- United Kingdom

- /

- Consumer Finance

- /

- LSE:FCH

UK Penny Stocks: 3 Hidden Gems With Market Caps Below £2B

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting the interconnectedness of global economies. In such a climate, investors may find value in exploring alternative investment opportunities like penny stocks. While often considered a throwback term, penny stocks represent smaller or newer companies that can offer growth potential at lower price points when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| DSW Capital (AIM:DSW) | £0.50 | £12.57M | ✅ 3 ⚠️ 4 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.695 | £535.43M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.05 | £165.61M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.98 | £14.8M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.13 | £27.03M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.655 | $380.77M | ✅ 4 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.345 | £64.96M | ✅ 3 ⚠️ 3 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.49 | £42.24M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.125 | £179.55M | ✅ 4 ⚠️ 2 View Analysis > |

| Billington Holdings (AIM:BILN) | £3.15 | £41.12M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 302 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Ashmore Group (LSE:ASHM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ashmore Group plc is a publicly owned investment manager with a market cap of £1.06 billion, focusing on emerging markets.

Operations: The company generates revenue of £142.4 million through its investment management services.

Market Cap: £1.06B

Ashmore Group, with a market cap of £1.06 billion and revenue of £144.1 million, is an investment manager focusing on emerging markets. Despite being debt-free and having strong asset coverage for liabilities, its earnings have declined by 25.3% annually over the past five years and are forecast to continue declining by 6.6% per year for the next three years. While it maintains a high net profit margin of 57%, its return on equity is low at 10.8%. The dividend yield of 10.43% appears unsustainable given current earnings coverage challenges despite recent affirmations at their AGM.

- Click to explore a detailed breakdown of our findings in Ashmore Group's financial health report.

- Evaluate Ashmore Group's prospects by accessing our earnings growth report.

Auction Technology Group (LSE:ATG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Auction Technology Group plc operates online auction marketplaces across the United Kingdom, North America, and Germany, with a market cap of £340.56 million.

Operations: Auction Technology Group does not report specific revenue segments.

Market Cap: £340.56M

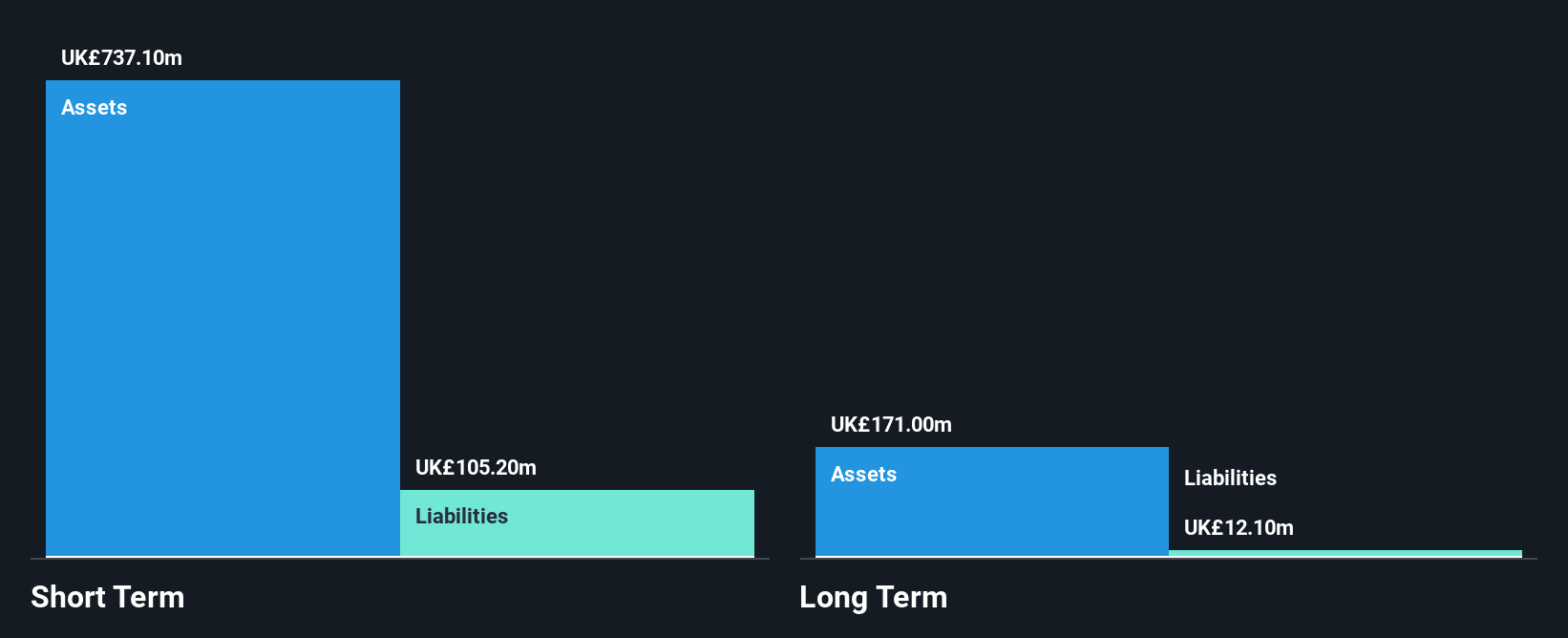

Auction Technology Group, with a market cap of £340.56 million, operates online auction marketplaces and reported sales of US$190.15 million for the year ending September 2025. Despite this revenue growth from the previous year, it recorded a significant net loss of US$144.6 million compared to a net income in the prior period. The company's management and board are experienced, but short-term assets do not cover liabilities, posing financial challenges. While unprofitable with negative equity five years ago now improved to positive levels, its removal from FTSE indices indicates potential investor caution amidst ongoing volatility and strategic adjustments.

- Take a closer look at Auction Technology Group's potential here in our financial health report.

- Understand Auction Technology Group's earnings outlook by examining our growth report.

Funding Circle Holdings (LSE:FCH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Funding Circle Holdings plc operates online lending platforms in the United Kingdom and internationally, with a market cap of £397.33 million.

Operations: The company generates revenue from its United Kingdom operations through FlexiPay, contributing £26.4 million, and Term Loans, which account for £146.9 million.

Market Cap: £397.33M

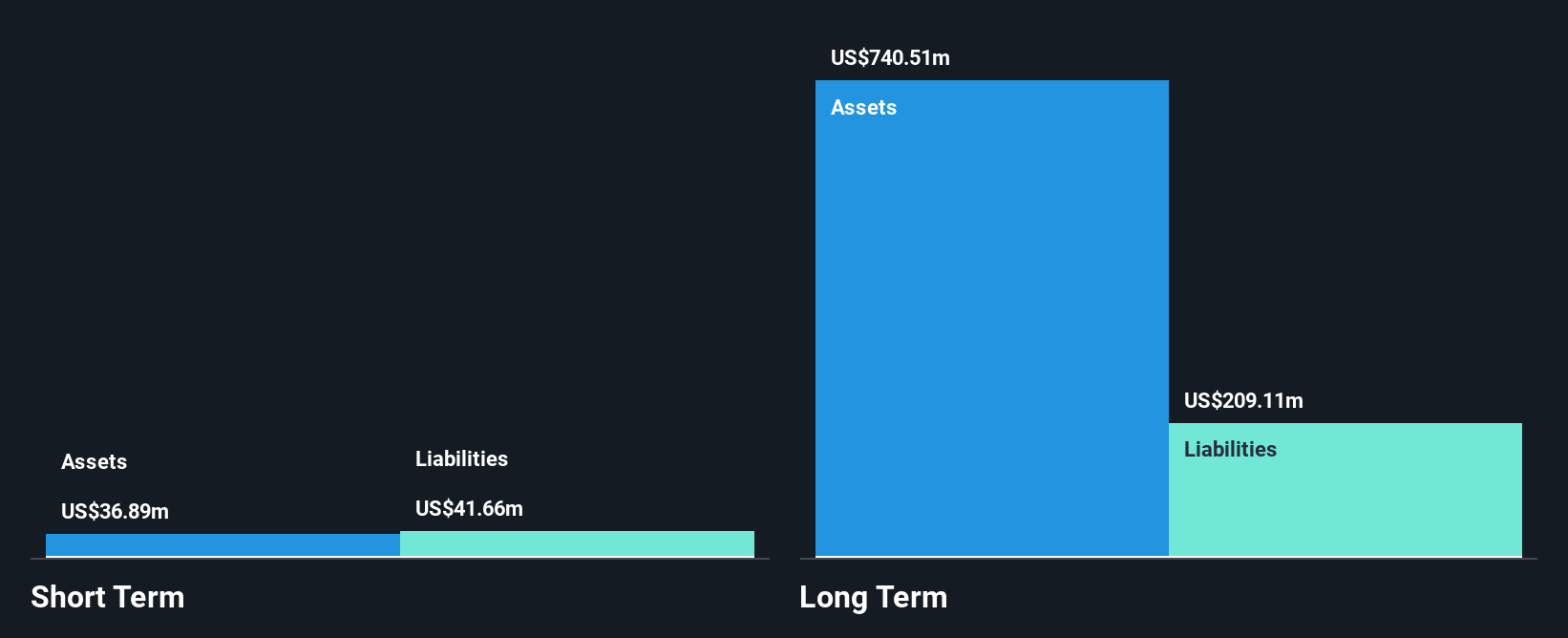

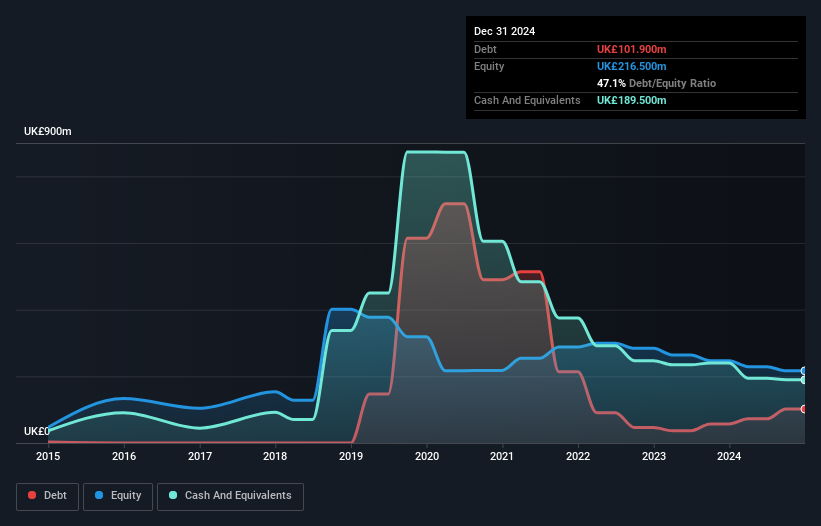

Funding Circle Holdings, with a market cap of £397.33 million, has shown financial improvement by becoming profitable this year and reporting H1 2025 revenue of £92.3 million. Recent partnerships with TPG Angelo Gordon, Barclays, Waterfall Asset Management, and BNP Paribas have secured significant forward funding commitments totaling over £1 billion to support SME lending. Despite these strengths, challenges include low return on equity at 4.2%, negative operating cash flow affecting debt coverage, and significant insider selling recently observed. The board's inexperience could also impact strategic decisions as they navigate the competitive consumer finance landscape.

- Jump into the full analysis health report here for a deeper understanding of Funding Circle Holdings.

- Gain insights into Funding Circle Holdings' future direction by reviewing our growth report.

Turning Ideas Into Actions

- Click here to access our complete index of 302 UK Penny Stocks.

- Contemplating Other Strategies? We've found 15 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:FCH

Funding Circle Holdings

Provides online lending platforms in the United Kingdom and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.