- United Kingdom

- /

- Insurance

- /

- LSE:HSD

3 Promising Penny Stocks On UK Exchange With Over £10M Market Cap

Reviewed by Simply Wall St

Amidst the backdrop of a faltering FTSE 100, influenced by weak trade data from China and declining commodity prices, investors are exploring alternative opportunities in the UK market. Penny stocks, although an older term, remain significant as they often represent smaller or newer companies that can offer unique investment potential. This article will explore three penny stocks on the UK exchange that stand out for their financial resilience and potential for growth, providing investors with intriguing options beyond mainstream investments.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.98 | £154.59M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.135 | £804.39M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.56 | £67.89M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.19 | £101.67M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.90 | £186M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.288 | £198.65M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.40 | £178.29M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.27 | £424.68M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.455 | $264.5M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £1.14 | £86.34M | ★★★★★★ |

Click here to see the full list of 469 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Galileo Resources (AIM:GLR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Galileo Resources Plc is engaged in the exploration and development of mineral projects across South Africa, Botswana, the United Kingdom, and the United States with a market capitalization of £11.63 million.

Operations: The company's revenue primarily comes from its mineral assets, amounting to £0.13 million.

Market Cap: £11.63M

Galileo Resources, with a market cap of £11.63 million, is pre-revenue and remains unprofitable, reporting a net loss of £1.05 million for the year ending March 2024. Despite being debt-free and having no long-term liabilities, the company faces going concern doubts from its auditor due to limited cash runway under one year. Recent initiatives include geophysical surveys in Botswana's Kalahari Copperbelt and ongoing drilling in Zambia's Shinganda Licence targeting copper and gold mineralization. While volatility has been stable, continued financial challenges may impact future operational capabilities without significant revenue growth or capital infusion.

- Take a closer look at Galileo Resources' potential here in our financial health report.

- Learn about Galileo Resources' historical performance here.

EJF Investments (LSE:EJFI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: EJF Investments Limited is a principal investment firm with a market cap of £74.29 million.

Operations: The company generates revenue through its investment in EJFIH, amounting to £11.30 million.

Market Cap: £74.29M

EJF Investments Limited, with a market cap of £74.29 million, has recently turned profitable, reporting a net income of £5.37 million for the half year ended June 2024. Despite this positive shift, its dividend yield of 8.81% is not well covered by earnings or free cash flows, raising sustainability concerns. The company's revenue generation through EJFIH investments reached £11.30 million, and it maintains satisfactory debt levels with a net debt to equity ratio of 24.6%. However, short-term assets are insufficient to cover long-term liabilities (£25 million), and recent delisting from OTC Equity may impact liquidity perceptions among investors.

- Jump into the full analysis health report here for a deeper understanding of EJF Investments.

- Explore EJF Investments' analyst forecasts in our growth report.

Hansard Global (LSE:HSD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hansard Global plc is a specialist long-term savings provider offering savings and investment products to investors, institutions, and wealth-management groups in the Isle of Man, Republic of Ireland, and The Bahamas with a market cap of £66.65 million.

Operations: The company's revenue is primarily derived from the distribution and servicing of long-term investment products, totaling £168.3 million.

Market Cap: £66.65M

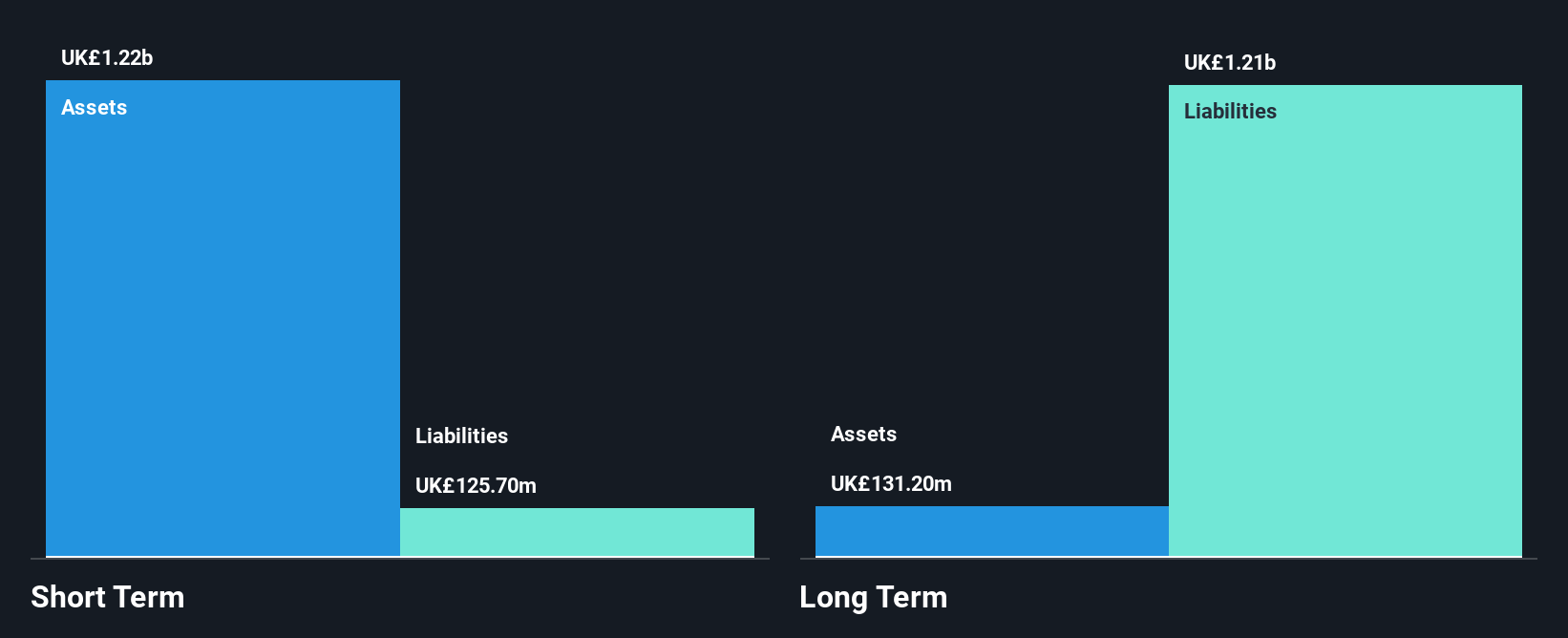

Hansard Global plc, with a market cap of £66.65 million, faces challenges in earnings growth and profit margins, which have declined to 3.1% from 6.3% last year. Despite a high return on equity of 25%, the company is trading at nearly half its estimated fair value, suggesting potential undervaluation. The firm is debt-free and has substantial short-term assets (£1.2 billion) that cover short-term liabilities but not long-term ones (£1.2 billion). Recent board changes include appointing Lynzi Harrison as an Independent Non-Executive Director, bringing over 25 years of industry experience to the company’s leadership team amidst ongoing executive transitions.

- Unlock comprehensive insights into our analysis of Hansard Global stock in this financial health report.

- Learn about Hansard Global's future growth trajectory here.

Next Steps

- Click here to access our complete index of 469 UK Penny Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hansard Global might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HSD

Hansard Global

Operates as a specialist long-term savings provider that offers savings and investment products for investors, institutions, and wealth-management groups in the Isle of Man, Republic of Ireland, and The Bahamas.

Excellent balance sheet slight.