- United Kingdom

- /

- Professional Services

- /

- AIM:FNTL

3 UK Stocks Estimated To Be Trading Below Intrinsic Value By Up To 40.5%

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently experienced a downturn, influenced by weak trade data from China, highlighting the interconnectedness of global markets and the challenges faced by economies attempting to recover post-pandemic. Amid these conditions, investors may find opportunities in stocks that are trading below their intrinsic value, offering potential for growth if market sentiments shift favorably.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| On the Beach Group (LSE:OTB) | £2.275 | £4.47 | 49.1% |

| Dr. Martens (LSE:DOCS) | £0.656 | £1.22 | 46.4% |

| Gaming Realms (AIM:GMR) | £0.365 | £0.67 | 45.7% |

| Legal & General Group (LSE:LGEN) | £2.46 | £4.87 | 49.5% |

| Victrex (LSE:VCT) | £9.24 | £18.16 | 49.1% |

| Deliveroo (LSE:ROO) | £1.35 | £2.46 | 45.2% |

| Likewise Group (AIM:LIKE) | £0.195 | £0.37 | 47.5% |

| Calnex Solutions (AIM:CLX) | £0.555 | £1.01 | 45.2% |

| Optima Health (AIM:OPT) | £1.82 | £3.34 | 45.4% |

| Melrose Industries (LSE:MRO) | £6.55 | £12.22 | 46.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

Fintel (AIM:FNTL)

Overview: Fintel Plc provides intermediary services and distribution channels to the retail financial services sector in the United Kingdom, with a market cap of £287.57 million.

Operations: The company's revenue segments include Research & Fintech (£24.20 million), Distribution Channels (£21.40 million), and Intermediary Services (£23.30 million).

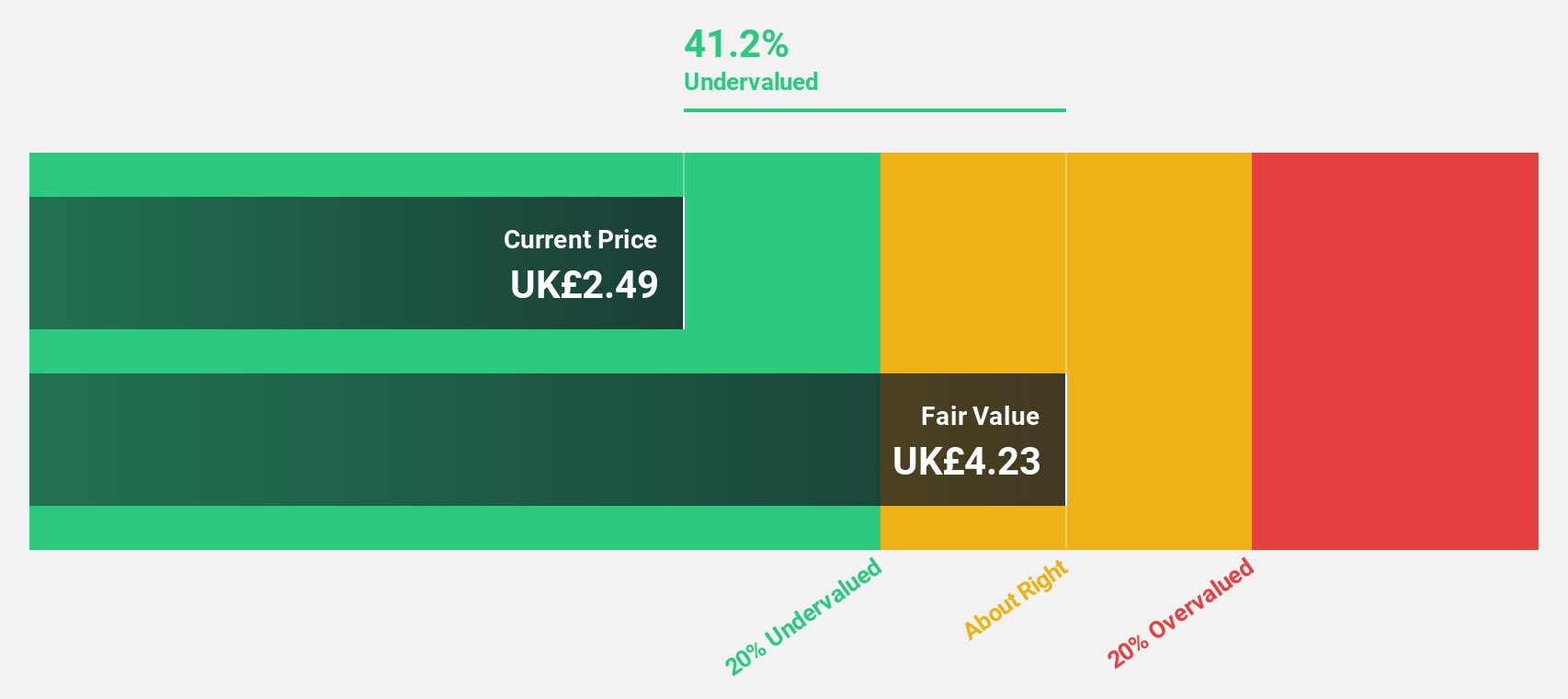

Estimated Discount To Fair Value: 33.8%

Fintel appears undervalued, trading at £2.76 compared to a fair value estimate of £4.17, with earnings expected to grow significantly at 31.7% annually over the next three years, outpacing the UK market's 14%. Revenue growth is forecasted at 7.5%, above the market average but below high-growth thresholds. Recent executive changes include Neil Stevens stepping down as Joint CEO by June 2025, with Matt Timmins assuming sole CEO responsibilities post-AGM in May 2025.

- According our earnings growth report, there's an indication that Fintel might be ready to expand.

- Take a closer look at Fintel's balance sheet health here in our report.

Hochschild Mining (LSE:HOC)

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market cap of £944.55 million.

Operations: The company's revenue segments include $266.70 million from San Jose and $451.91 million from Inmaculada, with a segment adjustment of $79.60 million.

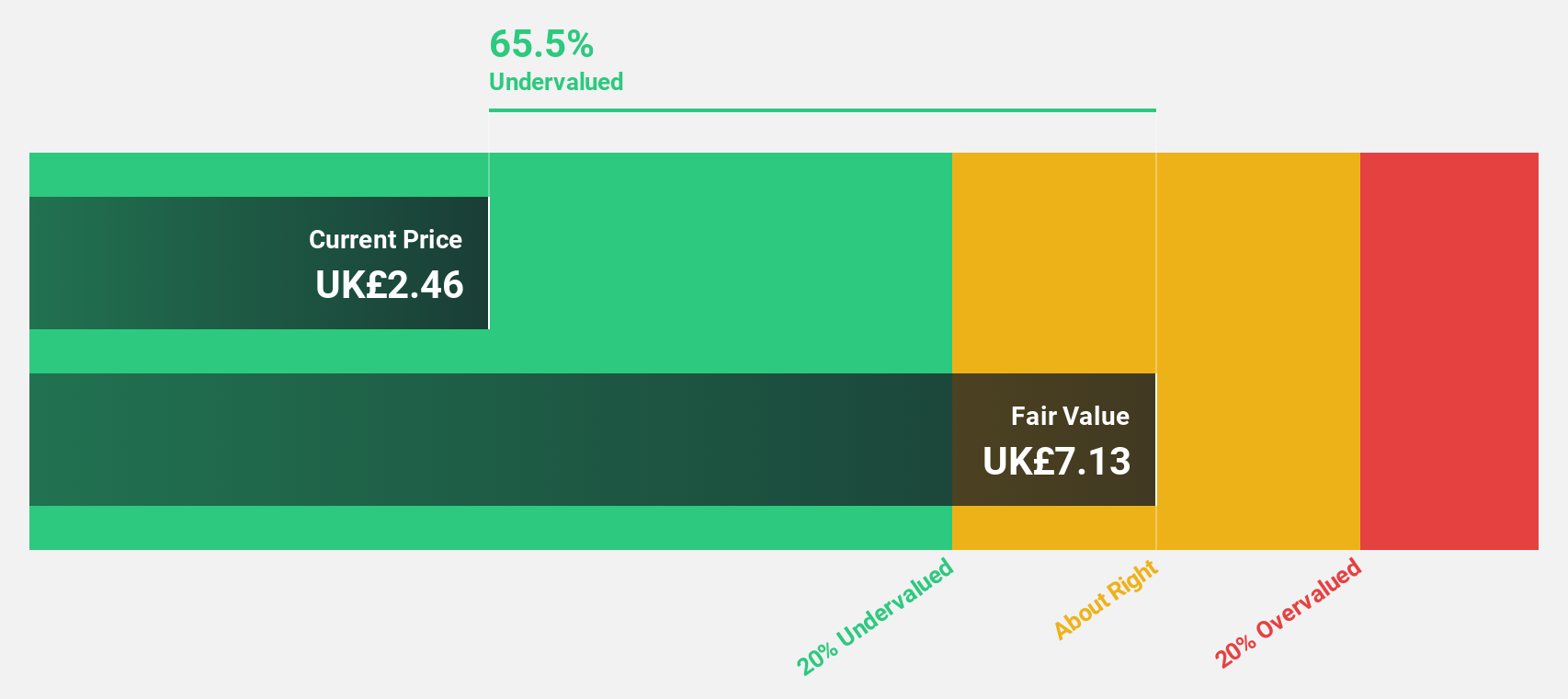

Estimated Discount To Fair Value: 23.8%

Hochschild Mining is trading at £1.84, significantly below its estimated fair value of £2.41, with a forecasted earnings growth of 40.3% annually, surpassing the UK market's 14%. Despite high debt and recent share price volatility, revenue is expected to grow at 9.1% per year, above the market average. Recent board changes include Andrew Wray joining as an independent Non-Executive Director post-June AGM, enhancing governance with his extensive sector experience.

- Our comprehensive growth report raises the possibility that Hochschild Mining is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Hochschild Mining stock in this financial health report.

Morgan Advanced Materials (LSE:MGAM)

Overview: Morgan Advanced Materials plc is a UK-based materials science and application engineering company with a market cap of approximately £602 million.

Operations: Morgan Advanced Materials plc generates revenue through its operations in the materials science and application engineering sectors, primarily within the United Kingdom.

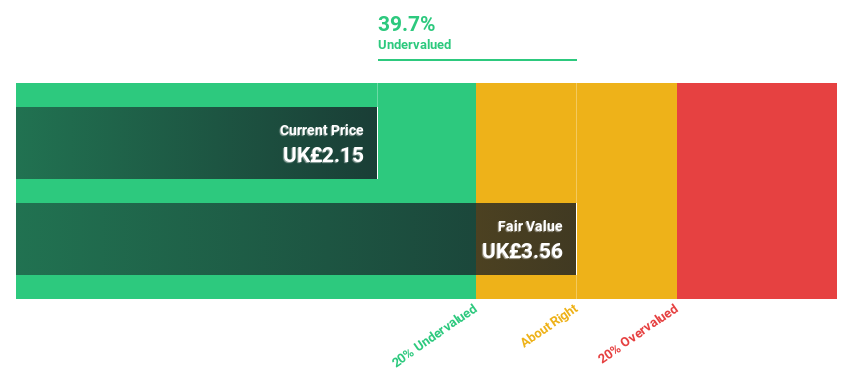

Estimated Discount To Fair Value: 40.5%

Morgan Advanced Materials is trading at £2.14, below its estimated fair value of £3.59, with earnings expected to grow significantly at 21.8% annually, outpacing the UK market's 14%. Despite high debt levels and a dividend not well covered by free cash flows, revenue growth is forecasted at 3.9% per year. Recent leadership changes include CEO Pete Raby retiring in July 2025, with Damien Caby set to assume the role, potentially impacting strategic direction.

- Our expertly prepared growth report on Morgan Advanced Materials implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Morgan Advanced Materials with our comprehensive financial health report here.

Summing It All Up

- Gain an insight into the universe of 56 Undervalued UK Stocks Based On Cash Flows by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FNTL

Fintel

Engages in the provision of intermediary services and distribution channels to the retail financial services sector in the United Kingdom.

Reasonable growth potential with adequate balance sheet.