- United Kingdom

- /

- Oil and Gas

- /

- LSE:GKP

3 UK Growth Companies Insiders Own With At Least 29% Earnings Growth

Reviewed by Simply Wall St

In the current climate, the UK market is grappling with challenges as the FTSE 100 index recently dipped due to weak trade data from China, highlighting concerns over global economic recovery. Amidst these uncertainties, growth companies with high insider ownership can offer a unique perspective on potential resilience and confidence in their long-term prospects.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 23.7% |

| Gaming Realms (AIM:GMR) | 20.1% | 22.1% |

| LSL Property Services (LSE:LSL) | 10.8% | 28.2% |

| Foresight Group Holdings (LSE:FSG) | 31.8% | 27.9% |

| Judges Scientific (AIM:JDG) | 11% | 23% |

| Enteq Technologies (AIM:NTQ) | 20% | 53.8% |

| Facilities by ADF (AIM:ADF) | 22.7% | 144.7% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 29.6% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 80.6% |

Let's dive into some prime choices out of the screener.

Fintel (AIM:FNTL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fintel Plc provides intermediary services and distribution channels to the retail financial services sector in the United Kingdom, with a market cap of £272.96 million.

Operations: The company's revenue is derived from three main segments: Research & Fintech (£24.20 million), Distribution Channels (£21.40 million), and Intermediary Services (£23.30 million).

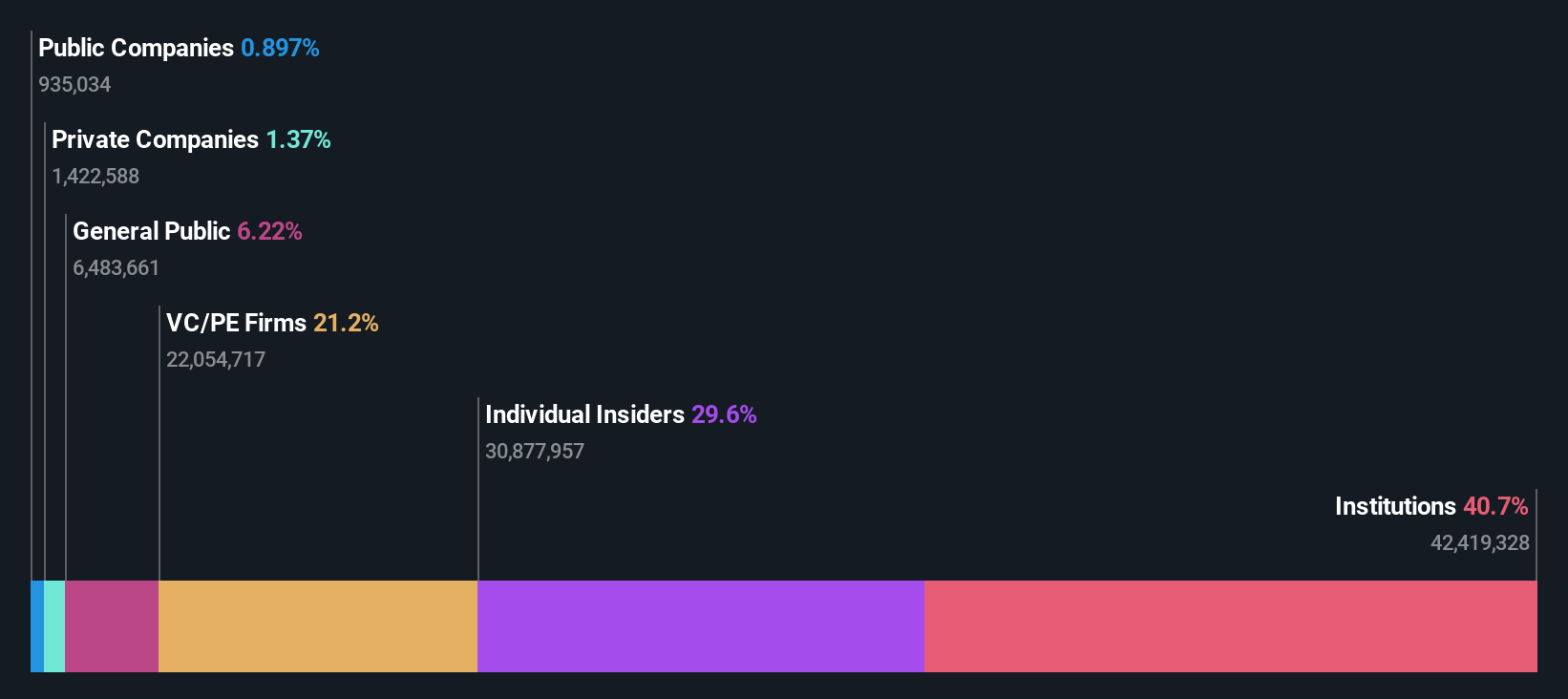

Insider Ownership: 29.1%

Earnings Growth Forecast: 32.6% p.a.

Fintel's revenue is forecasted to grow at 10% annually, outpacing the UK market growth of 3.6%. Despite a decline in profit margins from 12.7% to 8.6%, earnings are expected to grow significantly at over 20% annually, surpassing the UK market's projected growth of 14.2%. The company trades below its estimated fair value and announced an interim dividend increase, reflecting potential value for investors focused on growth amidst high insider ownership dynamics.

- Delve into the full analysis future growth report here for a deeper understanding of Fintel.

- In light of our recent valuation report, it seems possible that Fintel is trading beyond its estimated value.

Mortgage Advice Bureau (Holdings) (AIM:MAB1)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mortgage Advice Bureau (Holdings) plc, with a market cap of £411.49 million, operates in the United Kingdom offering mortgage advice services through its subsidiaries.

Operations: The company generates revenue of £243.31 million from its provision of financial services in the UK.

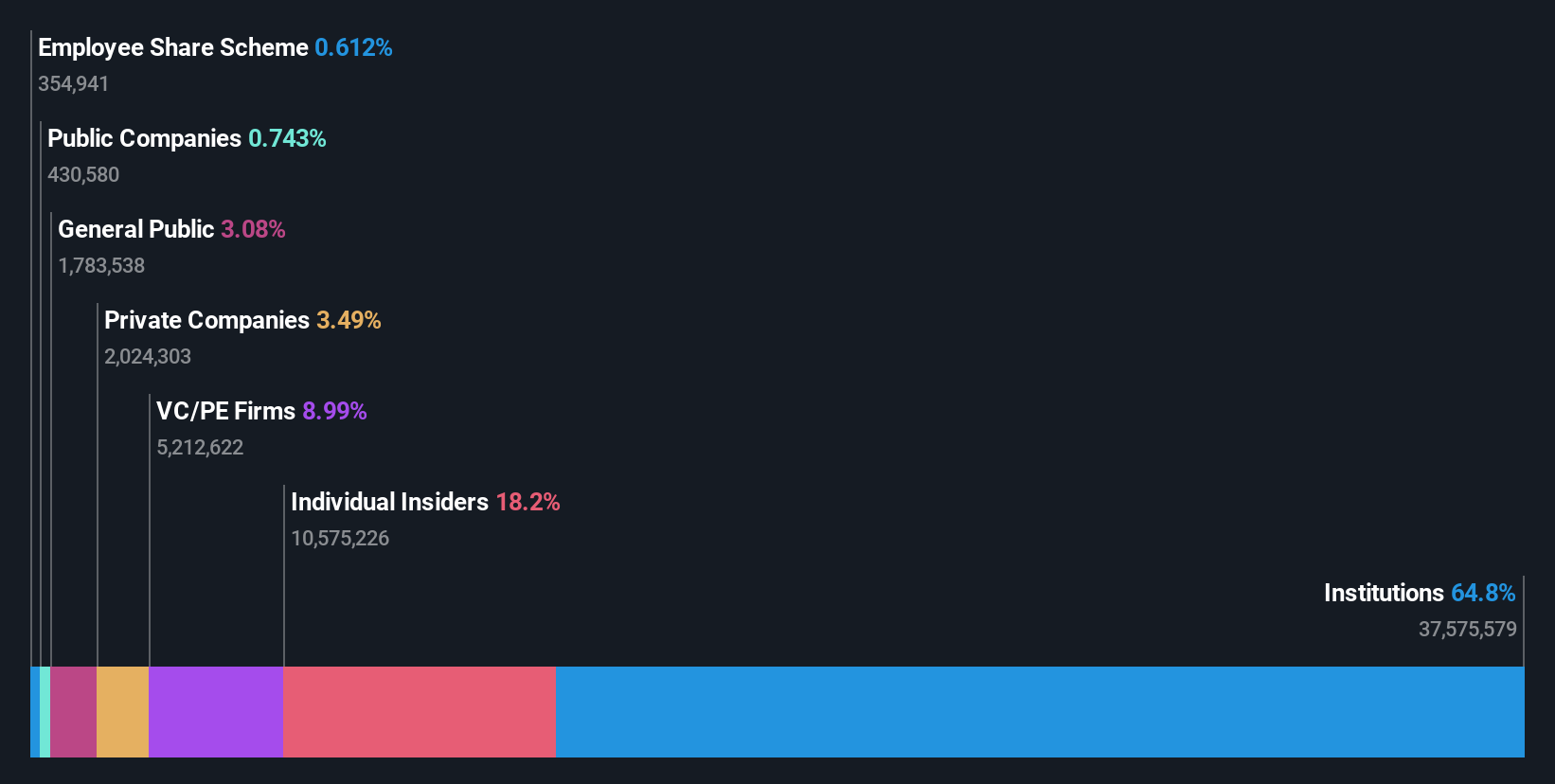

Insider Ownership: 19.8%

Earnings Growth Forecast: 29.6% p.a.

Mortgage Advice Bureau (Holdings) is poised for significant earnings growth, with forecasts indicating a 29.6% annual increase, surpassing the UK market's 14.2%. Despite high share price volatility and a dividend not fully covered by earnings, insider activity shows more purchases than sales recently. Revenue growth is expected at 15.3% annually, outpacing the broader UK market's 3.6%. Recent half-year results revealed net income of £3.7 million, down from £6.42 million last year.

- Unlock comprehensive insights into our analysis of Mortgage Advice Bureau (Holdings) stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Mortgage Advice Bureau (Holdings) shares in the market.

Gulf Keystone Petroleum (LSE:GKP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Gulf Keystone Petroleum Limited focuses on the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq, with a market cap of £276.53 million.

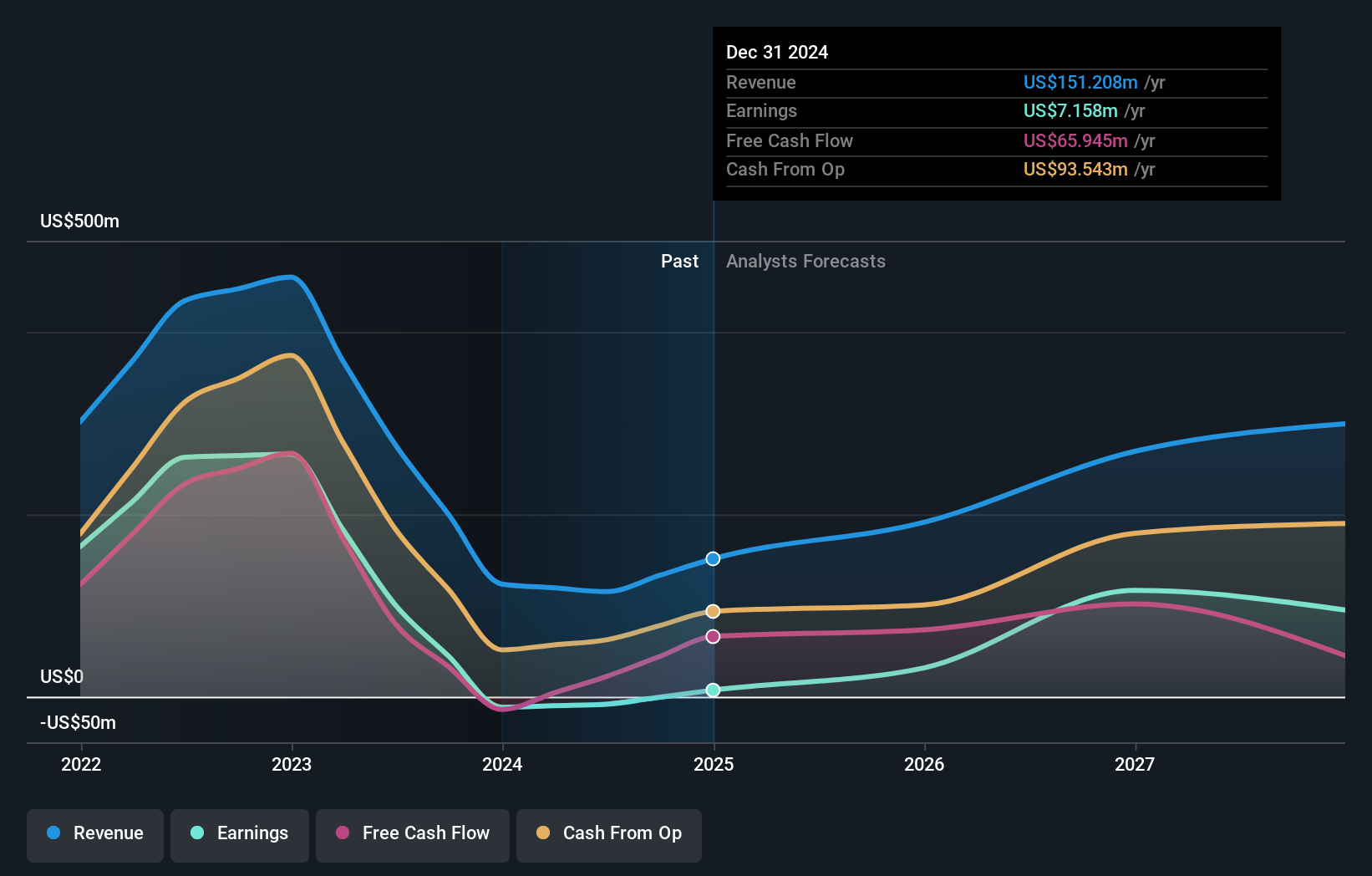

Operations: The company's revenue is primarily derived from the exploration and production of oil and gas, totaling $115.15 million.

Insider Ownership: 12.2%

Earnings Growth Forecast: 80.6% p.a.

Gulf Keystone Petroleum is set for robust growth, expecting earnings to rise 80.57% annually and revenue to increase 42.8% per year, outpacing the UK market. Insider activity shows more buying than selling in recent months, reflecting confidence despite a challenging period marked by leadership changes following the passing of its Chair. Recent results indicate a return to profitability with net income of US$0.44 million compared to last year's loss, supported by strategic share buybacks totaling US$10 million.

- Take a closer look at Gulf Keystone Petroleum's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Gulf Keystone Petroleum is priced higher than what may be justified by its financials.

Taking Advantage

- Explore the 65 names from our Fast Growing UK Companies With High Insider Ownership screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GKP

Gulf Keystone Petroleum

Engages in the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq.

Exceptional growth potential with excellent balance sheet.