- United Kingdom

- /

- Capital Markets

- /

- LSE:REC

UK Penny Stocks: 3 Picks With Market Caps Under £300M

Reviewed by Simply Wall St

The United Kingdom's stock market has recently experienced some turbulence, with the FTSE 100 and FTSE 250 indices slipping due to weaker-than-expected trade data from China. Despite these challenges, certain investment opportunities remain appealing for those looking beyond the blue-chip stocks. Penny stocks, while an older term, still signify smaller or newer companies that can offer unique value propositions when supported by strong financial fundamentals. In light of current market conditions, we'll explore three UK penny stocks that stand out for their financial strength and potential growth prospects.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Ultimate Products (LSE:ULTP) | £0.652 | £55.12M | ✅ 4 ⚠️ 4 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.58 | £266.51M | ✅ 4 ⚠️ 1 View Analysis > |

| Next 15 Group (AIM:NFG) | £2.47 | £245.66M | ✅ 4 ⚠️ 5 View Analysis > |

| Central Asia Metals (AIM:CAML) | £1.498 | £260.61M | ✅ 4 ⚠️ 2 View Analysis > |

| Warpaint London (AIM:W7L) | £3.45 | £278.72M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.14 | £355.76M | ✅ 4 ⚠️ 1 View Analysis > |

| City of London Investment Group (LSE:CLIG) | £3.29 | £162.14M | ✅ 3 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £3.705 | £357.15M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.954 | £152.15M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.34 | £36.79M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 392 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

Equals Group (AIM:EQLS)

Simply Wall St Financial Health Rating: ★★★★★★

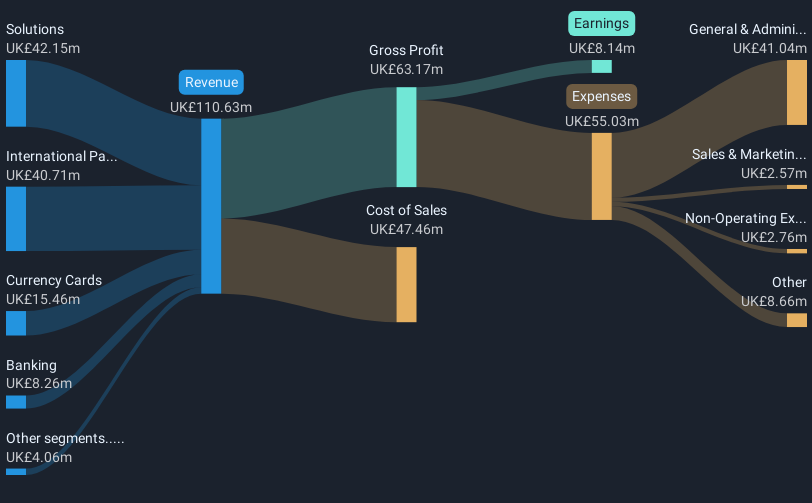

Overview: Equals Group plc operates in the United Kingdom, offering payment platforms to private clients and corporations through services such as prepaid currency cards, international money transfers, and current accounts, with a market cap of £262.23 million.

Operations: The company has not reported any specific revenue segments.

Market Cap: £262.23M

Equals Group plc, with a market cap of £262.23 million, is undergoing significant changes as it prepares for an all-cash acquisition by Alakazam Holdings BidCo Limited. The scheme is expected to be effective on 14 April 2025, leading to the delisting of Equals shares from AIM. Despite a decline in net profit margins from 8.1% to 5.6% and negative earnings growth over the past year, Equals has maintained high-quality earnings and stable volatility. Short-term assets exceed liabilities, and the company remains debt-free. A special dividend of 5 pence per share was recently announced ahead of the acquisition completion.

- Click here to discover the nuances of Equals Group with our detailed analytical financial health report.

- Assess Equals Group's future earnings estimates with our detailed growth reports.

Renold (AIM:RNO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Renold plc manufactures and sells high precision engineered products and solutions across the UK, Europe, the US, Canada, Australasia, China, India, and other international markets with a market cap of £85.55 million.

Operations: The company's revenue is derived from two main segments: Chain, contributing £191 million, and Torque Transmission, accounting for £53.9 million.

Market Cap: £85.55M

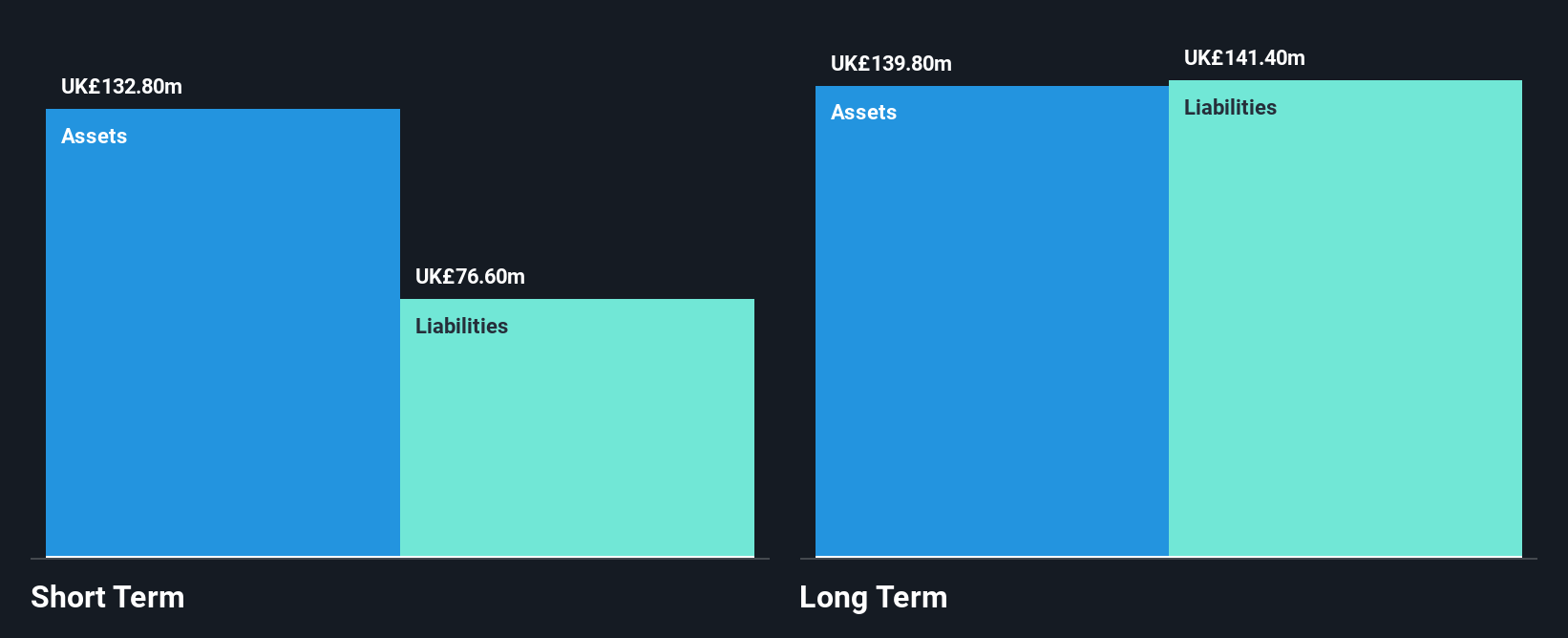

Renold plc, with a market cap of £85.55 million, trades at 24.7% below its estimated fair value and is considered to have high-quality earnings. Despite a significant debt level, operating cash flow covers it well, and interest payments are adequately managed by EBIT. The management team and board are experienced with average tenures of 6.8 and 5.5 years respectively. Although short-term assets surpass liabilities, long-term liabilities remain uncovered by short-term assets (£132.8M vs £141.4M). Earnings growth has been negative over the past year but is forecasted to grow significantly in the future according to analysts' consensus estimates.

- Jump into the full analysis health report here for a deeper understanding of Renold.

- Understand Renold's earnings outlook by examining our growth report.

Record (LSE:REC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Record plc, with a market cap of £100.41 million, offers currency and derivative management services across the United Kingdom, North America, Continental Europe, Australia, and other international markets.

Operations: The company generates £45.02 million in revenue from its currency and derivatives management services.

Market Cap: £100.41M

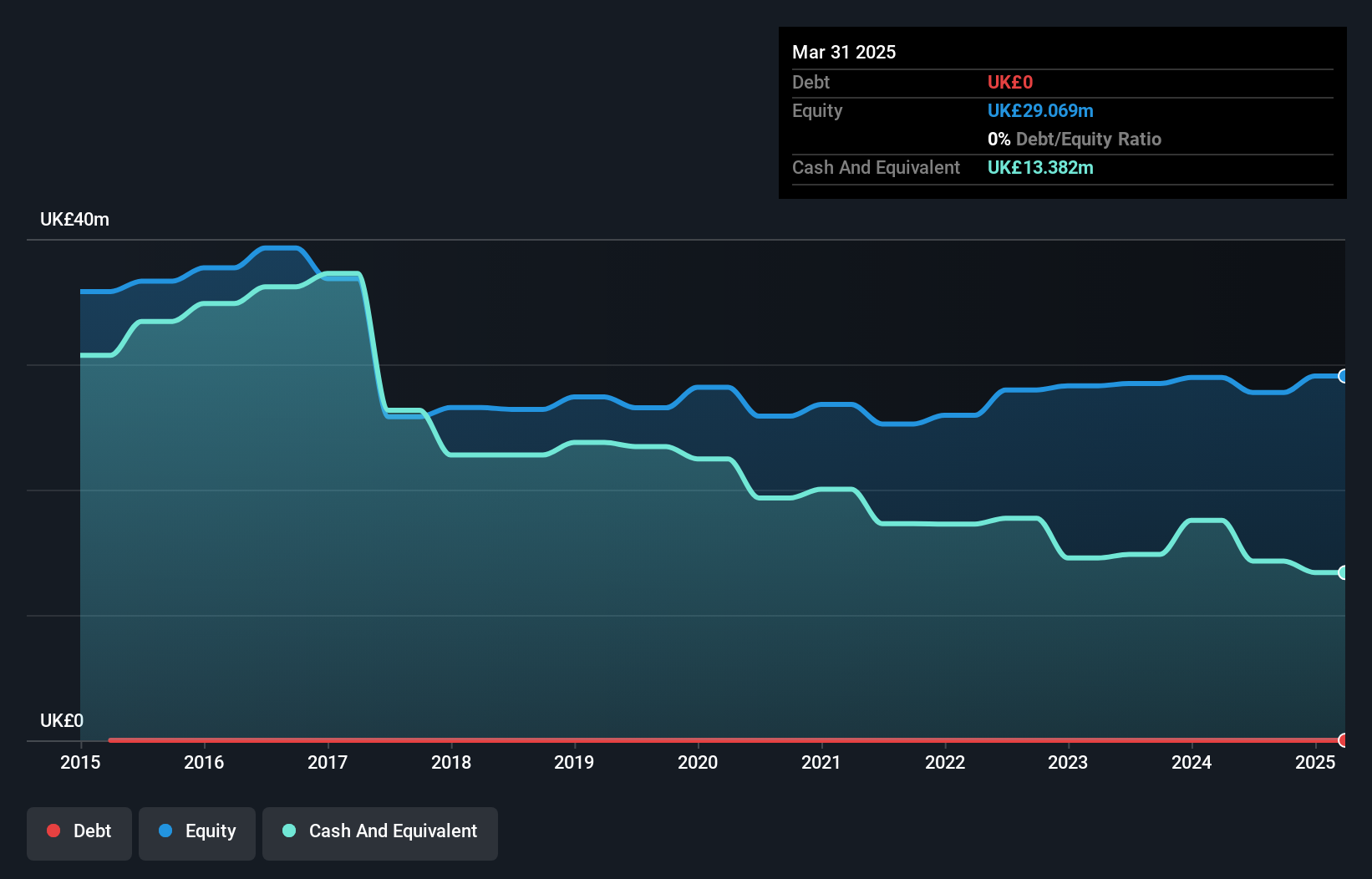

Record plc, with a market cap of £100.41 million, operates debt-free and has not diluted shareholders recently. Despite negative earnings growth over the past year, its earnings have grown by 13.2% annually over five years. The company revised its earnings guidance upward for the year ending March 31, 2025, indicating potential revenue improvement beyond previous expectations. Record's short-term assets comfortably cover both short- and long-term liabilities (£28.2M vs £5M and £446K respectively). However, its dividend yield of 8.81% is not well supported by current earnings or free cash flows. Recent executive changes include appointing Andreas Dänzer as Group CIO to enhance investment strategies globally.

- Take a closer look at Record's potential here in our financial health report.

- Gain insights into Record's future direction by reviewing our growth report.

Where To Now?

- Reveal the 392 hidden gems among our UK Penny Stocks screener with a single click here.

- Ready For A Different Approach? We've found 29 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:REC

Record

Through its subsidiaries, provides currency and derivative management services in the United Kingdom, North America, Continental Europe, Australia, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives