- United Kingdom

- /

- Consumer Durables

- /

- AIM:IGR

Shareholders May Be More Conservative With IG Design Group plc's (LON:IGR) CEO Compensation For Now

In the past three years, shareholders of IG Design Group plc (LON:IGR) have seen a loss on their investment. In addition, the company's per-share earnings growth is not looking good, despite growing revenues. Shareholders will have a chance to take their concerns to the board at the next AGM on 20 September 2021 and vote on resolutions including executive compensation, which studies show may have an impact on company performance. We think shareholders may be cautious of approving a pay rise for the CEO at the moment, based on our analysis below.

See our latest analysis for IG Design Group

Comparing IG Design Group plc's CEO Compensation With the industry

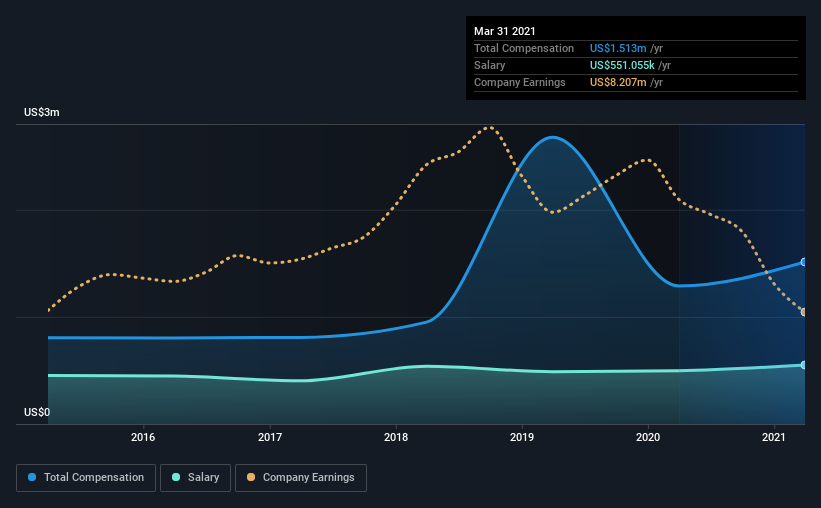

Our data indicates that IG Design Group plc has a market capitalization of UK£523m, and total annual CEO compensation was reported as US$1.5m for the year to March 2021. Notably, that's an increase of 17% over the year before. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$551k.

For comparison, other companies in the same industry with market capitalizations ranging between UK£291m and UK£1.2b had a median total CEO compensation of US$981k. Accordingly, our analysis reveals that IG Design Group plc pays Paul Fineman north of the industry median.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | US$551k | US$498k | 36% |

| Other | US$961k | US$790k | 64% |

| Total Compensation | US$1.5m | US$1.3m | 100% |

On an industry level, around 69% of total compensation represents salary and 31% is other remuneration. IG Design Group sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at IG Design Group plc's Growth Numbers

Over the last three years, IG Design Group plc has shrunk its earnings per share by 34% per year. In the last year, its revenue is up 40%.

The reduction in EPS, over three years, is arguably concerning. On the other hand, the strong revenue growth suggests the business is growing. It's hard to reach a conclusion about business performance right now. This may be one to watch. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has IG Design Group plc Been A Good Investment?

Given the total shareholder loss of 8.5% over three years, many shareholders in IG Design Group plc are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

The loss to shareholders over the past three years is certainly concerning and possibly has something to do with the fact that the company's earnings haven't grown. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 3 warning signs for IG Design Group that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading IG Design Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:IGR

IG Design Group

Engages in the design, production, and distribution of gift packaging, arty, goods not for resale, craft, stationery, and homeware consumable products in the Americas, the United Kingdom, Netherlands, and internationally.

Excellent balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026