- United Kingdom

- /

- Metals and Mining

- /

- LSE:CEY

Exploring Three UK Exchange Stocks With Estimated Discounts Between 38.8% And 47.4%

Reviewed by Simply Wall St

As the United Kingdom navigates through significant political changes and economic strategies, with a focus on Chancellor Reeves' upcoming initiatives and market reactions, investors are keenly observing shifts in the FTSE 100 and broader financial indicators. In such a climate, identifying stocks that appear undervalued becomes particularly compelling, offering potential opportunities amidst the evolving economic landscape.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| LSL Property Services (LSE:LSL) | £3.33 | £6.53 | 49% |

| Ibstock (LSE:IBST) | £1.792 | £3.43 | 47.8% |

| Auction Technology Group (LSE:ATG) | £4.77 | £9.20 | 48.1% |

| Franchise Brands (AIM:FRAN) | £1.58 | £3.13 | 49.6% |

| Ricardo (LSE:RCDO) | £4.90 | £9.49 | 48.4% |

| Entain (LSE:ENT) | £6.394 | £12.31 | 48.1% |

| Accsys Technologies (AIM:AXS) | £0.555 | £1.07 | 48.1% |

| Loungers (AIM:LGRS) | £2.84 | £5.63 | 49.5% |

| M&C Saatchi (AIM:SAA) | £2.03 | £3.98 | 49% |

| Nexxen International (AIM:NEXN) | £2.45 | £4.76 | 48.6% |

Let's uncover some gems from our specialized screener

Centamin (LSE:CEY)

Overview: Centamin plc operates in the exploration, mining, and development of gold and precious metals across Egypt, Côte d’Ivoire, Burkina Faso, Jersey, the United Kingdom, and Australia with a market capitalization of approximately £1.51 billion.

Operations: The company generates its revenue primarily from the exploration, mining, and development of gold and precious metals in various international locations.

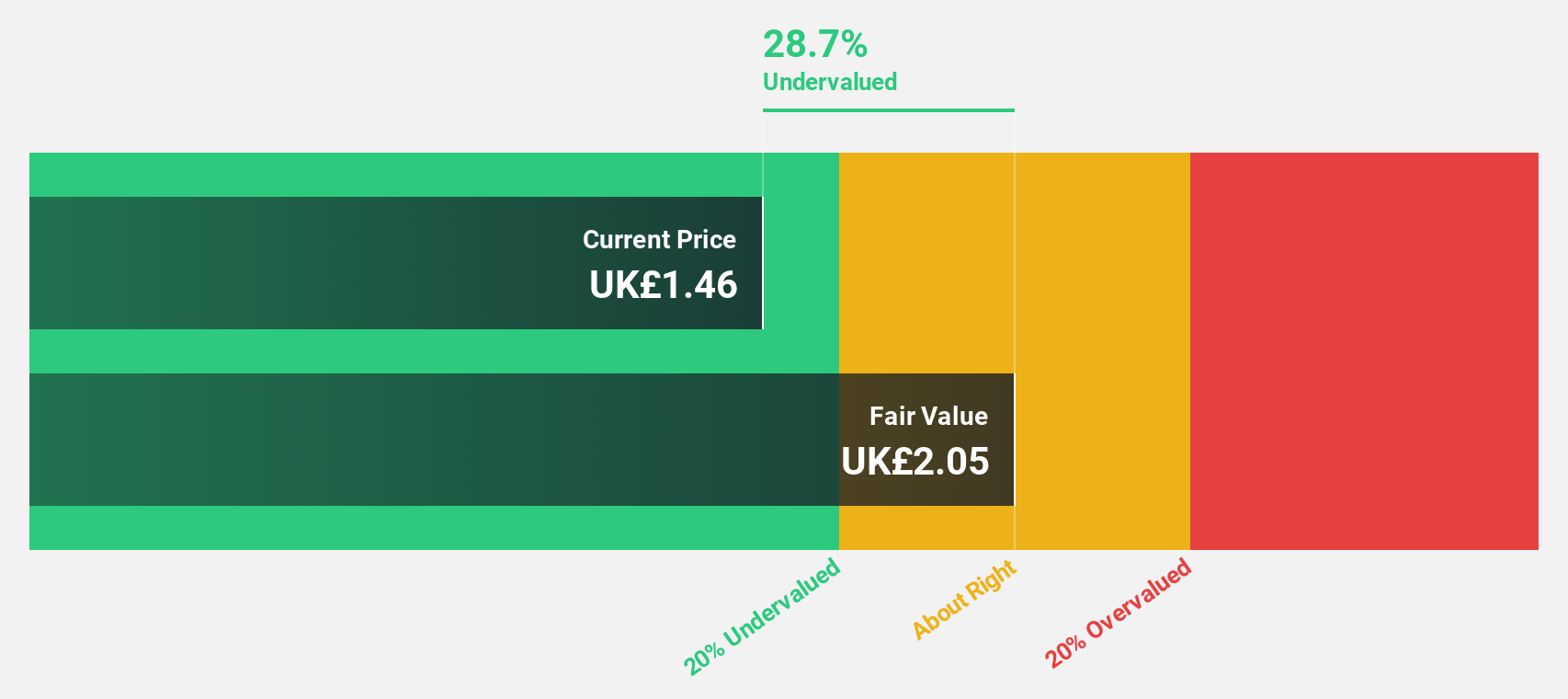

Estimated Discount To Fair Value: 38.8%

Centamin, with a current trading price of £1.3 against a fair value estimate of £2.12, appears undervalued by 38.8%. Despite an unstable dividend track record and modest return on equity forecast at 13.3% in three years, the company's financials show promise with earnings growth of 20.7% per year outpacing the UK market average of 12.6%. Recent production results from Sukari Gold Mine indicate robust operational performance, supporting this growth trajectory amidst a competitive gold production environment.

- Upon reviewing our latest growth report, Centamin's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Centamin with our comprehensive financial health report here.

TBC Bank Group (LSE:TBCG)

Overview: TBC Bank Group PLC operates as a diversified financial services provider offering banking, leasing, insurance, brokerage, and card processing solutions across Georgia, Azerbaijan, and Uzbekistan with a market capitalization of approximately £1.49 billion.

Operations: The company generates its revenue from banking, leasing, insurance, brokerage, and card processing services in Georgia, Azerbaijan, and Uzbekistan.

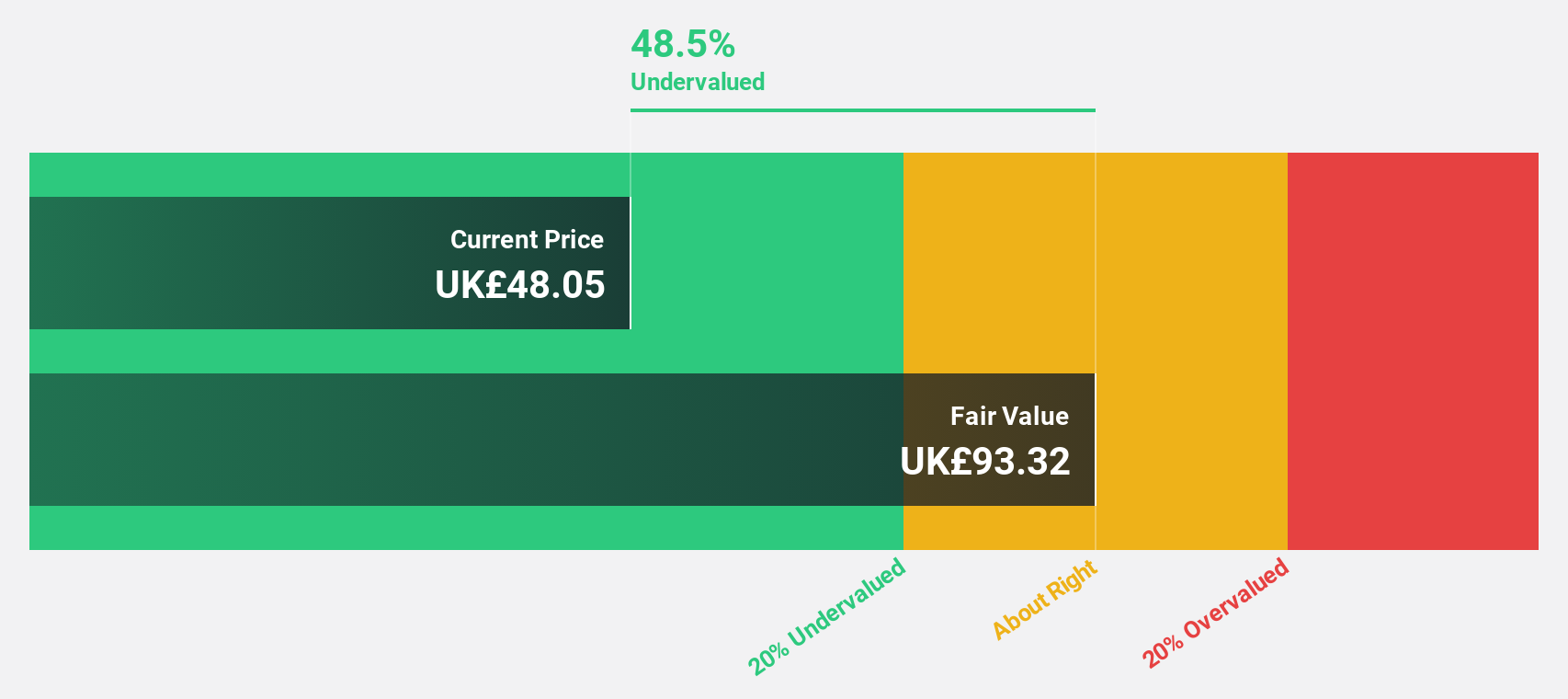

Estimated Discount To Fair Value: 43.5%

TBC Bank Group, priced at £27.55, significantly trails our fair value estimate of £48.75, indicating a potential undervaluation. Despite its high bad loans ratio of 2.1% and low allowance for bad loans at 74%, the bank's earnings have expanded by an average of 23.6% annually over the past five years and are projected to continue growing by 15.22% yearly. Recent strategic moves include a share buyback program and robust first-quarter earnings growth, reflecting strong operational momentum which may support future financial stability.

- Our expertly prepared growth report on TBC Bank Group implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in TBC Bank Group's balance sheet health report.

WPP (LSE:WPP)

Overview: WPP plc is a creative transformation company offering communications, experience, commerce, and technology services worldwide, with a market capitalization of approximately £7.98 billion.

Operations: WPP's revenue is generated from three primary segments: Public Relations (£1.26 billion), Specialist Agencies (£0.99 billion), and Global Integrated Agencies (£12.59 billion).

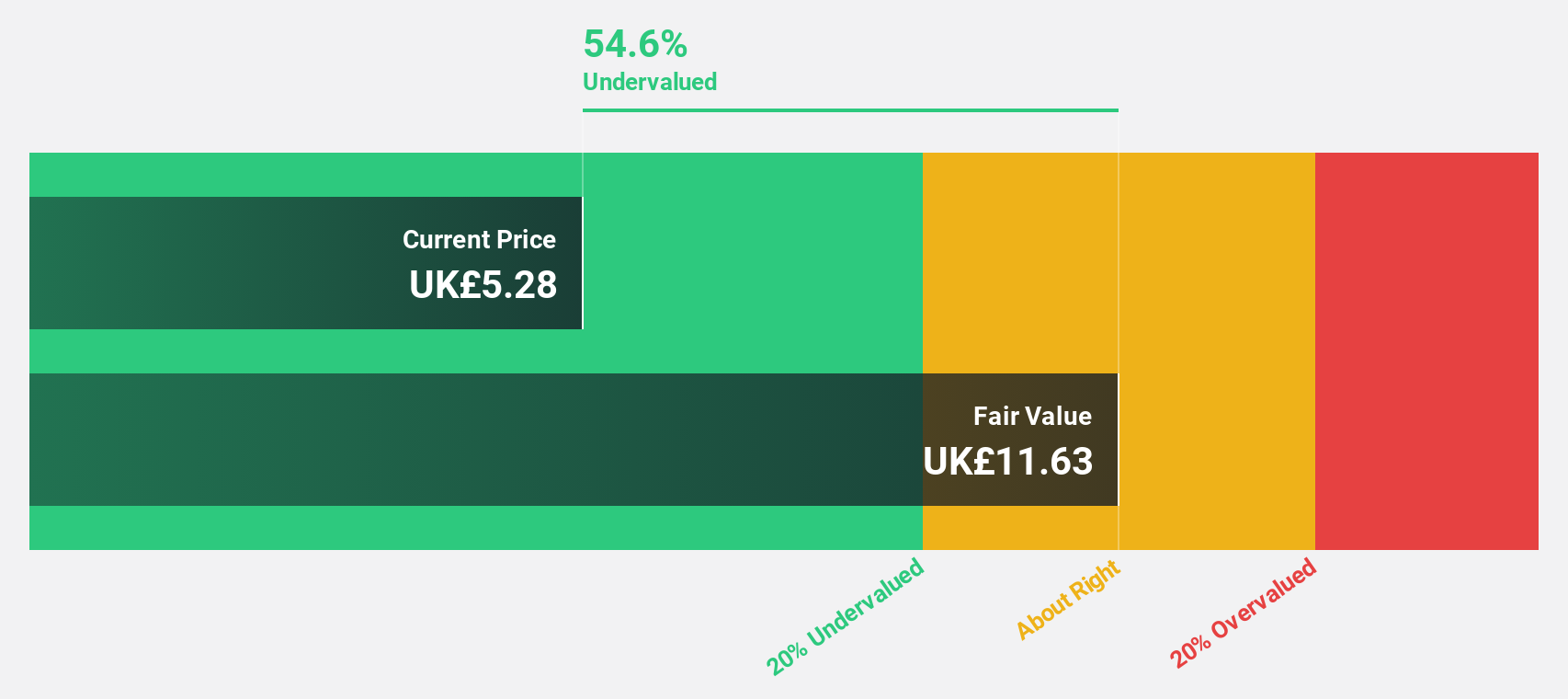

Estimated Discount To Fair Value: 47.4%

WPP, trading at £7.44, is significantly undervalued compared to our fair value estimate of £14.13, marked by a 47.4% discount. While earnings are expected to surge by 28.3% annually, revenue forecasts show a decline of about 5.1% per year over the next three years, reflecting mixed financial health. Recent strategic collaborations with Google Cloud aim to enhance marketing efficiency through advanced AI integration, potentially boosting future profitability despite current challenges in covering dividend payments and interest expenses from earnings.

- Insights from our recent growth report point to a promising forecast for WPP's business outlook.

- Delve into the full analysis health report here for a deeper understanding of WPP.

Turning Ideas Into Actions

- Embark on your investment journey to our 62 Undervalued UK Stocks Based On Cash Flows selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CEY

Centamin

Engages in the exploration, mining, and development of gold and precious metals in Egypt, Côte d’Ivoire, Burkina Faso, Jersey, the United Kingdom, and Australia.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives