The UK market has been experiencing fluctuations, with the FTSE 100 index recently closing lower due to weak trade data from China, highlighting global economic interdependencies. For investors looking beyond well-known names, penny stocks can offer intriguing opportunities despite their somewhat outdated moniker. These smaller or newer companies often present a blend of value and growth potential, making them worth considering for those seeking under-the-radar investments with solid financial foundations.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.085 | £785.55M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.60 | £68.66M | ★★★★☆☆ |

| Luceco (LSE:LUCE) | £1.288 | £198.65M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.38 | £175.75M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.88 | £385.89M | ★★★★☆☆ |

| Foresight Group Holdings (LSE:FSG) | £4.00 | £458.26M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.155 | £98.68M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.43 | £310.49M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.435 | $252.88M | ★★★★★★ |

Click here to see the full list of 471 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

ITM Power (AIM:ITM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ITM Power Plc designs and manufactures proton exchange membrane (PEM) electrolysers, operating in the United Kingdom, Germany, Australia, the rest of Europe, and the United States with a market cap of £220.90 million.

Operations: The company generates revenue of £16.51 million from its electric equipment segment.

Market Cap: £220.9M

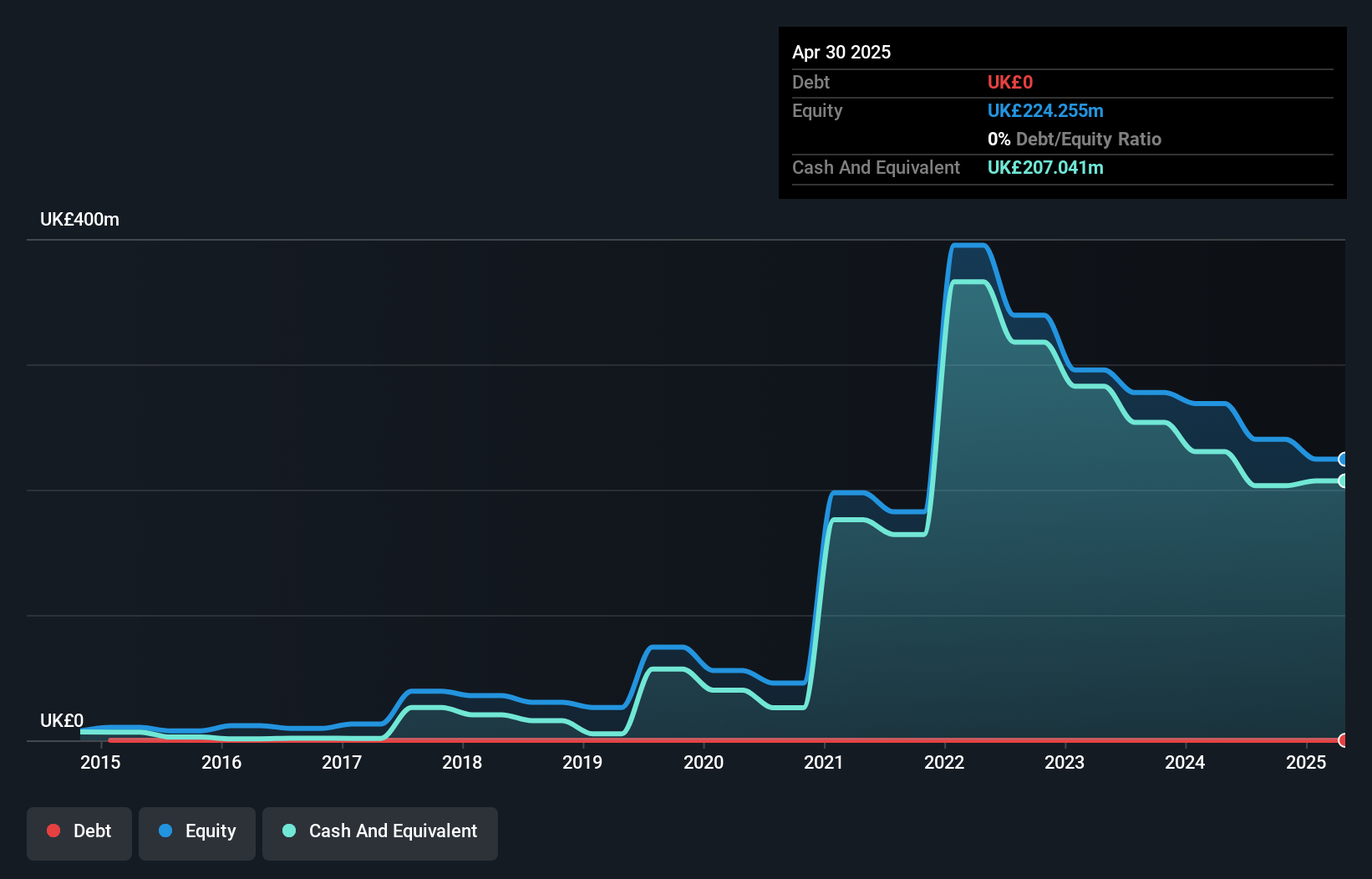

ITM Power has been actively securing contracts, including supplying NEPTUNE V units to Germany and a FEED contract for a 50MW green hydrogen site in the EU. Despite generating £15.2 million in revenue for the half year ending October 2024, the company remains unprofitable with increasing losses over five years. However, ITM is debt-free with sufficient cash runway exceeding three years and robust short-term asset coverage against liabilities. The stock exhibits high volatility compared to most UK stocks but shows potential revenue growth of 37.33% annually, supported by an experienced management team and board of directors.

- Click here and access our complete financial health analysis report to understand the dynamics of ITM Power.

- Explore ITM Power's analyst forecasts in our growth report.

AJ Bell (LSE:AJB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AJ Bell plc operates investment platforms in the United Kingdom and has a market capitalization of approximately £1.87 billion.

Operations: The company generates revenue of £268.53 million from its Investment Services segment.

Market Cap: £1.87B

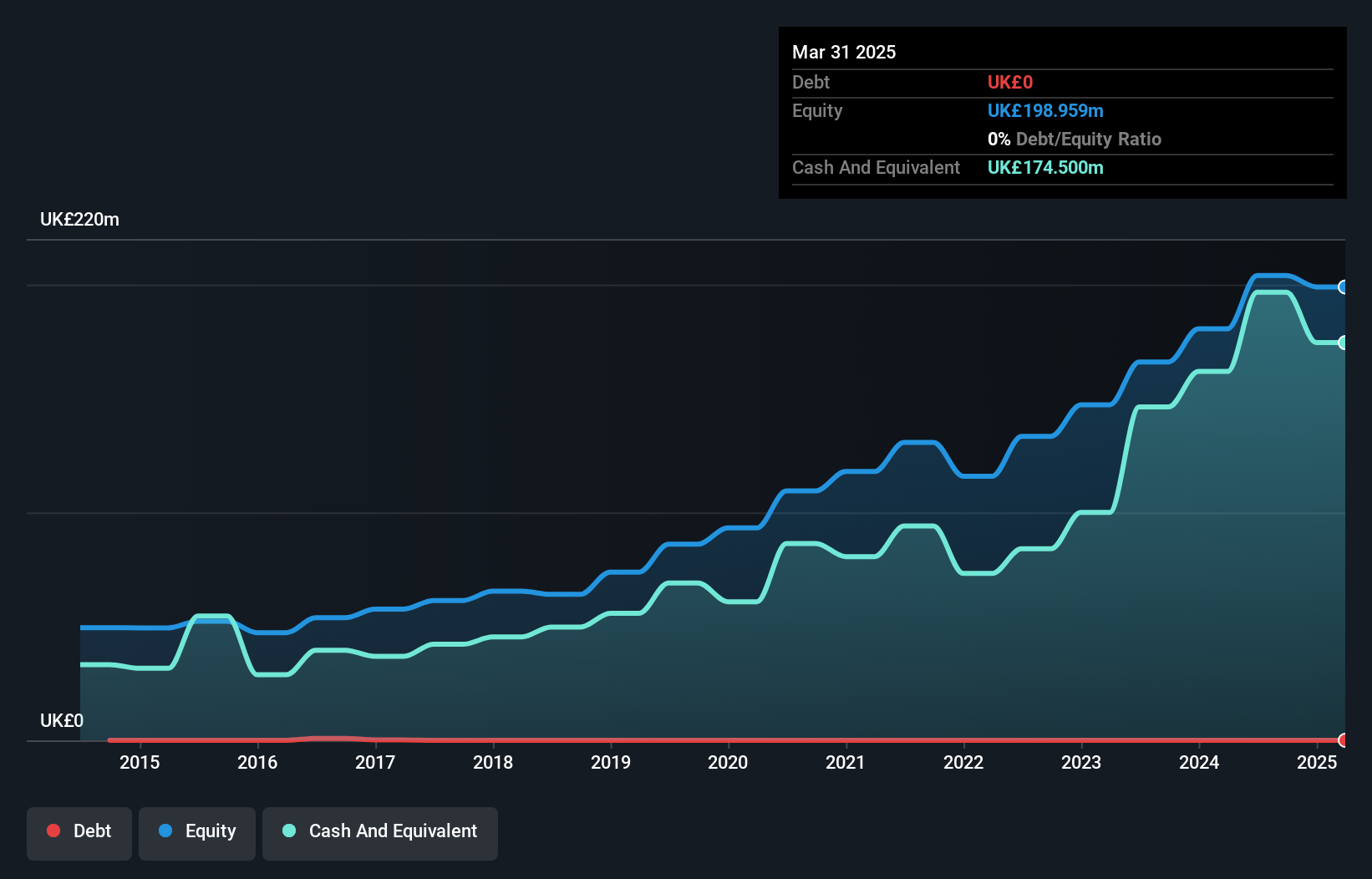

AJ Bell plc, with a market cap of £1.87 billion, demonstrates strong financial health as its short-term assets comfortably exceed both short and long-term liabilities. The company is debt-free, ensuring no concern over interest payments or cash flow coverage for debt. Earnings have grown significantly at 23.6% over the past year, surpassing industry growth rates and reflecting high-quality earnings with an outstanding return on equity of 41.3%. Recent strategic moves include a £30 million share buyback program and an increased dividend payout, showcasing confidence in its capital position while exploring potential M&A opportunities to enhance growth further.

- Click here to discover the nuances of AJ Bell with our detailed analytical financial health report.

- Assess AJ Bell's future earnings estimates with our detailed growth reports.

Baltic Classifieds Group (LSE:BCG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Baltic Classifieds Group PLC operates online classifieds portals for automotive, real estate, jobs and services, and general merchandise in Estonia, Latvia, and Lithuania with a market cap of £1.51 billion.

Operations: The company generates revenue from its segments as follows: Auto (€29.89 million), Real Estate (€20.27 million), Jobs & Services (€15.03 million), and Generalist (€12.92 million).

Market Cap: £1.51B

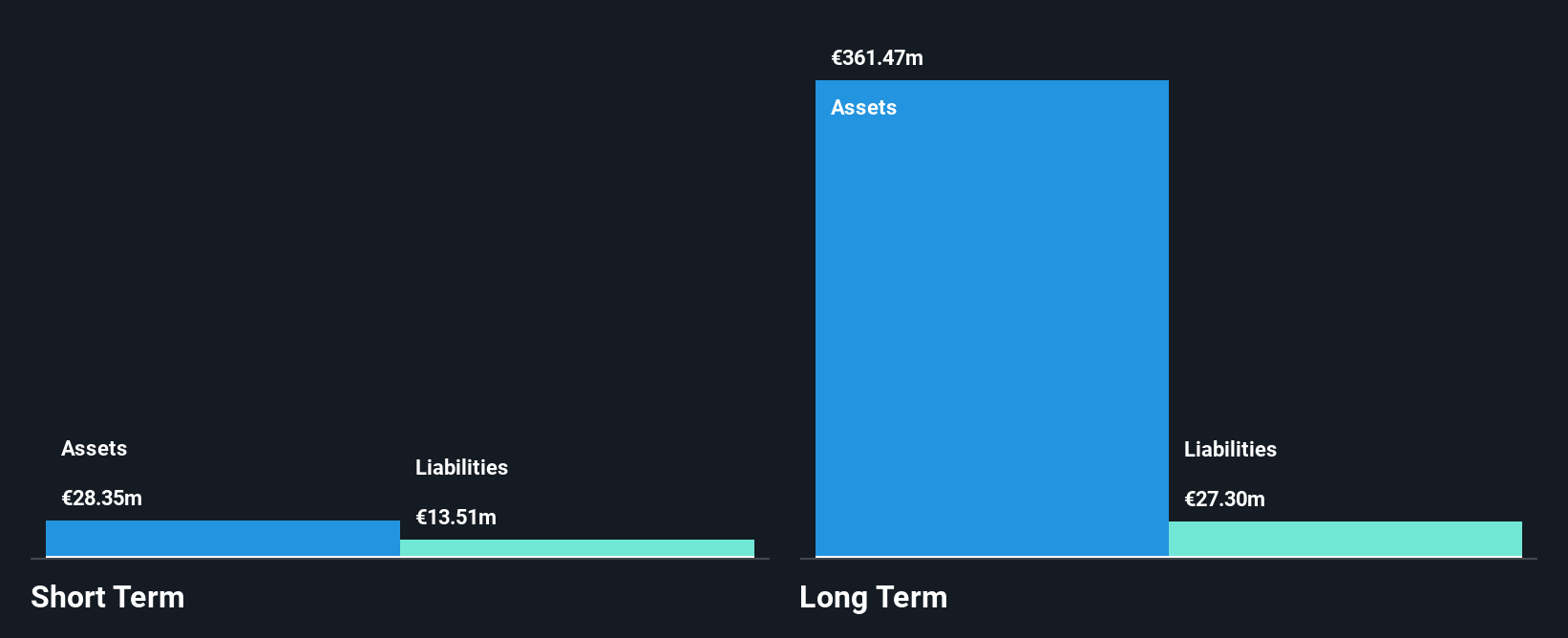

Baltic Classifieds Group PLC, with a market cap of £1.51 billion, shows robust financial performance in its classified portals across the Baltic region. The company reported half-year sales of €41.83 million and net income of €21.69 million, reflecting strong earnings growth and improved profit margins compared to the previous year. Despite a low return on equity at 11.6%, its debt is well covered by operating cash flow, and short-term assets exceed short-term liabilities but not long-term ones. Recent initiatives include dividend affirmations and seeking M&A opportunities, indicating strategic growth intentions while maintaining financial stability.

- Dive into the specifics of Baltic Classifieds Group here with our thorough balance sheet health report.

- Gain insights into Baltic Classifieds Group's future direction by reviewing our growth report.

Next Steps

- Gain an insight into the universe of 471 UK Penny Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baltic Classifieds Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BCG

Baltic Classifieds Group

Owns and operates online classifieds portals for automotive, real estate, jobs and services, and general merchandise in Estonia, Latvia, and Lithuania.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives