- United Kingdom

- /

- Capital Markets

- /

- LSE:STJ

UK Stocks That May Be Valued Below Intrinsic Estimates In December 2024

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting concerns over global economic recovery. As these conditions persist, investors may find potential opportunities in stocks that appear undervalued relative to their intrinsic estimates, offering a chance for growth amidst broader market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| TBC Bank Group (LSE:TBCG) | £31.40 | £59.94 | 47.6% |

| Gaming Realms (AIM:GMR) | £0.36 | £0.72 | 49.8% |

| Fevertree Drinks (AIM:FEVR) | £6.78 | £13.12 | 48.3% |

| Bellway (LSE:BWY) | £24.24 | £47.96 | 49.5% |

| Brickability Group (AIM:BRCK) | £0.636 | £1.26 | 49.3% |

| Zotefoams (LSE:ZTF) | £3.08 | £5.77 | 46.6% |

| Victorian Plumbing Group (AIM:VIC) | £1.055 | £2.02 | 47.7% |

| Duke Capital (AIM:DUKE) | £0.30 | £0.58 | 47.9% |

| Informa (LSE:INF) | £8.28 | £15.80 | 47.6% |

| Andrada Mining (AIM:ATM) | £0.0245 | £0.046 | 46.7% |

Here's a peek at a few of the choices from the screener.

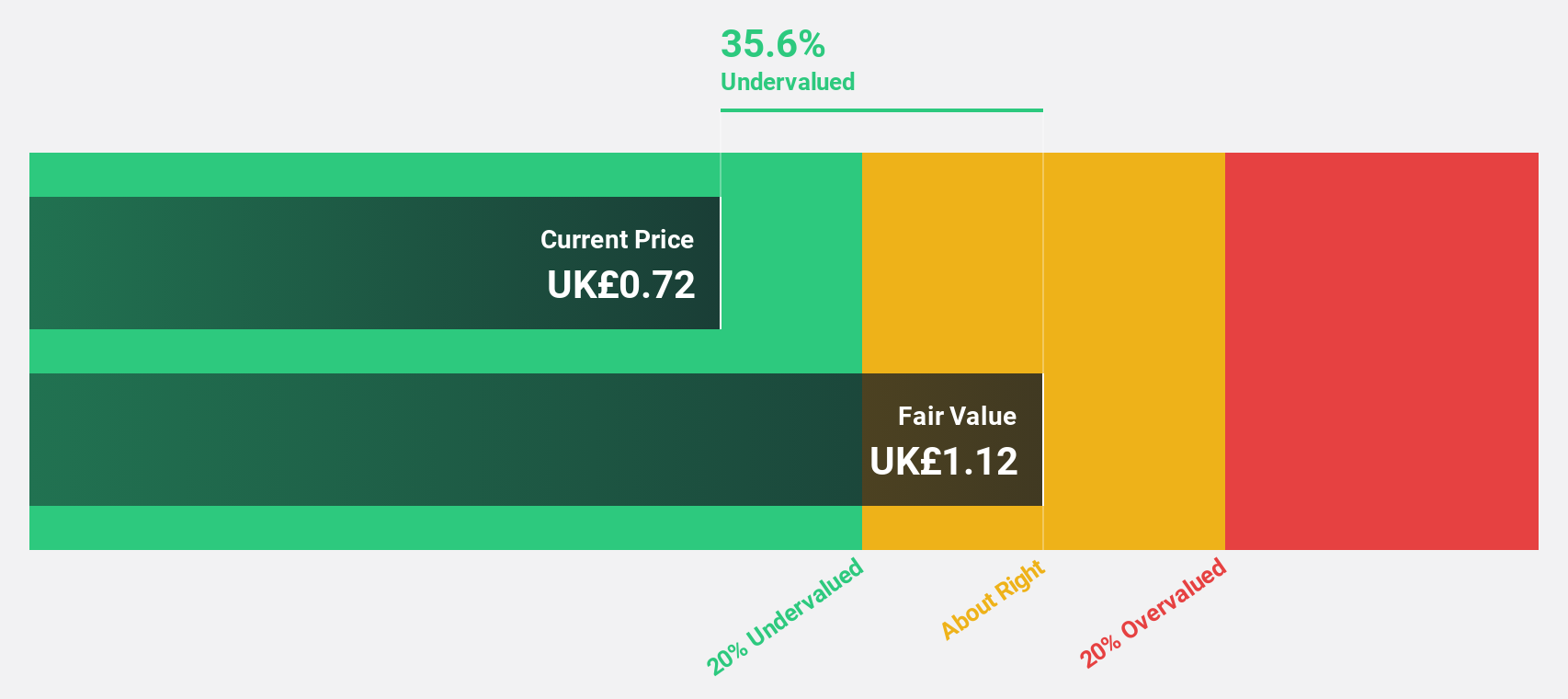

Victorian Plumbing Group (AIM:VIC)

Overview: Victorian Plumbing Group plc is an online retailer specializing in bathroom products and accessories in the United Kingdom, with a market cap of £343.61 million.

Operations: The company generates revenue of £282.90 million from its online retail operations focused on bathroom products and accessories in the UK.

Estimated Discount To Fair Value: 47.7%

Victorian Plumbing Group is trading at £1.06, significantly below its estimated fair value of £2.02, indicating it may be undervalued based on cash flows. The company's earnings are forecast to grow at 26.78% annually, outpacing the UK market's growth rate of 14.9%. While revenue growth is slower than desired at 9.6%, it still exceeds the broader market's 3.6%. Investors should note the high level of non-cash earnings in their analysis.

- Our earnings growth report unveils the potential for significant increases in Victorian Plumbing Group's future results.

- Click here to discover the nuances of Victorian Plumbing Group with our detailed financial health report.

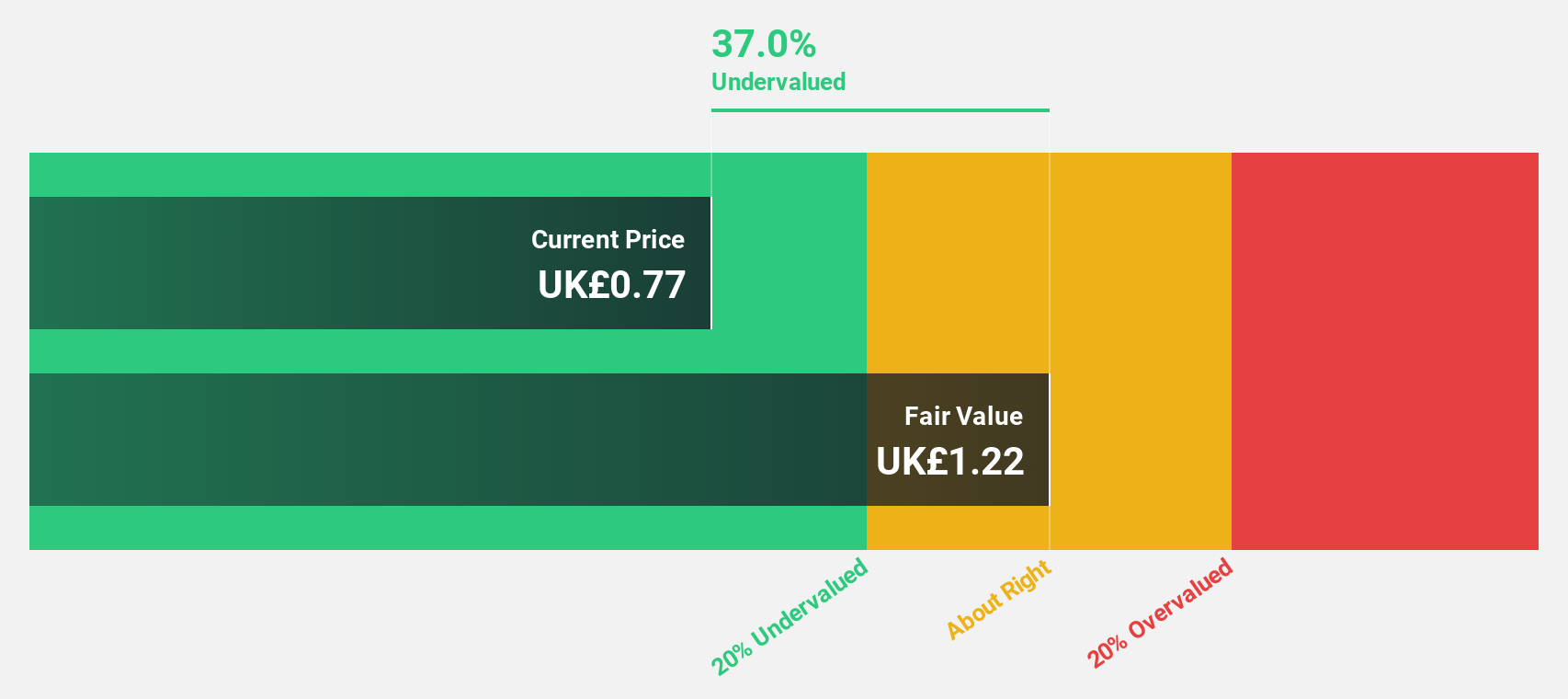

NewRiver REIT (LSE:NRR)

Overview: NewRiver REIT plc is a prominent UK-based Real Estate Investment Trust focused on acquiring, managing, and developing resilient retail assets, with a market cap of £293.11 million.

Operations: NewRiver REIT generates its revenue primarily from the acquisition, management, and development of resilient retail assets across the UK.

Estimated Discount To Fair Value: 34.8%

NewRiver REIT, trading at £0.78, is significantly below its estimated fair value of £1.2, suggesting it could be undervalued based on cash flows. Earnings are expected to grow rapidly at 48.15% annually, surpassing the UK market's growth rate of 14.9%. However, its dividend yield of 8.46% isn't well covered by free cash flows and shareholders have experienced dilution recently. The company is exploring M&A opportunities for strategic growth alignment and capital efficiency improvement.

- According our earnings growth report, there's an indication that NewRiver REIT might be ready to expand.

- Get an in-depth perspective on NewRiver REIT's balance sheet by reading our health report here.

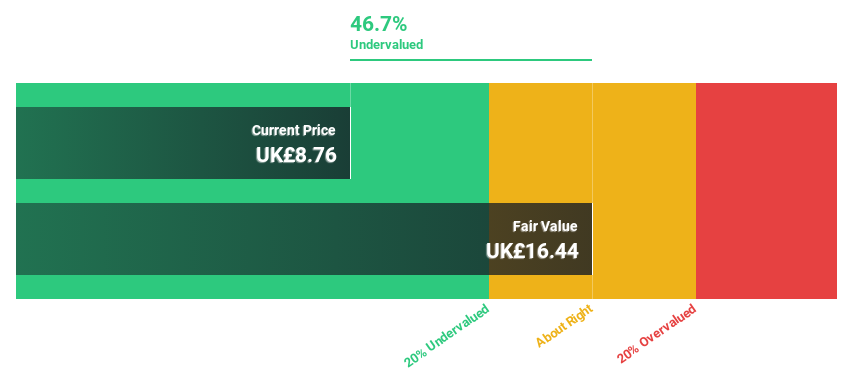

St. James's Place (LSE:STJ)

Overview: St. James's Place plc is a publicly owned investment manager with a market cap of £4.86 billion.

Operations: The company's revenue primarily comes from its Wealth Management Business, generating £26.80 billion.

Estimated Discount To Fair Value: 44.5%

St. James's Place, trading at £9.01, is significantly undervalued with a fair value estimate of £16.22 based on discounted cash flows. Despite an expected annual earnings growth rate of 27.26%, revenue is forecast to decline sharply over the next three years by -98.5% per year, which could impact overall valuation perceptions. The company benefits from strong relative value compared to peers and a high projected return on equity of 22.8%.

- The analysis detailed in our St. James's Place growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in St. James's Place's balance sheet health report.

Where To Now?

- Discover the full array of 58 Undervalued UK Stocks Based On Cash Flows right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:STJ

Undervalued with reasonable growth potential.