- United Kingdom

- /

- Consumer Services

- /

- AIM:TRB

Griffin Mining And 2 Other Promising Penny Stocks On UK Exchange

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting global economic interdependencies. Despite these broader market pressures, certain investment opportunities remain attractive. Penny stocks, often representing smaller or newer companies, continue to offer potential for growth at lower price points when they possess strong financial foundations.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Secure Trust Bank (LSE:STB) | £3.49 | £66.56M | ★★★★☆☆ |

| Begbies Traynor Group (AIM:BEG) | £0.95 | £149.86M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.885 | £185.28M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.085 | £785.55M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.16 | £99.11M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.288 | £198.65M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.225 | £420.2M | ★★★★☆☆ |

| Serabi Gold (AIM:SRB) | £1.18 | £89.37M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.437 | $254.04M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.375 | £175.11M | ★★★★★☆ |

Click here to see the full list of 467 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

Griffin Mining (AIM:GFM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Griffin Mining Limited is a mining and investment company focused on the exploration, development, and operation of mineral properties, with a market cap of £265.73 million.

Operations: The company's revenue is primarily derived from the Caijiaying Zinc Gold Mine, generating $162.25 million.

Market Cap: £265.73M

Griffin Mining Limited, with a market cap of £265.73 million, primarily generates revenue from its Caijiaying Zinc Gold Mine, reporting $162.25 million in earnings. The company is debt-free and has shown significant earnings growth of 116.5% over the past year, surpassing industry averages. Its net profit margins improved to 13.2% from 7.6% last year, indicating high-quality earnings despite a low return on equity at 7.8%. Recent production results show mixed performance across different minerals but highlight increased gold and silver outputs compared to the previous year’s third quarter figures.

- Unlock comprehensive insights into our analysis of Griffin Mining stock in this financial health report.

- Evaluate Griffin Mining's prospects by accessing our earnings growth report.

Tribal Group (AIM:TRB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tribal Group plc, with a market cap of £92.89 million, provides software and services to education institutions globally through its subsidiaries.

Operations: The company generates revenue from two main segments: Education Services, contributing £17.24 million, and Student Information Systems (SIS), which accounts for £70.08 million.

Market Cap: £92.89M

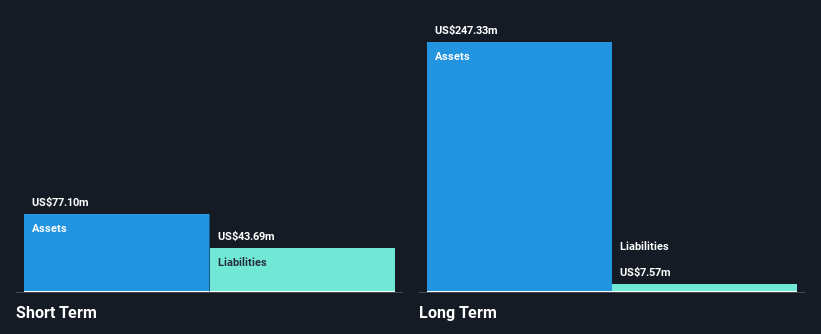

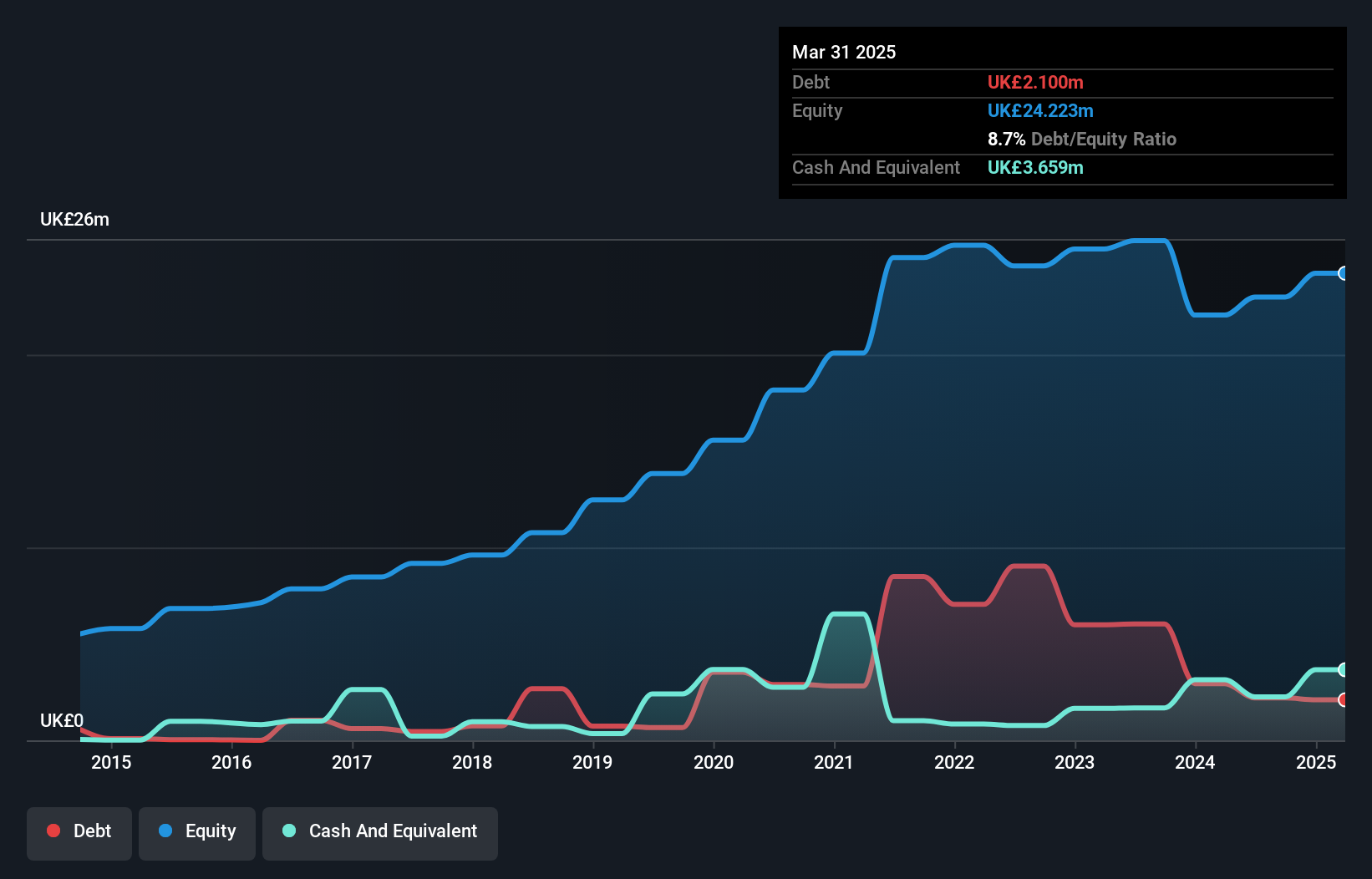

Tribal Group plc, with a market cap of £92.89 million, has shown profitability growth over the past five years, yet recent earnings have declined by 27.1%. The company is trading significantly below estimated fair value and faces challenges with short-term liabilities (£44.3M) exceeding short-term assets (£22.8M). Despite a satisfactory net debt to equity ratio of 20.1% and well-covered interest payments (4.7x EBIT), a large one-off loss of £4 million impacted recent financial results. Insider selling in the last quarter raises concerns, while its dividend coverage remains weak at 2.99%.

- Jump into the full analysis health report here for a deeper understanding of Tribal Group.

- Examine Tribal Group's earnings growth report to understand how analysts expect it to perform.

Creightons (LSE:CRL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Creightons Plc, along with its subsidiaries, develops, manufactures, and markets toiletries and fragrances both in the United Kingdom and internationally, with a market cap of £23.68 million.

Operations: The company generates revenue of £52.72 million from its Personal Products segment.

Market Cap: £23.68M

Creightons Plc, with a market cap of £23.68 million, has demonstrated stable weekly volatility despite being higher than most UK stocks. It trades significantly below its estimated fair value but remains unprofitable with declining earnings over the past five years. Recent half-year results show improved net income to £1.22 million from £0.285 million last year, though losses have increased annually by 51.9%. The company's debt is well covered by operating cash flow and interest payments are adequately managed, while short-term assets exceed both short and long-term liabilities, indicating solid liquidity management amidst executive changes.

- Click here and access our complete financial health analysis report to understand the dynamics of Creightons.

- Understand Creightons' track record by examining our performance history report.

Seize The Opportunity

- Investigate our full lineup of 467 UK Penny Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tribal Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:TRB

Tribal Group

Through its subsidiaries, provides software and services to education institutions worldwide.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives