- United Kingdom

- /

- Electrical

- /

- AIM:GELN

December 2024's Top Picks: UK Penny Stocks To Watch

Reviewed by Simply Wall St

The UK market has recently experienced turbulence, with the FTSE 100 and FTSE 250 indices reflecting concerns over weak trade data from China and its impact on global economic recovery. Despite these challenges, investors often turn to penny stocks as a potential avenue for discovering value and growth opportunities that larger firms may overlook. Although the term "penny stocks" might seem outdated, these smaller or newer companies can still offer substantial potential when backed by strong financials, making them an intriguing option for those seeking under-the-radar investments.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.085 | £785.55M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.60 | £68.66M | ★★★★☆☆ |

| Luceco (LSE:LUCE) | £1.288 | £198.65M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.38 | £175.75M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.88 | £385.89M | ★★★★☆☆ |

| Foresight Group Holdings (LSE:FSG) | £4.00 | £458.26M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.155 | £98.68M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.43 | £310.49M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.435 | $252.88M | ★★★★★★ |

Click here to see the full list of 471 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Gelion (AIM:GELN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Gelion plc, along with its subsidiary, focuses on the research and development, design, manufacture, and sale of battery systems both in the United Kingdom and internationally, with a market cap of £23.12 million.

Operations: No revenue segments have been reported.

Market Cap: £23.12M

Gelion plc, with a market cap of £23.12 million, is pre-revenue and unprofitable but shows potential in the battery technology sector. The company has secured a £2.5 million grant from the Australian Renewable Energy Agency to advance its lithium-sulfur and silicon-sulfur battery technologies, which could position it for future revenue generation through partnerships and commercial scale-up. Despite high share price volatility, Gelion's recent equity offerings have bolstered its financial runway. Its strategic focus on energy storage solutions aims to leverage existing capabilities while preparing for eventual commercialization of proprietary technologies.

- Get an in-depth perspective on Gelion's performance by reading our balance sheet health report here.

- Explore historical data to track Gelion's performance over time in our past results report.

Parkmead Group (AIM:PMG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: The Parkmead Group plc is an independent oil and gas company focused on the exploration and production of oil and gas properties in Europe, with a market cap of £20.76 million.

Operations: The company's revenue is derived from two main segments: £0.68 million from renewables and £5.04 million from oil and gas exploration and production.

Market Cap: £20.76M

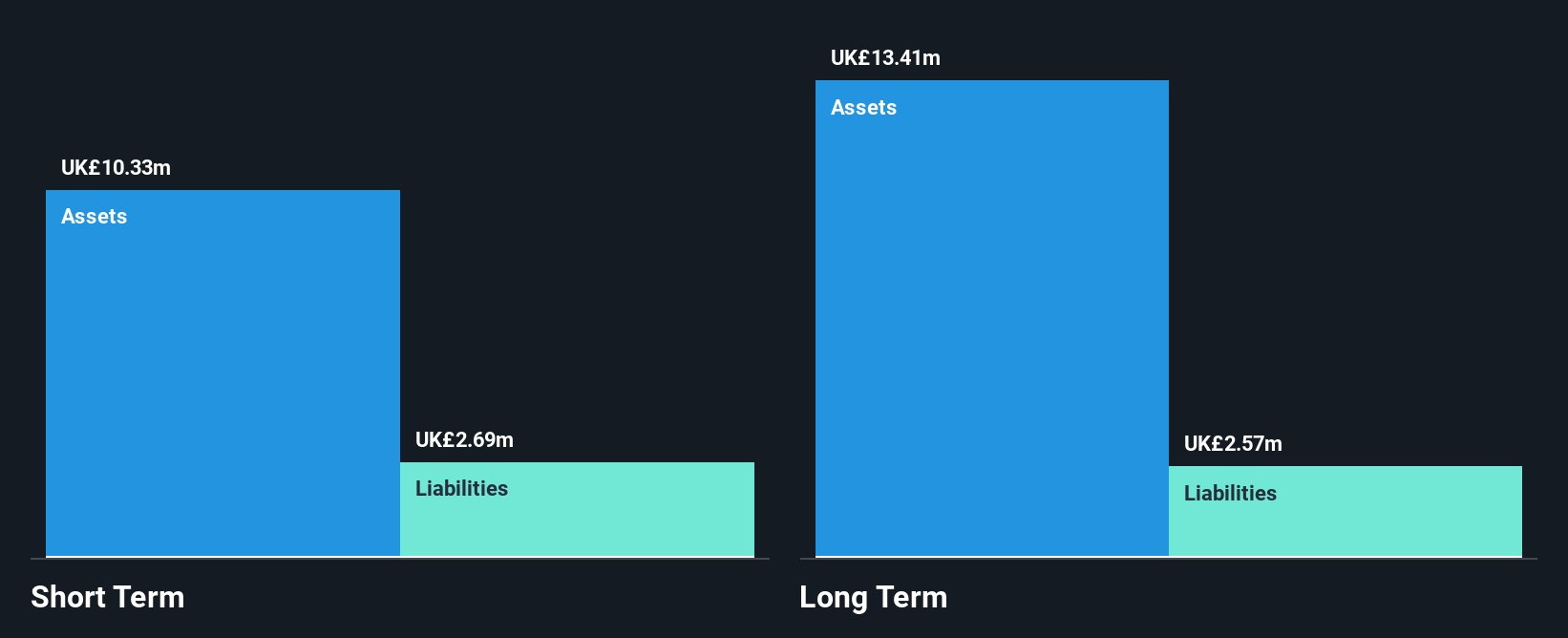

Parkmead Group, with a market cap of £20.76 million, has transitioned to profitability recently, reporting net income of £4.94 million for the year ending June 2024 despite a decline in sales to £5.72 million from the previous year's £14.77 million. Its financial strength is underscored by more cash than debt and strong interest coverage, positioning it well for potential acquisitions in renewable energy and international exploration sectors. The company's stable weekly volatility remains higher than most UK stocks but hasn't deterred its strategic focus on enhancing shareholder value through targeted investments and acquisitions in cashflow-generating assets.

- Jump into the full analysis health report here for a deeper understanding of Parkmead Group.

- Examine Parkmead Group's past performance report to understand how it has performed in prior years.

Secure Trust Bank (LSE:STB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Secure Trust Bank PLC offers banking and financial products and services in the United Kingdom, with a market cap of £68.66 million.

Operations: The company generates revenue through its Consumer Finance segment, comprising Retail Finance (£87.8 million) and Vehicle Finance (£30.5 million), as well as its Business Finance segment, which includes Commercial Finance (£30.3 million) and Real Estate Finance (£31.6 million).

Market Cap: £68.66M

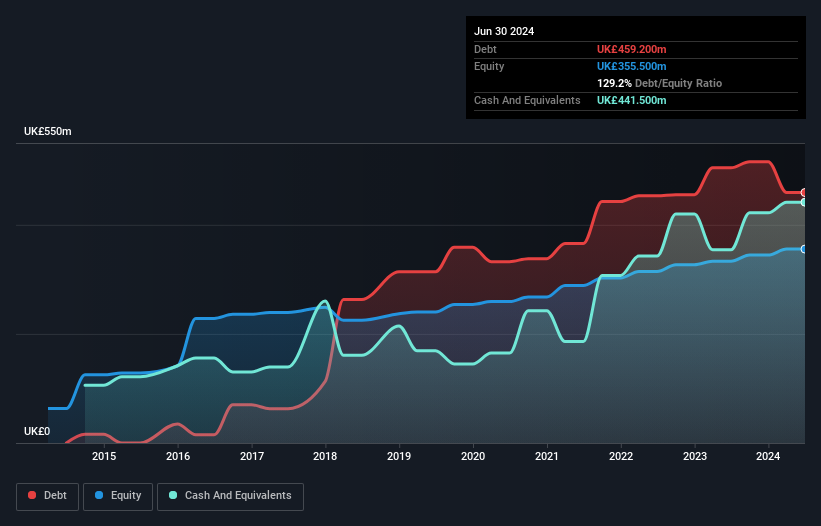

Secure Trust Bank PLC, with a market cap of £68.66 million, shows promising growth in earnings, having increased by 33.8% over the past year, surpassing industry averages. Despite its high volatility and unstable dividend track record, the bank's assets to equity ratio is moderate at 11x, and it maintains an appropriate loans to deposits ratio of 112%. The company's net profit margin has improved from last year to 18.7%, although it faces challenges with a high bad loans ratio of 4.5%. Recent board changes may influence strategic direction as Julie Hopes joins as Non-Executive Director.

- Navigate through the intricacies of Secure Trust Bank with our comprehensive balance sheet health report here.

- Gain insights into Secure Trust Bank's future direction by reviewing our growth report.

Make It Happen

- Click here to access our complete index of 471 UK Penny Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:GELN

Gelion

Together with its subsidiary, engages in the research and development, manufacture, and sale of battery systems in the United Kingdom and internationally.

Flawless balance sheet moderate.

Similar Companies

Market Insights

Community Narratives