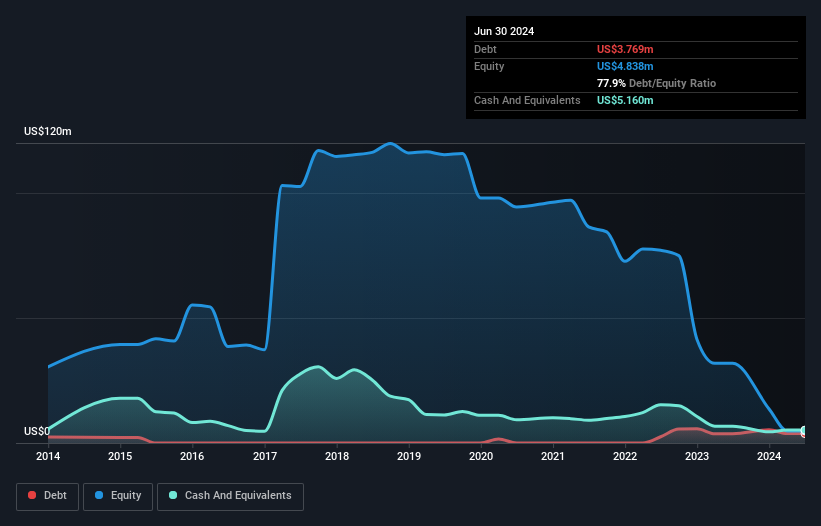

SDX Energy, with a market cap of £3.99 million, is trading significantly below its estimated fair value, making it potentially attractive to investors seeking undervalued opportunities. Despite being unprofitable and experiencing increased losses over the past five years, SDX maintains a positive free cash flow and has sufficient cash runway for over three years. The company's short-term assets slightly lag behind its liabilities, but it holds more cash than debt. Recent board changes include the appointment of Alexander Craig as Non-Executive Director, enhancing expertise in commodities and infrastructure within the leadership team.

- Click here and access our complete financial health analysis report to understand the dynamics of SDX Energy.

- Explore historical data to track SDX Energy's performance over time in our past results report.

WH Ireland Group (AIM:WHI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: WH Ireland Group plc offers wealth management services mainly in the United Kingdom and has a market cap of £7.22 million.

Operations: The company's revenue is derived from two main segments: Capital Markets, generating £9.57 million, and Wealth Management (including Harpsden), contributing £11.89 million.

Market Cap: £7.22M

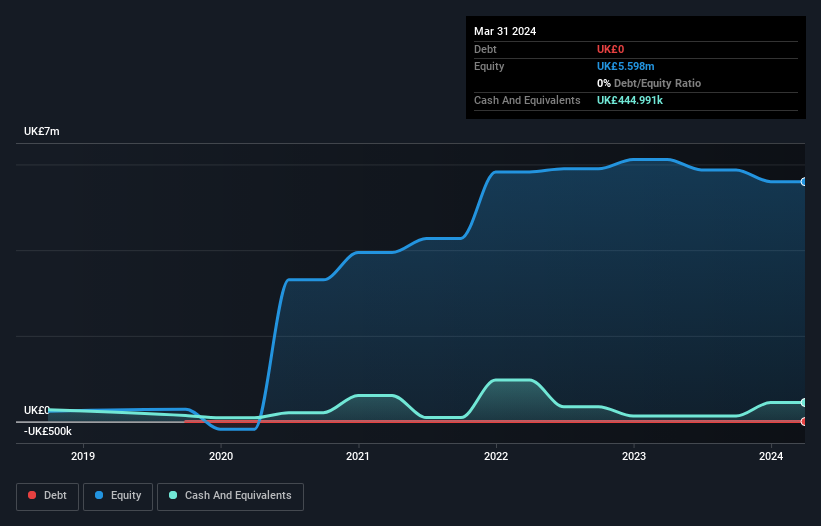

WH Ireland Group plc, with a market cap of £7.22 million, remains unprofitable but has shown significant progress by reducing losses at an impressive rate over the past five years. The company operates debt-free and maintains a strong balance sheet, with short-term assets significantly exceeding liabilities. Despite having less than a year of cash runway based on current free cash flow trends, its management team is seasoned with an average tenure of 5.3 years. While recent volatility has decreased considerably, the board's relatively short tenure suggests room for further stabilization in leadership experience.

- Dive into the specifics of WH Ireland Group here with our thorough balance sheet health report.

- Learn about WH Ireland Group's historical performance here.

Blencowe Resources (LSE:BRES)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Blencowe Resources Plc focuses on acquiring, developing, and exploring graphite properties in Northern Uganda, with a market cap of £8.69 million.

Operations: Currently, there are no reported revenue segments for Blencowe Resources Plc.

Market Cap: £8.69M

Blencowe Resources, with a market cap of £8.69 million, is pre-revenue and focuses on developing its Orom-Cross graphite project in Uganda. Recent strategic moves include a £1.5 million equity offering and commencing a 6,700-metre drilling program to expand resources and reserves. The company has received MSP accreditation, enhancing its credibility and access to funding opportunities. A joint venture with Triessence Limited aims to establish a graphite purification facility in Uganda, potentially increasing commercial returns by producing high-value battery-ready SPG. Despite financial challenges like short-term liabilities exceeding assets, Blencowe remains debt-free and strategically aligned for future growth.

- Get an in-depth perspective on Blencowe Resources' performance by reading our balance sheet health report here.

- Examine Blencowe Resources' past performance report to understand how it has performed in prior years.

Key Takeaways

- Embark on your investment journey to our 465 UK Penny Stocks selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WH Ireland Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:WHI

WH Ireland Group

Provides wealth management services primarily in the United Kingdom.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives