- United Kingdom

- /

- Professional Services

- /

- AIM:RWS

UK's April 2025 Penny Stock Picks: Discovering Hidden Opportunities

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting the interconnectedness of global economies. Despite these broader market fluctuations, penny stocks continue to capture investor interest as a niche area offering potential growth opportunities. While once considered a buzzword, penny stocks remain relevant for those seeking smaller or newer companies with strong financial health that could offer stability and upside potential.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Ultimate Products (LSE:ULTP) | £0.64 | £54.1M | ✅ 4 ⚠️ 4 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.65 | £273.74M | ✅ 4 ⚠️ 1 View Analysis > |

| Next 15 Group (AIM:NFG) | £2.46 | £244.66M | ✅ 4 ⚠️ 5 View Analysis > |

| Central Asia Metals (AIM:CAML) | £1.50 | £260.96M | ✅ 4 ⚠️ 2 View Analysis > |

| Warpaint London (AIM:W7L) | £3.60 | £290.83M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.23 | £365.96M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £3.605 | £347.51M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £149.92M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.774 | £2.08B | ✅ 5 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.34 | £36.79M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 390 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Avingtrans (AIM:AVG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Avingtrans plc, with a market cap of £107.80 million, provides engineered components, systems, and services to the energy, medical, and infrastructure industries across various global regions including the UK, Europe, the USA, Africa, and Asia Pacific.

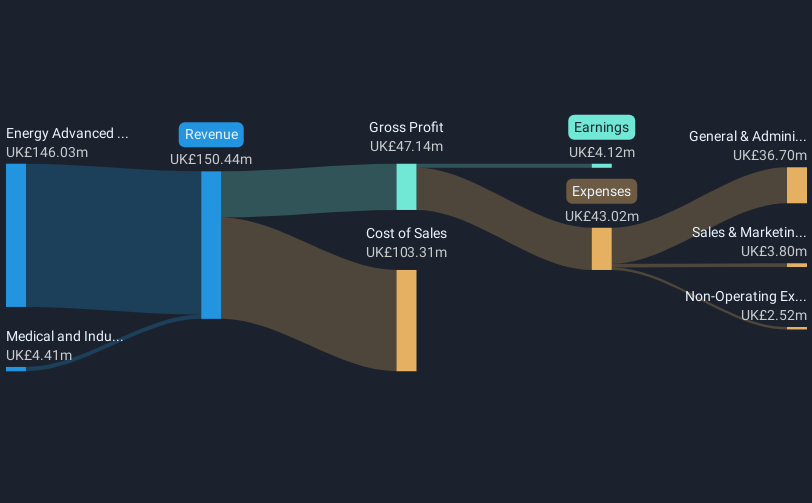

Operations: The company generates revenue primarily from its Energy Advanced Engineering Systems segment, which accounts for £146.03 million, and its Medical and Industrial Imaging segment, contributing £4.41 million.

Market Cap: £107.8M

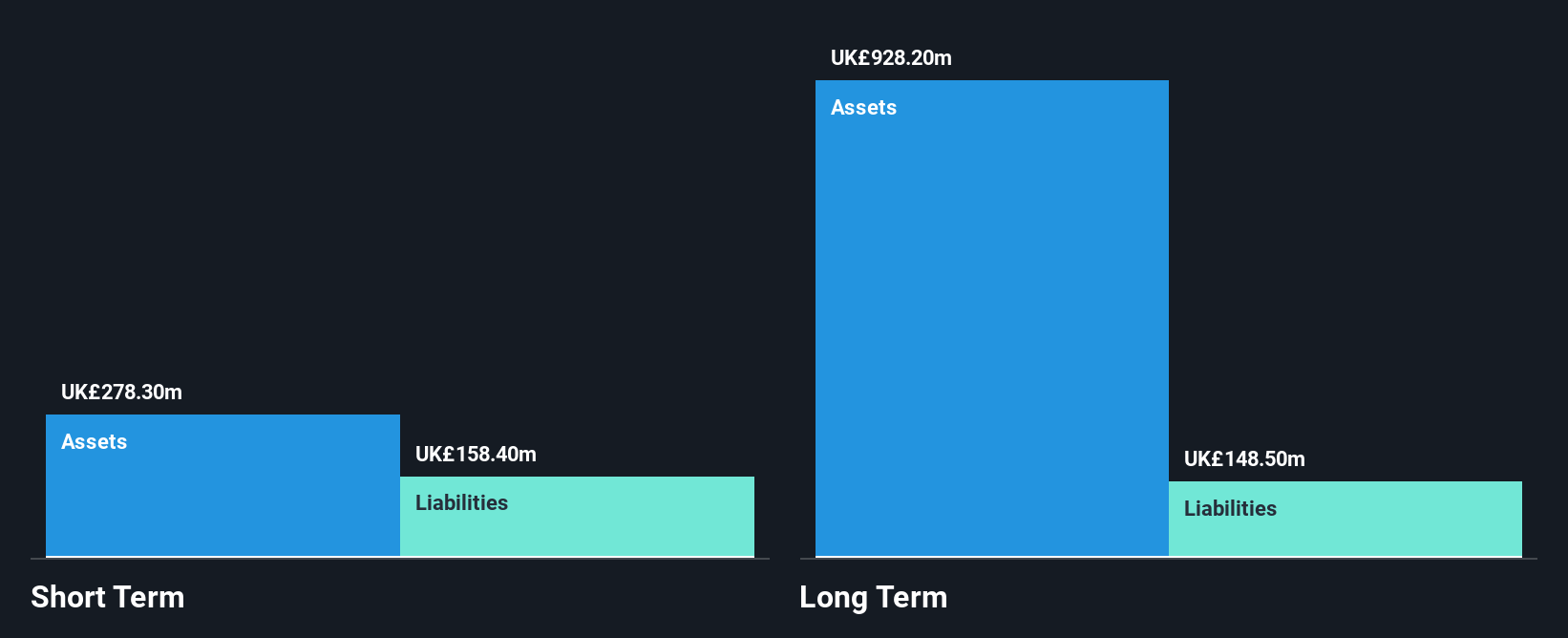

Avingtrans plc, with a market cap of £107.80 million, shows mixed signals as a penny stock. The company has secured significant contracts, such as a £4.5 million deal for HS2 fire doors, indicating business growth potential. Recent earnings reveal increased sales to £79.02 million and net income of £3.29 million for the half year ended November 2024, but profit margins decreased from 4.7% to 2.7%. While debt is well-managed and short-term assets cover liabilities comfortably, recent negative earnings growth presents challenges despite forecasts suggesting substantial future growth prospects at 47.5% annually.

- Click here to discover the nuances of Avingtrans with our detailed analytical financial health report.

- Examine Avingtrans' earnings growth report to understand how analysts expect it to perform.

RWS Holdings (AIM:RWS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RWS Holdings plc offers technology-enabled language, content, and intellectual property services across the UK, Continental Europe, the United States, and internationally with a market cap of £416.37 million.

Operations: The company's revenue is derived from four main segments: IP Services (£102.3 million), Language Services (£327.1 million), Regulated Industry (£146.5 million), and Language & Content Technology (£142.3 million).

Market Cap: £416.37M

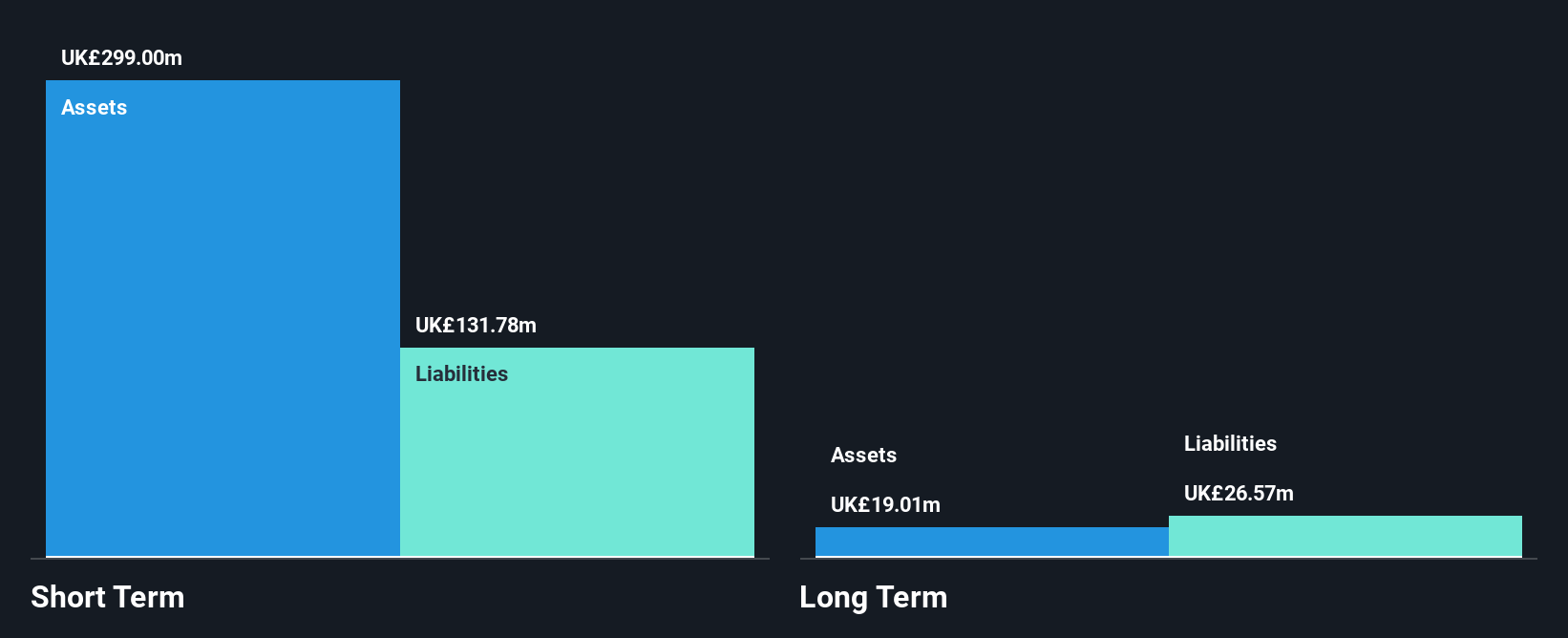

RWS Holdings, with a market cap of £416.37 million, presents a complex picture as a penny stock. The company recently turned profitable, though its earnings have historically declined by 23.1% annually over five years. Despite this, RWS's debt is well managed and covered by operating cash flow at 101.2%, and its short-term assets exceed liabilities comfortably. However, the dividend yield of 11.06% is not well supported by earnings or free cash flows. Recent strategic changes include appointing Joseph Ayala to enhance growth through M&A strategies and strengthening ties with Canva as an official localization partner for global expansion initiatives.

- Unlock comprehensive insights into our analysis of RWS Holdings stock in this financial health report.

- Understand RWS Holdings' earnings outlook by examining our growth report.

Springfield Properties (AIM:SPR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Springfield Properties Plc, with a market cap of £105.92 million, operates in the United Kingdom as a house building company through its subsidiaries.

Operations: The company generates revenue of £250.48 million from its housing building activity segment.

Market Cap: £105.92M

Springfield Properties, with a market cap of £105.92 million, shows mixed performance as a penny stock. While its earnings grew by 9.9% over the past year and profit margins improved to 3.6%, it faces challenges with declining sales and forecasted earnings contraction by an average of 5.5% annually over the next three years. The company’s debt is well covered by operating cash flow at 57.7%, and short-term assets significantly exceed liabilities, indicating solid financial management despite low return on equity at 5.7%. Recently, Springfield appointed Johnston Carmichael LLP as its new auditor without any issues reported from the previous auditor transition.

- Click here and access our complete financial health analysis report to understand the dynamics of Springfield Properties.

- Gain insights into Springfield Properties' future direction by reviewing our growth report.

Next Steps

- Click here to access our complete index of 390 UK Penny Stocks.

- Searching for a Fresh Perspective? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade RWS Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:RWS

RWS Holdings

Provides technology-enabled language, content, and intellectual property (IP) services in the United Kingdom, Continental Europe, the United States, and internationally.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives