- United Kingdom

- /

- Electrical

- /

- LSE:LUCE

Discover UK Penny Stocks: FRP Advisory Group And Two More High-Potential Picks

Reviewed by Simply Wall St

The United Kingdom's market landscape has been influenced by global economic factors, with recent data showing the FTSE 100 index facing pressure due to weak trade figures from China. For investors seeking opportunities beyond established giants, penny stocks—often representing smaller or newer companies—remain an intriguing option despite their somewhat dated moniker. These stocks can offer surprising value and potential for growth, particularly when they demonstrate solid financial foundations and resilience in challenging market conditions.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Ultimate Products (LSE:ULTP) | £0.64 | £54.06M | ✅ 4 ⚠️ 3 View Analysis > |

| Helios Underwriting (AIM:HUW) | £2.21 | £160.1M | ✅ 4 ⚠️ 2 View Analysis > |

| Warpaint London (AIM:W7L) | £3.60 | £290.83M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.40 | £385.22M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £3.665 | £353.29M | ✅ 3 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.36 | £173.77M | ✅ 2 ⚠️ 3 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.612 | £999.84M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.972 | £155.02M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.962 | £2.18B | ✅ 5 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.34 | £36.79M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 388 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

FRP Advisory Group (AIM:FRP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: FRP Advisory Group plc, with a market cap of £327.04 million, offers business advisory services to companies, lenders, investors, individuals, and other stakeholders through its subsidiaries.

Operations: The company generated £147.1 million in revenue from its specialist business advisory services segment.

Market Cap: £327.04M

FRP Advisory Group plc, with a market cap of £327.04 million, has demonstrated strong financial health and growth potential. The company generated £147.1 million in revenue from its business advisory services, showing substantial earnings growth of 68.6% over the past year, surpassing industry averages. Its return on equity is high at 30.7%, and short-term assets significantly exceed both short- and long-term liabilities, indicating robust financial stability. Despite an increase in the debt-to-equity ratio over five years, FRP maintains well-covered interest payments and cash flow coverage for its debt obligations remains strong at 319.1%.

- Jump into the full analysis health report here for a deeper understanding of FRP Advisory Group.

- Assess FRP Advisory Group's future earnings estimates with our detailed growth reports.

MJ Gleeson (LSE:GLE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: MJ Gleeson plc operates in the United Kingdom, focusing on house building and land promotion and sales, with a market cap of £274.06 million.

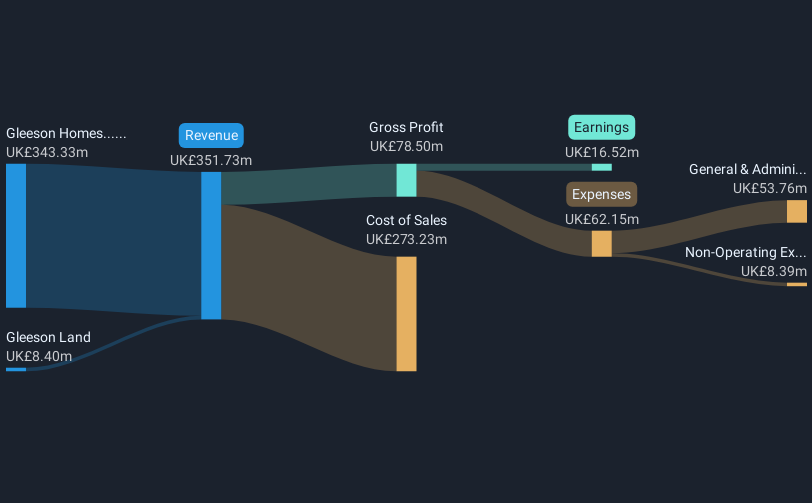

Operations: The company generates revenue through its two main segments: Gleeson Homes, contributing £343.33 million, and Gleeson Land, adding £8.40 million.

Market Cap: £274.06M

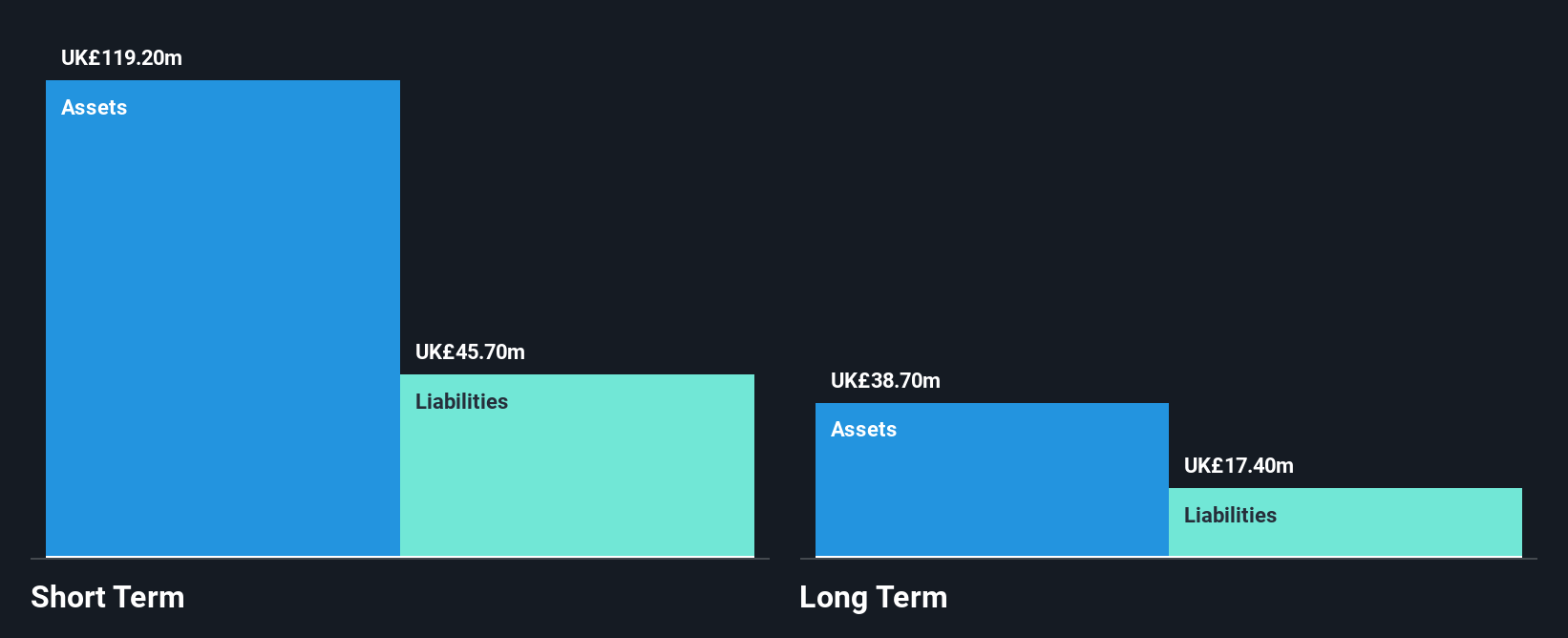

MJ Gleeson plc, with a market cap of £274.06 million, operates in the house building and land promotion sectors. The company reported half-year sales of £157.85 million, up from £151.46 million the previous year, though net income decreased to £2.8 million from £5.59 million. Despite this decline, MJ Gleeson maintains financial stability with short-term assets exceeding both short- and long-term liabilities significantly (£379.3M vs £75.5M and £15.6M respectively). The company's debt is well managed with a satisfactory net debt to equity ratio of 1.7%, and interest payments are covered 7.8 times by EBIT, indicating sound fiscal management amidst challenging earnings growth conditions.

- Get an in-depth perspective on MJ Gleeson's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into MJ Gleeson's future.

Luceco (LSE:LUCE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Luceco plc is a company that manufactures and distributes wiring accessories, LED lighting, and portable power products across various regions including the United Kingdom, the Americas, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of £201.30 million.

Operations: The company's revenue is primarily derived from three segments: Wiring Accessories (£108.9 million), LED Lighting (£78.4 million), and Portable Power (£55.2 million).

Market Cap: £201.3M

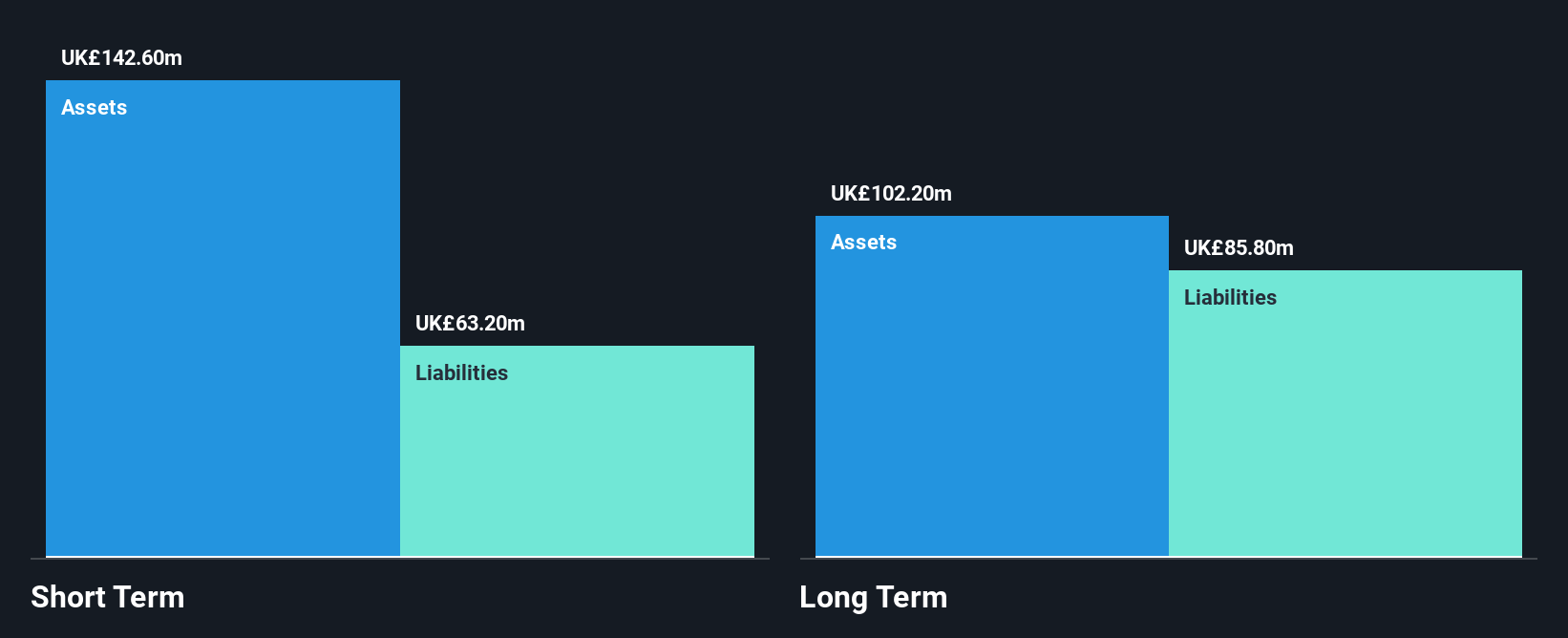

Luceco plc, with a market cap of £201.30 million, recently reported increased sales of £242.5 million for 2024, up from £209 million the previous year, though net income declined to £14.6 million from £16.7 million. Despite this earnings dip and a high net debt to equity ratio of 70.7%, the company's debt is well covered by operating cash flow (20.4%) and interest payments are adequately managed (5.4x EBIT coverage). Trading at 55% below estimated fair value and stable weekly volatility (7%), Luceco offers potential upside but faces challenges with low profit margins and earnings growth pressures in its sector.

- Unlock comprehensive insights into our analysis of Luceco stock in this financial health report.

- Examine Luceco's earnings growth report to understand how analysts expect it to perform.

Next Steps

- Take a closer look at our UK Penny Stocks list of 388 companies by clicking here.

- Looking For Alternative Opportunities? This technology could replace computers: discover the 21 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:LUCE

Luceco

Manufactures and distributes wiring accessories, LED lighting, and portable power products in the United Kingdom, the Americas, Europe, the Middle East, Africa, the Asia Pacific.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives